2023 Il Tax Rebate Web 15 avr 2023 nbsp 0183 32 Taxpayers will need to provide documentation to verify their eligibility such as a copy of their tax return for the 2022 tax year The deadline for claiming the rebate is

Web 17 juin 2022 nbsp 0183 32 Illinois Governor Pritzker signed into law more than 1 8 billion in tax relief including suspending sales tax on groceries freezing tax on fuel providing a back to Web 19 avr 2022 nbsp 0183 32 Andrew Adams State Journal Register Illinois Gov JB Pritzker on Tuesday signed the state s 46 5 billion budget for 2023 The budget includes a plan to issue tax

2023 Il Tax Rebate

2023 Il Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Federal-Tax-Rebate-2023.jpg?ssl=1

Most Residential Properties To Incur Higher Tax From Jan 1 2023

https://onecms-res.cloudinary.com/image/upload/s--ljAe074S--/f_auto%2Cq_auto/v1/mediacorp/tdy/image/2022/12/02/20221202-sw-hdbtax3.png?itok=IFvC-aSJ

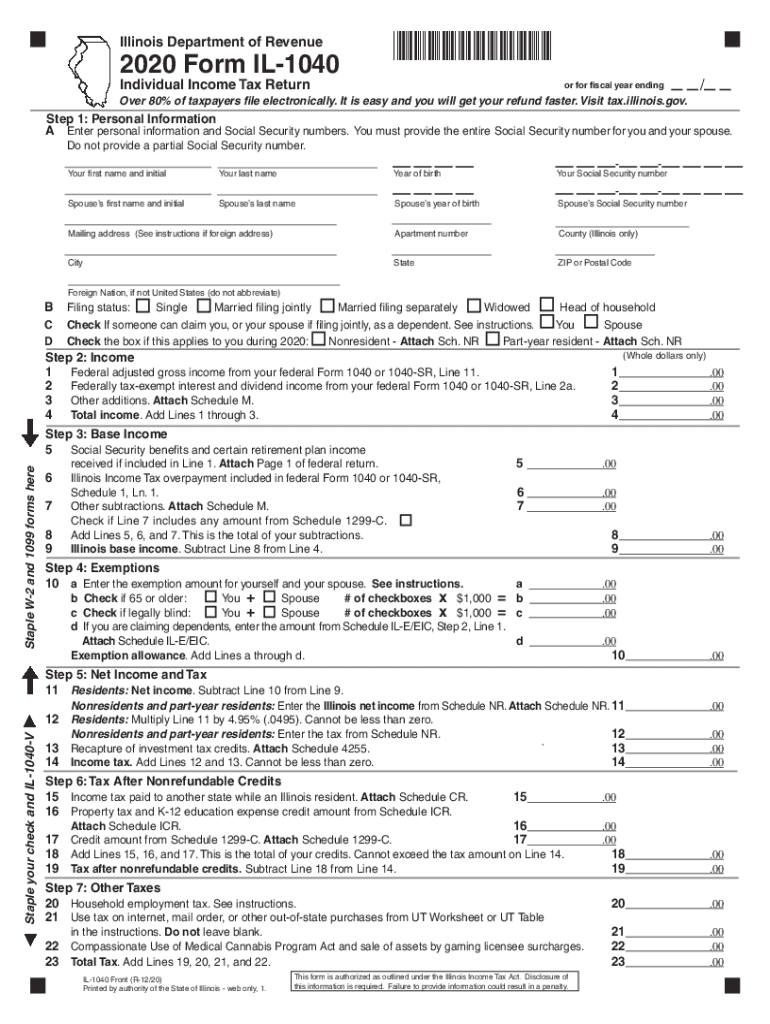

Illinois Tax Forms Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/552/409/552409798/large.png

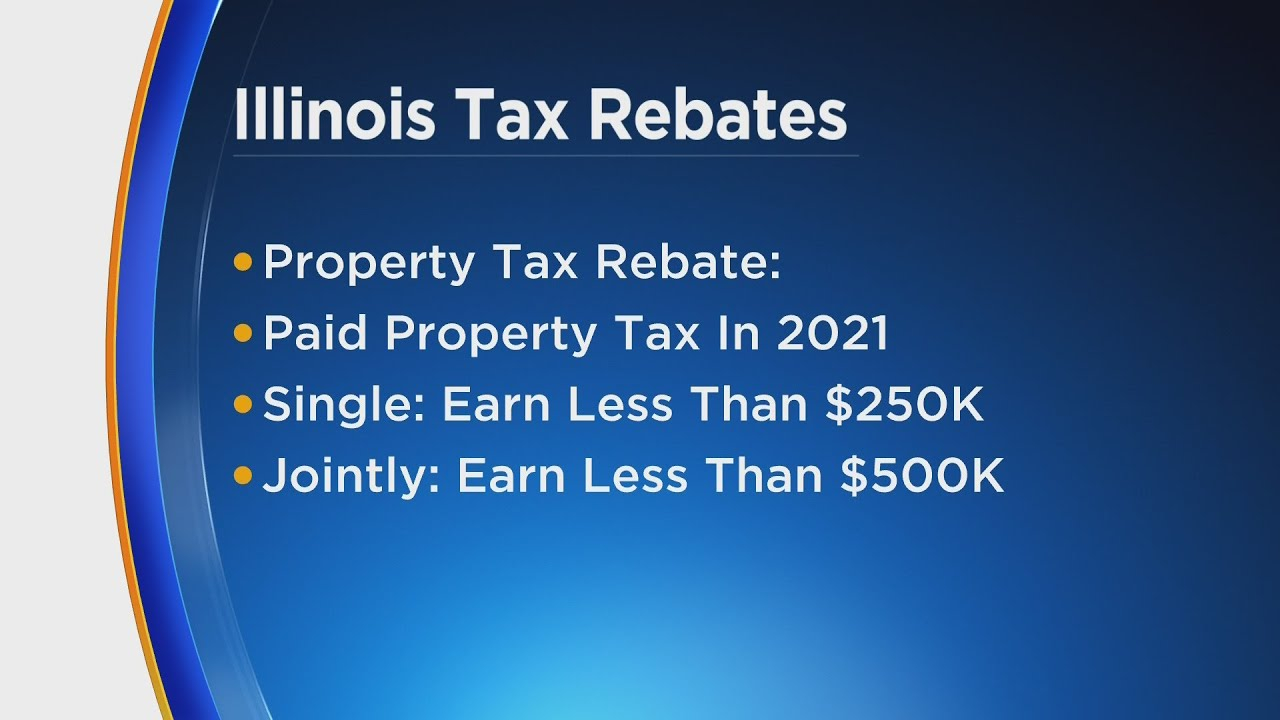

Web The individual income tax rebate is a one time payment for filing your Form IL 1040 and meeting the adjusted gross income guidelines of under 400 000 for returns with a Web 19 avr 2023 nbsp 0183 32 The tax rebate program in Illinois for 2023 offers eligible taxpayers the opportunity to receive a rebate on their state income taxes By understanding the eligibility criteria claim process and strategies to

Web 22 mai 2023 nbsp 0183 32 The Illinois Income Tax Rebate 2023 is a state government initiative aimed at providing financial relief to eligible individuals and businesses It is a form of tax refund Web 5 sept 2023 nbsp 0183 32 NEW For the 2023 tax year the IRS has announced that most state rebate payments won t be taxable on your federal return However there could be some exceptions in some state payments and

Download 2023 Il Tax Rebate

More picture related to 2023 Il Tax Rebate

Fortune India Business News Strategy Finance And Corporate Insight

https://images.assettype.com/fortuneindia/2023-02/3b8dd321-a9ba-4a6c-916b-573958eeef52/Tax_03160_copy.JPG?w=1250&q=60

Maximize Your Savings New Jersey Tax Rebate 2023 Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/New-Jersey-Tax-Rebate-2023.jpg?ssl=1

Nj Property Tax Rebates 2023 PropertyRebate

https://www.propertyrebate.net/wp-content/uploads/2023/05/illinois-to-begin-sending-out-property-tax-and-income-tax-rebates-youtube-3.jpg

Web 12 sept 2022 nbsp 0183 32 The Pritzker administration is sending income and property tax rebates to many Illinoisans struggling with inflation These tax rebates were part of the 1 8 billion Web 8 d 233 c 2022 nbsp 0183 32 To qualify for the Illinois income tax rebate you had to be an Illinois resident in 2021 and the adjusted gross income on your 2021 Illinois tax return must be under

Web 12 f 233 vr 2023 nbsp 0183 32 Those rebates passed as part of the state s fiscal year 2023 budget were given to individuals who made less than 200 000 or couples who made less than Web 20 avr 2022 nbsp 0183 32 Illinois Gov JB Pritzker signed the state s 2023 budget into law on April 19 Credit AP Direct payments are among a raft of measures included in the budget

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Minnesota-Tax-Rebate-2023-768x679.png

National Budget Speech 2023 SimplePay Blog

https://www.simplepay.co.za/blog/assets/images/blog-image.png

https://www.tax-rebate.net/il-tax-rebate-2023

Web 15 avr 2023 nbsp 0183 32 Taxpayers will need to provide documentation to verify their eligibility such as a copy of their tax return for the 2022 tax year The deadline for claiming the rebate is

https://www.sikich.com/insight/illinois-tax-relief-coming-soon

Web 17 juin 2022 nbsp 0183 32 Illinois Governor Pritzker signed into law more than 1 8 billion in tax relief including suspending sales tax on groceries freezing tax on fuel providing a back to

Know New Rebate Under Section 87A Budget 2023

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

Carbon Tax Rebates Coming To Provinces That Rejected Federal Plan

Alconchoice Rebate 2023 Printable Rebate Form

2023 Rebates And Tax Credits For HVAC Upgrades Alsip IL

2023 Elanco Interceptor Rebate Save On Flea Tick Treatment For Your

2023 Elanco Interceptor Rebate Save On Flea Tick Treatment For Your

Income Tax Slab Budget 2023 LIVE Updates Highlights Tax Rebate New

Alconchoice Rebate Code 2023 Printable Rebate Form

Louisiana Tax Credits 2023 Printable Rebate Form

2023 Il Tax Rebate - Web 22 mai 2023 nbsp 0183 32 The Illinois Income Tax Rebate 2023 is a state government initiative aimed at providing financial relief to eligible individuals and businesses It is a form of tax refund