2023 Homeowner Rebate The fiscal year 2023 property tax rebate is for homeowners whose New York City property is their primary residence and whose combined income is 250 000 or less Most recipients of the School Tax Relief STAR exemption or credit were automatically qualified and have already received their rebates

The Property Tax Rent Rebate Program supports homeowners and renters across Pennsylvania This program provides a rebate ranging from 380 to 1 000 to eligible older adults and people with disabilities age 18 and older This program is supported by funds from the Pennsylvania Lottery and gaming Ways to Apply Forms and Information The Property Tax Credit Lookup is updated in real time as credits are issued You can view and print the following information regarding the property tax credits we ve issued to you from 2018 to the present description STAR HTRC or Property Tax Relief credit year check issue date

2023 Homeowner Rebate

2023 Homeowner Rebate

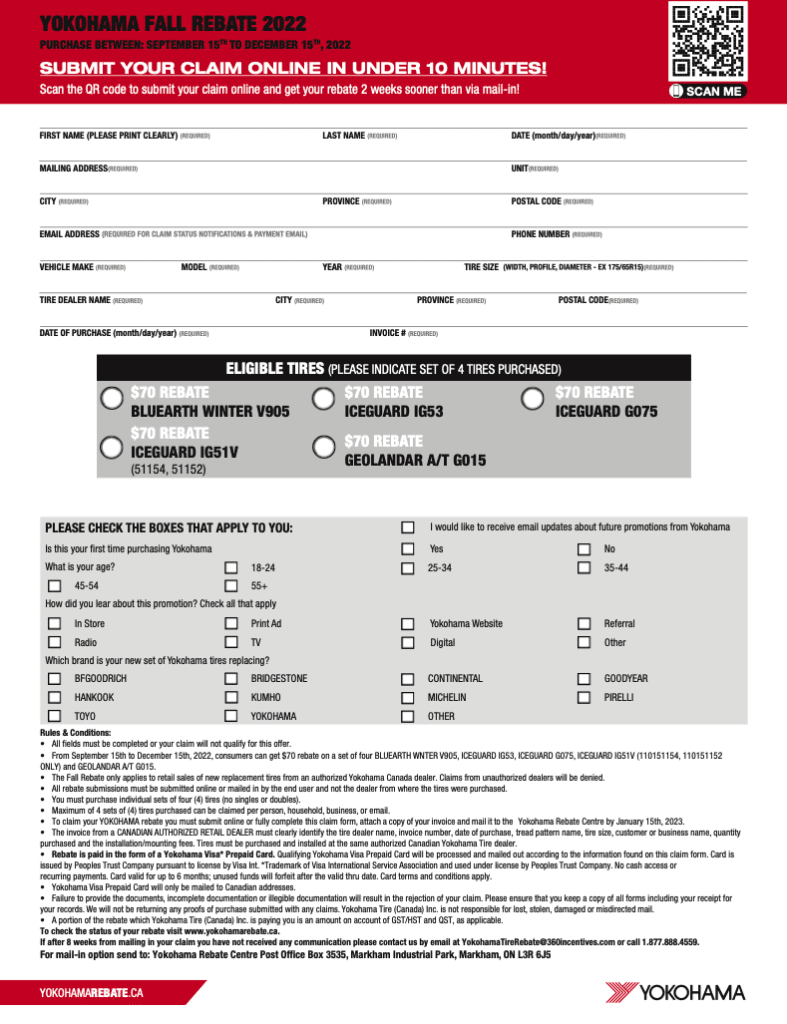

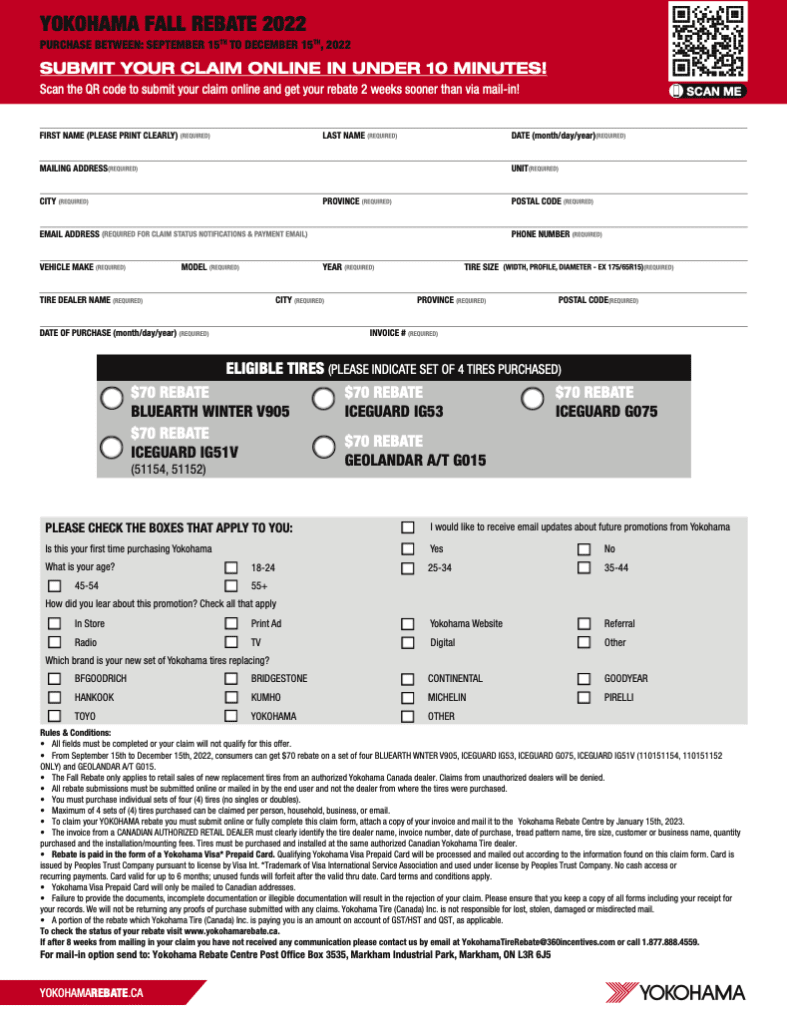

https://printablerebateform.net/wp-content/uploads/2022/04/Yokohama-Rebate-Form-2023-787x1024.png

Official Homeowner Est 2023 First Time New Home Owner Gift Homeowner

https://res.cloudinary.com/teepublic/image/private/s--5-L8fl0F--/t_Resized Artwork/c_fit,g_north_west,h_954,w_954/co_000000,e_outline:48/co_000000,e_outline:inner_fill:48/co_ffffff,e_outline:48/co_ffffff,e_outline:inner_fill:48/co_bbbbbb,e_outline:3:1000/c_mpad,g_center,h_1260,w_1260/b_rgb:eeeeee/t_watermark_lock/c_limit,f_auto,h_630,q_90,w_630/v1679445380/production/designs/41607353_0.jpg

Homeowner Tax Rebate 2023 Who s Eligible And How To Claim It Tax

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/04/2023-Homeowner-Tax-Rebate.jpg?resize=990%2C787&ssl=1

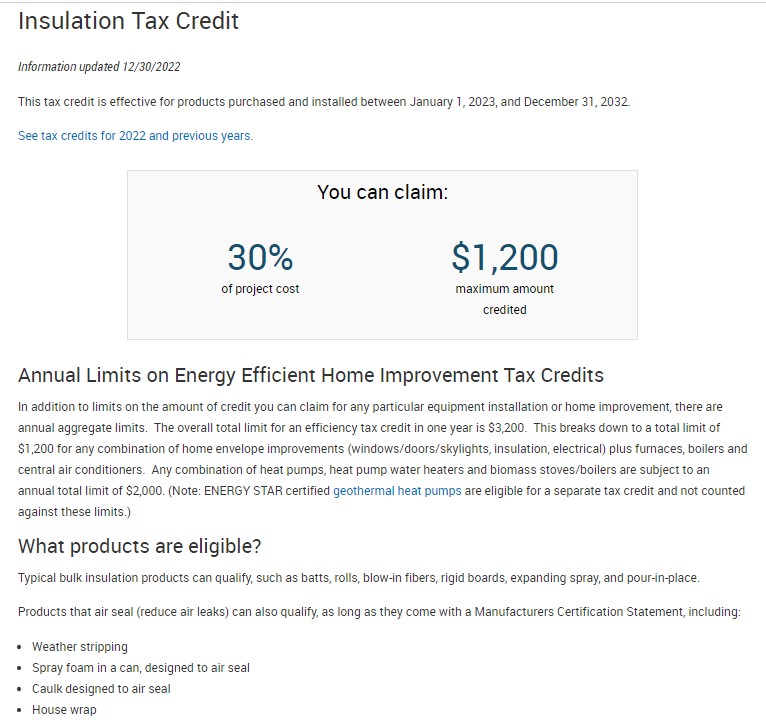

The Property Tax Rent Rebate Program supports homeowners and renters across Pennsylvania This program provides a rebate ranging from 380 to 1 000 to eligible older adults and people with disabilities age 18 and older If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Refund or rebate of real estate taxes If you receive a refund or rebate of real estate taxes this year for amounts you paid this year you must reduce your real estate tax deduction by the amount refunded to you To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit

Download 2023 Homeowner Rebate

More picture related to 2023 Homeowner Rebate

HOMEOWNER REBATES AND TAX CREDITS FOR 2023 Radiant Barrier USA

https://www.radiantbarrierusa.com/wp-content/uploads/2023/01/01.02.2023-HEEHRA-Supporting-Doc-for-Insulation.jpg

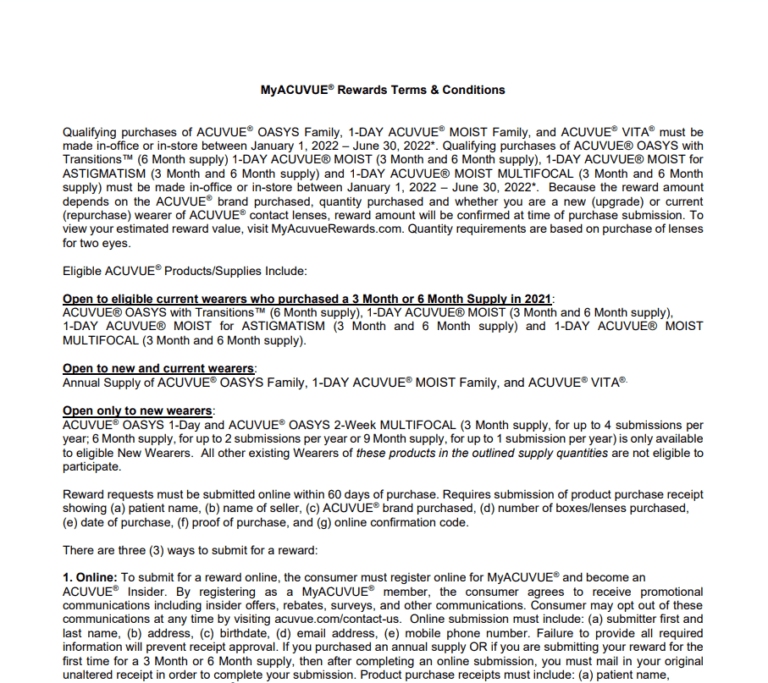

Alconchoice Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/01/Alconchoice.com-Rebate-2023-768x727.png

2023 Renters Rebate Easthartfordct

https://www.easthartfordct.gov/sites/g/files/vyhlif9241/f/bulletins/2023_renters_rebate_10.67_x_5.33_in.png

The Minnesota Homestead Credit Refund can provide relief to homeowners paying property taxes To qualify you must You owned and lived in your home on January 2 2024 You owned and lived in the same home on January 2 2023 and on January 2 2024 The Homestead Benefit program provides property tax relief to eligible homeowners For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces your property taxes

Your 2023 return should be electronically filed postmarked or dropped off by August 15 2024 The final deadline to claim the 2023 refund is August 15 2025 Where s my refund The one time Property Tax Relief Grant is a budget proposal by Governor Brian Kemp to refund 950 million in property taxes back to homestead owners in the Amended Fiscal Year 2023 budget This proposal became law when Governor Kemp signed HB 18 on March 13 2023

Unlocking Savings NYS 2023 Homeowner Tax Rebate Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/NYS-2023-Homeowner-Tax-Rebate.jpg?w=1046&h=765&ssl=1

Know New Rebate Under Section 87A Budget 2023

https://studycafe.in/wp-content/uploads/2023/02/Know-new-rebate-under-section-87A.jpg

https://www.nyc.gov/site/finance/property/property-tax-rebate.page

The fiscal year 2023 property tax rebate is for homeowners whose New York City property is their primary residence and whose combined income is 250 000 or less Most recipients of the School Tax Relief STAR exemption or credit were automatically qualified and have already received their rebates

https://www.pa.gov/en/agencies/revenue/incentives...

The Property Tax Rent Rebate Program supports homeowners and renters across Pennsylvania This program provides a rebate ranging from 380 to 1 000 to eligible older adults and people with disabilities age 18 and older This program is supported by funds from the Pennsylvania Lottery and gaming Ways to Apply Forms and Information

Oral B Rebate 2023 Get Money Back On Your Toothbrush Purchase

Unlocking Savings NYS 2023 Homeowner Tax Rebate Tax Rebate

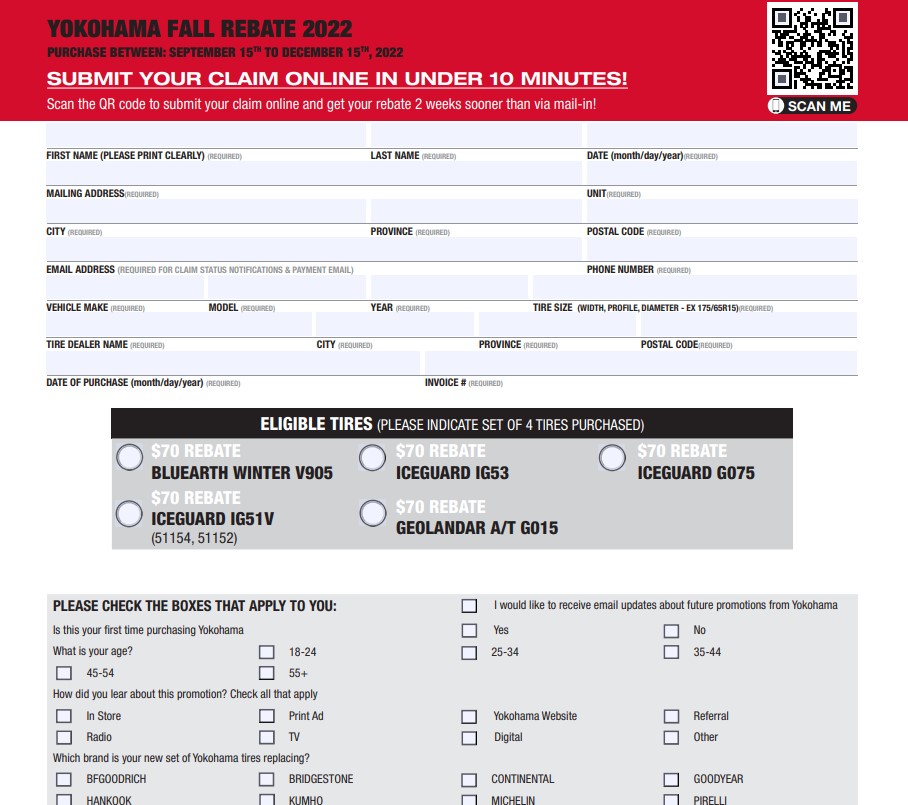

Yokohama Tire Rebate 2023 How To Qualify And Claim Your Rebate

2023 Equinox Rebates Printable Rebate Form

Ducane Homeowner Rebate

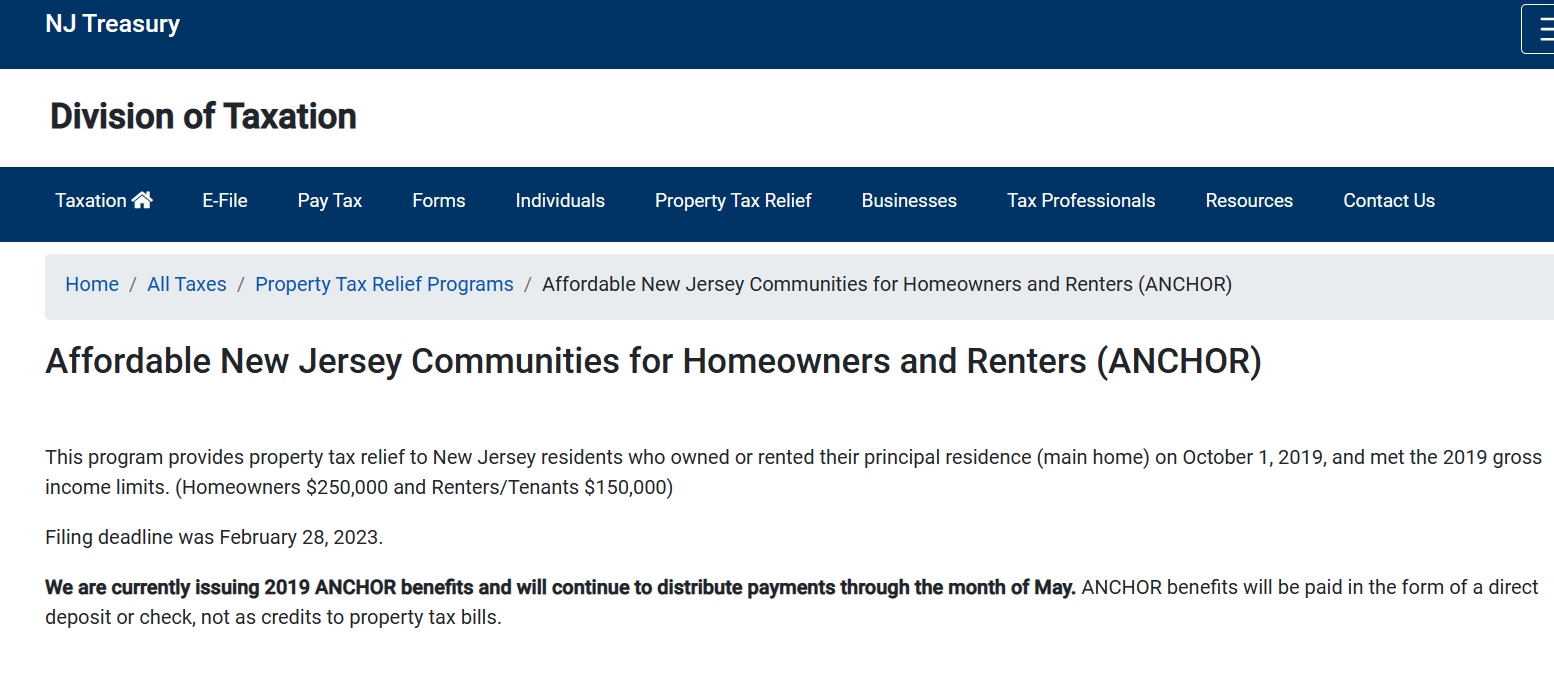

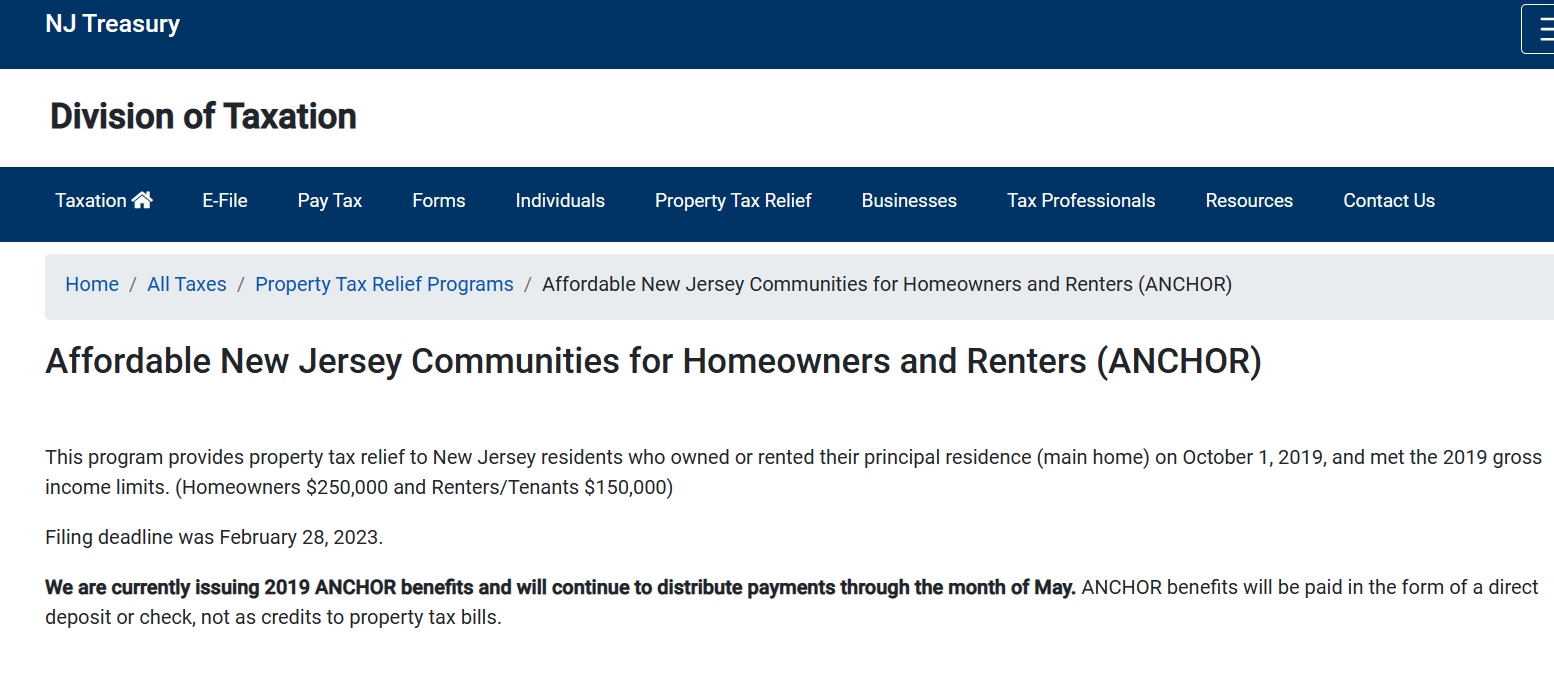

New Jersey Property Tax Rebate 2023 Tax Rebate

New Jersey Property Tax Rebate 2023 Tax Rebate

2023 Acuvue Rebates Printable Rebate Form

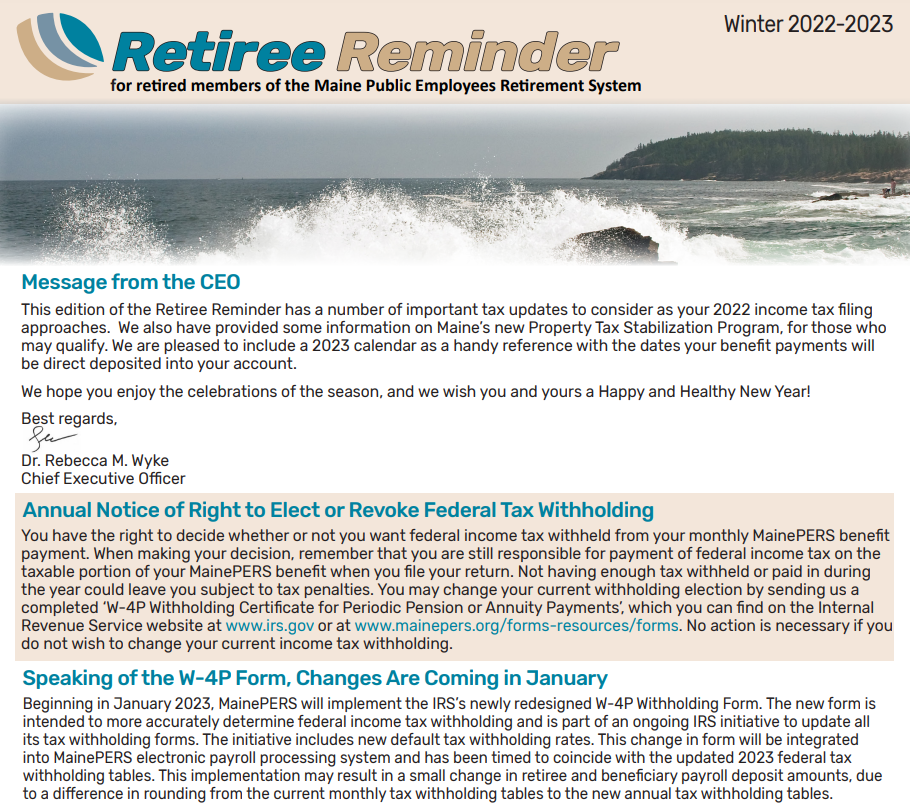

Maine Renters Rebate 2023 Printable Rebate Form

Tax Rebate 2023 California Tax Rebate

2023 Homeowner Rebate - The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034