2024 Energy Star Rebates 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project Final 2024 Recognition Criteria Monitors ENERGY STAR Most Efficient 2024 Criteria Correction PDF 264 KB ENERGY STAR Most Efficient 2024 Final Criteria Cover Letter Revised 12 2023 PDF 416 KB ENERGY STAR Most Efficient 2024 Criteria Stakeholder Comments and Responses PDF 218 KB ASHP ENERGY

2024 Energy Star Rebates

2024 Energy Star Rebates

https://www.energystar.gov/sites/default/files/ES_ME_2024_small-01_0.png

Registration Energy Star Rebates

https://i1.wp.com/energystarrebates.com/wp-content/uploads/2021/08/favpng_family-royalty-free-stock-photography-istock.png?w=1800&ssl=1

Foster Appliance Promotions

https://foster-appliance.markupfactory.com/assets/foster-appliance/UtilityCoRebate copy.jpeg

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

Florida signaled it wouldn t offer the rebates after a recent veto by Gov Ron DeSantis Consumers may soon be able to access 14 000 or more of federal rebates for making energy efficient Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home improvements will be available through 2032 A broad selection of ENERGY STAR certified equipment is eligible for the tax credits

Download 2024 Energy Star Rebates

More picture related to 2024 Energy Star Rebates

729 Year End 2024 Stock Photos Free Royalty Free Stock Photos From Dreamstime

https://thumbs.dreamstime.com/b/hand-turns-cube-changes-year-to-268546774.jpg

Clean Air Council Blog Archive Save Money And Energy With ENERGY STAR Rebates

https://cleanair.org/wp-content/uploads/6-PECO-Collage-01.png

Common HVAC Questions Samsung HVAC

https://res.cloudinary.com/govimg/image/upload/q_60,f_auto,w_2000,h_2000,c_limit,fl_lossy/v1608045228/5b294f9467c0d0489028b276/74271_Samsung_2021_Misc_Energy_Star_Image_01.jpg

Home Performance with ENERGY STAR 202 Customer Rebate Application Valid through Dec 31 2024 I Customer Information Full Name as it appears on Consumers Energy bill Consumers Energy Account Number required 2024 to qualify for the incentive amounts shown on the following pages Envelope Measures Minimum Efficiency for Measures Published January 25 2024 Written by CLEAResult We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and

Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit 30 of project cost 2 000 maximum amount credited What Products are Eligible Heat pumps are either ducted or non ducted mini splits Eligibility depends on whether you live in the north or south Ducted South All heat pumps that have earned the ENERGY STAR label North Heat pumps designated as ENERGY STAR Cold Climate that have an EER2 10

Global View 2023

https://cdn.kbiznews.co.kr/news/photo/202301/93089_61573_2952.jpg

Rebate Info The Best Commercial Deep Fryers In The World

https://ultrafryer.com/wp-content/uploads/2019/02/UF-Energy-Star-Rebate-Maps.jpg

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

https://www.forbes.com/home-improvement/hvac/heat-pump-tax-credit/

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project

Mn Energy Rebate Forms Printable Rebate Form

Global View 2023

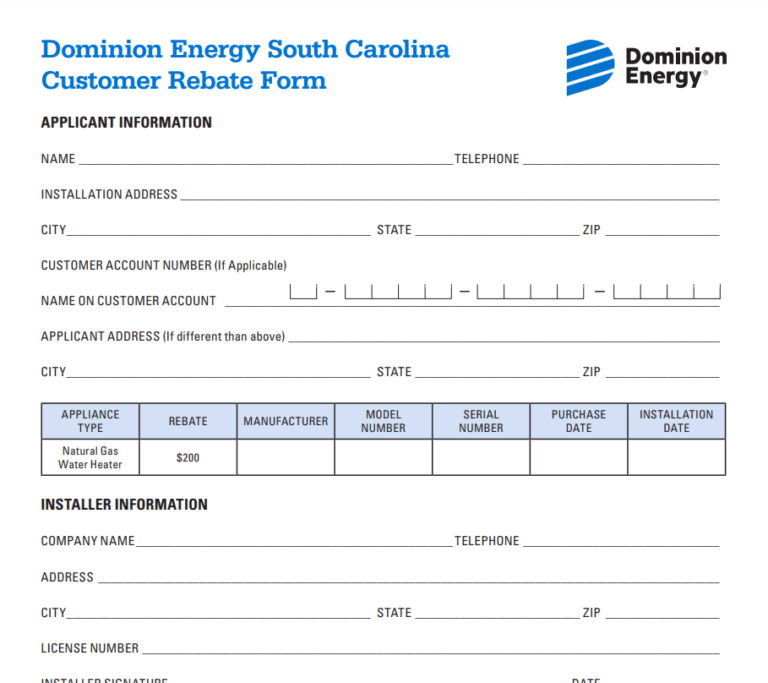

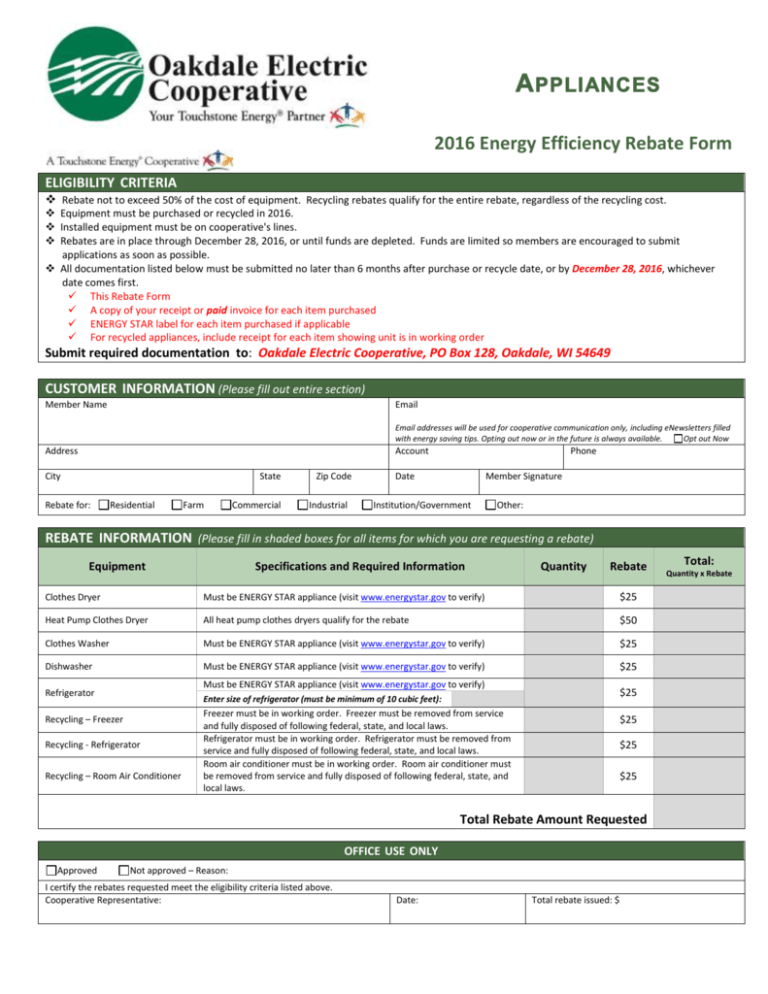

Application Energy Star Rebate Form

Energy Star Appliances Rebates Explained

Florida Energy Rebates For Air Conditioners 300 Federal Tax Credit For Air Conditioners Kobie

EnergyStar Logo

EnergyStar Logo

Limpiador Hassy Credencial Cafe Slide In Electric Range Educaci n Moral Delicioso No Puedo

Energy Star Rebates City Of Redwood Falls

How To Save With ENERGY STAR Window Rebates Harvey Windows Doors

2024 Energy Star Rebates - Rebate will be issued as a credit on your electric account Please allow 6 to 8 weeks for credit to appear A detailed receipt listing of your purchase and the yellow energy guide label with the Energy Star logo can be uploaded below Submission of this application does not guarantee a rebate