2024 Az Families Tax Rebate Phoenix AZ The Arizona Department of Revenue ADOR is sending this information to assist taxpayers as the 2024 tax filing season begins The IRS has determined the Arizona Families Tax Rebate recently sent to eligible taxpayers is subject to federal income tax and is required to be reported as part of the federal adjusted gross income

The Internal Revenue Service has determined that the Arizona Families Tax Rebate is subject to federal income tax and 2024 by visiting azdor gov arizona families tax rebate and clicking on View my 1099 MISC January 2024 Page 2 602 255 3381 or toll free at 800 352 4090 www azdor go 2023 Arizona Families Tax Rebate You can use this page to check your rebate status update your rebate address or to make a claim for your rebate Instructions Enter the qualifying tax return information from tax year 2021 into each of the fields Fields marked with are required

2024 Az Families Tax Rebate

2024 Az Families Tax Rebate

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

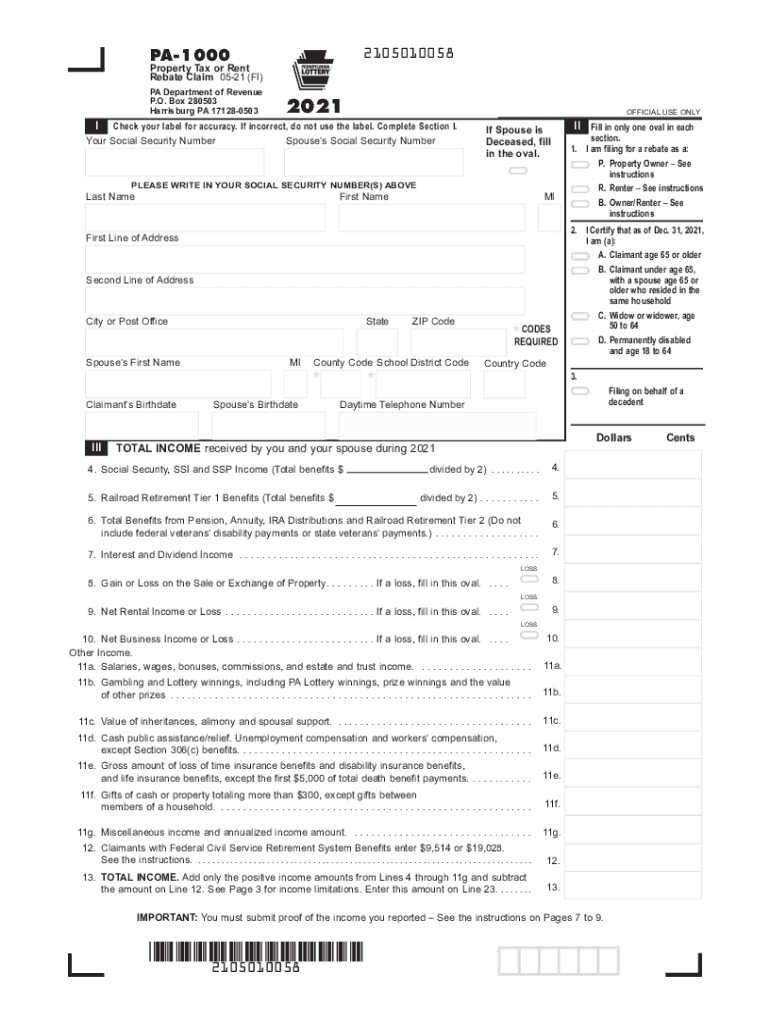

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

AZ Senator Justine Wadsack On Twitter I m Proud To Have Played A Role In Helping Arizona

https://pbs.twimg.com/ext_tw_video_thumb/1658230147374538752/pu/img/0wjY87sb2BMfq_Z3.jpg

Jan 26 2024 10 31 AM The IRS wants taxpayers who received the Arizona Families Tax Rebate in 2023 to pay taxes on the refunds Pexels Photo BY KEVIN STONE KTAR PHOENIX Arizona Gov Katie Hobbs approved the state s 17 8 billion budget last summer Qualifying taxpayers received the child tax rebate for up to three dependents So in some cases families with

Published Jan 19 2024 at 8 12 PM PST PHOENIX 3TV CBS 5 Last year more than half a million Arizonans with kids got a tax rebate But now the IRS has made a change that will mean less IRS Arizona families that got tax rebate owe US taxes on it Howard Fischer Jan 16 2024 Jan 16 2024 Updated This Tucson neighborhood is a top place to go in 2024 Conde Nast Traveler says

Download 2024 Az Families Tax Rebate

More picture related to 2024 Az Families Tax Rebate

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

IRAS Tax Savings For Married Couples And Families

https://www.iras.gov.sg/media/images/default-source/uploadedimages/pages/tax-savings.png?sfvrsn=80db0649_0

Arizona Families Tax Rebate Claim AZ 750 Checks Payment Date Status

https://matricbseb.com/wp-content/uploads/2023/11/Arizona-Families-Tax-Rebate-Claim-AZ-750-Checks-Payment-Date-Status-768x512.jpg

About 750 000 Arizona families were eligible for a Republican backed tax credit related to children and dependents But now the federal government wants a cut of that money The IRS says the Arizona Families Rebate is subject to federal income taxes Published Wednesday January 17 2024 11 24am Updated Friday January 19 2024 7 24am The IRS says the rebates Arizona families received last fall are taxable taking a bite out of the relief state lawmakers sent to roughly 750 000 households Only the IRS will levy the tax There

Howard Fischer Capitol Media Services January 26 2024 The Internal Revenue Service has no right to force 750 000 Arizona families who got a state income tax rebate last year to now pay federal taxes on the funds Attorney General Kris Mayes said Thursday And she said if the agency doesn t back off and soon she may sue saying The new Arizona flat personal income tax rate wasn t expected until 2024 However the lower rate is effective as of last year 2023 due to higher than expected tax revenues Arizona

Arizona Families Tax Rebate Claim AZ 750 Checks Payment Date Status

https://newsd.in/wp-content/uploads/2023/12/Arizona-Families-Tax-Rebate-Claim-–-AZ-750-Checks-Payment-Date-Status-1280x720.jpg

Modelos De Motos 2023 W4 Pdf Form IMAGESEE

https://www.taxuni.com/wp-content/uploads/2022/04/W4-Form-2022-Withholding-Tax-Adjustment.jpg

https://azdor.gov/news-center/arizona-families-rebate-recipients-will-need-report-rebate-income-tax-returns

Phoenix AZ The Arizona Department of Revenue ADOR is sending this information to assist taxpayers as the 2024 tax filing season begins The IRS has determined the Arizona Families Tax Rebate recently sent to eligible taxpayers is subject to federal income tax and is required to be reported as part of the federal adjusted gross income

https://azdor.gov/sites/default/files/2024-01/ind_updates-2401.pdf

The Internal Revenue Service has determined that the Arizona Families Tax Rebate is subject to federal income tax and 2024 by visiting azdor gov arizona families tax rebate and clicking on View my 1099 MISC January 2024 Page 2 602 255 3381 or toll free at 800 352 4090 www azdor go

Printable Blank Form 4923h Mo Printable Forms Free Online

Arizona Families Tax Rebate Claim AZ 750 Checks Payment Date Status

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

Nearly 200 000 Families Can Still Apply For 2022 CT Child Tax Rebate Before July 31 Deadline

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Big Update On Income Tax Rebate In Union Budget 2023 No Tax Upto 7 Lakh YouTube

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And

New Income Tax Regime Will Be Default Citizens Union Budget 2023 Live Updates Income

2024 Az Families Tax Rebate - Published Jan 19 2024 at 8 12 PM PST PHOENIX 3TV CBS 5 Last year more than half a million Arizonans with kids got a tax rebate But now the IRS has made a change that will mean less