2023 Illinois Tax Rebates Web 5 mai 2023 nbsp 0183 32 To qualify for Illinois Tax Rebates in 2023 you must meet the following criteria Be a resident of Illinois or a business operating within the state Have filed

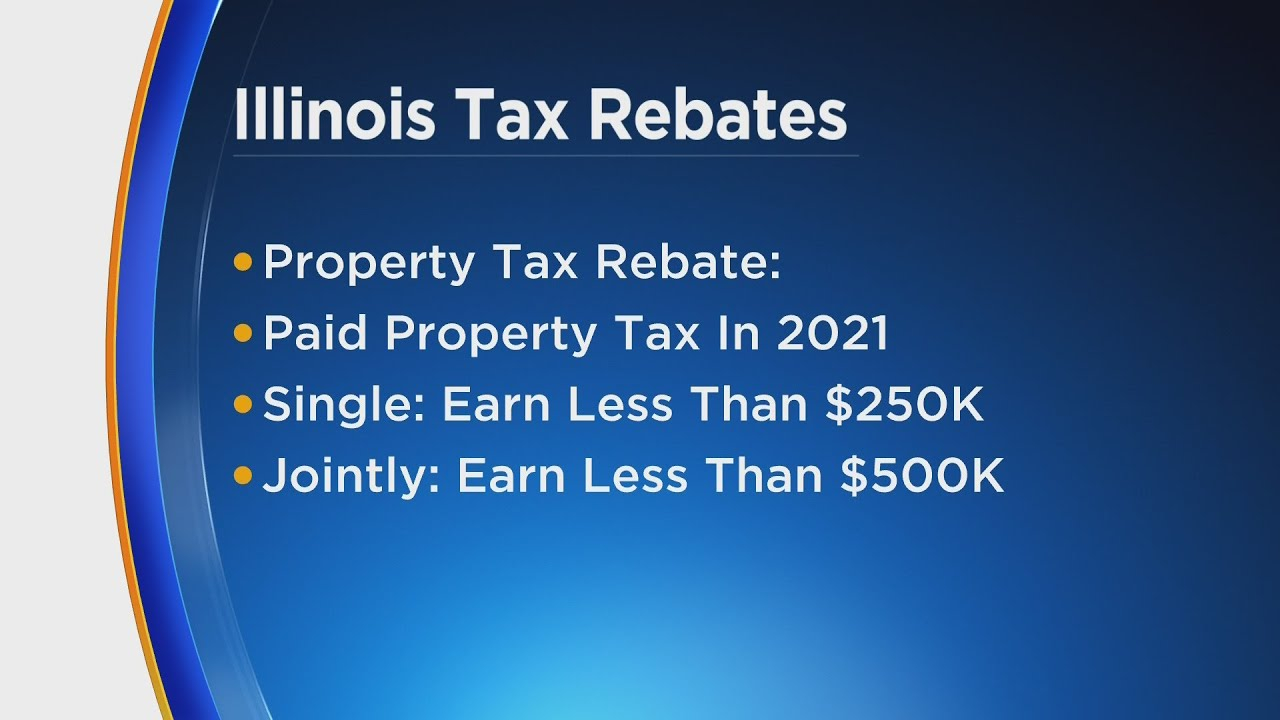

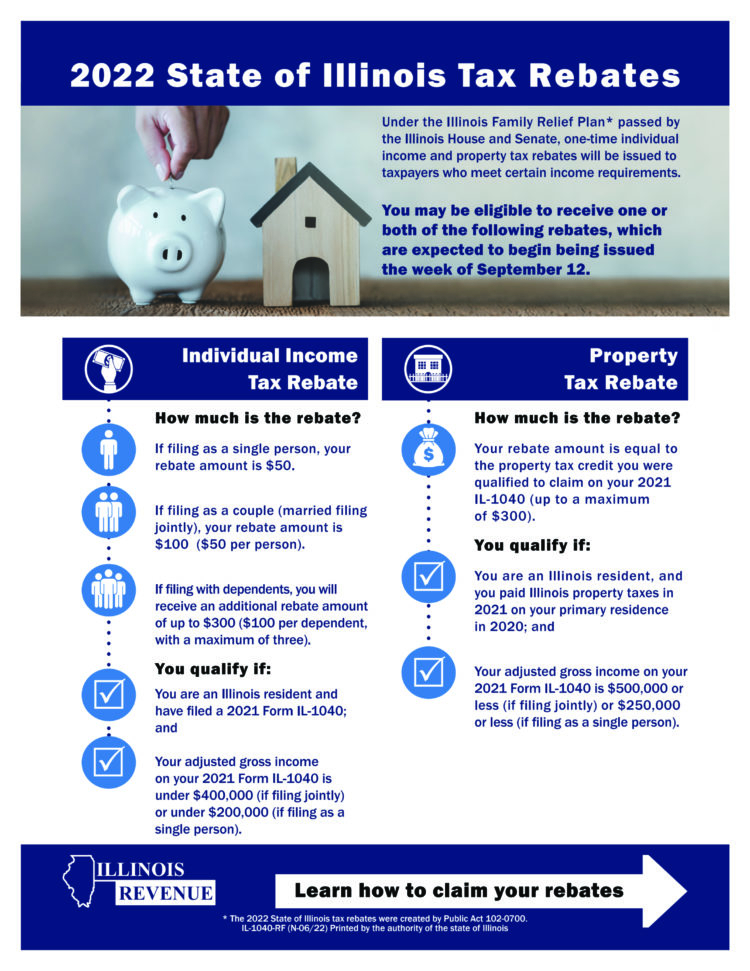

Web 17 juin 2022 nbsp 0183 32 As part of the 2023 budget S B 157 that Illinois Governor J B Pritzker signed into law on April 19 more than 1 8 billion in tax relief was passed Most of this Web If filing as a single person your rebate amount is 50 If filing as a couple married filing jointly your rebate amount is 100 50 per person If you have dependents you will

2023 Illinois Tax Rebates

2023 Illinois Tax Rebates

https://www.latestrebate.com/wp-content/uploads/2023/02/retirees-need-to-take-action-for-latest-property-tax-rebate-npr-illinois-1-1536x836.png

Il W 4 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/0/56/56393/large.png

Illinois Tax Rebate 2023 Everything You Need To Know Printable

http://printablerebateform.net/wp-content/uploads/2023/03/Illinois-Tax-Rebate-2023.png

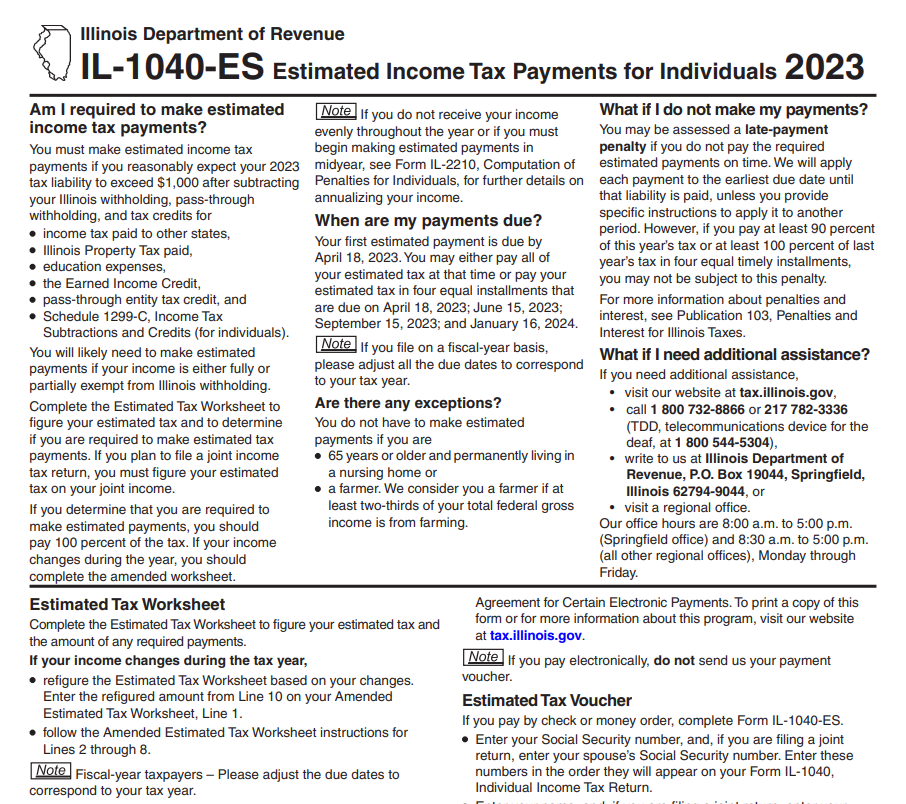

Web 5 juil 2023 nbsp 0183 32 Informational Bulletin What s New for Illinois Income Taxes FY 2023 10 2 What are the changes to the 2022 Form IL 1040 Illinois Individual Income Tax Return Web 12 f 233 vr 2023 nbsp 0183 32 Those rebates passed as part of the state s fiscal year 2023 budget were given to individuals who made less than 200 000 or couples who made less than

Web 19 avr 2023 nbsp 0183 32 The tax rebate program in Illinois for 2023 offers eligible taxpayers the opportunity to receive a rebate on their state income taxes By understanding the eligibility criteria claim process and strategies to Web 28 mars 2023 nbsp 0183 32 To apply for the Illinois Tax Rebate 2023 simply take these steps Gather all necessary documents such as a copy of your state tax return from the previous year proof of residency in Stay the Illinois

Download 2023 Illinois Tax Rebates

More picture related to 2023 Illinois Tax Rebates

Nj Property Tax Rebates 2023 PropertyRebate

https://www.propertyrebate.net/wp-content/uploads/2023/05/illinois-to-begin-sending-out-property-tax-and-income-tax-rebates-youtube-3.jpg

Illinois Tax Rebate Tracker Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

Which States Have Property Tax Rebates PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/north-central-illinois-economic-development-corporation-property-taxes-1.png

Web 29 ao 251 t 2023 nbsp 0183 32 Illinois Solar Incentives Rebates Tax Credits amp More in 2023 In this guide to solar benefits and incentive programs available in Illinois you ll learn How do solar incentives affect the cost of solar Web 27 avr 2023 nbsp 0183 32 Income Requirements To qualify for the Property Tax Rebate Illinois 2023 program applicants must have an annual household income of 75 000 or less This

Web 7 sept 2023 nbsp 0183 32 IRS weighs in on state rebate payments In most cases according to the IRS taxpayers who receive special state payments one time refunds rebates or other Web Il y a 2 jours nbsp 0183 32 IRS weighs in on state rebate payments In most cases according to the IRS taxpayers who receive special state payments one time refunds rebates or other

2023 Illinois Tax Filing Season Opens Monday January 23

https://content.govdelivery.com/attachments/fancy_images/ILDOR/2023/01/7012627/tax-filing-begins-jan23-facebook_original.jpg

Illinois Tax Rebate Check Status Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/reminder-illinois-tax-rebate-program-filing-due-date-is-october-17.jpg?w=691&h=363&ssl=1

https://www.tax-rebate.net/illinois-tax-rebates-2023

Web 5 mai 2023 nbsp 0183 32 To qualify for Illinois Tax Rebates in 2023 you must meet the following criteria Be a resident of Illinois or a business operating within the state Have filed

https://www.sikich.com/insight/illinois-tax-relief-coming-soon

Web 17 juin 2022 nbsp 0183 32 As part of the 2023 budget S B 157 that Illinois Governor J B Pritzker signed into law on April 19 more than 1 8 billion in tax relief was passed Most of this

Ameren Illinois Rebates 2023 Printable Rebate Form

2023 Illinois Tax Filing Season Opens Monday January 23

IRS Tax Brackets For 2023 Taxed Right

Deadline To Fill Out Form For Illinois Income And Property Tax Rebates

Illinois Rebate For Property Taxes PropertyRebate PropertyRebate

Illinois Tax Rebates Are Coming In Time For The Election

Illinois Tax Rebates Are Coming In Time For The Election

2022 State Of Illinois Tax Rebates Kakenmaster Tax Accounting

Tax Rebate 2023 Illinois Qualification Criteria Claim Process And

Montana Tax Rebate 2023 Benefits Eligibility How To Apply

2023 Illinois Tax Rebates - Web 14 f 233 vr 2023 nbsp 0183 32 From June 1 2023 through January 1 2033 sustainable aviation fuel sold to or used by an air carrier certified by the carrier to the Department to be used in Illinois