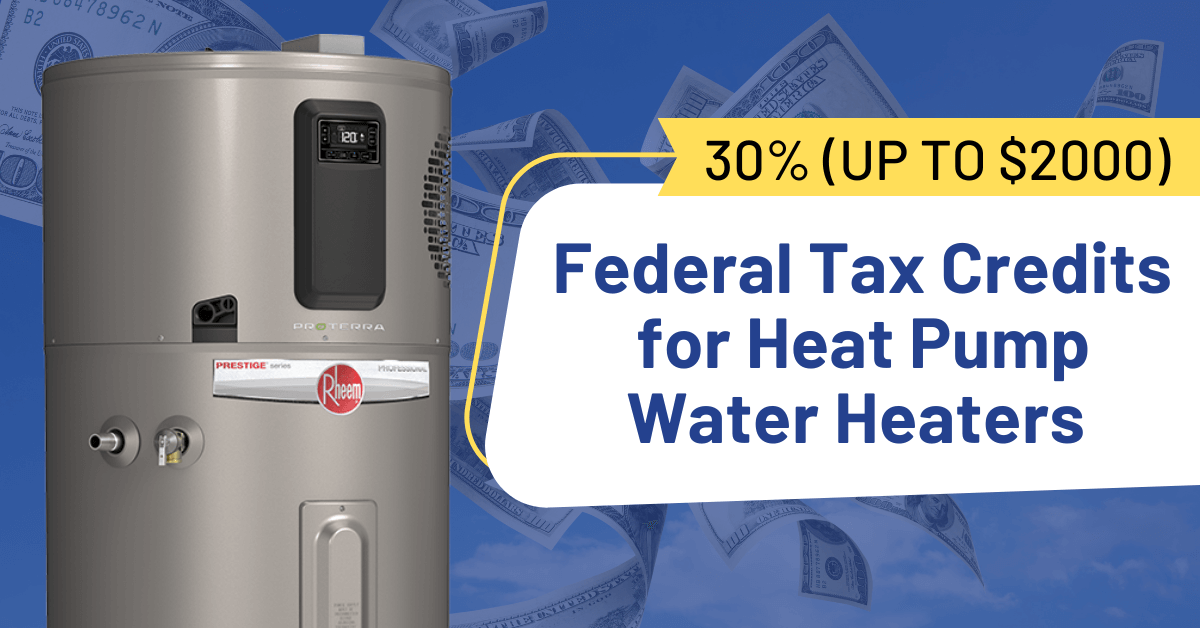

2023 Hot Water Heater Tax Credit Any combination of heat pumps heat pump water heaters and biomass stoves boilers are subject to an annual total limit of 2 000 Note ENERGY STAR certified geothermal heat pumps are eligible for a separate tax credit and not counted against these limits

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022 2023 through 2032 30 up to a maximum of 1 200 water heaters heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit For 2022 biomass stoves and boilers are treated as a Residential Clean Energy Credit with no lifetime maximum

2023 Hot Water Heater Tax Credit

2023 Hot Water Heater Tax Credit

http://1stclassplumber.com/wp-content/uploads/2015/09/State-Water-Heaters.png

Inline Water Heater

https://rmc-cdn.s3.amazonaws.com/media/uploads/iat/sites/33/2019/03/booster.png

300 Federal Water Heater Tax Credit 2022 And Earlier Ray s

https://www.raysplumbinginc.com/wp-content/uploads/water-heater-tax-credit-2020.png

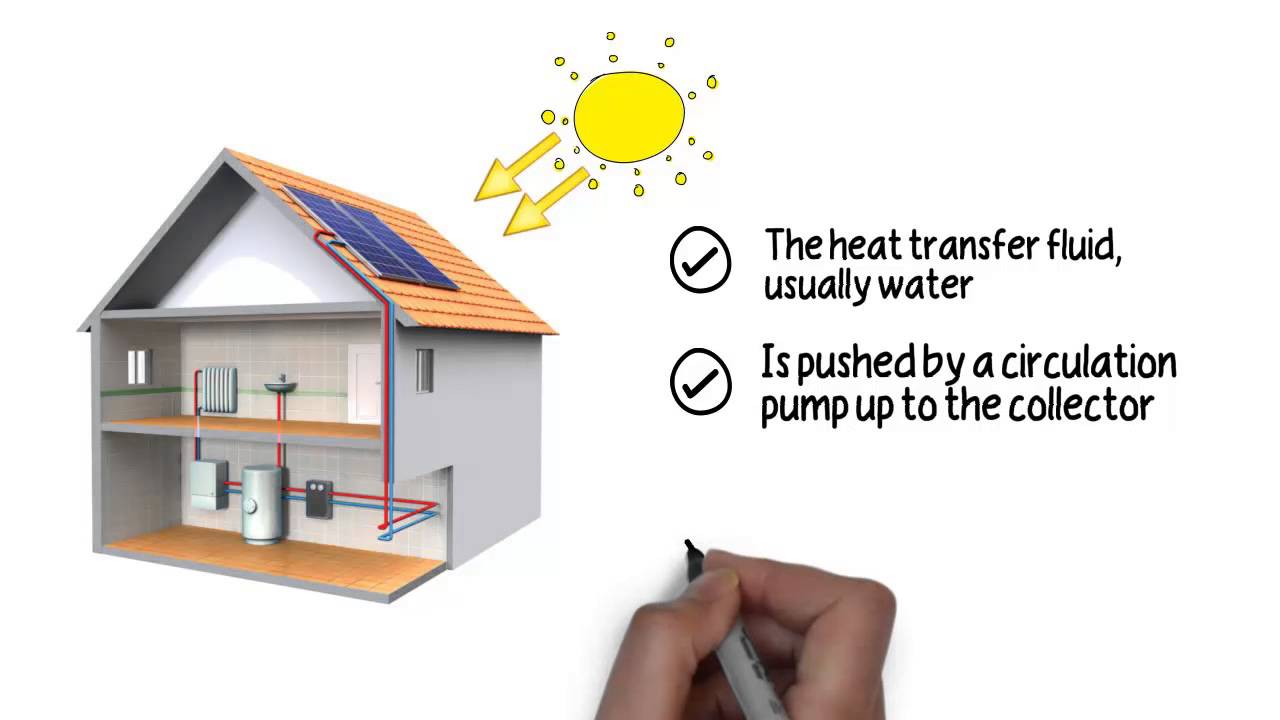

There are lots of ways to save on energy bills around the home by upgrading your appliances Water heaters air conditioners and certain stoves qualify for a 30 percent tax credit when you upgrade to newer more efficient models Solar powered water heaters for water used inside the home at least half of the home s water heating capacity must be solar and water for swimming pools and hot tubs doesn t qualify Wind turbines that generate up to 100 kilowatts of electricity for residential use

Tax Credit Available for 2022 Tax Year Updated Tax Credit Available for 2023 2032 Tax Years Home Clean Electricity Products Solar electricity Fuel Cells 30 of cost Wind Turbine Battery Storage N A 30 of cost Heating Cooling and Water Heating Heat pumps 300 30 of cost up to 2 000 per year Heat pump water heaters Biomass On January 1 2023 new federal tax credits came into effect under the Inflation Reduction Act These tax credits cover a wide range of home energy efficiency improvements including heat pump water heaters natural gas water heaters and other equipment and upgrades like air conditioners windows doors home energy audits and more

Download 2023 Hot Water Heater Tax Credit

More picture related to 2023 Hot Water Heater Tax Credit

110V 3000W Instant Electric Tankless Hot Water Heater Home Whole House

https://i5.walmartimages.com/asr/e29decd5-f726-454e-86de-d1b2d96af85c.4a8e13507252d8ae1f2d65cd4c610a8e.jpeg

Rheem 4A1315G8 Stellar 315 Litre 4 8kw 1st Choice Hot Water

https://1stchoicehotwater.com.au/wp-content/uploads/2016/08/Rheem-4A1315.jpg

Outdoor Residential Commercial Heat Pump Water Heater From China

https://irrorwxhmkqrlr5p-static.micyjz.com/cloud/lkBpnKrklmSRjjnnkikiio/baishen-lan.png

Tax Credits are available for Air Source and Ductless Heat Pumps Heat Pump Water Heaters Insulation Windows Doors and Central Air Conditioners The table below provides more detail about the tax credits and required minimum specifications Federal Energy Tax Credits for Calendar Year 2023 Residential renewable energy products are still eligible for tax credits until December 31 2023 Tax credits for energy efficient commercial buildings were made permanent in 2021 Although incentives are offered for installing a tankless water heater there are specific criteria you must consider Renewable Energy Property Credits

Notwithstanding these limits the credit for qualifying expenditures on biomass stoves or water heaters and or heat pumps powered by electricity or natural gas is capped at 2 000 600 on windows 150 for home energy audits 500 for exterior doors in the aggregate and 250 per exterior door Beginning 2023 the expanded version of 25C now called the Energy Efficient Home Improvement Tax Credit under the Inflation Reduction Act of 2022 will provide up to 2 000 in tax credits for qualified water heaters as well as credits for electrical upgrades

Amazon SRCC Certified 30 Tax Credit Local Rebate Eligible

https://images-na.ssl-images-amazon.com/images/I/91zI2WTGzTL._AC_SL1500_.jpg

18L Instant Tankless Water Heater Pevor 36KW Tankless Water Bolier

https://m.media-amazon.com/images/I/61vzAYqojiL.jpg

https://www. energystar.gov /about/federal-tax...

Any combination of heat pumps heat pump water heaters and biomass stoves boilers are subject to an annual total limit of 2 000 Note ENERGY STAR certified geothermal heat pumps are eligible for a separate tax credit and not counted against these limits

https://www. irs.gov /credits-deductions/home-energy-tax-credits

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

Solar Hot Water Heater Fed State Tax Credits Rebates Apply YouTube

Amazon SRCC Certified 30 Tax Credit Local Rebate Eligible

30 Federal Tax Credits For Heat Pump Water Heaters 2023

How To Install A Propane Tankless Hot Water Heater Multifileshandy

HQMPC Tankless Water Heater Isolation Valves Tankless Water Heater

Buy HQMPC Tankless Water Heater Isolation Valves Tankless Water Heater

Buy HQMPC Tankless Water Heater Isolation Valves Tankless Water Heater

Buy RV Tankless Water Heater FOGATTI 2 9 GPM 55000 BTU Hot Water

Buy RV Tankless Water Heater FOGATTI 2 9 GPM 55000 BTU Hot Water

DC 24V 600W Water Heating Element Immersion Heater Screw In Heater With

2023 Hot Water Heater Tax Credit - For qualified fuel cell property see Lines 7a and 7b later You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property battery storage technology and