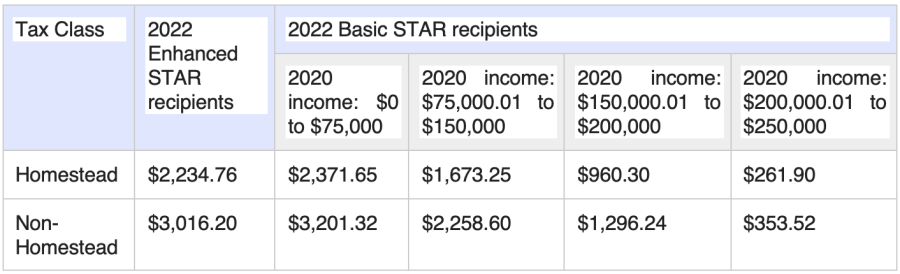

2023 Homeowner Tax Rebate Credit Amounts Web 29 ao 251 t 2022 nbsp 0183 32 If your household income falls Below 80 of the area median income you can claim rebates for 100 of your upgrades up

Web Eligibility To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal Web 4 mai 2023 nbsp 0183 32 Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 for the tax year the

2023 Homeowner Tax Rebate Credit Amounts

2023 Homeowner Tax Rebate Credit Amounts

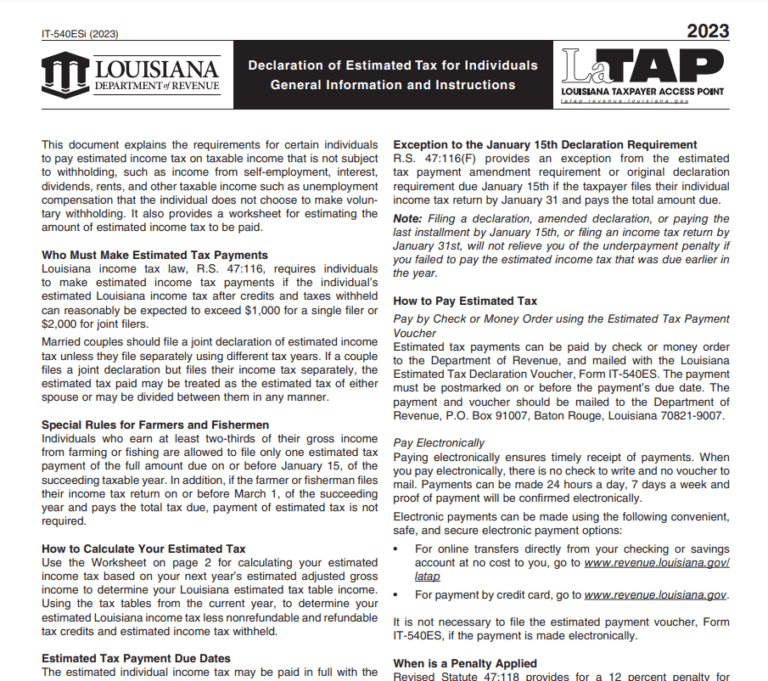

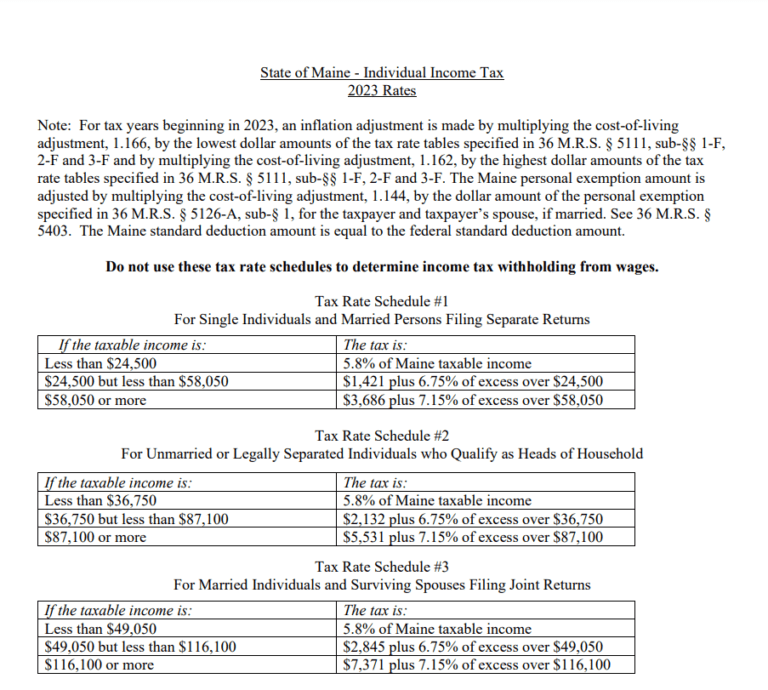

https://printablerebateform.net/wp-content/uploads/2023/04/Maine-Tax-Rebate-2023-768x690.png

Louisiana Tax Credits 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Louisiana-Tax-Rebate-2023-768x681.png

Homeowner Tax Rebate Credit 2023 DoyanTekno English

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhA9Ap4lq_NtwmWdmz9OAjCDFAX_HoAwRnI27Z-BcqcE8qNfaVkOi8U3LaCXBeR-oMly1wGLHRZelm3VlnvJTdkk62TCvTzGRs_ywfROFuF9w7sjIjjIMbuEiqq7wgKwsXXOX_YeZN6WzpBkteh3xI3UteLtOqgLLgsPTA3FbJpM1DPsVHZY8g4zKw4/w1200-h630-p-k-no-nu/Homeowner Tax Rebate Credit 2023.jpg

Web 14 juin 2021 nbsp 0183 32 The first time home buyer tax credit would approach 22 000 by 2027 assuming a five percent annual inflation rate 2023 Maximum tax credit of 17 850 2024 Maximum tax credit of 18 745 2025 Web 21 avr 2023 nbsp 0183 32 April 21 2023 by tamble Homeowner Tax Rebate 2023 The 2023 Homeowner Tax Rebate is a refund that homeowners may be eligible to claim on their taxes This rebate is designed to provide

Web 14 mars 2023 nbsp 0183 32 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program providing direct property tax relief to eligible Web 28 juil 2022 nbsp 0183 32 Some limitations apply as the amount of the homeowner s tax rebate cannot exceed their net school tax liability for the 2022 2023 school year after factoring

Download 2023 Homeowner Tax Rebate Credit Amounts

More picture related to 2023 Homeowner Tax Rebate Credit Amounts

Homeowner Tax Rebate 2023 Who s Eligible And How To Claim It Tax

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/04/2023-Homeowner-Tax-Rebate.jpg?resize=990%2C787&ssl=1

Tax Rebate 2023 NC Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Tax-Rebate-2023-NC.jpg

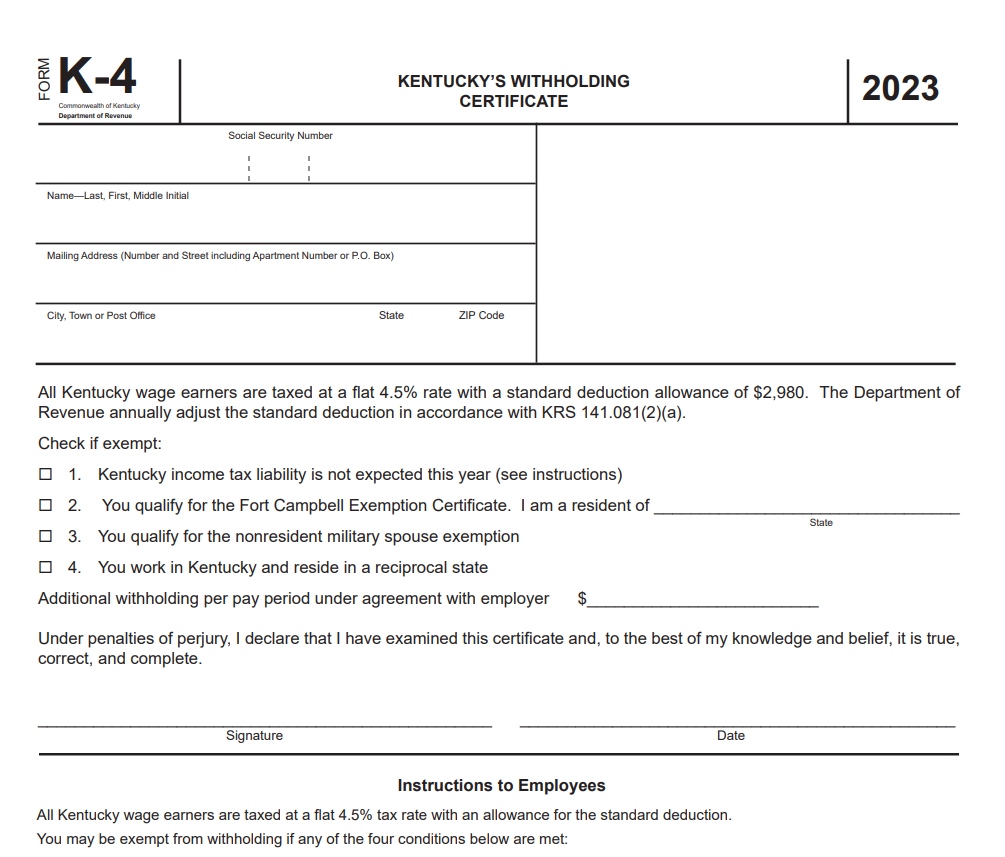

Kentucky Tax Rebate 2023 Tax Rebate

https://www.tax-rebate.net/wp-content/uploads/2023/05/Kentucky-Tax-Rebate-2023.jpg

Web 21 mai 2023 nbsp 0183 32 NYS 2023 Homeowner Tax Rebate As the year 2023 rolls in New York State homeowners have an exciting opportunity to reap the benefits of the NYS 2023 Web 2 juil 2023 nbsp 0183 32 2023 Homeowner Tax Rebate Credit If you are looking for 2023 Homeowner Tax Rebate Credit you ve come to the right place We have 34 rebates

Web Les travaux 233 ligibles 224 MaPrimeR 233 nov Comme pour le cr 233 dit d imp 244 t MaPrimeR 233 nov concerne de nombreux travaux de r 233 novation 233 nerg 233 tique sous r 233 serve que les Web 23 janv 2023 nbsp 0183 32 Published on January 23 2023 by Leslie Bailey NY Homeowner Tax Rebate Credit HTRC is a one year tax credit program for eligible homeowners The

Unlocking Savings NYS 2023 Homeowner Tax Rebate Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/NYS-2023-Homeowner-Tax-Rebate.jpg?w=1046&h=765&ssl=1

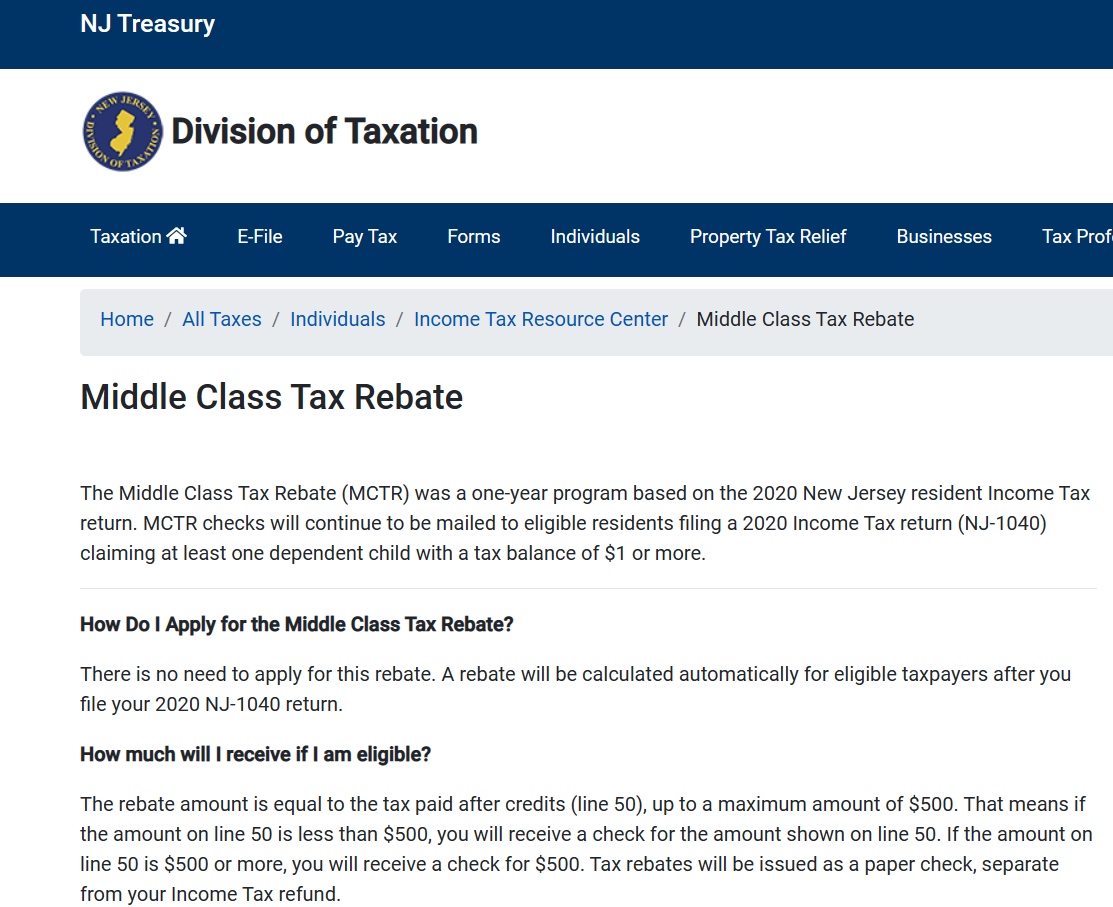

NJ Middle Class Tax Rebate 2023 Tax Rebate

https://www.tax-rebate.net/wp-content/uploads/2023/05/NJ-Middle-Class-Tax-Rebate-2023.jpg

https://www.investopedia.com/tax-credits-for …

Web 29 ao 251 t 2022 nbsp 0183 32 If your household income falls Below 80 of the area median income you can claim rebates for 100 of your upgrades up

https://www.tax.ny.gov/pit/property/homeowner-tax-rebate-credit.htm

Web Eligibility To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal

Official Homeowner Est 2023 First Time New Home Owner Gift Homeowner

Unlocking Savings NYS 2023 Homeowner Tax Rebate Tax Rebate

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

Town Of Pelham Assessor State Begins Sending One year Homeowner Tax

Information About The 2023 Homeowner Tax Relief Grant

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

Tax Rebate 2023 NM Tax Rebate

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks

HDC Joint Memo Historic Homeowner Rehabilitation Tax Credit HDC

2023 Homeowner Tax Rebate Credit Amounts - Web 21 avr 2023 nbsp 0183 32 April 21 2023 by tamble Homeowner Tax Rebate 2023 The 2023 Homeowner Tax Rebate is a refund that homeowners may be eligible to claim on their taxes This rebate is designed to provide