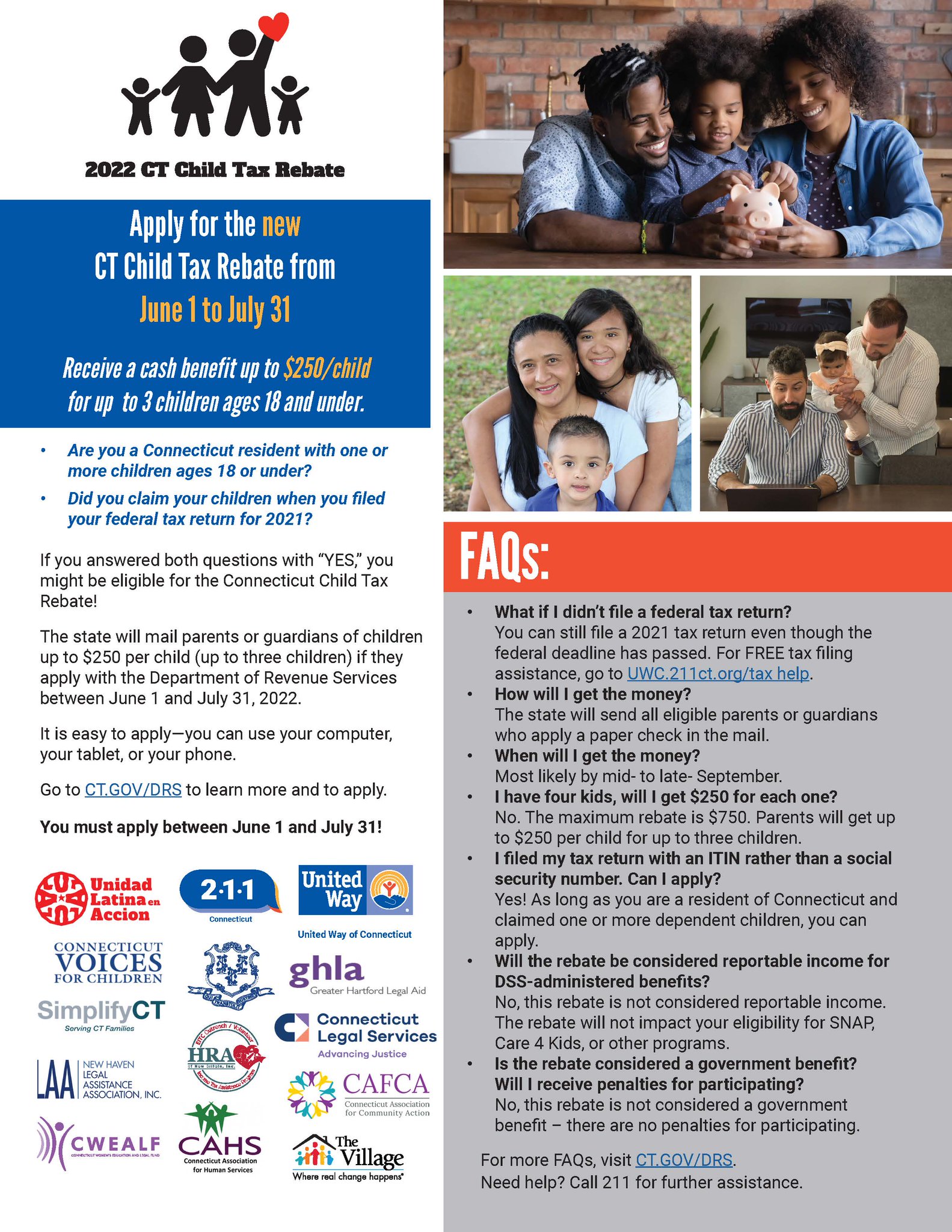

2024 Child Tax Rebate Status You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit

Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief Senior lawmakers in Congress announced a bipartisan deal Tuesday to expand the child tax credit and provide a series of tax breaks for businesses 2024 2 14 PM UTC Updated Jan 16 2024

2024 Child Tax Rebate Status

2024 Child Tax Rebate Status

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

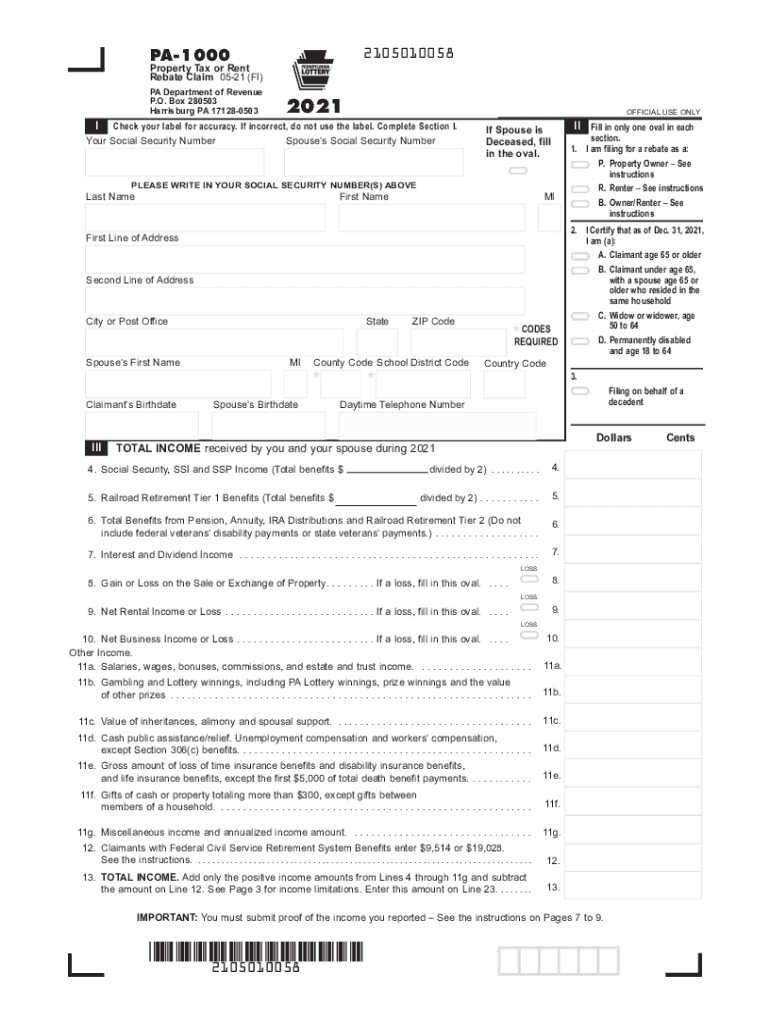

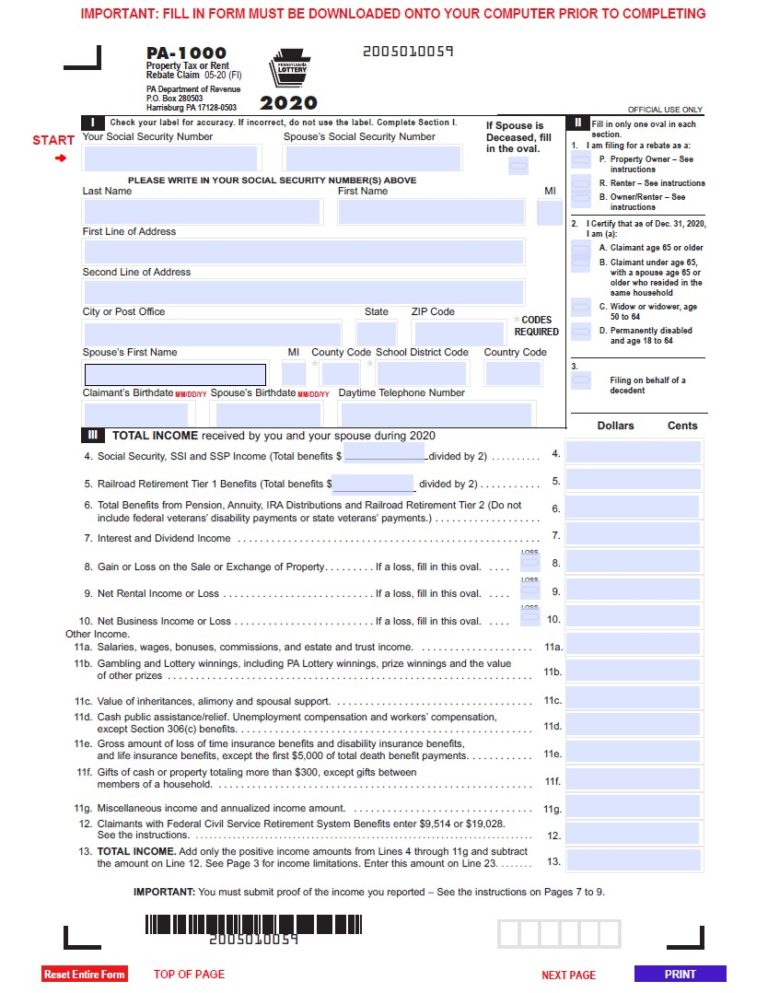

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

CT Families Should Begin Receiving Child Tax Rebates This Week Governor NBC Connecticut

https://media.nbcconnecticut.com/2022/08/child-tax-rebate-news-conference.jpeg?quality=85&strip=all&resize=1200%2C675

For the 2024 tax year returns you ll file in 2025 the refundable portion of the credit increases to 1 700 That means eligible taxpayers could receive an additional 100 per qualifying We estimate on a conventional basis the tax deal would be roughly revenue neutral raising about 40 million from 2024 through 2033 The revenue losses from retroactively changing bonus depreciation R D expensing the interest limitation and the child tax credit amount to 110 billion and are reflected in 2024 in the table below because that is when tax revenues would change

How much is the child tax credit in 2024 The maximum tax credit available per child is 2 000 for each child under 17 on Dec 31 2023 Only a portion is refundable this year up to 1 600 per child People with kids under the age of 17 may be eligible to claim a tax credit of up to 2 000 per qualifying dependent For taxes filed in 2024 1 600 of the credit is potentially refundable

Download 2024 Child Tax Rebate Status

More picture related to 2024 Child Tax Rebate Status

New Haven CSA On Twitter Applications For The Child Tax Rebate Are Open June 1st To July 31st

https://pbs.twimg.com/media/FUQOuiOWQAI-e9m.jpg:large

CT Child Tax Rebate Checks Are In The Mail Lamont Across Connecticut CT Patch

https://patch.com/img/cdn20/users/22994611/20220825/105526/styles/patch_image/public/money-bills___25105510368.jpg

RI Child Tax Rebate Available McKee Kicks Off Program In Newport

https://www.gannett-cdn.com/presto/2022/08/02/NNDN/20ea0d62-aeb3-4fb4-b156-c44b656906dd-DSC_0585.JPG?crop=3536,1989,x0,y266&width=3200&height=1800&format=pjpg&auto=webp

Adjustment of Child Tax Credit for Inflation This provision would adjust the 2 000 value of the child tax credit for inflation in tax years 2024 and 2025 rounded down to the nearest 100 Rule for Determination of Earned Income Updated for Tax Year 2023 January 12 2024 1 27 PM OVERVIEW The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements 1 age 2 relationship 3 support 4 dependent status 5 citizenship 6 length of residency and 7 family income You and or your child must pass all seven to claim this tax credit

About 90 percent of the proposed child tax credit changes are aimed at expanding how much the lowest income families can receive But the proposal faces a difficult road to passage For 2024 it would be 1 900 and for 2025 it would be 2 000 plus a new adjustment for inflation that is estimated to be an additional 100 in 2025 Child Tax Credit Expansion For tax years 2024 and 2025 this Act would adjust the maximum child tax credit for inflation raising it from 2 000 currently to 2 100 Additionally in 2023 if the child tax credit exceeds a taxpayer s tax liability the taxpayer may receive up to 1 600 of the credit as a refund based on an earned income

2022 Connecticut Child Tax Rebate Bailey Scarano

https://baileyscarano.com/wp-content/uploads/2022/06/Depositphotos_329030836_XL.jpg

Minnesota Rebate Checks And Child Tax Credit Coming Soon Kiplinger

https://cdn.mos.cms.futurecdn.net/6s7GLrUiaDFw4PtLwHLk5U-1024-80.jpg

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit

https://tax.thomsonreuters.com/blog/understanding-the-tax-relief-for-american-families-and-workers-act-of-2024/

Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief

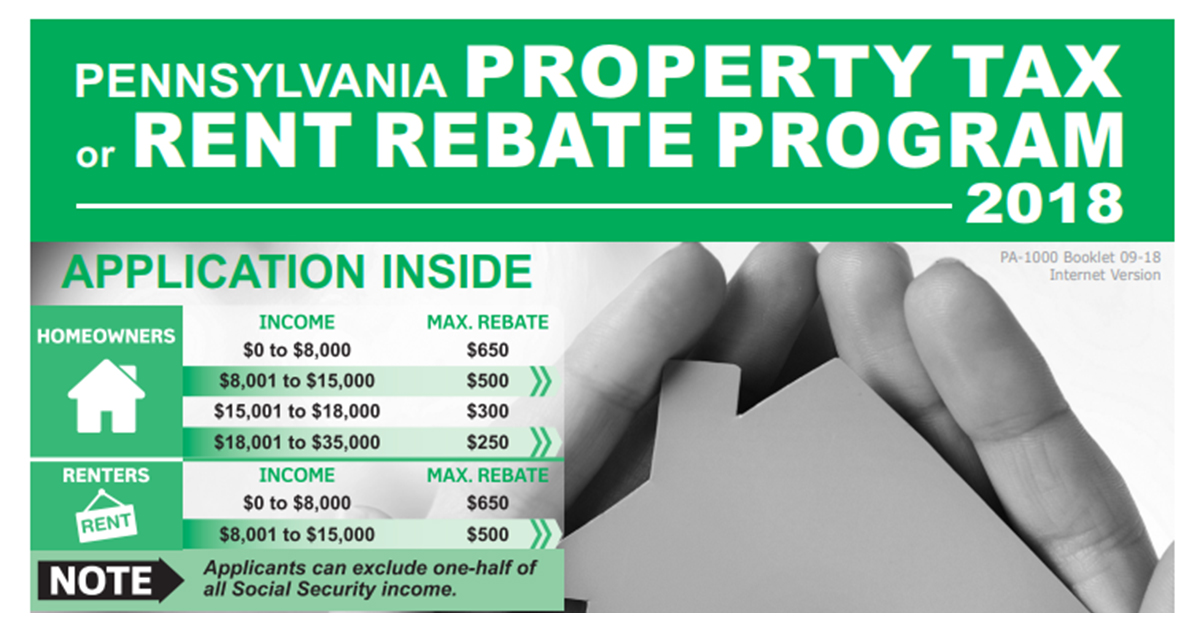

PA Rent Rebate Form Printable Rebate Form

2022 Connecticut Child Tax Rebate Bailey Scarano

The 1 100 Per Child Tax Rebate Bonus For Divorced And Unmarried Parents

Child Tax Credit 2022 How Much Is It And When Will I Get It The US Sun

Child Tax Credit 2023 Can You Claim CTC With No Income YouTube

Nj Property Tax Rebates 2023 PropertyRebate

Nj Property Tax Rebates 2023 PropertyRebate

Nearly 200 000 Families Can Still Apply For 2022 CT Child Tax Rebate Before July 31 Deadline

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

Military Journal Ri Child Tax Rebate Child Tax Credits Are One Of The Most Important Ways

2024 Child Tax Rebate Status - The American Rescue Plan increased the Child Tax Credit from 2 000 per child to 3 000 per child for children over the age of six and from 2 000 to 3 600 for children under the age of six