20 Tax Rebate On Medical Expenses Web 18 d 233 c 2020 nbsp 0183 32 You generally receive tax relief for health expenses at your standard rate of tax 20 There is no upward limit as to the cost of health expenses that you can claim for Although any refund will be capped at

Web 12 janv 2023 nbsp 0183 32 Most taxpayers can claim medical expenses that exceed 7 5 of their adjusted gross incomes AGIs subject to certain rules Though the deduction seems simple there are a variety of rules about Web 1 juil 2019 nbsp 0183 32 NMETO Claim Calculation The medical expenses tax rebate is calculated as follows NMETO 2018 19 20 of eligible expenses only above the threshold of 2 377

20 Tax Rebate On Medical Expenses

.png)

20 Tax Rebate On Medical Expenses

https://uploads-ssl.webflow.com/5e57eb33765372f7d30e19f9/5e60276cf755ee1ecad92ae8_How%2520to%2520Calculate%2520Your%2520Adjusted%2520Gross%2520Income%2520(AGI).png

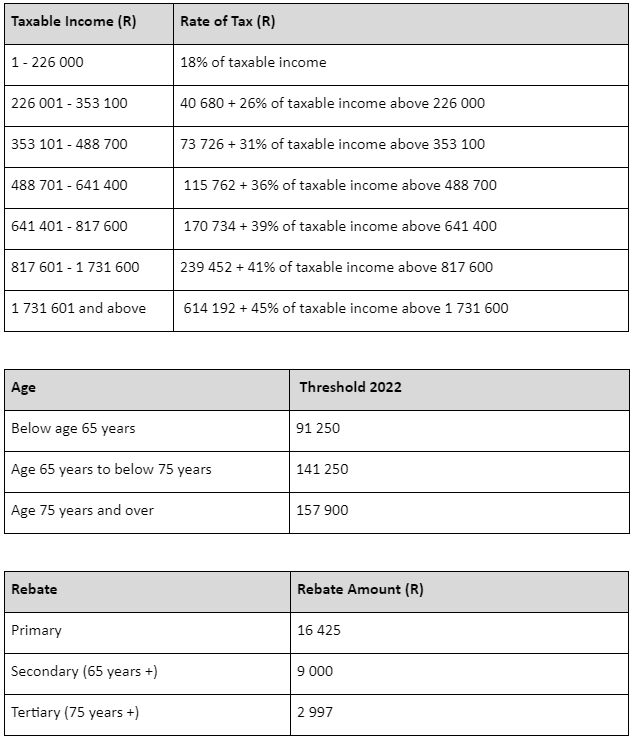

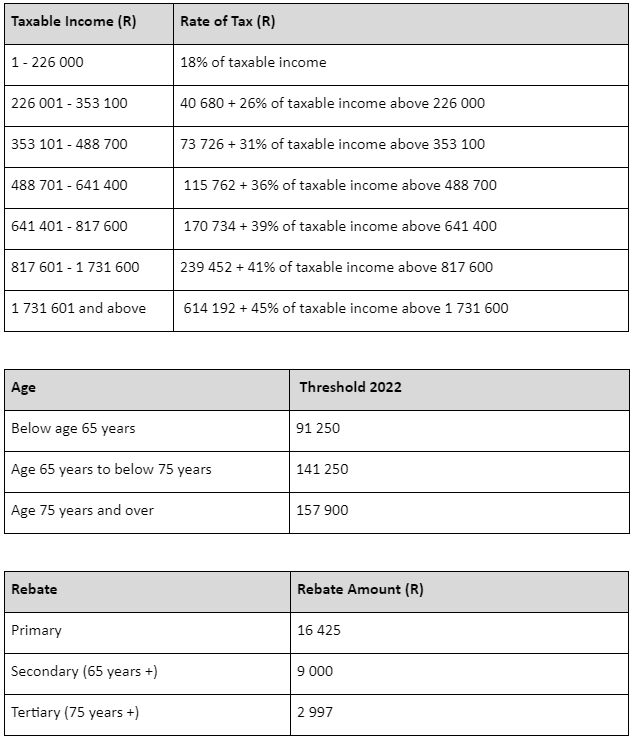

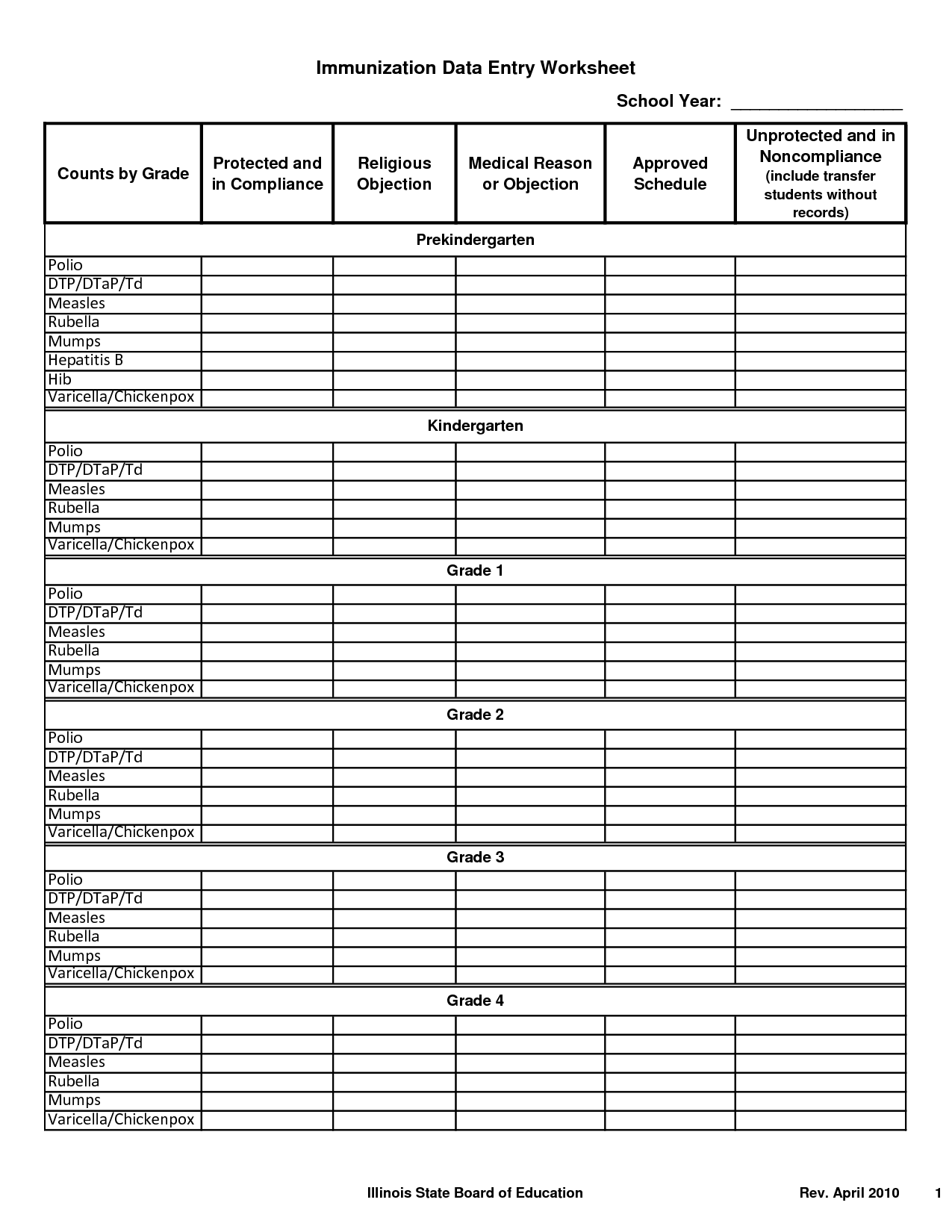

Medical Expenses Rebates

https://s3.studylib.net/store/data/008082010_1-c32f4bdb4afdf54db3e7d4bebd5ba95a-768x994.png

Http www anchor tax service financial tools deductions medical

https://i.pinimg.com/originals/93/fc/e8/93fce8e4872e20094e9c7743332faf81.jpg

Web 16 nov 2022 nbsp 0183 32 An Additional Medical Expenses Tax Credit also known as an AMTC is a rebate which in itself is non refundable but which is used to reduce the normal tax a Web Net expenses are your total eligible medical expenses minus refunds you or someone else receive from either National Disability Insurance Scheme NDIS private health

Web 5 sept 2023 nbsp 0183 32 As per an amendment in the Budget 2018 tax exemption on medical reimbursement amounting to Rs 15 000 and transport allowance amounting to Rs 19 200 Web 13 f 233 vr 2020 nbsp 0183 32 Any money paid by an employee for obtaining medical treatment for him or her or family upto a maximum of Rs 15 000 will be tax free Also the expenses incurred

Download 20 Tax Rebate On Medical Expenses

More picture related to 20 Tax Rebate On Medical Expenses

Private Insurers Are Expected To Pay A Record Of At Least 1 3 Billion

https://i0.wp.com/www.kff.org/wp-content/uploads/2019/09/Medical-Loss-Ratio-Rebates-no-figure-number.png?ssl=1

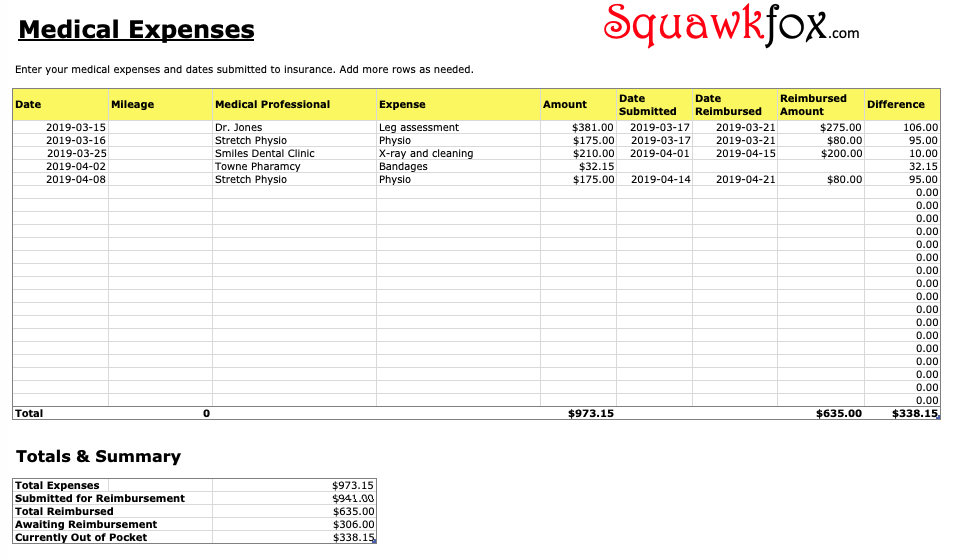

Cool Medical Expense Tracker Spreadsheet Best Financial

https://i.pinimg.com/originals/2b/c5/e1/2bc5e1983ea8db88b79466e883431950.jpg

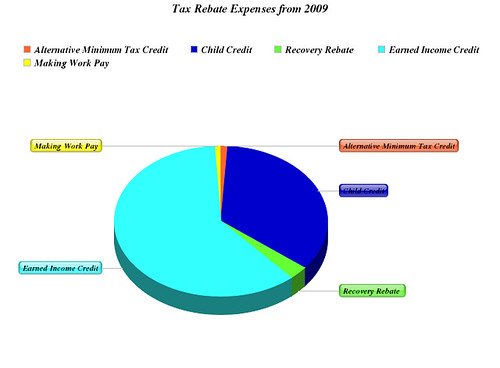

Tax Rebate Expenses From 2009 Maddogg41283 Flickr

https://live.staticflickr.com/4036/4711289081_54db022a57.jpg

Web What is Section 80D Every individual or HUF can claim a deduction from their total income for medical insurance premiums paid in any given year under Section 80D This Web 26 nov 2020 nbsp 0183 32 130 15 0 5 Business News Insurance News All about income tax deduction under Sec 80D 80DD 80DDB for medical expenses

Web 8 mars 2022 nbsp 0183 32 There are five income tax rates after the personal allowance in Scotland 19 20 21 41 and 46 Most doctors in Scotland will be in the 41 income tax Web 16 mai 2022 nbsp 0183 32 The Income Tax Act permits you to claim a maximum deduction of Rs 50 000 as of FY 2021 22 for medical expenses spent in a fiscal year for the healthcare of

EXCEL TEMPLATES Spreadsheet To Track Medical Expenses

https://i.pinimg.com/736x/0c/7a/d3/0c7ad3d0b638d7e009b3055c47d48959.jpg

T20 0262 Additional 2020 Recovery Rebates For Individuals In The

https://www.taxpolicycenter.org/sites/default/files/model-estimates/images/t20-0262_0.gif

.png?w=186)

https://www.mytaxrebate.ie/tax-back-on-me…

Web 18 d 233 c 2020 nbsp 0183 32 You generally receive tax relief for health expenses at your standard rate of tax 20 There is no upward limit as to the cost of health expenses that you can claim for Although any refund will be capped at

https://www.thebalancemoney.com/medical-e…

Web 12 janv 2023 nbsp 0183 32 Most taxpayers can claim medical expenses that exceed 7 5 of their adjusted gross incomes AGIs subject to certain rules Though the deduction seems simple there are a variety of rules about

10 Patient Medical Bill Tracker Sample Excel Templates

EXCEL TEMPLATES Spreadsheet To Track Medical Expenses

Deferred Tax And Temporary Differences The Footnotes Analyst

What Medical Expenses Are Tax Deductible

Tax Exemption Malaysia 2019

National Budget Speech 2022 SimplePay Blog

National Budget Speech 2022 SimplePay Blog

2019 2023 Form Canada T778 E Fill Online Printable Fillable Blank

Medical Expense Spreadsheet Template For Your Needs Bank2home

10 Pay Stub Format Sampletemplatess Sampletemplatess C83

20 Tax Rebate On Medical Expenses - Web If you have spent less than Rs 15 000 then only the incurred expense is tax free E g if your medical expense in a year with supporting bills was Rs 9 000 you will get a tax