2023 Homeowners Tax Credit Application The Homeowners Property Tax Credit Program provides tax relief for eligible homeowners by setting a limit on the amount of property taxes owed based on their income

In 2023 the Department will be accepting applications through October 1st This application is closed Please contact the administrator if you have questions Review the steps To go straight to the Application click here The Application is used for the State Homeowners Tax Credit the Montgomery County Supplemental Homeowners Property Tax Credit and the

2023 Homeowners Tax Credit Application

2023 Homeowners Tax Credit Application

https://www.signnow.com/preview/513/825/513825734/large.png

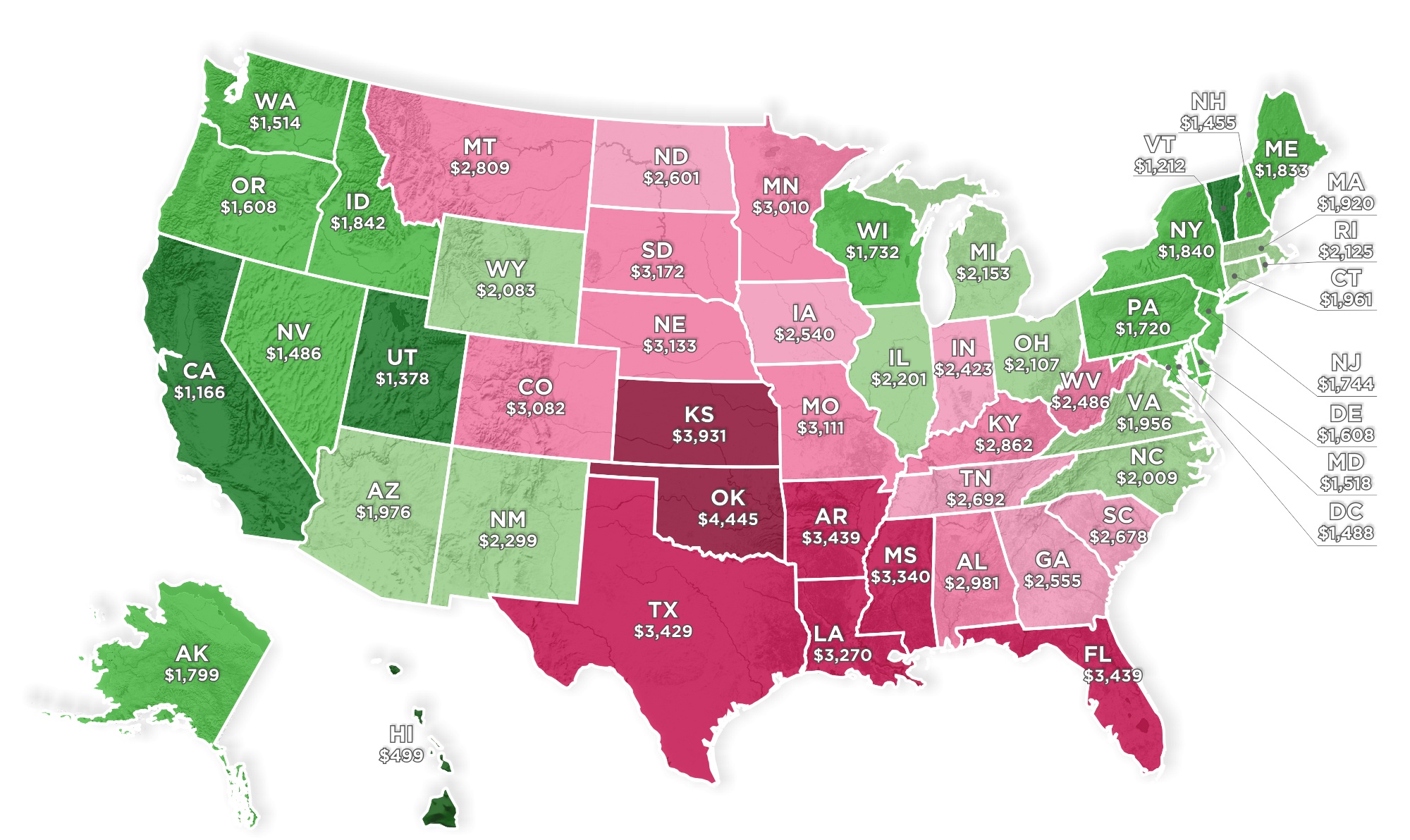

Mapped Average Homeowners Insurance Rates For Each State

https://cdn.howmuch.net/articles/homeowners-insurance-rates-2020-COVER-8114.jpg

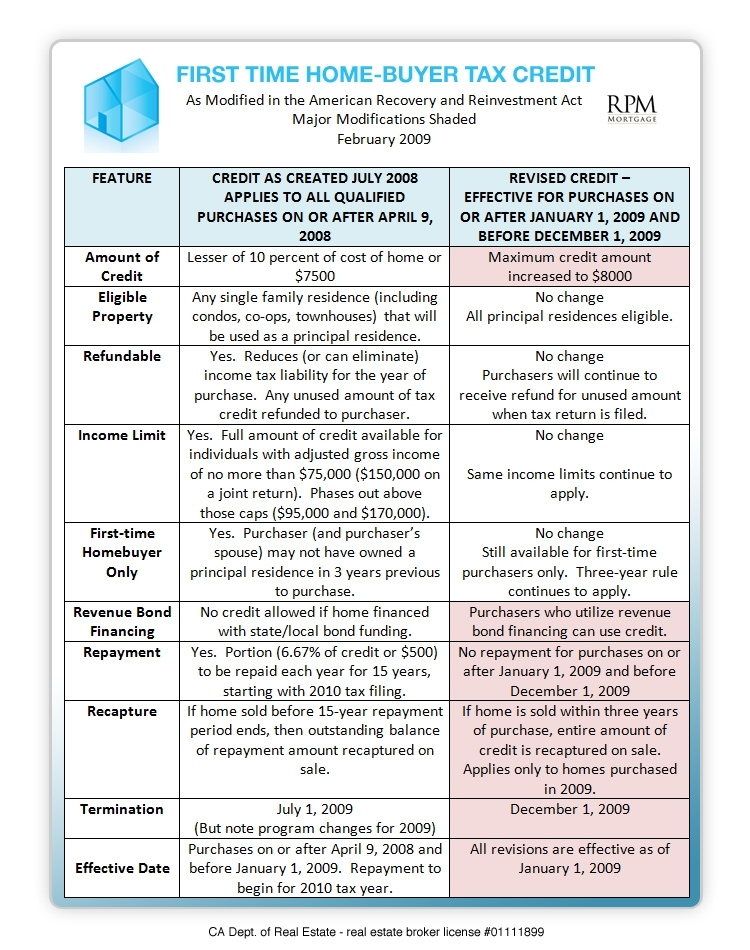

Homeowners Tax Credit Overview The Basis Point

https://thebasispoint.com/wp-content/uploads/2009/03/tax-credit-overview.jpg

This program allows credits against the homeowners property tax bill if the property taxes exceed a fixed percentage of the person s gross income in other words it limits the amount of Homeowners and Renters Tax Credit applications now online BALTIMORE The Maryland Department of Assessments and Taxation recently announced applications for

The Maryland State Department of Assessments and Taxation SDAT 2023 Homeowners and Renters Tax Credit applications are now available online You can apply If you are a homeowner in tax sale you may qualify for the Homeowner Protection Program a loan program that could remove you from the tax sale process for three years

Download 2023 Homeowners Tax Credit Application

More picture related to 2023 Homeowners Tax Credit Application

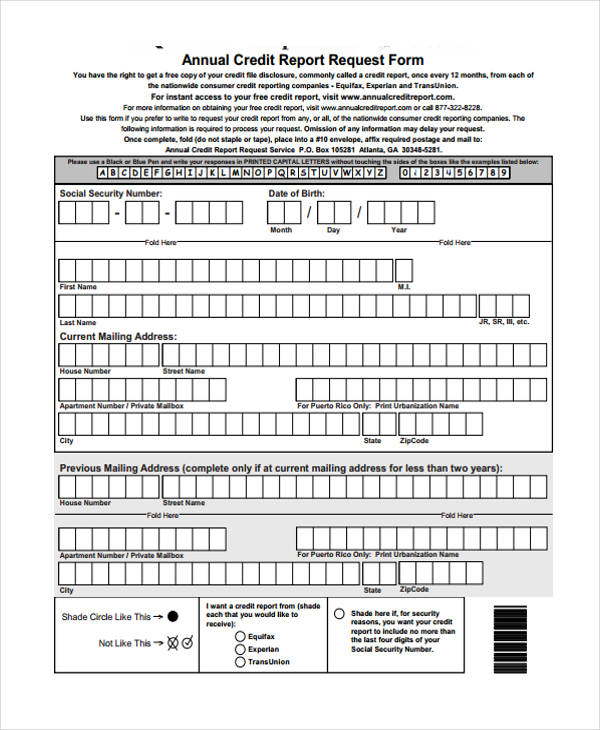

FREE 24 Credit Application Forms In PDF

https://images.sampleforms.com/wp-content/uploads/2017/04/Annual-Credit-Report-Application-Form.jpg?width=390

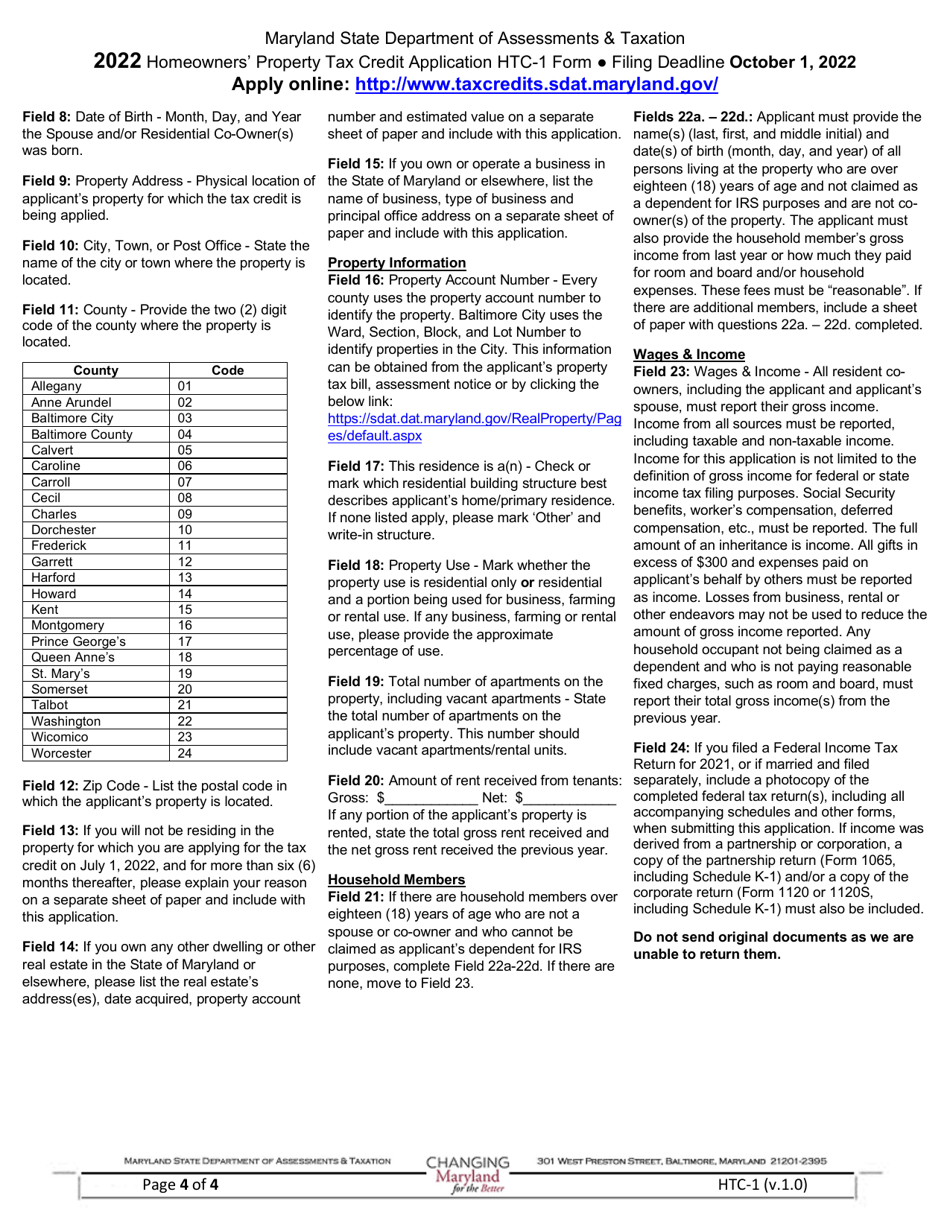

Form HTC 1 Download Printable PDF Or Fill Online Homeowners Property

https://data.templateroller.com/pdf_docs_html/2378/23783/2378304/page_4_thumb_950.png

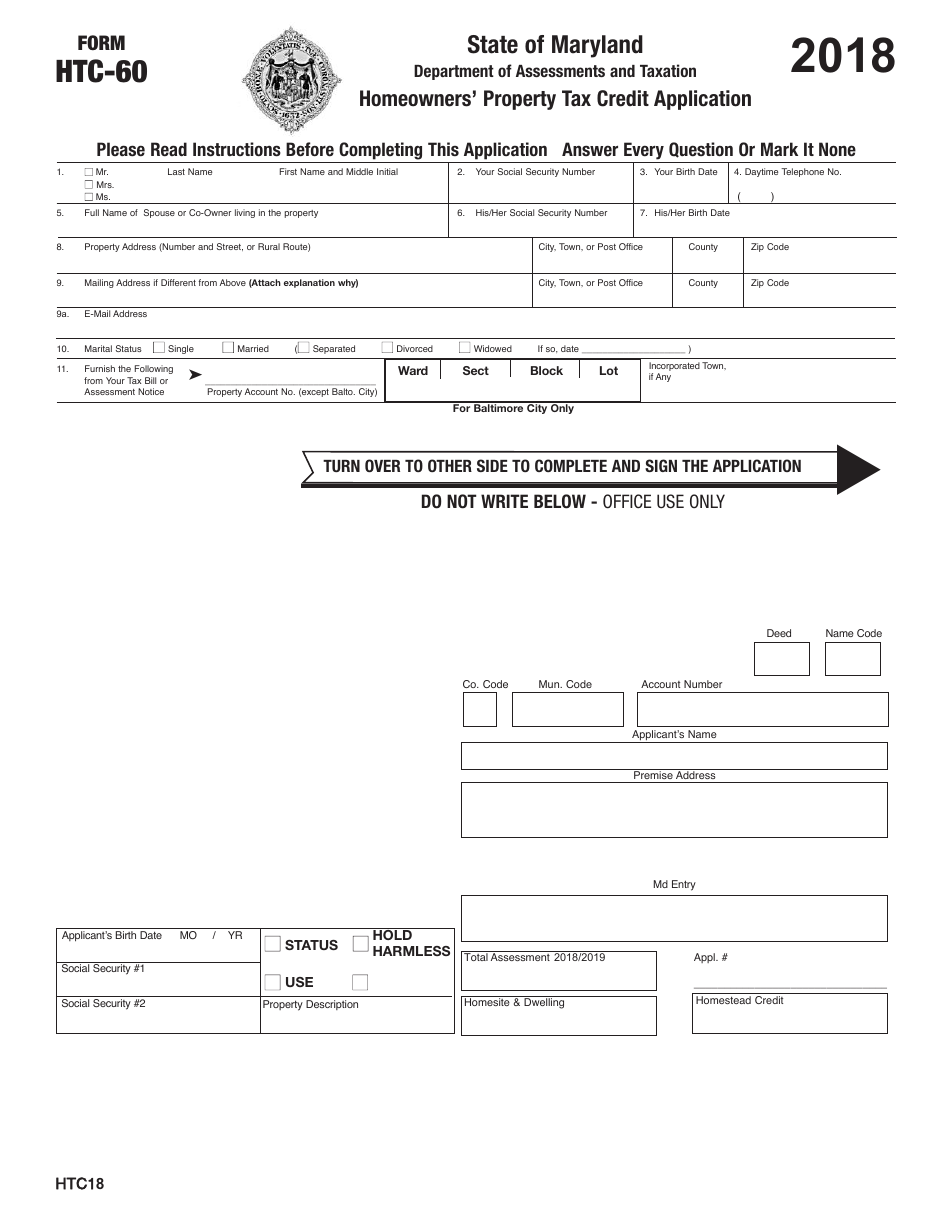

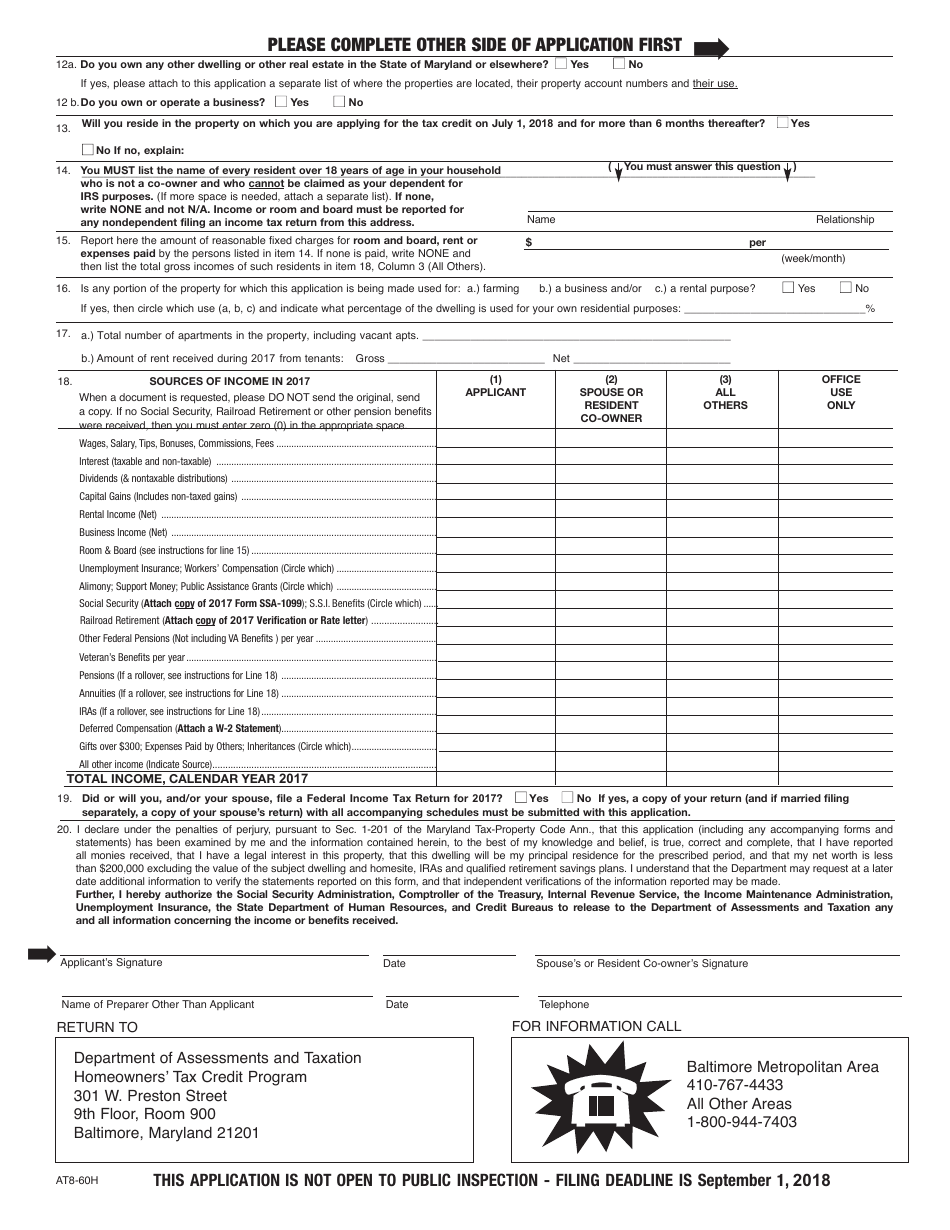

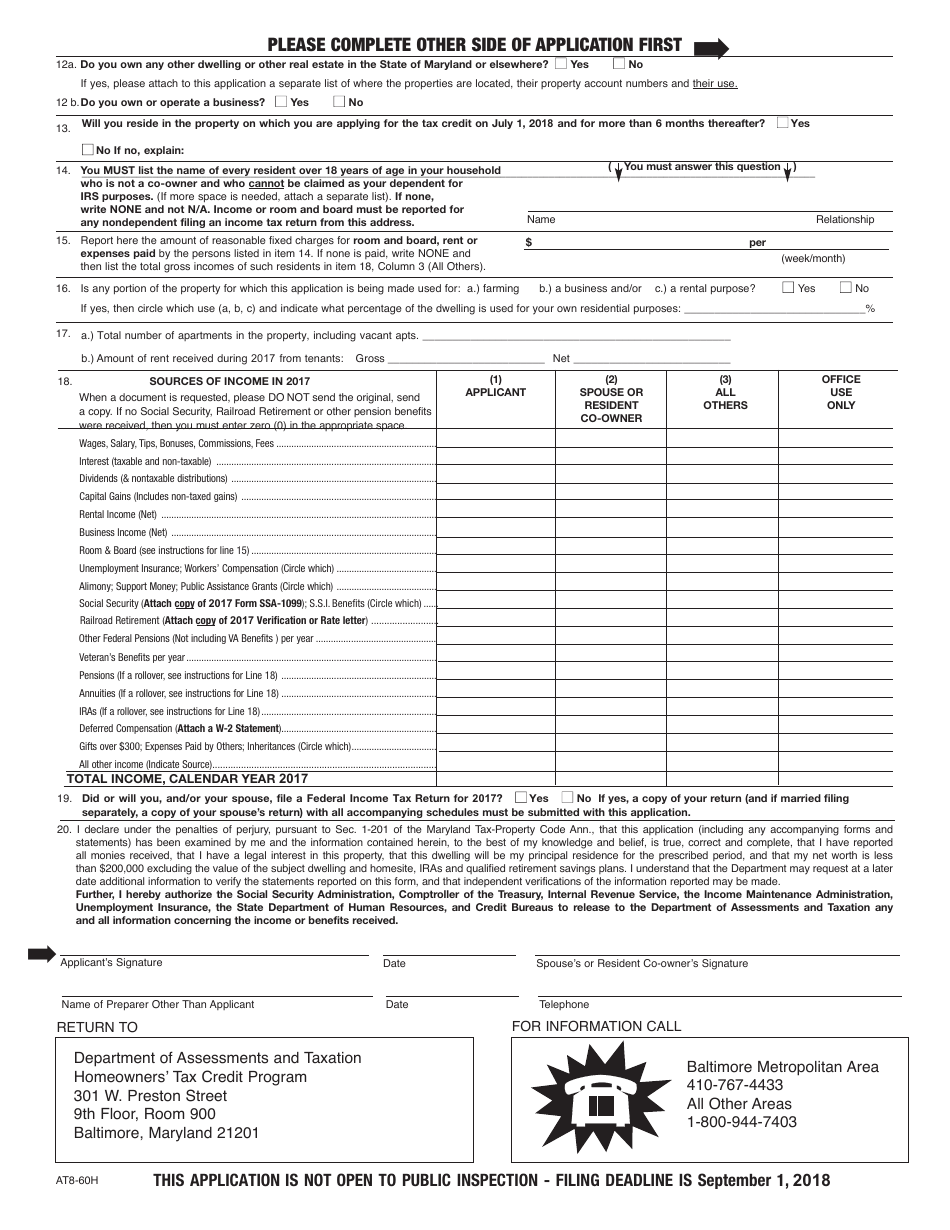

Form HTC 60 2018 Fill Out Sign Online And Download Printable PDF

https://data.templateroller.com/pdf_docs_html/1728/17289/1728997/form-htc-60-2018-homeowners-property-tax-credit-application-maryland_print_big.png

Click to apply online Paper applications are available for download Processing timeline 30 90 days When applications become available In person at your local assessment office or your local community action partnership You must Customers can apply for the 2023 Homeowners Tax Credit online Paper applications are also available online However customers should be advised that applications

You can also call 410 222 1748 and ask about the status of your tax credit application If your application is incomplete or there are additional questions about the information you provided Anne Arundel County will contact you in Can I apply for the Homeowner tax credit Answer Yes If the owner is proposing work for a portion of the interior that is exclusively the owner occupied residential portion of the structure

Tax Exemptions For Homeowners

https://static.wixstatic.com/media/94cb92_d1b159444ca740628f8b6eb90929486b~mv2.jpg/v1/fill/w_1000,h_566,al_c,q_90,usm_0.66_1.00_0.01/94cb92_d1b159444ca740628f8b6eb90929486b~mv2.jpg

3 Homeowners Tax Credit Programs To Utilize In 2020 Millionacres

https://i.pinimg.com/originals/3d/c8/0c/3dc80c19c02a5a5334a1dc826afbf122.png

https://dat.maryland.gov/newsroom/Pages/2023-04-04...

The Homeowners Property Tax Credit Program provides tax relief for eligible homeowners by setting a limit on the amount of property taxes owed based on their income

https://onestop.md.gov/forms/homeowners-property...

In 2023 the Department will be accepting applications through October 1st This application is closed Please contact the administrator if you have questions Review the steps

State Withholding Tax Form 2023 Printable Forms Free Online

Tax Exemptions For Homeowners

Bronwyn Ladner

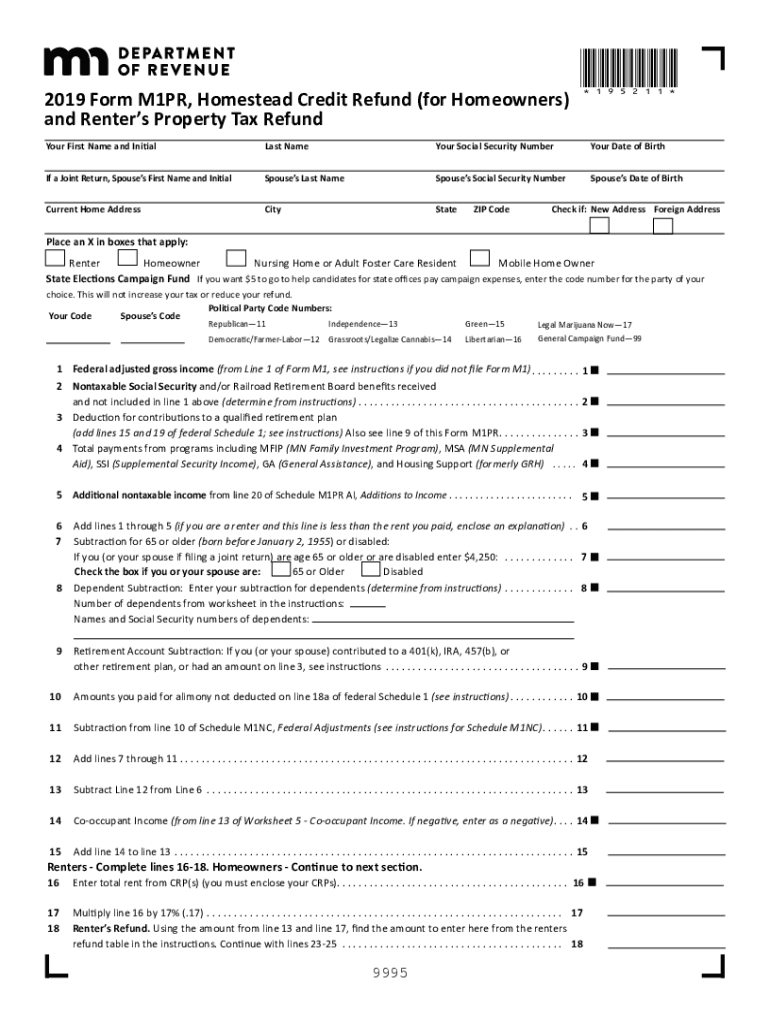

Fillable Form M1pr Homestead Credit Refund For Homeowners And

Texas Solar Power Systems Installations Portfolio Wells Solar

Form HTC 60 2018 Fill Out Sign Online And Download Printable PDF

Form HTC 60 2018 Fill Out Sign Online And Download Printable PDF

Homeowners Deductions For Property Taxes On Personal Residences Hobe

Homeowners Tax Credit

2021 Declaration Of Homestead Form Fillable Printable Pdf And Forms

2023 Homeowners Tax Credit Application - If you are a homeowner in tax sale you may qualify for the Homeowner Protection Program a loan program that could remove you from the tax sale process for three years