100 Rebate In Income Tax Web 13 janv 2022 nbsp 0183 32 A1 You must file a 2021 tax return to claim a 2021 Recovery Rebate Credit even if you usually don t file a tax return See the 2021 Recovery Rebate Credit FAQs

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your Web 20 ao 251 t 2022 nbsp 0183 32 100 of Income Tax Payable 12 500 Rebate on Life Insurance Premium or Contribution to provident fund Section 88 Indivdual and HUF with Gross Total Income

100 Rebate In Income Tax

100 Rebate In Income Tax

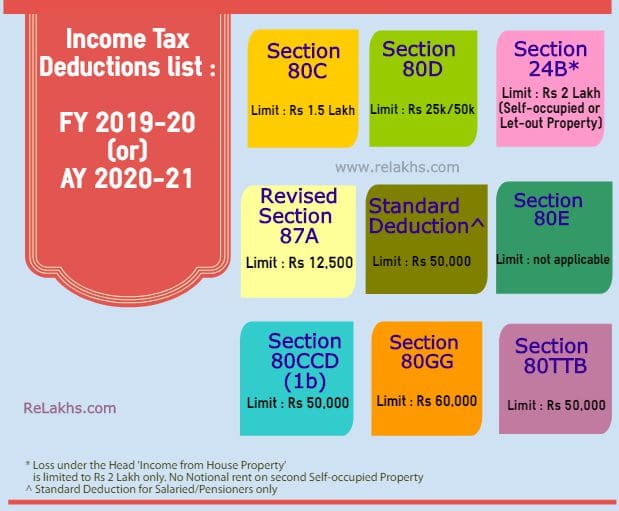

https://www.relakhs.com/wp-content/uploads/2019/02/Income-Tax-Deductions-List-FY-2019-20-Latest-Tax-exemptions-for-AY-2020-2021-tax-saving-optionschart-tax-rebate.jpg

Fillable Online What Is Rebate In Income Tax Bajaj Finserv Fax Email

https://www.pdffiller.com/preview/630/36/630036795/large.png

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

Web Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay Web This return is applicable for an Individual or Hindu Undivided Family HUF who is Resident other than Not Ordinarily Resident or a Firm other than LLP which is a Resident having

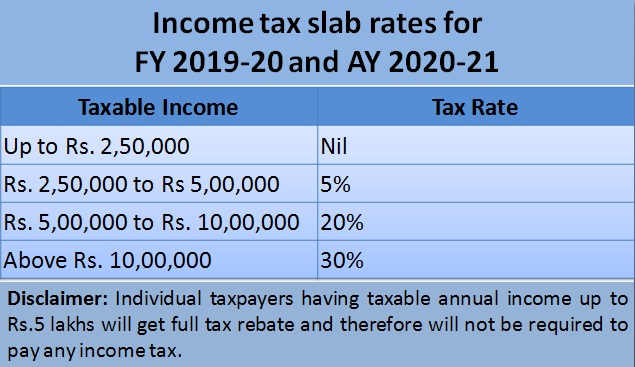

Web 2 mai 2023 nbsp 0183 32 A resident individual with taxable income up to Rs 5 00 000 will be eligible for a tax rebate of Rs 12 500 or the amount of tax payable whichever is lower Under the new income tax regime the amount of Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount

Download 100 Rebate In Income Tax

More picture related to 100 Rebate In Income Tax

Pajak Penghasilan Untuk Keperluan Pajak Pemerintah Atas Pendapatan

https://ajaib.co.id/wp-content/uploads/2019/12/objek-pajak-penghasilan-1024x576.jpg

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/06/7PY4cfZG8ZE.jpg

How To Calculate Tax Rebate In Income Tax Of Bangladesh BDesheba Com

https://bdesheba.com/wp-content/uploads/2023/02/Calculate-Tax-Rebate-in-Income-Tax-of-Bangladesh.jpg

Web 1 f 233 vr 2023 nbsp 0183 32 Put simply only those with an annual income of up to Rs 7 lakh under the new tax regime will benefit from the proposal as they will get a 100 per cent rebate on their tax liability On the other hand those with Web 19 f 233 vr 2023 nbsp 0183 32 Playlist Income Tax Tax Planning amp Management Taxation Laws https www youtube playlist list PLsh2FvSr3n7fQZ7Jc1K G32gsLksa7xEDIncome

Web 9 sept 2023 nbsp 0183 32 If you itemize deductions on your federal income tax return and receive a state tax refund or special payment the IRS says you might need to include it in your Web 25 mai 2021 nbsp 0183 32 Income tax is to be paid by all individuals of the country though to claim an income tax rebate under Section 87A you need to keep the following pointers in mind

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 A1 You must file a 2021 tax return to claim a 2021 Recovery Rebate Credit even if you usually don t file a tax return See the 2021 Recovery Rebate Credit FAQs

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-c...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Pol cia Tis c Bal k How To Calculate Rebate Ob iansky V a ok Vlastn k

Rebate In Income Tax Ultimate Guide

Incometax Individual Income Taxes Urban Institute This Service

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Taxes 2023 IRS Says California Most State Tax Rebates Aren t

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

100 Rebate In Income Tax - Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can