2023 Tax Refund Schedule Eitc Here s what you need to know about the 2023 EITC tax refund schedule and the 2024 EITC numbers Who Qualifies for the EITC Can You Claim the EITC If You Have No Children Key Points The Earned Income

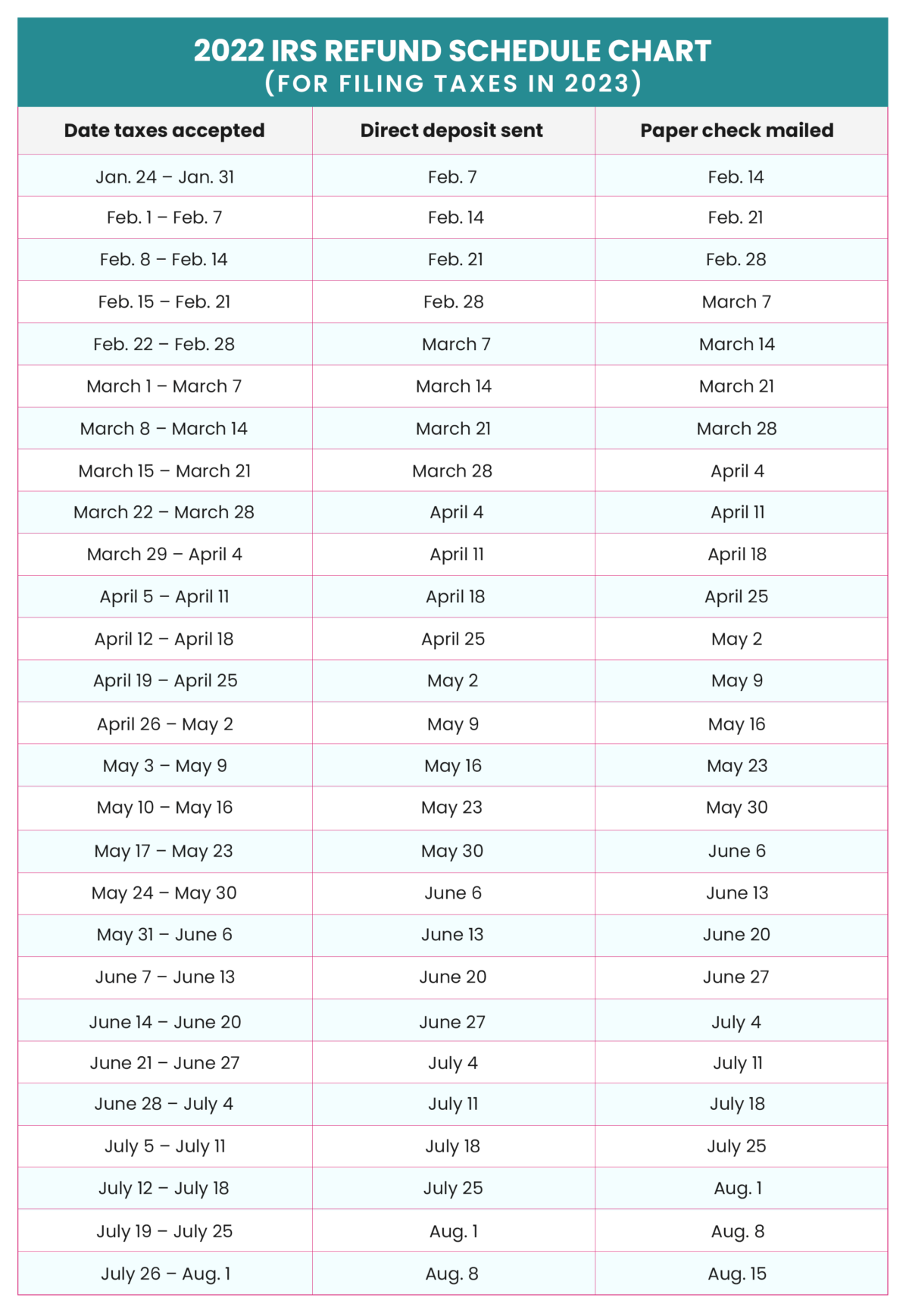

To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit limits for the current previous and Early tax filers who are a due a refund can often see them as early as mid or late February Use this chart to see when you may be able to get refund Updated January 8 2023 11 01 pm

2023 Tax Refund Schedule Eitc

2023 Tax Refund Schedule Eitc

https://i.ytimg.com/vi/cZ-f0xO-DJc/maxresdefault.jpg

Earned Income Tax Credit EITC Tax Refund Schedule For Tax Years 2022

https://d32ijn7u0aqfv4.cloudfront.net/wp/wp-content/uploads/raw/SORL1222001_780x440_mobile.jpeg

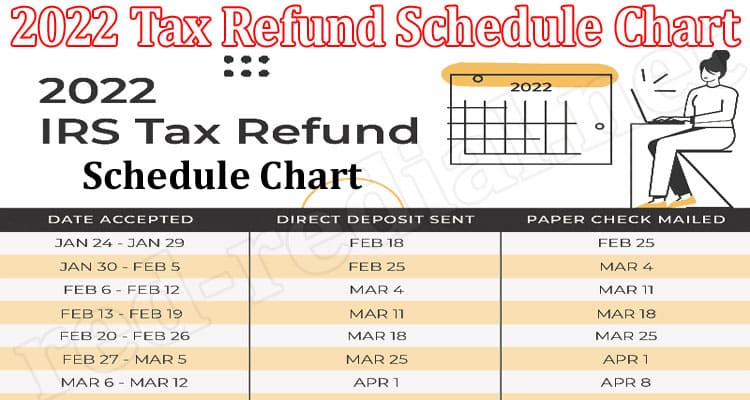

2022 Tax Refund Schedule Chart Mar A Precise Info

https://www.red-redial.net/wp-content/uploads/2022/02/Latest-News-2022-Tax-Refund-Schedule-Chart.jpg

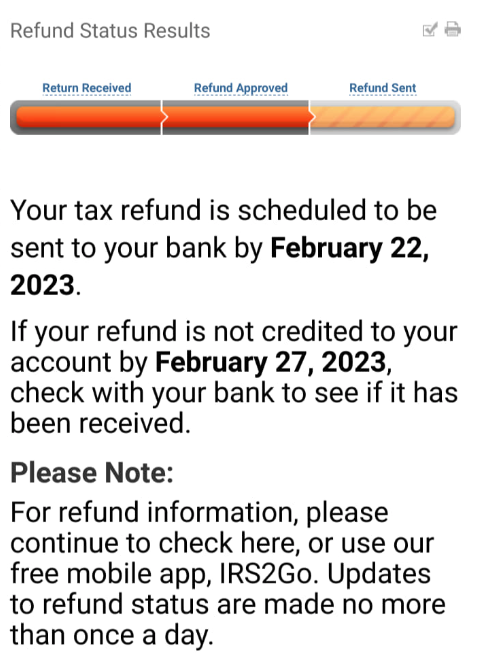

The 2023 IRS tax refund schedule is now available outlining the timeline for when refunds will be issued and when taxpayers can expect to receive their return The IRS will begin accepting For 2023 the maximum EITC amounts are 1 600 for a taxpayer without children in their household 2 3 995 for a taxpayer with one child 3 6 604 for a taxpayer

Here s what you need to know about the 2023 EITC tax refund schedule and the 2024 EITC numbers What Is the Earned Income Tax Credit EITC The IRS expects most EITC ACTC related refunds to be available in taxpayer bank accounts or on debit cards by February 28 if taxpayers chose direct deposit and there are no

Download 2023 Tax Refund Schedule Eitc

More picture related to 2023 Tax Refund Schedule Eitc

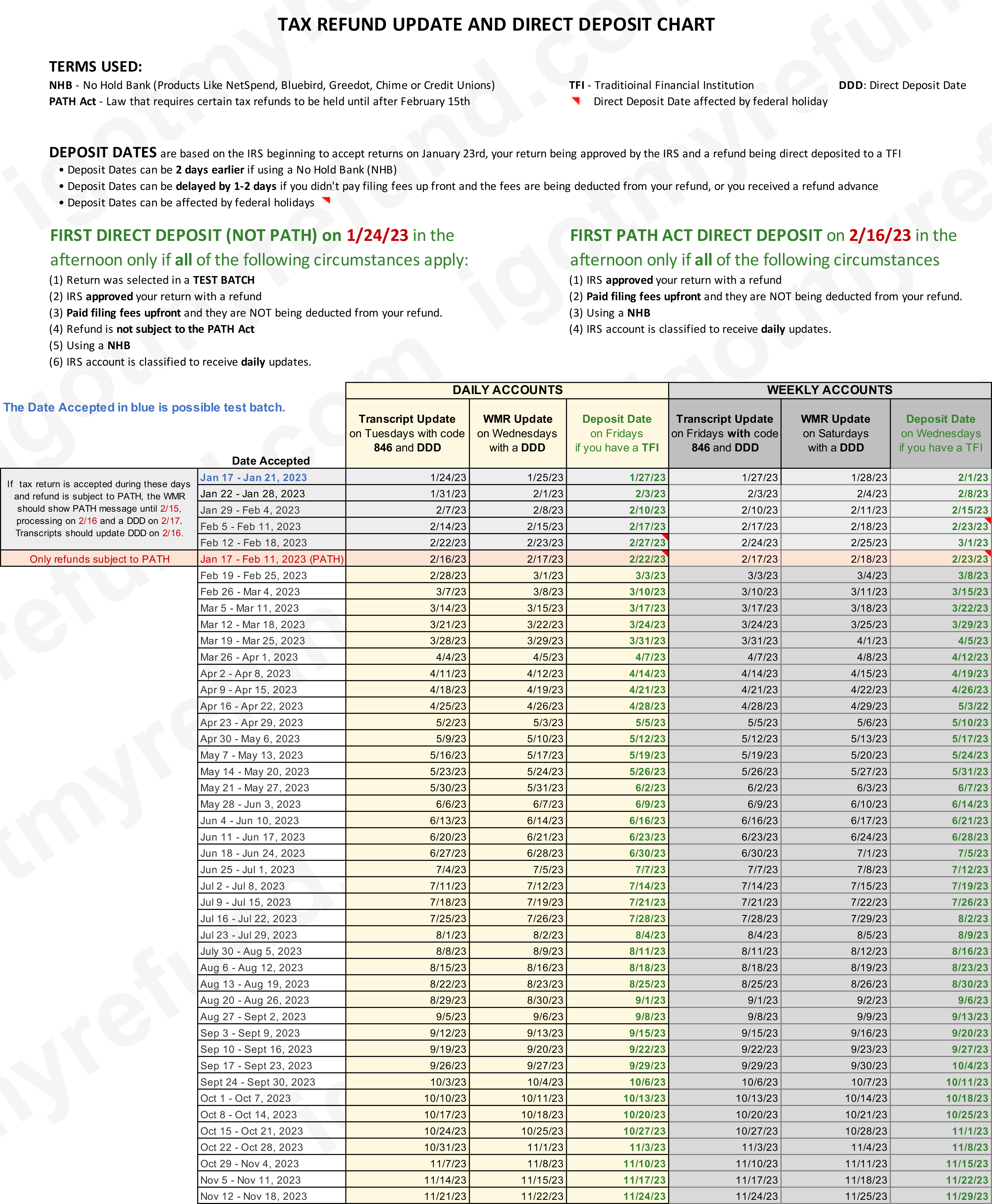

IRS E file Refund Cycle Chart For 2023

https://igotmyrefund.com/wp-content/uploads/2023/01/2023-refund-cycle-chart.png

See The EIC Earned Income Credit Table Income Tax Return Income

https://i.pinimg.com/originals/aa/af/be/aaafbed0a4b639f5c32ede742b5dd17b.png

2023 Tax Refund Date Chart Printable Forms Free Online

https://www.wealthysinglemommy.com/wp-content/uploads/Edited-Chart-1-1200x1737.png

Tax payers can expect their refund within 21 days of the IRS accepting your return But there are deadlines and rules one needs to follow in order to accelerate the process as much as possible Is Tax Year For wages and other income earned in 2024 select 2024 2023 select 2023 2022 select 2022

File a 2023 tax return including Schedule EIC if you have a qualifying child IRS gov EITC If eligible you can claim the EIC to get a refund even if you had no tax withheld from your pay or Will there be EITC refunds in 2023 According to the IRS if you claimed the EITC then it is realistic to expect your refund to be paid to you by March 1

2023 Irs Tax Brackets Chart Printable Forms Free Online

https://image.cnbcfm.com/api/v1/image/107136825-1666125851699-6clBX-marginal-tax-brackets-for-tax-year-2023-single-individuals_1.png?v=1666125859

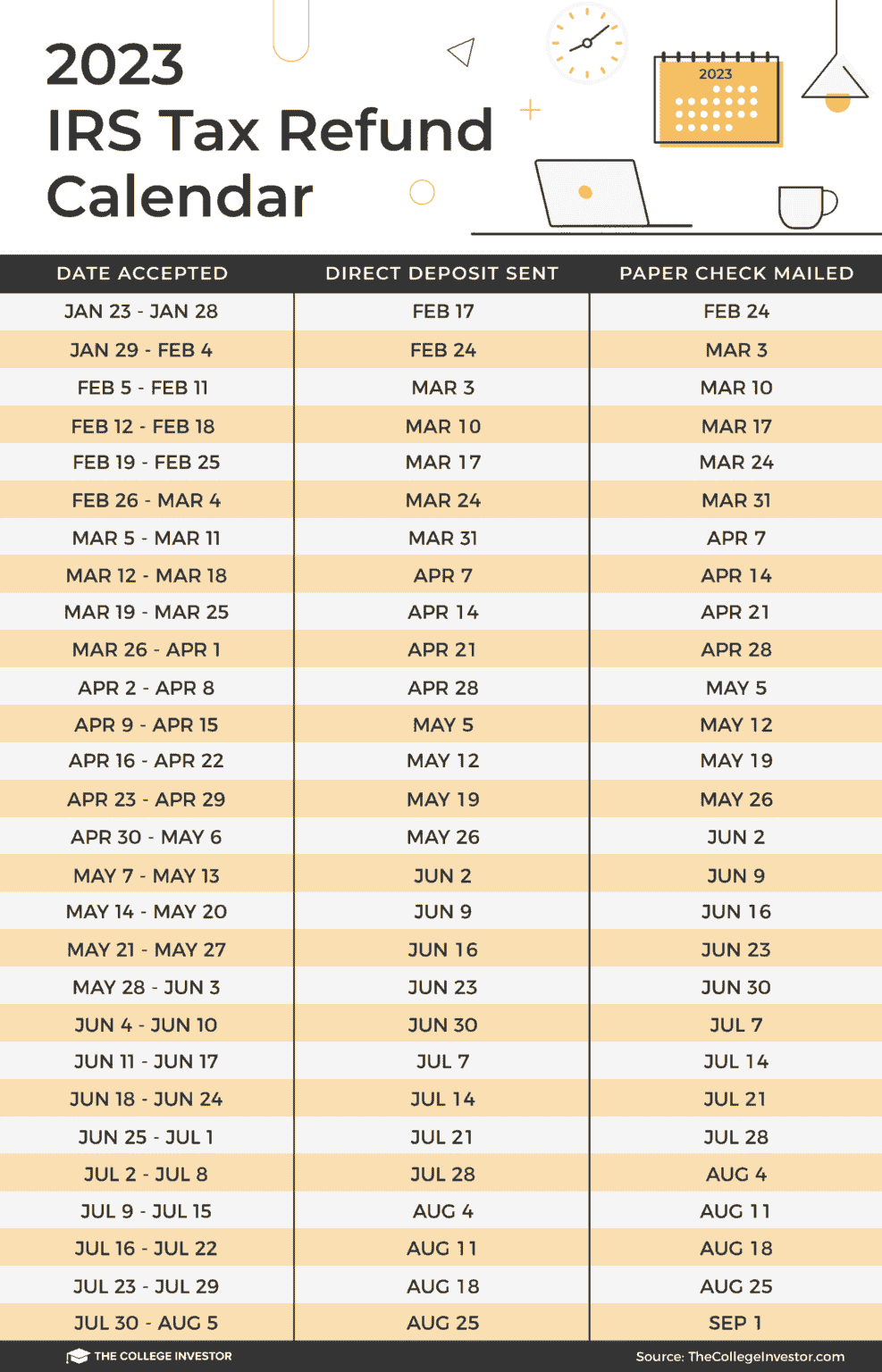

Tax Refund Deposit Schedule 2024 Evey Oneida

https://texasbreaking.com/wp-content/uploads/2023/01/the-college-investor-calendar-987x1536.png

https://www.sofi.com › ... › eitc-tax-refund-…

Here s what you need to know about the 2023 EITC tax refund schedule and the 2024 EITC numbers Who Qualifies for the EITC Can You Claim the EITC If You Have No Children Key Points The Earned Income

https://www.irs.gov › credits-deductions › individuals...

To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit limits for the current previous and

The Earned Income Tax Credit EITC Refund Schedule For 2022 2023

2023 Irs Tax Brackets Chart Printable Forms Free Online

Refund Schedule 2023 R IRS

2023 PATH Act IRS Refund Release And Payment Dates For Tax Returns With

Earned Income Credit Calculator 2021 DannielleThalia

Ga State Refund Cycle Chart 2023 Printable Forms Free Online

Ga State Refund Cycle Chart 2023 Printable Forms Free Online

Bmw Tax Credit 2023

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

7 Photos Earned Income Credit Table 2017 Pdf And Description Alqu Blog

2023 Tax Refund Schedule Eitc - The 2023 IRS tax refund schedule is now available outlining the timeline for when refunds will be issued and when taxpayers can expect to receive their return The IRS will begin accepting