2024 Az Tax Rebate Jan 26 2024 10 31 AM The Arizona Families Tax Rebate is not subject to state income tax so the amount should be subtracted from the federal adjusted gross income on state tax forms

You can use this page to check your rebate status update your rebate address or to make a claim for your rebate Instructions Enter the qualifying tax return information from tax year 2021 into each of the fields Fields marked with are required The primary taxpayer is the taxpayer listed first on the tax year 2021 return The new Arizona flat personal income tax rate wasn t expected until 2024 However the lower rate is effective as of last year 2023 due to higher than expected tax revenues Arizona tax rebate

2024 Az Tax Rebate

2024 Az Tax Rebate

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate.jpg

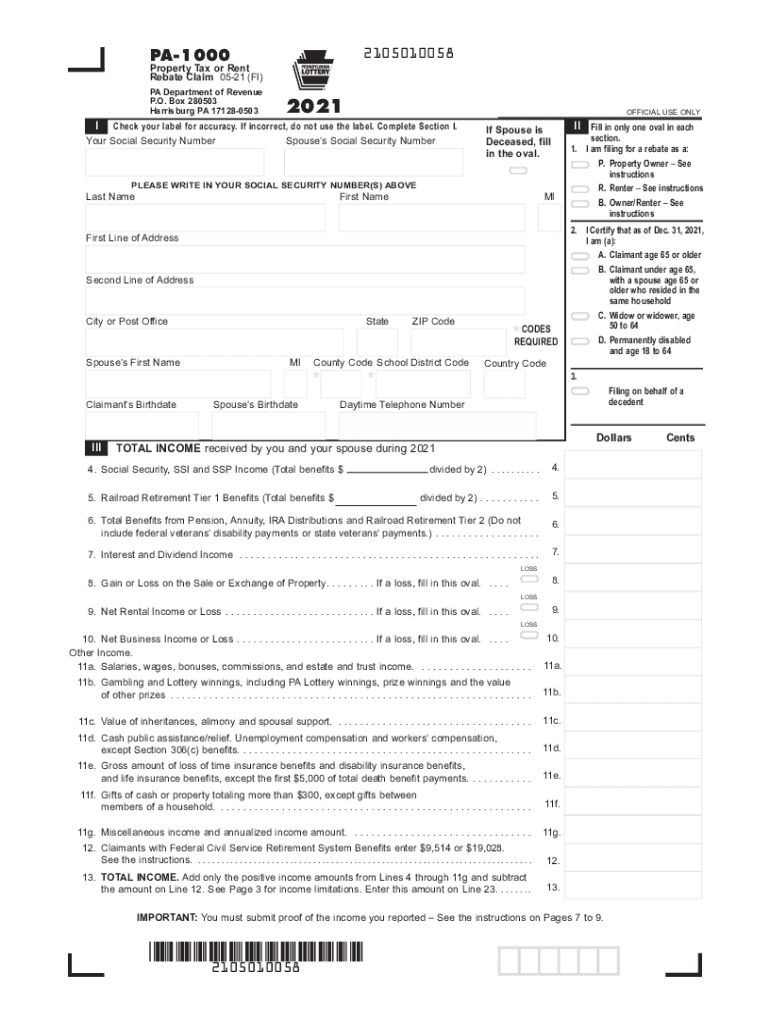

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/585/571/585571881/large.png

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Howard Fischer Capitol Media Services January 26 2024 The Internal Revenue Service has no right to force 750 000 Arizona families who got a state income tax rebate last year to now pay federal taxes on the funds Attorney General Kris Mayes said Thursday And she said if the agency doesn t back off and soon she may sue saying There is no state tax the state Department of Revenue said Taxpayers should deduct the rebate from their federally adjusted gross income when filing their Arizona tax form the agency said The

The announcement comes over five months after the Arizona Families Tax Rebate was signed into law as part of the Fiscal Year 2024 state budget Hobbs calls the rebate the first of its kind saying So everything else being equal someone getting a 500 rebate whose income is in the 22 bracket from 44 726 to 95 375 for individuals will be giving back 110 to Uncle Sam The state

Download 2024 Az Tax Rebate

More picture related to 2024 Az Tax Rebate

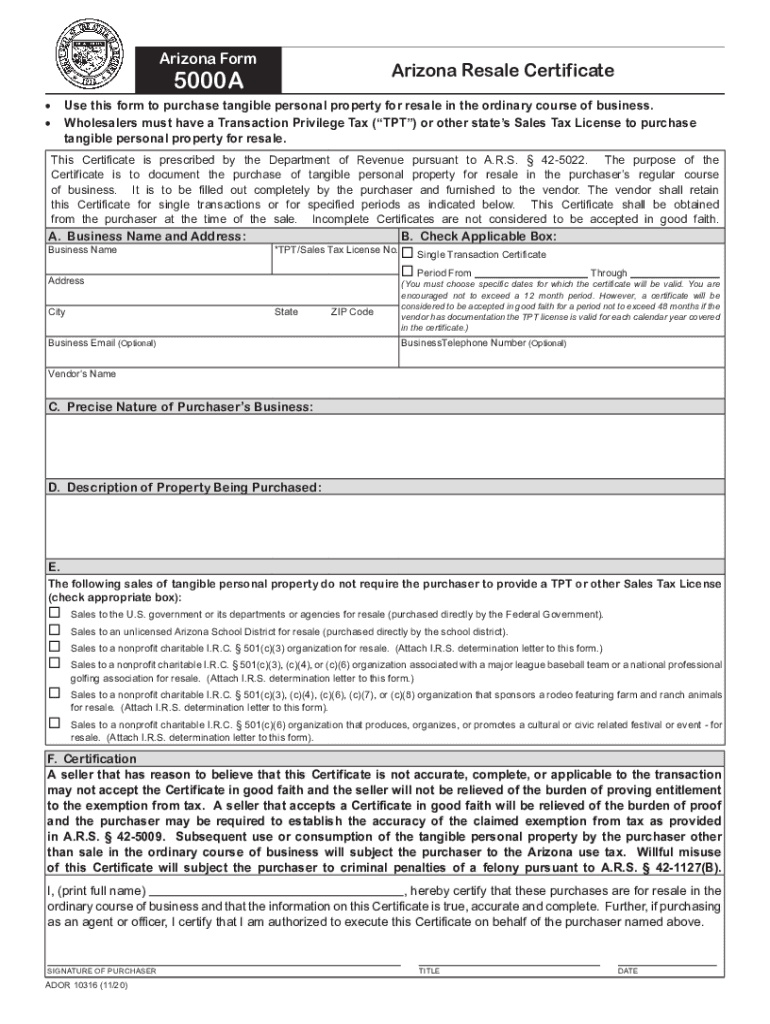

AZ Form 5000A 2020 2022 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/551/799/551799593/large.png

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of What You Should Claim

https://i0.wp.com/blog.fundingsocieties.com.my/wp-content/uploads/2023/03/Personal-Income-Tax-Relief-Malaysia-2023-YA-2022.png?fit=1200%2C628&ssl=1

Explainers FOX 10 Phoenix PHOENIX Arizona Governor Katie Hobbs announced on Oct 31 the deployment of a new tax rebate that officials say will put many back in the pockets of about 750 000 The rebate is available to year round residents who claimed Arizona s existing tax credit for dependents in 2021 on their tax returns which were due in 2022 and owed at least 1 in taxes during

Those who claimed the dependent child tax credit on their 2021 tax return and paid at least 1 in income tax to the state in 2019 2020 and 2021 were eligible for a rebate The payment will be On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

https://asset5.scripbox.com/wp-content/uploads/2021/05/tax-rebate.jpg

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

https://ktar.com/story/5559296/state-leaders-push-back-on-irs-for-taxing-arizona-families-tax-rebate/

Jan 26 2024 10 31 AM The Arizona Families Tax Rebate is not subject to state income tax so the amount should be subtracted from the federal adjusted gross income on state tax forms

https://familyrebate.aztaxes.gov/

You can use this page to check your rebate status update your rebate address or to make a claim for your rebate Instructions Enter the qualifying tax return information from tax year 2021 into each of the fields Fields marked with are required The primary taxpayer is the taxpayer listed first on the tax year 2021 return

Szemafor Hat kony Iskola El tti 2024 Eb Forg cs Tant rgy Lejt

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Personal Tax Relief 2021 L Co Accountants

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

Missouri State Tax Rebate 2023 Printable Rebate Form

Georgia Income Tax Rebate 2023 Printable Rebate Form

5 Ways To Make Your Tax Refund Bigger The Motley Fool

2024 Az Tax Rebate - So everything else being equal someone getting a 500 rebate whose income is in the 22 bracket from 44 726 to 95 375 for individuals will be giving back 110 to Uncle Sam The state