1040x Form Recovery Rebate Credit Web 26 mars 2021 nbsp 0183 32 If you did not receive your first and or second stimulus payment or if the amount received is not correct you can claim it on your 2020 tax return as the Recovery

Web 10 d 233 c 2021 nbsp 0183 32 If you must file an amended return to claim the Recovery Rebate Credit use the worksheet on page 59 of the 2020 instructions for Form 1040 and Form 1040 SR Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

1040x Form Recovery Rebate Credit

1040x Form Recovery Rebate Credit

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

https://images.dailykos.com/images/912447/story_image/1040.PNG?1612073472

1040 Recovery Rebate Credit Drake20

https://kb.drakesoftware.com/Site/Uploads/Images/RRC reduction.jpg

Web 20 d 233 c 2022 nbsp 0183 32 Enter the amount in your tax preparation software or in the Form 1040 Recovery Rebate Credit Worksheet to calculate your credit Having this information will Web 10 d 233 c 2021 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the Form 1040 and Form 1040 SR instructions PDF can help determine if you are eligible for the credit The fastest way

Web 10 d 233 c 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Download 1040x Form Recovery Rebate Credit

More picture related to 1040x Form Recovery Rebate Credit

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

How To Fill Out 1040x For Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-1040-form-updates-how-to-fill-out-irs-form-1040-with-form.jpg?fit=1280%2C720&ssl=1

Federal Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-1040-form-recovery-rebate-credit-irs-releases-draft-of-form-1040-5.jpg?fit=1140%2C641&ssl=1

Web 10 d 233 c 2021 nbsp 0183 32 Q C1 How to claim How do I claim the Recovery Rebate Credit on a 2020 tax return updated December 10 2021 Q C2 The IRS hasn t finished processing my Web What is the Recovery Rebate Credit The Recovery Rebate Credit was added to 2020 individual tax returns in order to reconcile the Economic Impact stimulus Payments

Web 9 avr 2021 nbsp 0183 32 AMENDING 2020 1040 FOR RECOVERY REBATE ERROR Intuit Accountants Community Here you go be sure and read my last post guidance says Web What is the Recovery Rebate Credit The Recovery Rebate Credit is a new tax credit added to the 2020 IRS Form 1040 The stimulus payments were an advance or pre

Irs gov Recovery Rebate 1040 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-1040-form-recovery-rebate-credit-irs-releases-draft-of-form-1040.png?w=486&h=629&ssl=1

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

https://www.consumerismcommentary.com/wp-content/uploads/2009/01/recovery-rebate-credit-1040.jpg

https://ttlc.intuit.com/community/after-you-file/discussion/can-you...

Web 26 mars 2021 nbsp 0183 32 If you did not receive your first and or second stimulus payment or if the amount received is not correct you can claim it on your 2020 tax return as the Recovery

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-g...

Web 10 d 233 c 2021 nbsp 0183 32 If you must file an amended return to claim the Recovery Rebate Credit use the worksheet on page 59 of the 2020 instructions for Form 1040 and Form 1040 SR

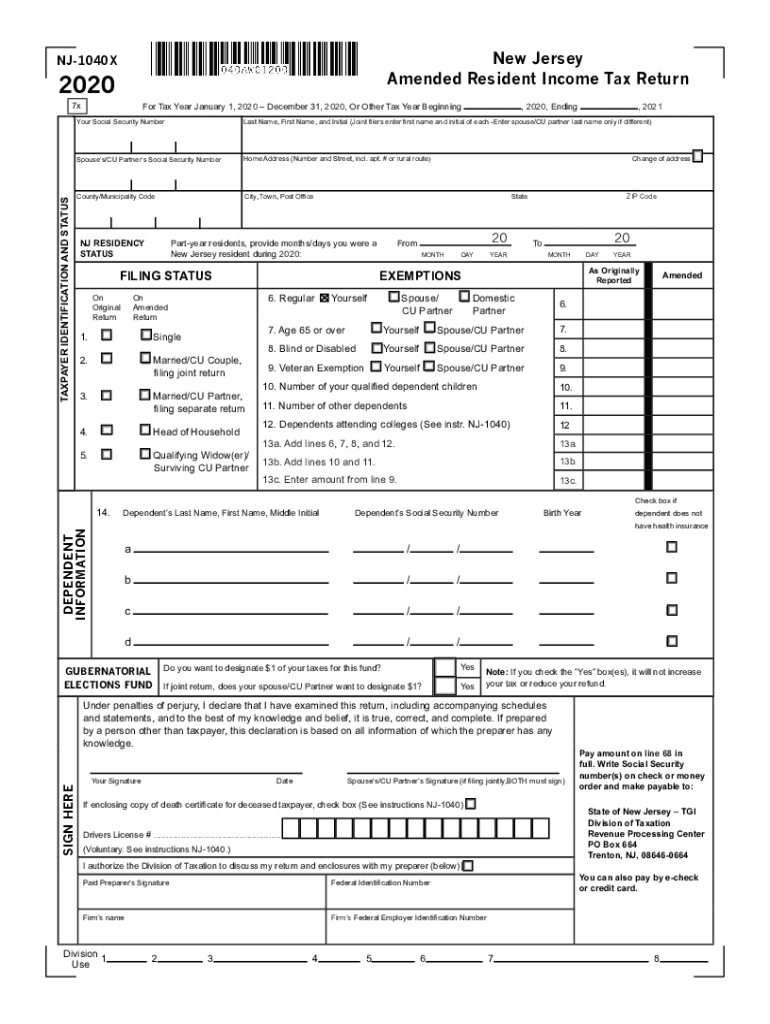

2020 Form NJ DoT NJ 1040x Fill Online Printable Fillable Blank

Irs gov Recovery Rebate 1040 Recovery Rebate

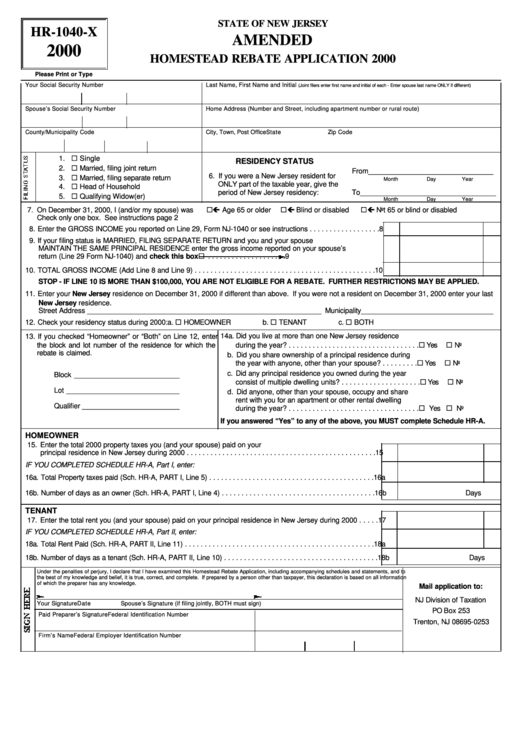

Fillable Form Hr 1040 X Amended Homestead Rebate Application 2000

Irs Form 1040x Fill Out Sign Online DocHub

1040 EF Message 0006 Recovery Rebate Credit Drake20

1040 Line 30 Recovery Rebate Credit Recovery Rebate

1040 Line 30 Recovery Rebate Credit Recovery Rebate

What Is The Recovery Rebate Credit CD Tax Financial

Is The Recovery Rebate Credit The Same As The Stimulus Leia Aqui Is

Recovery Credit Printable Rebate Form

1040x Form Recovery Rebate Credit - Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal