2024 Child Tax Credit Rebate Child tax credit 2024 How much is it Lawmakers have reached a deal on the tax framework for a new child tax credit However unless changes to the amount of the credit go into

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit Child Tax Credit 2023 2024 What It Is Requirements and How to Claim For 2023 taxpayers may be eligible for a credit of up to 2 000 and 1 600 of that may be refundable Legislation

2024 Child Tax Credit Rebate

2024 Child Tax Credit Rebate

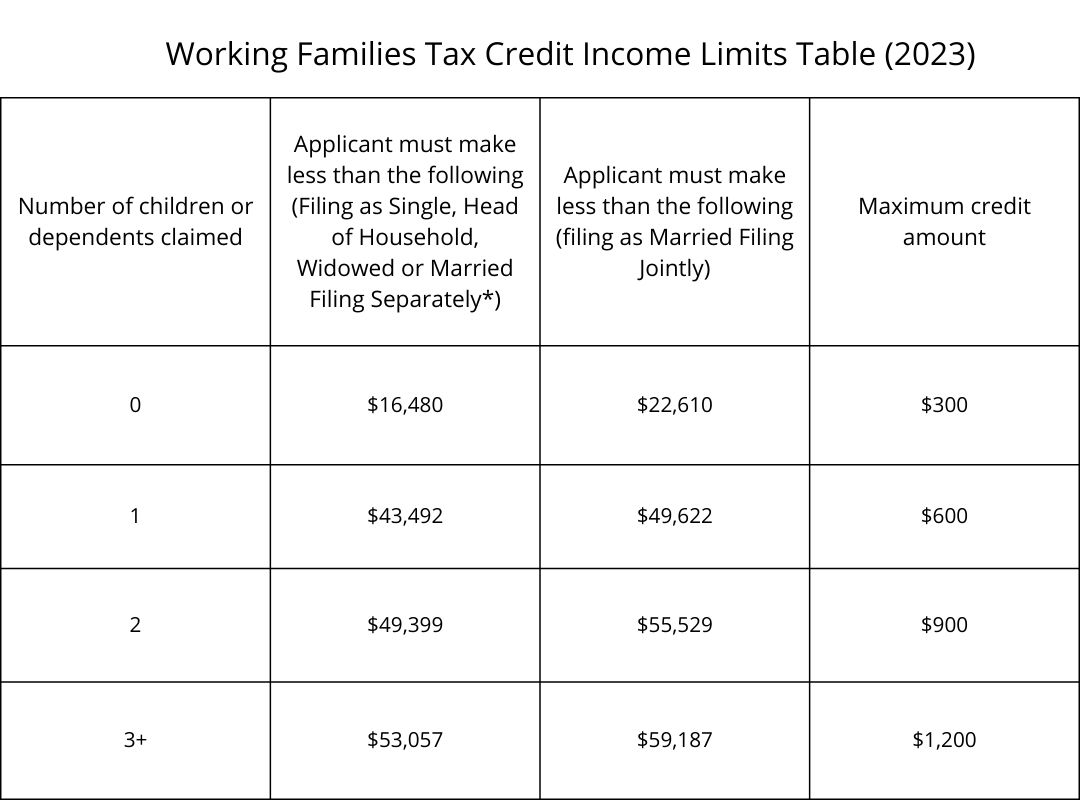

https://www.wataxcredit.org/wp-content/uploads/2023/01/WFTC-Income-Table-.jpg

Electric Car Credit Income Limit How The Electric Car Tax Credit Works For Businesses

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

Child Tax Credit Income Limit 2024 Credits Zrivo

https://www.zrivo.com/wp-content/uploads/2021/01/Child-Tax-Credit-Income-Limit.jpg

7 min Comment 295 Congressional negotiators announced a roughly 80 billion deal on Tuesday to expand the federal child tax credit that if it becomes law would make the program more Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief

The new child tax credit policy would benefit about 16 million kids in low income families according to an analysis by the liberal leaning Center on Budget and Policy Priorities The expansion Currently 1 600 of the 2 000 credit per child is refundable The credit s phaseout threshold is 400 000 for married earners filing jointly and 200 000 for head or single households At the

Download 2024 Child Tax Credit Rebate

More picture related to 2024 Child Tax Credit Rebate

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.gannett-cdn.com/-mm-/14ee05d59f10019b9af859e1b8044dff44c16b5c/c=0-64-2118-1261&r=x1683&c=3200x1680/local/-/media/2017/03/28/USATODAY/USATODAY/636262972570306279-tax-credits.jpg

IRS Child Tax Credit Portal 2024 Login Advance Update Bank Information Payments Dates Phone

http://refundschedule.us/wp-content/uploads/2022/01/IRS-Child-Tax-Credit-Portal-Login-Advance-Update-Bank-Information-Payments-Dates-Phone-Number-Stimulus.jpg

Earned Income Tax Credit For Households With One Child 2023 Center On Budget And Policy

https://www.cbpp.org/sites/default/files/2023-04/policybasics-eitc_rev4-28-23_f1.png

January 16 2024 1 57 PM EST O n Tuesday a bipartisan group of lawmakers announced a 78 billion deal that would expand corporate tax breaks and the child tax credit which could put extra money ACTC is refundable for the unused amount of your Child Tax Credit up to 1 600 per qualifying child tax year 2023 and 2024 The amount of your Child Tax Credit will be reduced if your adjusted gross income exceeds 400 000 if married filing jointly or 200 000 for all other tax filing statuses 2023 and 2024 Child Tax Credit

Also you must meet several requirements to be eligible for the child tax credit in 2024 The child tax credit is still at its pre pandemic amount however lawmakers are working on The amount would rise to 1 900 in 2024 and 2 000 in 2025 The bill would also ensure the child tax credit phase in applies fairly to families with multiple children it said

Child Tax Credit CTC Update 2024

https://www.taxuni.com/wp-content/uploads/2022/10/Child-Tax-Credit-CTC-Update-TaxUni-Cover-1.jpg

Did The Child Tax Credit Change For 2022 What You Need To Know

https://www.usatoday.com/gcdn/presto/2022/12/02/USAT/7dc53c6e-753d-4dbe-9927-b86d99089807-XXX_IMG_MONEY_CHILDTAXCREDIT_1_1_U6UQQIVP.JPG?crop=1897,1067,x224,y0&width=1897&height=1067&format=pjpg&auto=webp

https://www.kiplinger.com/taxes/how-much-is-the-child-tax-credit-for-2024

Child tax credit 2024 How much is it Lawmakers have reached a deal on the tax framework for a new child tax credit However unless changes to the amount of the credit go into

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit

Child Tax Credit Payment Update April 2022 Republican Support YouTube

Child Tax Credit CTC Update 2024

Military Journal Ri Child Tax Rebate Child Tax Credits Are One Of The Most Important Ways

Child Tax Credits 1st Payments Sent July 15 Welcomed By Chicago Area Families ABC7 Chicago

What Is The Amount Of The Child Tax Credit For 2023 Leia Aqui How Much Is The Qualifying Child

CHILD TAX CREDIT 2023 AMOUNT Tax Refund 2022 2023 IRS TAX REFUND UPDATE YouTube

CHILD TAX CREDIT 2023 AMOUNT Tax Refund 2022 2023 IRS TAX REFUND UPDATE YouTube

Child Tax Credit 88 Of Children Covered By Monthly Payments Starting In July As Part Of

Cra Tax Forms 2023 Printable Printable Forms Free Online

American Rescue Plan 2021 Tax Credit Stimulus Check Rules

2024 Child Tax Credit Rebate - What to do with a Child Tax Credit refund If you qualify for a refund consider making the most of it by devising a plan for how you ll use it ahead of time The contribution limits for 2024 are 7 000 for those under age 50 and 8 000 for those age 50 or older Add it to your emergency fund to ensure a safety net in the event of job