2024 Ct Child Tax Rebate Status Child Tax Credit SEVERE COLD WEATHER With brutally cold temperatures impacting Connecticut Governor Lamont has directed the state s severe cold weather protocol to be activated through noon on Monday January 22 2024 Shelters and warming centers are available Anyone in need of shelter is strongly urged to call 2 1 1 to get connected to

January 16 2024 1 57 PM EST O n Tuesday a bipartisan group of lawmakers announced a 78 billion deal that would expand corporate tax breaks and the child tax credit which could put extra money On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

2024 Ct Child Tax Rebate Status

2024 Ct Child Tax Rebate Status

https://stratfordcrier.com/wp-content/uploads/2022/06/hh-1030x1030.png

How To Claim Your CT Child Tax Rebate 2022 Before It s Too Late

https://www.thewistle.com/wp-content/uploads/2023/07/CT-Child-Tax-Credit-Rebate-1536x1065.jpeg

Who s Eligible For The Connecticut Child Tax Rebate

https://media.marketrealist.com/brand-img/mxVSc8gb7/1280x670/connecticut-ct-child-tax-rebate-check-1660116086071.jpg?position=top

For the 2024 tax year returns you ll file in 2025 the refundable portion of the credit increases to 1 700 That means eligible taxpayers could receive an additional 100 per qualifying The maximum tax credit available per child is 2 000 for each child under 17 on Dec 31 2023 Only a portion is refundable this year up to 1 600 per child For tax year 2021 the expanded child

Currently 1 600 of the 2 000 credit per child is refundable The credit s phaseout threshold is 400 000 for married earners filing jointly and 200 000 for head or single households At the What the Child Tax Credit is and who qualifies for it 03 22 as well as to get more money back in their annual tax refund 1 900 in 2024 and 2 000 in 2025

Download 2024 Ct Child Tax Rebate Status

More picture related to 2024 Ct Child Tax Rebate Status

CT Families Should Begin Receiving Child Tax Rebates This Week Governor NBC Connecticut

https://media.nbcconnecticut.com/2022/08/child-tax-rebate-news-conference.jpeg?quality=85&strip=all&resize=1200%2C675

CT Child Tax Rebate Claimed By More Than 70 Of Eligible Households

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA10eoKa.img?w=1568&h=1045&m=4&q=81

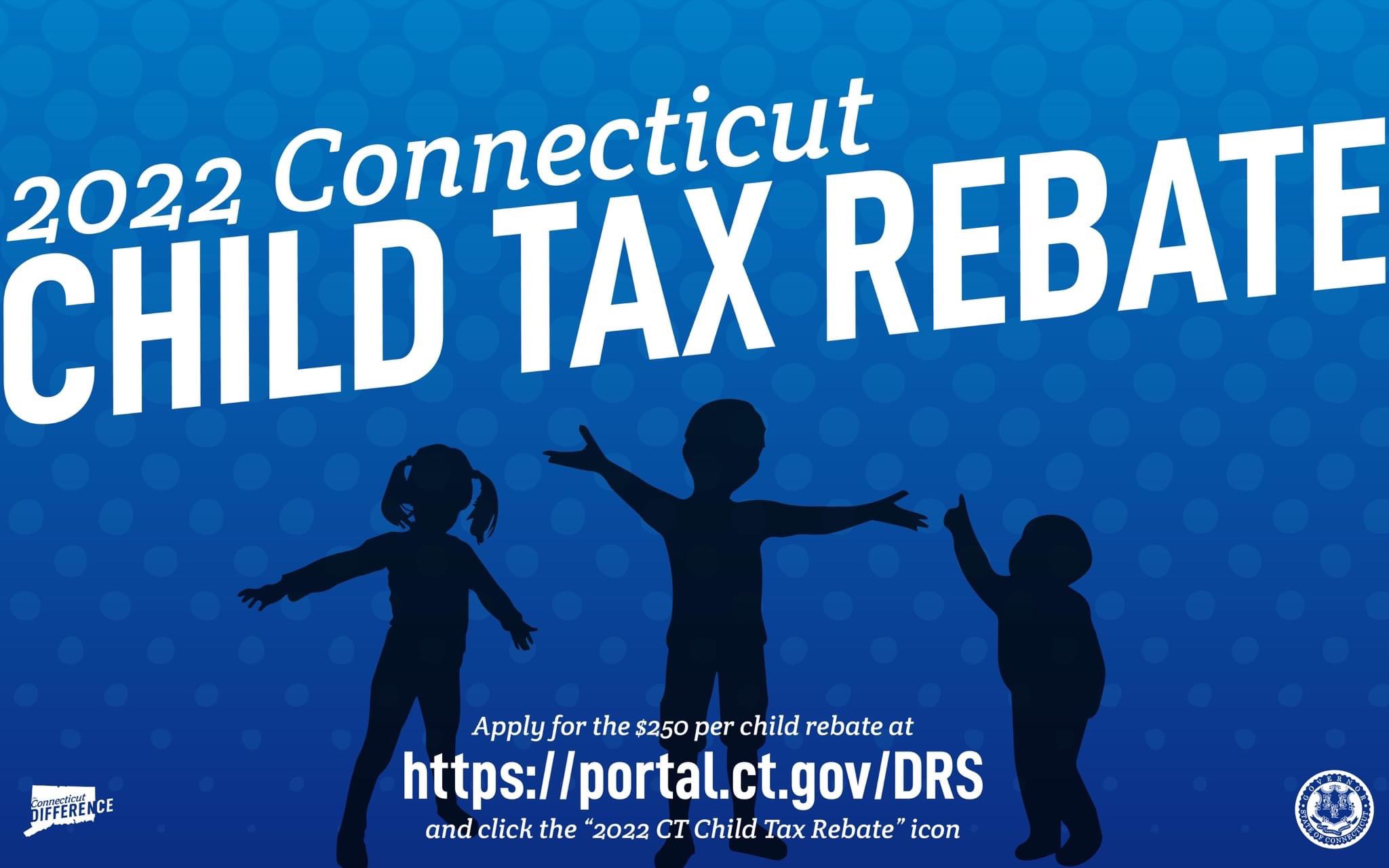

New Child Tax Rebate Available Applications Being Accepted Now

https://www.cthousegop.com/mccarty/wp-content/uploads/sites/44/2022/05/Baz-child-tax-credit.png

Register now Advertiser disclosure Child Tax Credit 2023 2024 What It Is Requirements and How to Claim For 2023 taxpayers may be eligible for a credit of up to 2 000 and 1 600 of that Thelegislation dubbed the Tax Relief for American Families and Workers Act of 2024 expands the child tax credit for three years and allows families with multiple children to take advantage of the credit The current cap for the refundable child tax credit is 1 600 Under the bill it would lift the amount to 1 800 in tax year 2023 1 900 in tax year 2024 and 2 000 in tax year 2025 and

Tax season starts in days and relief for parents remains in limbo LAWMAKERS IN D C CONSIDERING CHANGES TO CHILD TAX CREDIT In days Americans can file their taxes One way to get relief is File your taxes to get your full Child Tax Credit now through April 18 2022 Get help filing your taxes and find more information about the 2021 Child Tax Credit ChildTaxCredit gov In addition the American Rescue Plan extended the full Child Tax Credit permanently to Puerto Rico and the U S Territories

Connecticut Child Tax Rebate Still Available UHY

https://uhy-us.com/media/5748/child-tax-credit-three-cutouts-family-words.jpg

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

https://portal.ct.gov/DRS/Credit-Programs/Child-Tax-Rebate/

Child Tax Credit SEVERE COLD WEATHER With brutally cold temperatures impacting Connecticut Governor Lamont has directed the state s severe cold weather protocol to be activated through noon on Monday January 22 2024 Shelters and warming centers are available Anyone in need of shelter is strongly urged to call 2 1 1 to get connected to

https://time.com/6556152/congress-expanded-child-tax-credit-deal-money/

January 16 2024 1 57 PM EST O n Tuesday a bipartisan group of lawmakers announced a 78 billion deal that would expand corporate tax breaks and the child tax credit which could put extra money

2022 Connecticut Child Tax Rebate Bailey Scarano

Connecticut Child Tax Rebate Still Available UHY

CT Child Tax Rebate Checks Are In The Mail Lamont Across Connecticut CT Patch

Opinion CT Must Enact A Permanent Refundable Child Tax Credit

Advocates Push For CT Child Tax rebate Program To Return In 2023

Connecticut Child Tax Rebate Beginning June 1 Connecticut Lamont Governor

Connecticut Child Tax Rebate Beginning June 1 Connecticut Lamont Governor

West Hartford Residents Apply By July 31 For CT Child Tax Rebate We Ha West Hartford News

Income Tax Rebate Under Section 87A

Jimmy Tickey On Twitter Starting Today 250 Per Child Tax Rebates Are Available To

2024 Ct Child Tax Rebate Status - Still last fiscal year wrapped with more than 1 9 billion left over the second largest cushion in state history It was topped only by the 2021 22 fiscal year which closed with a 4 3 billion