2022 Tax Return Due Date For California Residents Personal income tax The due date to file your California state tax return and pay any balance due is April 15 2024 However California grants an automatic extension until

Individuals whose tax returns and payments are due on April 18 Quarterly estimated tax payments due on Jan 17 April 18 June 15 The agency set Oct 16 as the new deadline for eligible individuals to file their 2022 federal individual and business tax returns and to make tax payments the IRS

2022 Tax Return Due Date For California Residents

2022 Tax Return Due Date For California Residents

https://blog.caonweb.com/wp-content/uploads/2022/05/INCOME-TAX-RETURN-FILING-FY-2021-22-AY-2022-23.png

INCOME TAX RETURN DUE DATE FY 2021 22 AY 2022 23 WILL ITR DUE DATE

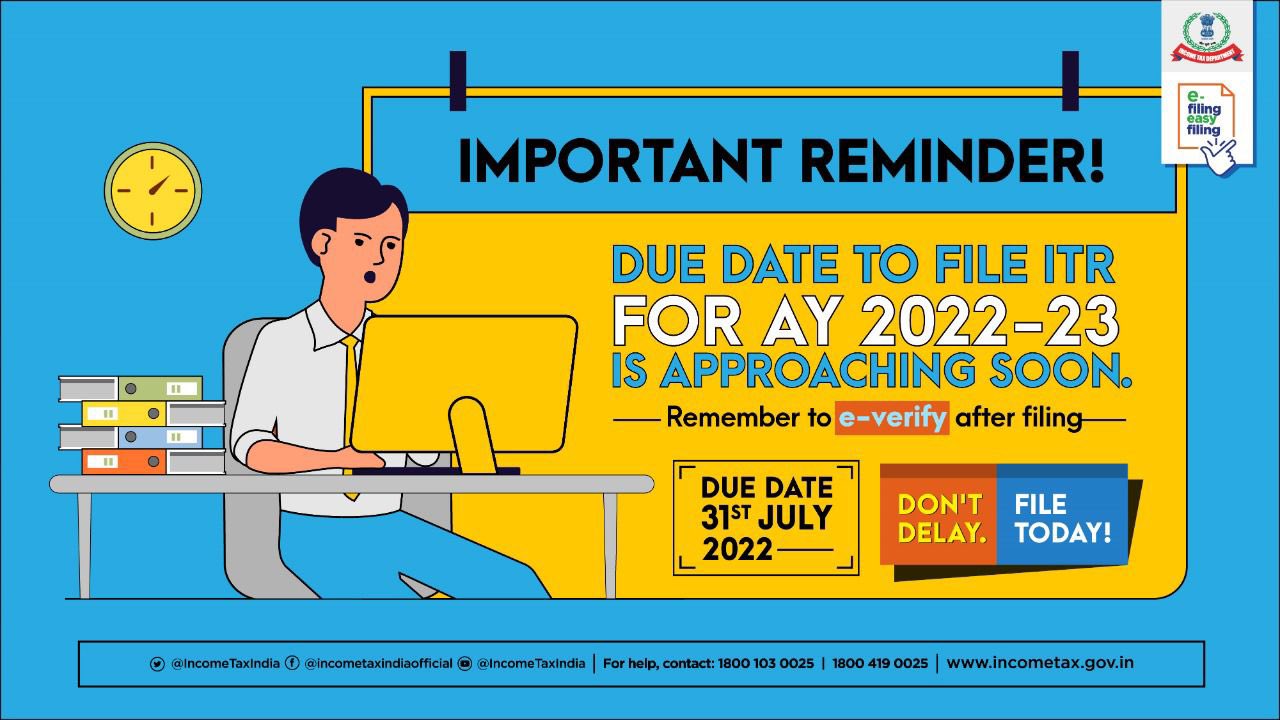

https://i.ytimg.com/vi/_z-Z3hV2SmQ/maxresdefault.jpg

AY 2022 23 Income Tax Slab Rate AY 2022 23 ITR Last Due Date Income

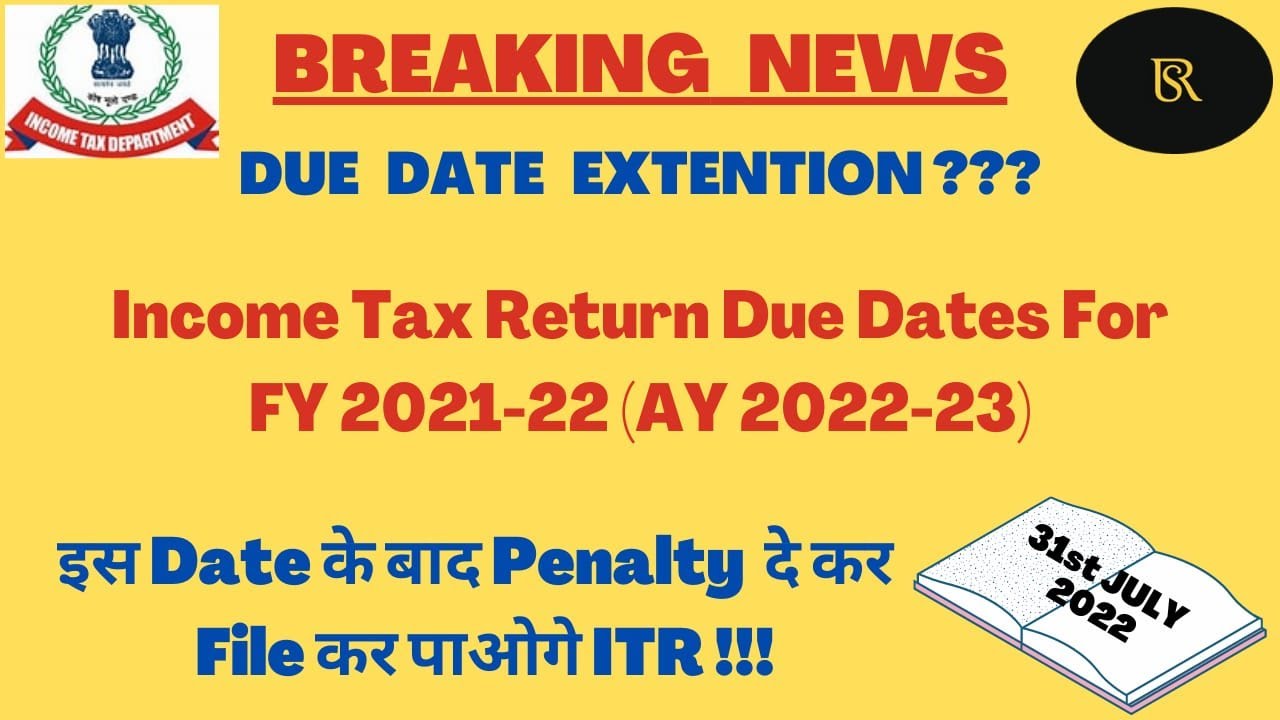

https://i.ytimg.com/vi/cC9C1neIOio/maxresdefault.jpg

Franchise Tax Board FTB has extended the filing and payment deadlines to October 16 2023 for California individuals and businesses impacted by 2022 23 winter storms Visit When the due date falls on a weekend or holiday the deadline to file and pay without penalty is extended to the next business day Due to the federal

2022 individual income tax returns and payments normally due on April 18 For eligible taxpayers 2022 contributions to IRAs and health savings accounts Quarterly 2022 California Resident Income Tax Return 540 Check here if this is an AMENDED return Fiscal year filers only Enter month of year end month year 2023 If

Download 2022 Tax Return Due Date For California Residents

More picture related to 2022 Tax Return Due Date For California Residents

File Your Income Tax Return Now For AY 2023 24 Only 28 Days Left

https://www.nbaoffice.com/wp-content/uploads/2023/06/Green-and-White-Tax-Day-Social-Media-Graphic.png

Due Date To File Income Tax Return For AY 2023 24 Is 31st Of July 2023

https://taxguru.in/wp-content/uploads/2023/06/Income-tax-return-filing-1.jpg

Income Tax India On Twitter Have You Filed Your ITR Yet Due Date To

https://pbs.twimg.com/media/FXhKfnhUUAAxG68.jpg:large

In January citing the winter storms that led to federal emergency and disaster declarations the Internal Revenue Service postponed the due date for most Residents and businesses in 55 of California s 58 counties including all nine in the Bay Area have until Oct 16 to file and pay their federal and state taxes for

California state tax payments are due on April 18 2022 However the state automatically allows filers a state tax return filing extension until October 17 2022 California Sales Use Tax Return WASHINGTON California storm victims now have until May 15 2023 to file various federal individual and business tax returns and make tax payments the

Estate Income Tax Return Due Date 2021 Anibal Greenlee

https://images.moneycontrol.com/static-mcnews/2022/07/Penalties-2-belate-returns-ITR-.jpg

Due Date ITR Fiing For AY 2023 24 Is July 31st 2023 Academy Tax4wealth

https://academy.tax4wealth.com/public/storage/uploads/1686567553-file-income-tax-return-for-ay-2023-24-by-july-31st-2023.jpg

https://www.ftb.ca.gov/file/when-to-file/due-dates-personal.html

Personal income tax The due date to file your California state tax return and pay any balance due is April 15 2024 However California grants an automatic extension until

https://www.sfchronicle.com/bayarea/article/...

Individuals whose tax returns and payments are due on April 18 Quarterly estimated tax payments due on Jan 17 April 18 June 15

Know The Last Date To File Income Tax Return For FY 2021 22 AY 2022 23

Estate Income Tax Return Due Date 2021 Anibal Greenlee

Last Date To File Income Tax Return ITR For FY 2022 23 AY 2023 24

Corporate Tax Filing Deadline 2023 Singapore Pay Period Calendars 2023

Income Tax Return Filing For AY 2022 23 Know About Deadlines Taxwink

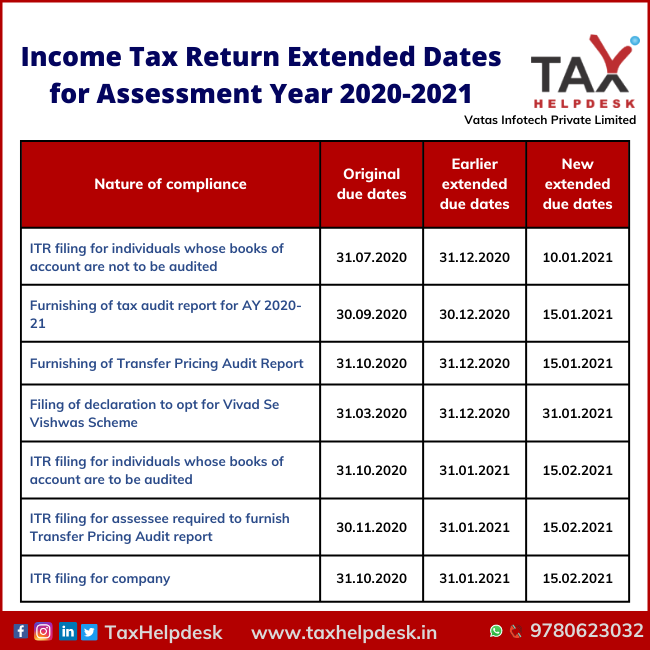

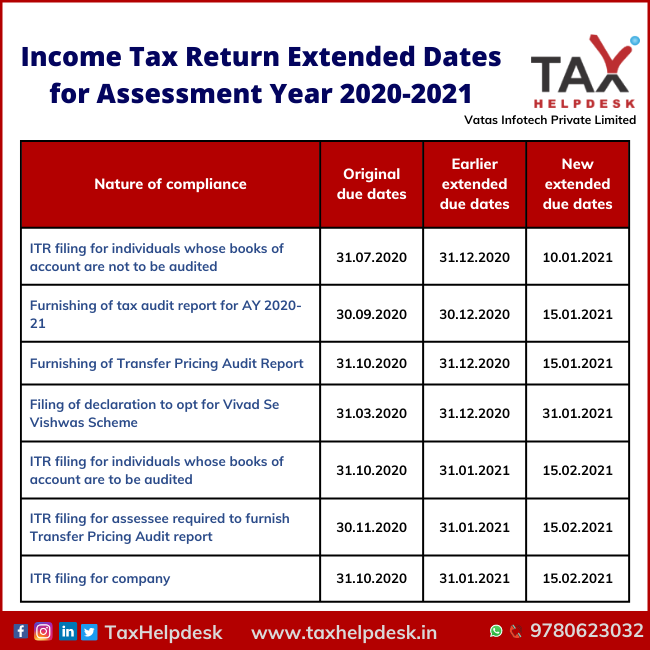

Income Tax Return Filing Due Date Extended For FY 2019 20

Income Tax Return Filing Due Date Extended For FY 2019 20

Tax Extension 2022 RickyFatima

Due dates For ITR Filing Online For FY 2022 23 Ebizfiling

2022 Federal Tax Refund Calendar

2022 Tax Return Due Date For California Residents - IR 2023 189 Oct 16 2023 WASHINGTON The Internal Revenue Service today further postponed tax deadlines for most California taxpayers to Nov 16 2023 In the wake of