20 Percent Tax Bracket Ireland A tax rate band is the amount of income which will be taxed at a particular percentage tax rate The current tax rates are 20 and 40 Standard rate of tax Your income up to a

Her monthly tax is calculated by applying the standard rate of tax 20 to the first 3 500 up to the limit of Ruth s rate band The higher rate of tax 40 is applied to the last 200 if you pay income tax at the standard rate of 20 400 if you also pay income tax at the higher rate of 40 Your standard rate tax credits are increased by 200 1 000 x

20 Percent Tax Bracket Ireland

20 Percent Tax Bracket Ireland

https://www.theoasisfirm.com/wp-content/uploads/2022/10/IRS-Tax-Bracket-Adjustment-for-2023.png

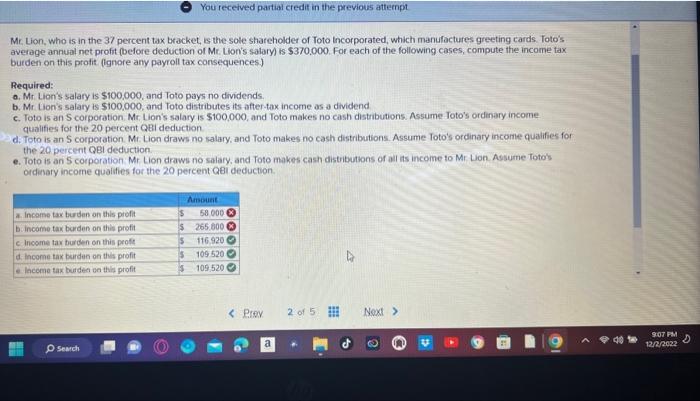

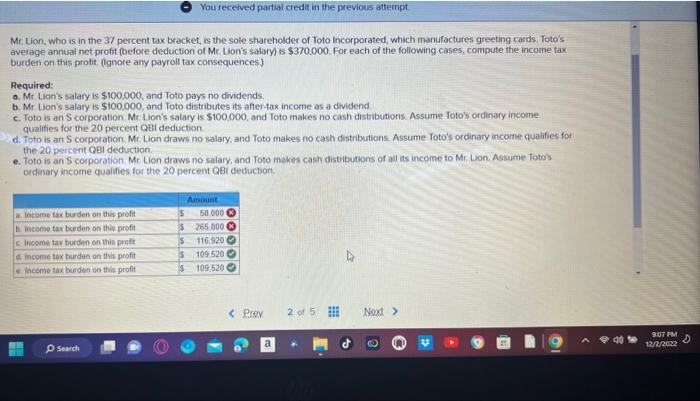

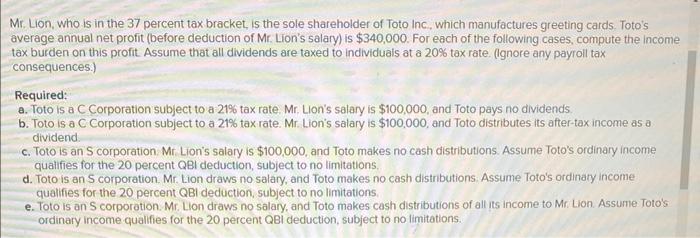

Solved Mr Lion Who Is In The 37 Percent Tax Bracket Is Chegg

https://media.cheggcdn.com/study/8d5/8d558ba1-3523-4047-a593-6d8bb16c5aa5/image

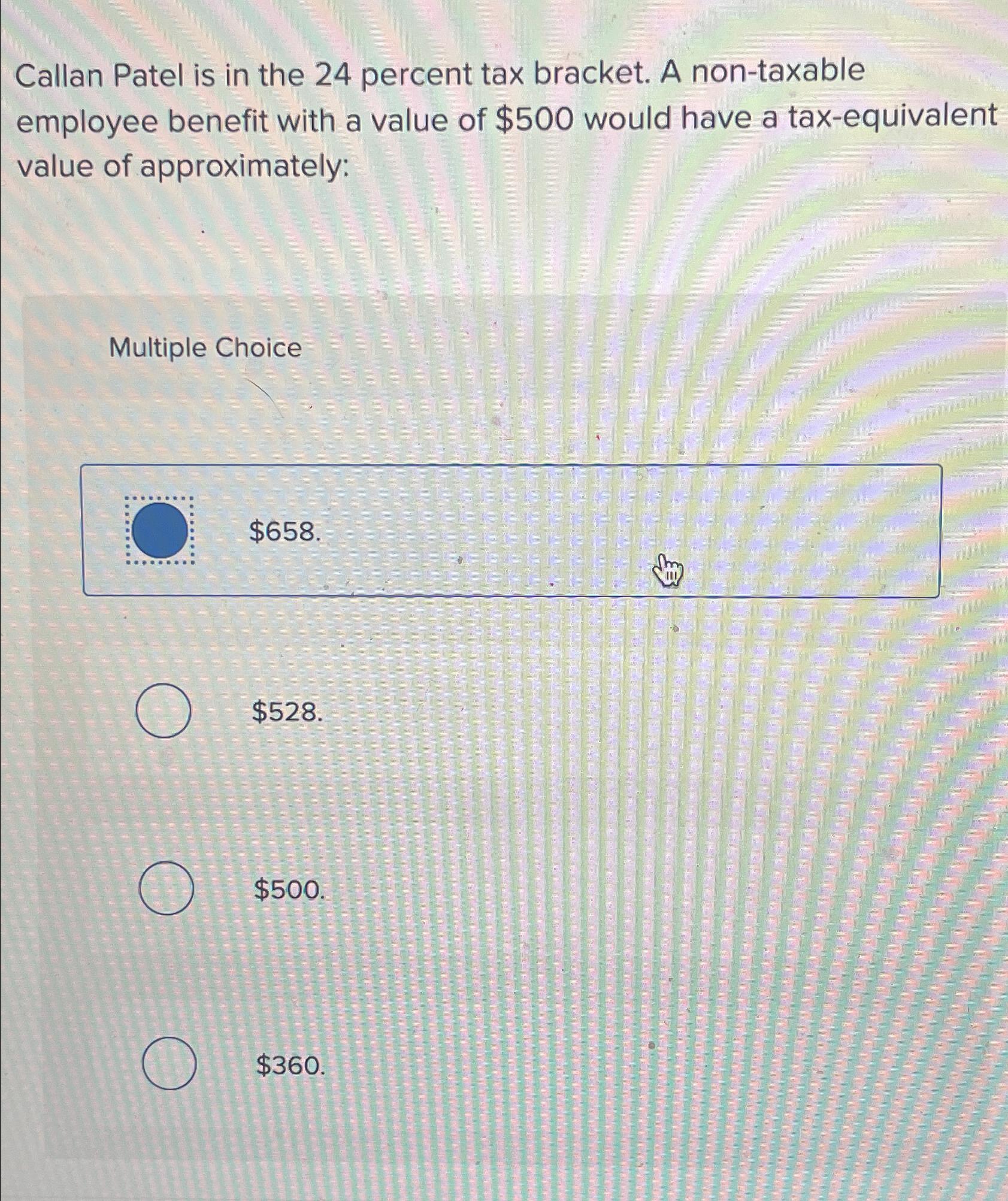

Solved Callan Patel Is In The 24 percent Tax Bracket A Chegg

https://media.cheggcdn.com/study/178/1782bc9e-e26f-4f3a-98b8-b9baa53a5245/image

An income tax exemption is available for certain individuals aged 65 years or over These individuals are only liable to income tax if their income is above a specified The Income tax rates and personal allowances in Ireland are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below

TAX RATES 2023 Employee 4 The reduced 9 rate of VAT is due to expire on 01 March 2023 Review the latest income tax rates thresholds and personal allowances in Ireland which are used to calculate salary after tax when factoring in social security contributions

Download 20 Percent Tax Bracket Ireland

More picture related to 20 Percent Tax Bracket Ireland

You Think Your Income Tax Bracket Is Highest 7 Countries With MIND

https://static.toiimg.com/thumb/msid-102204891,width-900,height-1200,resizemode-6.cms

IRS Announces New Tax Brackets Standard Deductions For 2023 Due To

https://h104216-fcdn.mp.lura.live/1/20003/pvw_lin/C89/42D/C8942D6075E14595056BDF5370DBC848_6.jpg?aktaexp=2082787200&aktasgn=658ed9dfdb2bfc83232b1e762c8fd6ef

How To Take Advantage Of Your Zero Percent Tax Bracket Lucia Capital

https://i.ytimg.com/vi/JbSjhtMTDyQ/maxresdefault.jpg

Marginal relief restricts the amount of tax payable to the amount by which total income exceeds the exemption limit at the above marginal relief rate and only applies to For single individuals earning over 35 300 per annum or married couples earning over 44 300 per annum the highest marginal rate is 41 In comparison Northern Ireland

In 2024 the standard 20 rate band for couples in a marriage or civil partnership is 51 000 If both people are working it is increased by the lower amount of either 33 000 A single taxpayer who earns 43 200 a year will have their tax calculated as follows The standard rate band for a single taxpayer is 42 000 This means that the first 42 000 is

2022 Income Tax Brackets Chart Printable Forms Free Online

https://ocdn.eu/pulscms-transforms/1/qTck9ktTURBXy8xMDA3MTBjYS1jNzY0LTQ0OTQtOTJhNy0xNjRkNDc0NzU0YzMucG5nkIGhMAA

Effective Income Tax Rates After Budget 2021 Social Justice Ireland

https://www.socialjustice.ie/sites/default/files/legacy/image/Pictures for website/budget2021analysis6.1.jpg

https://www.revenue.ie/.../tax-rate-band.aspx

A tax rate band is the amount of income which will be taxed at a particular percentage tax rate The current tax rates are 20 and 40 Standard rate of tax Your income up to a

https://www.revenue.ie/en/jobs-and-pensions/...

Her monthly tax is calculated by applying the standard rate of tax 20 to the first 3 500 up to the limit of Ruth s rate band The higher rate of tax 40 is applied to the last

Understanding 2023 Tax Brackets What You Need To Know

2022 Income Tax Brackets Chart Printable Forms Free Online

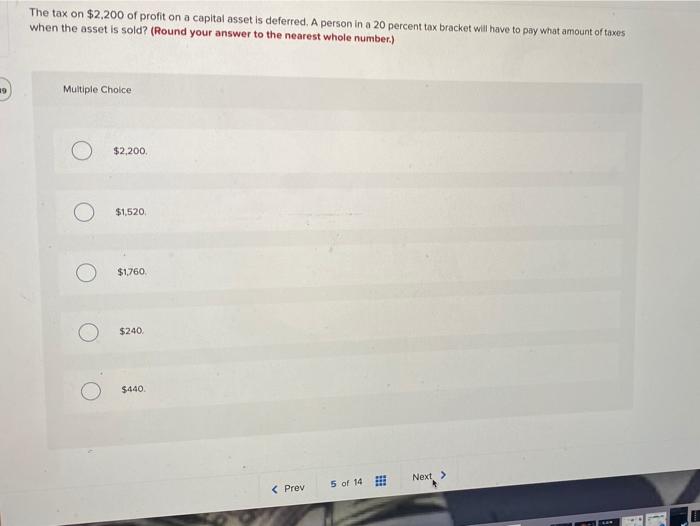

Solved The Tax On 2 200 Of Profit On A Capital Asset Is Chegg

Tax Filers Can Keep More Money In 2023 As IRS Shifts Brackets Andrews

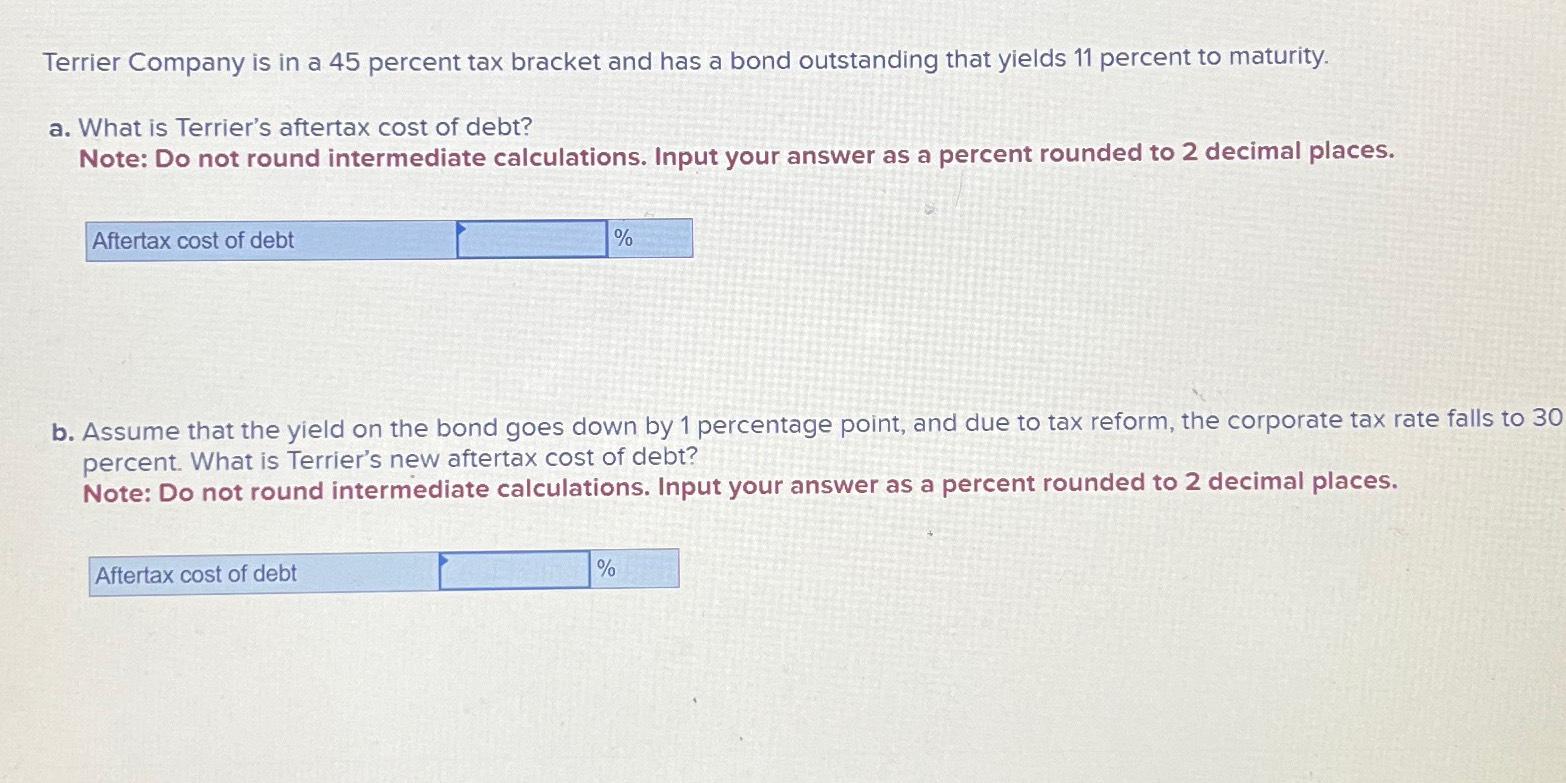

Solved Terrier Company Is In A 45 percent Tax Bracket And Chegg

Tax Brackets Chart 2023 IMAGESEE

Tax Brackets Chart 2023 IMAGESEE

Solved Mr Lion Who Is In The 37 Percent Tax Bracket Is Chegg

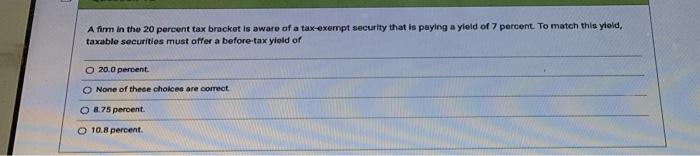

Solved A Firm In The 20 Percent Tax Bracket Is Aware Of A Chegg

Assume You Are In The 35 Percent Tax Bracket And Purchase A Municipal

20 Percent Tax Bracket Ireland - In Ireland income is split into two tax bands lower and higher Lower tax is currently paid on income UNDER 40 000 per year for a single person and is charged at 20 in every