2024 Child Tax Rebate Application The child tax credit may expand in 2024 Here s what it means for you The changes agreed to by negotiators would primarily benefit lower income families with multiple children but the

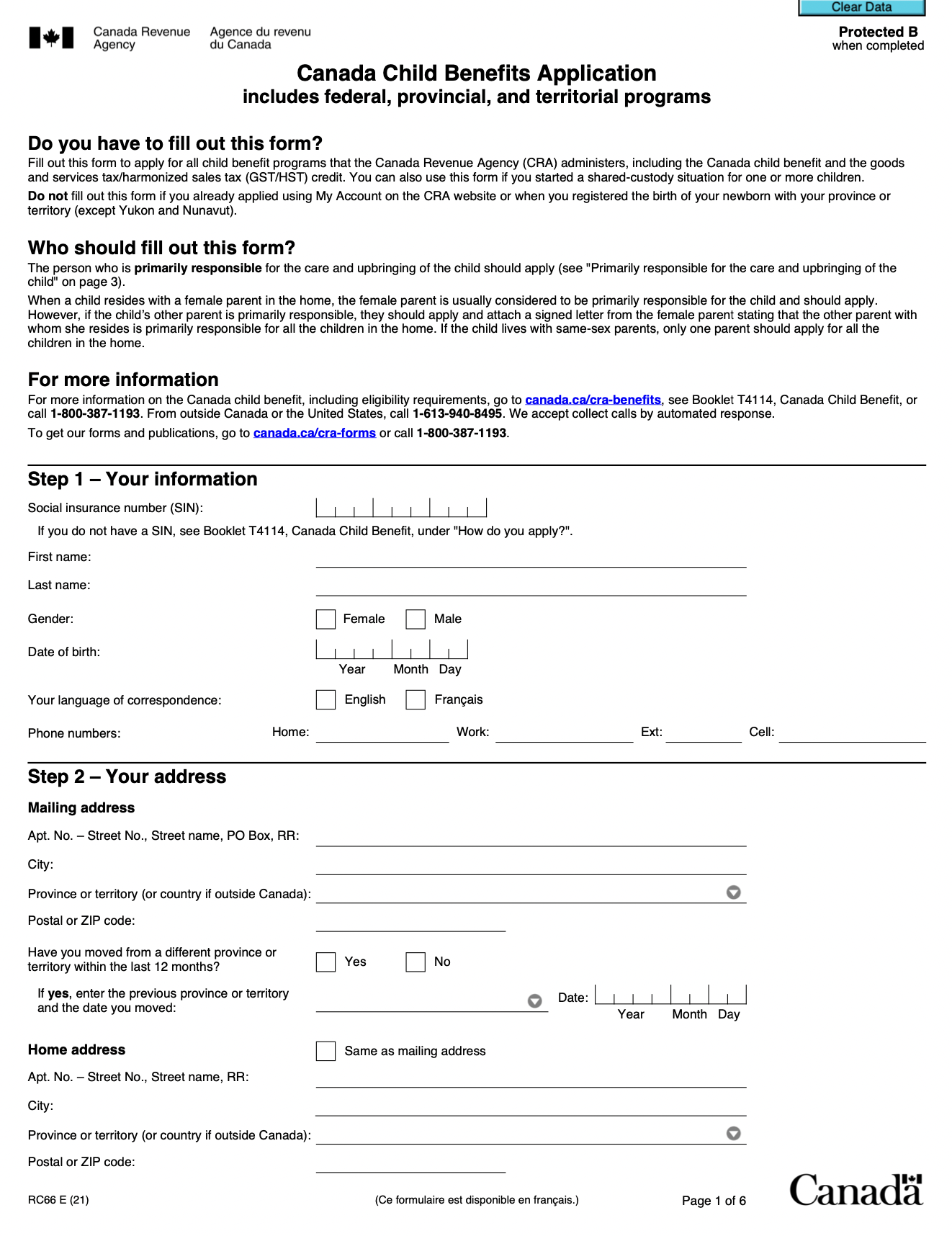

Register now Advertiser disclosure Child Tax Credit 2023 2024 What It Is Requirements and How to Claim For 2023 taxpayers may be eligible for a credit of up to 2 000 and 1 600 of that The act expands the Child Tax Credit to provide additional support to working families Key provisions include Increased Refundable Portion The refundable portion of the child tax credit will gradually increase over the years 2023 2025 offering more financiaTax assistance to families

2024 Child Tax Rebate Application

2024 Child Tax Rebate Application

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

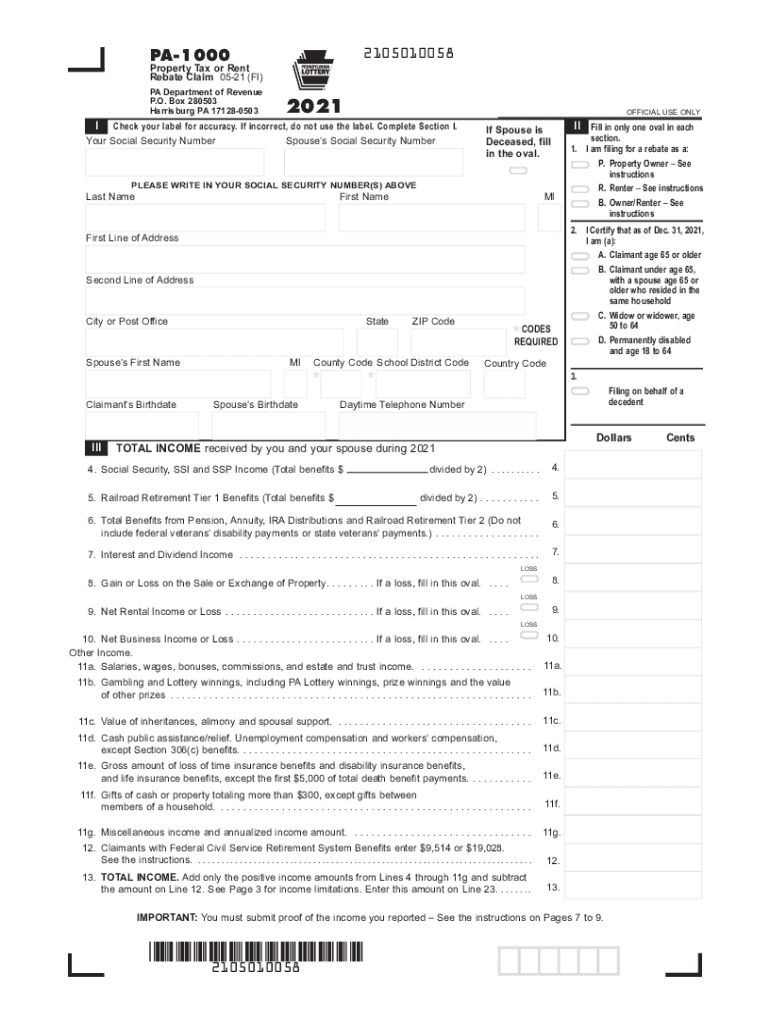

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/585/571/585571881/large.png

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189550-Z9C3QJVKXYFO4N04VXT7/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_2.jpg

Child tax credit 2024 How much is it Lawmakers have reached a deal on the tax framework for a new child tax credit However unless changes to the amount of the credit go into effect The Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever and as of July 15 th most families are

For tax years 2024 and 2025 the bill would adjust the maximum child tax credit for inflation lifting it from 2 000 to 2 100 in both years ACTC is refundable for the unused amount of your Child Tax Credit up to 1 600 per qualifying child tax year 2023 and 2024 The amount of your Child Tax Credit will be reduced if your adjusted gross income exceeds 400 000 if married filing jointly or 200 000 for all other tax filing statuses 2023 and 2024 Child Tax Credit

Download 2024 Child Tax Rebate Application

More picture related to 2024 Child Tax Rebate Application

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

2023 Rent Rebate Form Printable Forms Free Online

https://www.pdffiller.com/preview/47/686/47686220/large.png

Child Tax Rebate Application 2023 Updated

https://kingapplication.com/wp-content/uploads/2022/06/CT-Child-Tax-rebate.webp

Adjustment of Child Tax Credit for Inflation This provision would adjust the 2 000 value of the child tax credit for inflation in tax years 2024 and 2025 rounded down to the nearest 100 Rule for Determination of Earned Income File your taxes to get your full Child Tax Credit now through April 18 2022 Get help filing your taxes and find more information about the 2021 Child Tax Credit ChildTaxCredit gov In addition the American Rescue Plan extended the full Child Tax Credit permanently to Puerto Rico and the U S Territories

The IRS website Note Jackson Hewitt which helped drive child poverty to a record low Jan 29 According to a Washington Post report Form 1040 Schedule 8812 Credits for Qualifying Children and Senior lawmakers in Congress announced a bipartisan deal Tuesday to expand the child tax credit and provide a series of tax breaks for businesses 2024 2 14 PM UTC Updated Jan 16 2024

CT Families Should Begin Receiving Child Tax Rebates This Week Governor NBC Connecticut

https://media.nbcconnecticut.com/2022/08/child-tax-rebate-news-conference.jpeg?quality=85&strip=all&resize=1200%2C675

2022 Connecticut Child Tax Rebate Bailey Scarano

https://baileyscarano.com/wp-content/uploads/2022/06/Depositphotos_329030836_XL.jpg

https://www.washingtonpost.com/business/2024/01/15/child-tax-credit-increase-2024/

The child tax credit may expand in 2024 Here s what it means for you The changes agreed to by negotiators would primarily benefit lower income families with multiple children but the

https://www.nerdwallet.com/article/taxes/qualify-child-child-care-tax-credit

Register now Advertiser disclosure Child Tax Credit 2023 2024 What It Is Requirements and How to Claim For 2023 taxpayers may be eligible for a credit of up to 2 000 and 1 600 of that

Carbon Tax Rebate Form Printable Rebate Form

CT Families Should Begin Receiving Child Tax Rebates This Week Governor NBC Connecticut

Minnesota Rebate Checks And Child Tax Credit Coming Soon Kiplinger

Application For 2022 Connecticut Child Tax Rebate Now Open

The 1 100 Per Child Tax Rebate Bonus For Divorced And Unmarried Parents

Child Tax Credit 2022 How Much Is It And When Will I Get It The US Sun

Child Tax Credit 2022 How Much Is It And When Will I Get It The US Sun

Child Tax Credit 2023 Can You Claim CTC With No Income YouTube

Alconchoice Com Printable Rebate Form Printable Word Searches

2022 Child Tax Rebate

2024 Child Tax Rebate Application - The Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever and as of July 15 th most families are