2024 Child Tax Rebate You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit

7 min Comment 295 Congressional negotiators announced a roughly 80 billion deal on Tuesday to expand the federal child tax credit that if it becomes law would make the program more generous Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

2024 Child Tax Rebate

2024 Child Tax Rebate

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate.jpg

Child Tax Credit CTC Update 2024

https://www.taxuni.com/wp-content/uploads/2022/10/Child-Tax-Credit-CTC-Update-TaxUni-Cover-1-1536x864.jpg

Child tax credit 2024 How much is it Lawmakers have reached a deal on the tax framework for a new child tax credit However unless changes to the amount of the credit go into effect Senior lawmakers in Congress announced a bipartisan deal Tuesday to expand the child tax credit and provide a series of tax breaks for businesses 2024 2 14 PM UTC Updated Jan 16 2024

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax It would also increase the refundable portion of the child tax credit to 1 800 for 2023 the year for which Americans are now preparing tax forms and then to 1 900 in 2024 and 2 000 in

Download 2024 Child Tax Rebate

More picture related to 2024 Child Tax Rebate

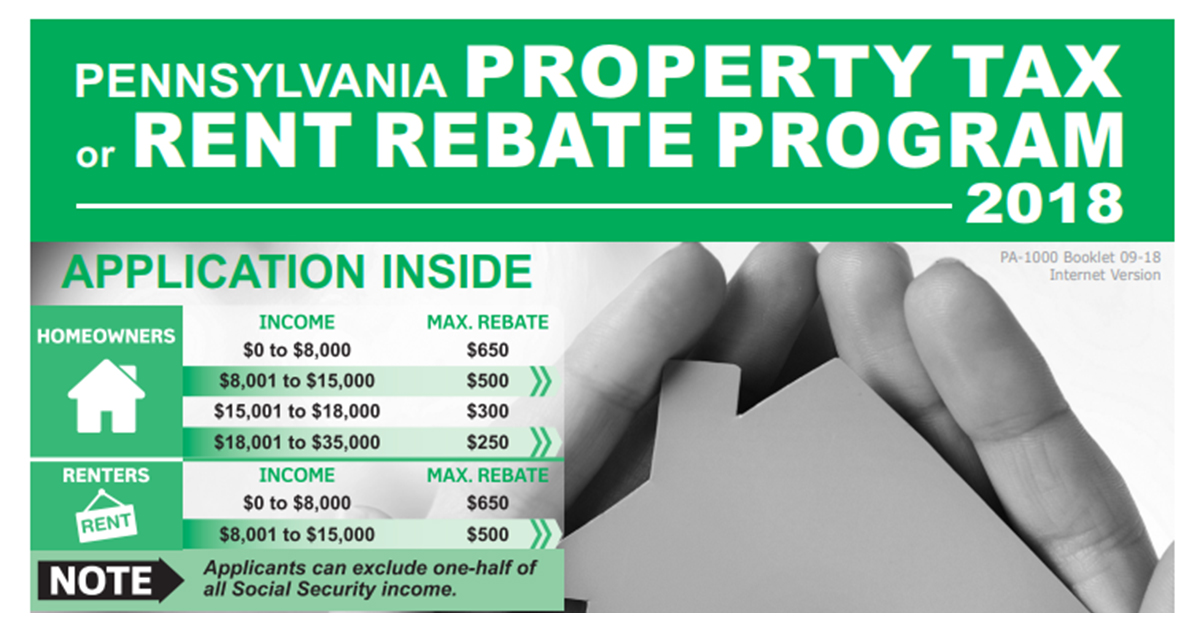

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

CT Families Should Begin Receiving Child Tax Rebates This Week Governor NBC Connecticut

https://media.nbcconnecticut.com/2022/08/child-tax-rebate-news-conference.jpeg?quality=85&strip=all&resize=1200%2C675

Adjustment of Child Tax Credit for Inflation This provision would adjust the 2 000 value of the child tax credit for inflation in tax years 2024 and 2025 rounded down to the nearest 100 Rule for Determination of Earned Income The child tax credit is worth up to 2 000 per qualifying dependent under the age of 17 The credit is nonrefundable but some taxpayers may be eligible for a partial refund of up to 1 600

Child Tax Credit 2024 How Much You Could Get and Who s Eligible Story by Dan Avery 1w Getty Images Provided by CNET If you have any children under the age of 17 including any born The amount would rise to 1 900 in 2024 and 2 000 in 2025 The bill would also ensure the child tax credit phase in applies fairly to families with multiple children it said Fifteen

2022 Connecticut Child Tax Rebate Bailey Scarano

https://baileyscarano.com/wp-content/uploads/2022/06/Depositphotos_329030836_XL.jpg

RI Child Tax Rebate Available McKee Kicks Off Program In Newport

https://www.gannett-cdn.com/presto/2022/08/02/NNDN/20ea0d62-aeb3-4fb4-b156-c44b656906dd-DSC_0585.JPG?crop=3536,1989,x0,y266&width=3200&height=1800&format=pjpg&auto=webp

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit

https://www.washingtonpost.com/business/2024/01/15/child-tax-credit-increase-2024/

7 min Comment 295 Congressional negotiators announced a roughly 80 billion deal on Tuesday to expand the federal child tax credit that if it becomes law would make the program more generous

Earned Income Tax Credit For Households With One Child 2023 Center On Budget And Policy

2022 Connecticut Child Tax Rebate Bailey Scarano

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

CT Child Tax Rebate Checks Are In The Mail Lamont Across Connecticut CT Patch

Minnesota Rebate Checks And Child Tax Credit Coming Soon Kiplinger

Child Tax Credit 2023 Can You Claim CTC With No Income YouTube

Child Tax Credit 2023 Can You Claim CTC With No Income YouTube

Connecticut Child Tax Rebate Still Available UHY

Child Tax Credit 2022 How Much Is It And When Will I Get It The US Sun

The 1 100 Per Child Tax Rebate Bonus For Divorced And Unmarried Parents

2024 Child Tax Rebate - Senior lawmakers in Congress announced a bipartisan deal Tuesday to expand the child tax credit and provide a series of tax breaks for businesses 2024 2 14 PM UTC Updated Jan 16 2024