12500 Tax Deduction The 2024 standard deduction for tax returns filed in 2025 is 14 600 for single filers 29 200 for joint filers or 21 900 for heads of household

An individual who receives 11 543 75 net salary after taxes is paid 12 500 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Let s look at how to The IRS reveals its 2025 tax brackets with Trump era tax cuts set to expire The standard deduction will be 15 000 for individuals next year and 30 000 for married couples

12500 Tax Deduction

12500 Tax Deduction

https://i.etsystatic.com/37903484/r/il/61e14b/5462529921/il_1080xN.5462529921_cvyy.jpg

Do You Qualify For A Vehicle Sales Tax Deduction

https://www.toptaxdefenders.com/hs-fs/hubfs/Depositphotos_138271860_s-2019.jpg?width=1500&name=Depositphotos_138271860_s-2019.jpg

100 Tax Deduction On Your Donation In Malaysia Jul 26 2021 Johor

https://cdn1.npcdn.net/image/16272778521a6ef50158b79f67207a9ee7fe2b2eb3.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

The following tax tips were developed to help you avoid some of the common errors dealing with the standard deduction for seniors the taxable amount of Social Security Your standard deduction depends on your filing status age and whether a taxpayer is blind Learn how it affects your taxable income and any limits on claiming it

Check your W 4 tax withholding with the IRS Tax Withholding Estimator See how your withholding affects your refund paycheck or tax due Use this tool to estimate the federal For the tax year 2025 the top tax rate is 37 for individual single taxpayers with incomes greater than 626 350 751 600 for married couples filing jointly The other rates

Download 12500 Tax Deduction

More picture related to 12500 Tax Deduction

Payroll 2023 Calculator RazwanMarcos

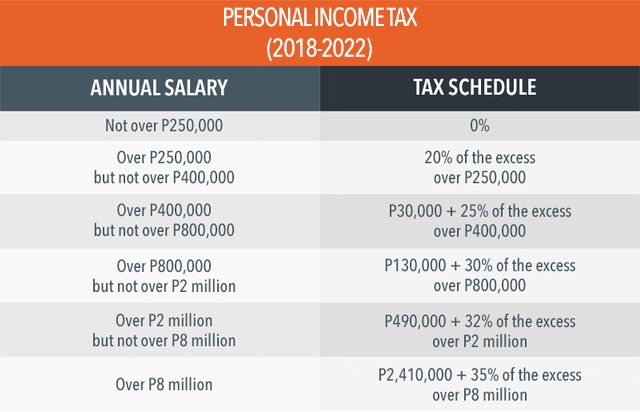

https://www.rappler.com/tachyon/r3-assets/612F469A6EA84F6BAE882D2B94A4B421/img/ABB83A969F6C4A63BD7A5AE957DAF456/personal-income-tax-20180112-01-1.jpg

Small Business Creative Tax Deductions Erin Armstrong Blog Taxes

https://i.pinimg.com/736x/bb/a8/05/bba80502cfe1d0e3b72ee6810271085f.jpg

Tax Deduction PDF

https://imgv2-1-f.scribdassets.com/img/document/299075294/original/864c8bd8ac/1704822528?v=1

Tax deductions lower your taxable income how much of your income you actually pay tax on while tax credits are a dollar for dollar reduction to your tax bill Knowing which deductions or credits to claim is The maximum rebate under section 87A for the AY 2024 25 is Rs 25 000 under the new tax regime and Rs 12 500 under the optional tax regime See the example below for

This Tax and NI Calculator will provide you with a forecast of your salary as well as your National Insurance Contributions for the tax year of 2024 25 Enter your Salary and click Calculate to Pass through owners who qualify can deduct up to 20 of their net business income from their income taxes reducing their effective income tax rate by 20 This

Tax Deduction Planner Graphic By Watercolortheme Creative Fabrica

https://www.creativefabrica.com/wp-content/uploads/2021/07/17/Tax-Deduction-Planner-Graphics-14848059-3.jpg

What Is A Tax Deduction Zaviad

https://zaviad.s3.eu-west-2.amazonaws.com/wp-content/uploads/2022/03/10111830/What-is-a-tax-deduction-1024x575.jpg

https://www.nerdwallet.com › article › t…

The 2024 standard deduction for tax returns filed in 2025 is 14 600 for single filers 29 200 for joint filers or 21 900 for heads of household

https://us.icalculator.com › salary-illustration

An individual who receives 11 543 75 net salary after taxes is paid 12 500 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Let s look at how to

Tax Deductions Guide Sunlight Tax

Tax Deduction Planner Graphic By Watercolortheme Creative Fabrica

A Look At The Tax Deduction Potential Of Strata Rates

Kurzstudie Tax Deduction Scheme Belgien EUKI

Premium Photo Tax Deduction

Example Tax Deduction System For A Single Gluten free GF Item And

Example Tax Deduction System For A Single Gluten free GF Item And

What Will My Tax Deduction Savings Look Like The Motley Fool

Filing Your 2021 Taxes What You Need To Know

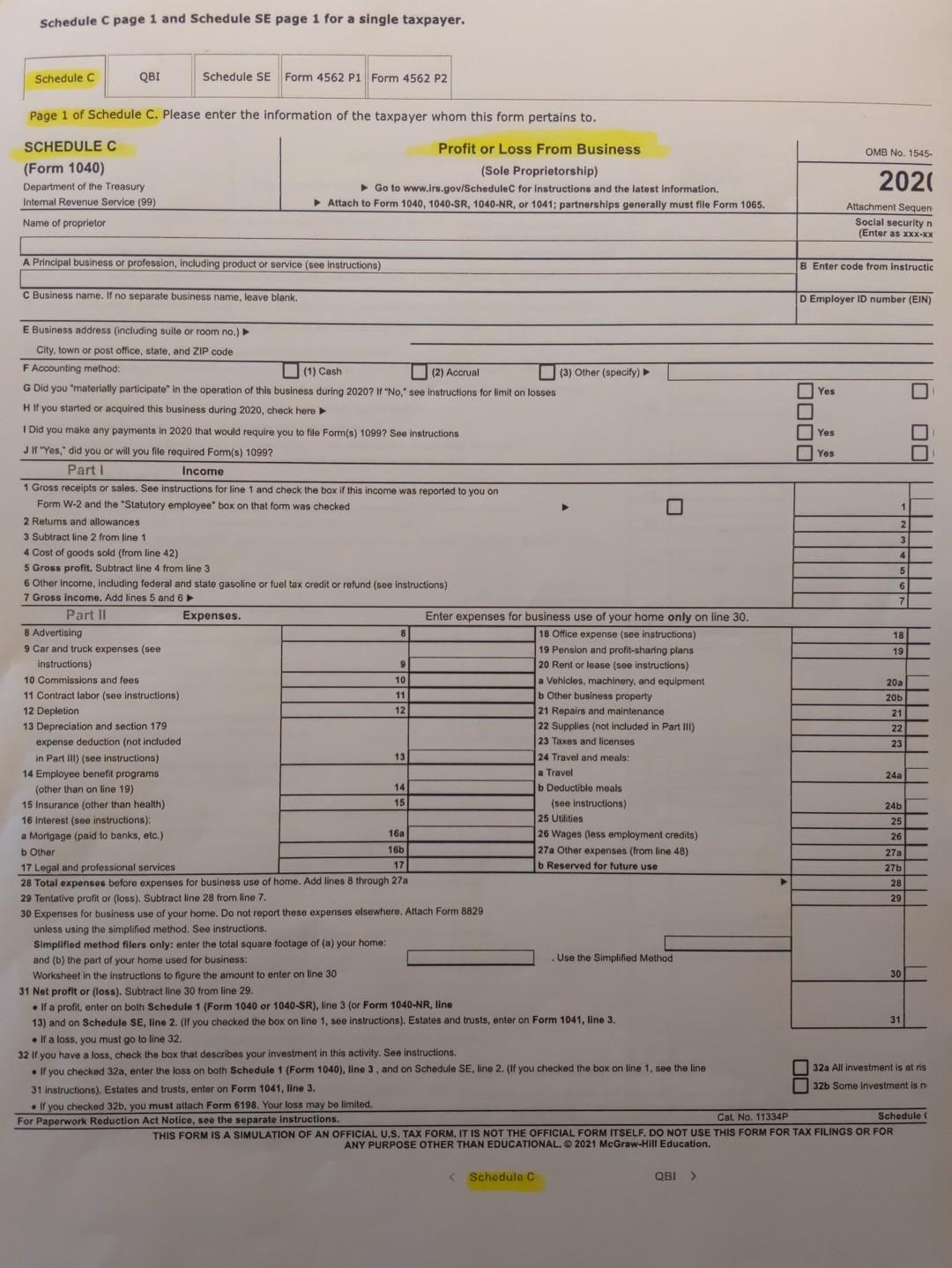

Solved Cassi SSN 412 34 5670 Has A Cash basis Home Chegg

12500 Tax Deduction - Calculate net income after taxes Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a