2023 Irs Payment Dates WASHINGTON The Internal Revenue Service today reminded taxpayers who didn t pay enough tax in 2023 to make a fourth quarter tax payment on or before Jan 16 to avoid

IR 2023 11 January 23 2023 The Internal Revenue Service kicked off the 2023 tax filing season with a focus on improving service and a reminder to taxpayers to file The due date for filing your tax return is typically April 15 if you re a calendar year filer Generally most individuals are calendar year filers For individuals the last day to file

2023 Irs Payment Dates

2023 Irs Payment Dates

http://static1.squarespace.com/static/6372c442140a59057df76be2/63742037666b4d4aacb07762/63b734efc853dd5cf6b5114e/1673374969504/unsplash-image-TyL24M6DpMg.jpg?format=1500w

Scarygirl 2023

https://m.media-amazon.com/images/M/MV5BYTA2NTlkNDUtYjRmYS00ZjQ0LWIzMjctNDQxOTYzZDAzOGVlXkEyXkFqcGdeQXVyMTUzMzU4Nw@@._V1_.jpg

MY3 2023

https://m.media-amazon.com/images/M/MV5BYTc0ZjUzNWUtYjg0ZS00MTM5LWJhYzktYTM0NDhjZjU4MWYzXkEyXkFqcGdeQXVyMTU0ODI1NTA2._V1_.jpg

The IRS has announced it will start accepting tax returns on January 23 2023 as we predicted as far back as October 2022 So early tax filers who are a due a refund can You don t have to make the payment due Jan 16 2024 if you file your 2023 tax return by Jan 31 2024 and pay the entire balance due with your return How do I know how

When you first receive income in 2023 for which you need to pay estimated tax you must make your first estimated payment by the due date for the corresponding payment period as shown in Important Tax Dates Jan 13 IRS Free File opens Jan 17 Due date for tax year 2022 fourth quarter estimated tax payment Jan 23 IRS begins 2023 tax season and starts

Download 2023 Irs Payment Dates

More picture related to 2023 Irs Payment Dates

Strays 2023

https://m.media-amazon.com/images/M/MV5BNDkwNjEzNTYtZmYyMS00MTJmLWE3ZjItMWIxNzBmZWU4ZGM1XkEyXkFqcGdeQXVyODE5NzE3OTE@._V1_.jpg

Dossier 2023

https://www.bloom.be/uploads/images/Jaarhoroscoop.gif

December 2023 PWG

https://printedwargames.blob.core.windows.net/images/images/dec_2023_kit_lo_6EZI31Z.jpg

You can pay the entire estimated tax by the Sept 15 due date or pay it in two installments by Sept 16 2024 and January 2025 For tax year 2023 the dates were April 17 2023 June 15 2023 September 15 2023 January 16 2024 We automatically calculate quarterly estimated tax payments and

The following are some of the key dates and deadlines for tax year 2023 For the key dates of the current tax year click here First Quarter January February March January 10 For recent developments see the tax year 2023 Publication 505 Tax Withholding and Estimated Tax Taxes must be paid as you earn or receive income during the year

2023 1 31 XuRui Blog

https://s2.loli.net/2023/01/31/brpA1VLFRYXxt2T.jpg

2023

https://www.hsjobfair.com/images/closing_img.jpg

https://www.irs.gov/newsroom/irs-reminds-taxpayers...

WASHINGTON The Internal Revenue Service today reminded taxpayers who didn t pay enough tax in 2023 to make a fourth quarter tax payment on or before Jan 16 to avoid

https://www.irs.gov/newsroom/irs-kicks-off-2023...

IR 2023 11 January 23 2023 The Internal Revenue Service kicked off the 2023 tax filing season with a focus on improving service and a reminder to taxpayers to file

Canada GST Payment Dates 2023 Tax Credit Guide Full Details

2023 1 31 XuRui Blog

2023

2023 IRS Tax Refund Updates Where Is My Refund PATH Act Lifted YouTube

Voeux 2023

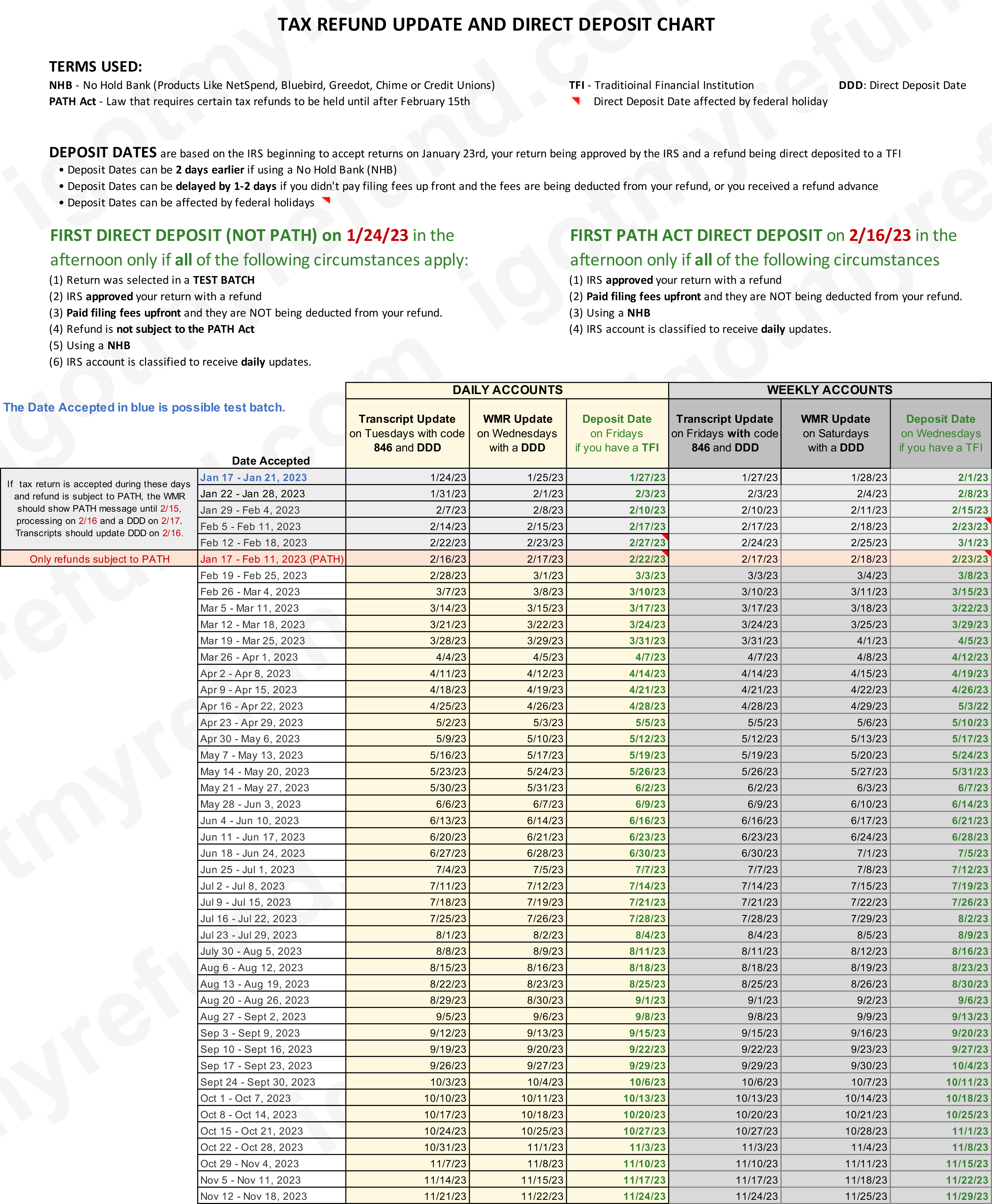

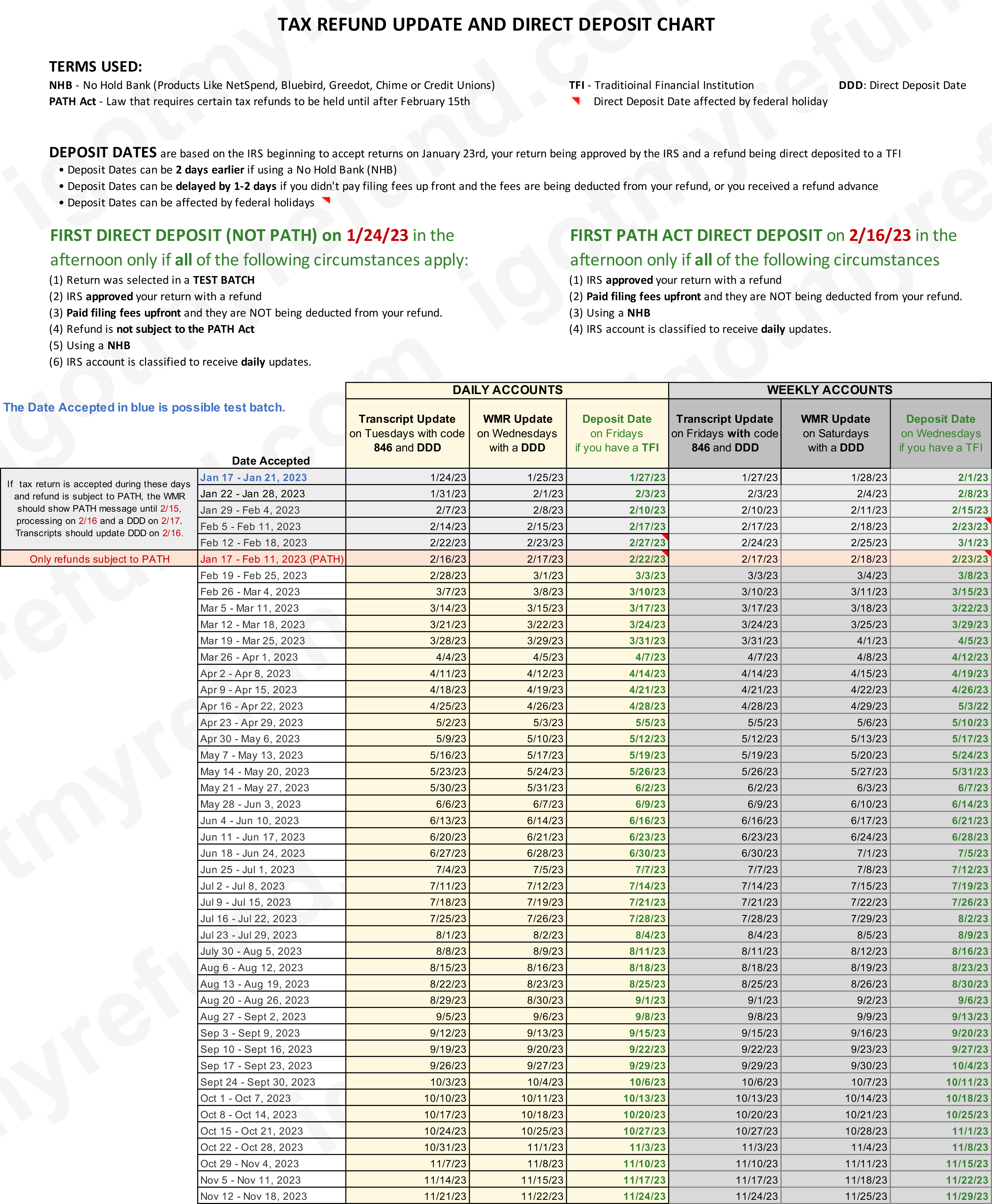

IRS E file Refund Cycle Chart For 2023

IRS E file Refund Cycle Chart For 2023

AASP 2023

Exam Reviewer 2023

Vol 1 No 2 2023 JOCRSS December 2023 Journal Of Communication

2023 Irs Payment Dates - The 2024 tax refund schedule for the 2023 tax year starts on January 29th Our tax refund chart lists the federal tax refund dates for direct deposits and mailed checks