2024 Ev Point Of Sale Rebate For all of 2023 the EV tax credit is just that a non refundable tax credit Starting January 1 2024 the EV tax credit becomes redeemable at the point of sale In other words you can take your federal incentive as a cash discount when you buy your car at the dealership or online in the case of Tesla Rivian and Lucid

For EV customers everything changes on January 1 2024 The Treasury Department has now issued new rules that will turn the federal EV tax credit into what is basically a point of sale rebate The Clean Vehicle Tax Credit up to 7 500 for electric vehicles can now be used at the point of sale like an instant rebate 2024 EV tax credits The details of the new rules

2024 Ev Point Of Sale Rebate

2024 Ev Point Of Sale Rebate

https://images.wheels.ca/wp-content/uploads/2022/07/2024-chevrolet-blazer-ev-main-scaled.jpg

Honda Urban Ev 2024 Redesign Release Date Specs 2024 Honda Release Date Redesign Changes And

https://hips.hearstapps.com/hmg-prod/images/05-2024-honda-prologue-styling-reveal-1664982222.jpg

2024 Chevrolet Equinox EV Previewed In New Video Arrives In 2023 For 30 000

https://cimg0.ibsrv.net/ibimg/hgm/1920x1080-1/100/822/chevrolet-equinox_100822952.jpg

2023 2024 VW ID 4 Most eligible for full 7 500 EV tax credit And provided the dealership has registered with the IRS it can provide the credit as an instant rebate meaning an effective Researchers have found that consumers overwhelmingly prefer an immediate rebate at point of sale Under the Inflation Reduction Act consumers can choose to transfer their new clean vehicle credit of up to 7 500 and their previously owned clean vehicle credit of up to 4 000 to a car dealer starting January 1 2024

Beginning in 2023 qualifying used EV purchases can fetch taxpayers a credit of up to 4 000 limited to 30 of the car s purchase price Some other qualifications Used car must be plug in The federal EV tax credit will shift to a point of sale dealership rebate in 2024 giving customers instant access to the credit the U S Treasury Department confirmed Friday in a press release Under current rules buyers can t claim the credit of up to 7 500 for new vehicles and 4 000 for used vehicles until they file their Electric Car Electric Vehicle EV Car Insurance Motor

Download 2024 Ev Point Of Sale Rebate

More picture related to 2024 Ev Point Of Sale Rebate

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

2024 Chevy Equinox EV CwrCars Com

https://cwrcars.com/wp-content/uploads/2022/10/2024-Chevy-Equinox-EV.png

2024 Chevy Equinox EV Trims Features Page 7 Chevy Equinox EV Forum

https://www.equinoxevforum.com/attachments/2024-chevrolet-equinox-ev-3lt-117-jpg.57/

Consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle tax credit on their annual tax filing Starting in 2024 the Inflation Reduction Act establishes a mechanism that will allow car buyers to transfer the credit to dealers at the point of sale so that it can directly reduce the purchase price New rules for 2024 will allow buyers to get the EV tax credit at the point of sale rather than waiting for tax season Unlike current rules consumers won t need to have a tax liability to get it

What is the EV tax credit 2024 point of sale rebate Another new EV tax credit benefit in 2024 If you re buying a clean vehicle you may have the option as of Jan 1 2024 to take the EV tax Beginning Jan 1 eligible consumers can take the federal EV tax credit as a discount at the point of sale when they purchase a qualifying vehicle In essence if you transfer the 2024 EV tax

2024 Range Rover EV Is Going Fully Electric Coming Soon Land Rover Event Confirms Tech Times

https://1734811051.rsc.cdn77.org/data/images/full/394958/range-rover-ev-to-release-in-2024.png

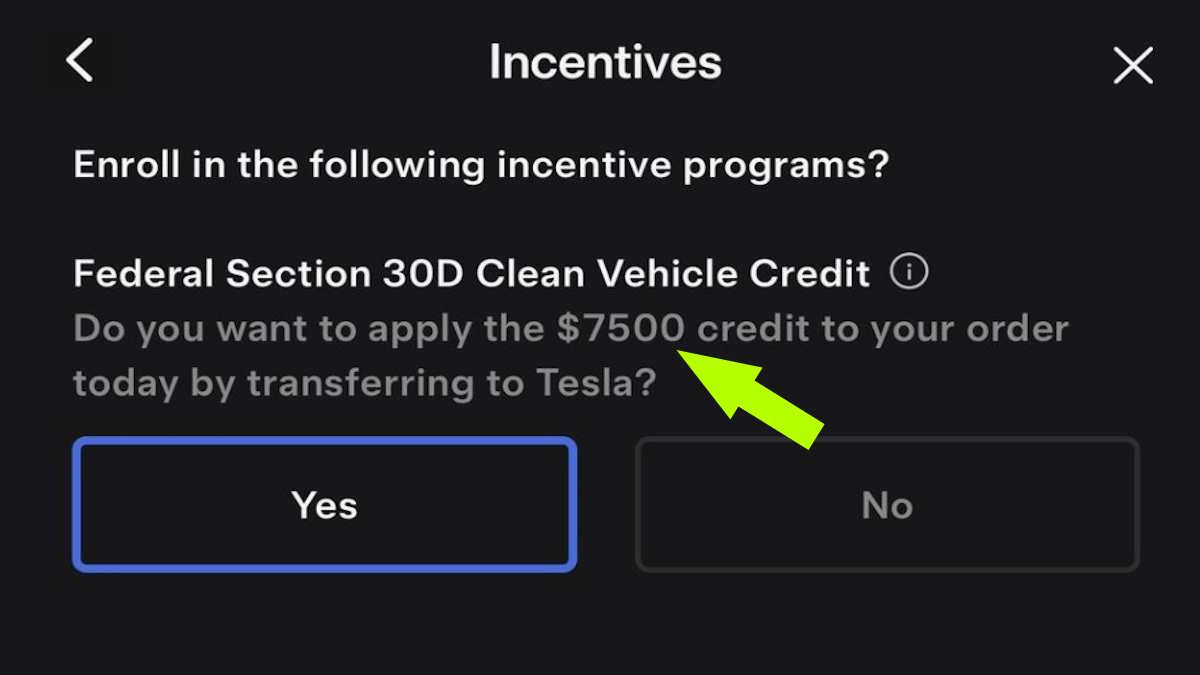

Tesla Finally Offering The 7 500 EV Tax Credit As An Instant Rebate At Point Of Sale Torque News

https://www.torquenews.com/sites/default/files/images/tesla_7500_ev_tax_credit_point_of_sale.jpg

https://caredge.com/guides/2024-point-of-sale-ev-tax-credit

For all of 2023 the EV tax credit is just that a non refundable tax credit Starting January 1 2024 the EV tax credit becomes redeemable at the point of sale In other words you can take your federal incentive as a cash discount when you buy your car at the dealership or online in the case of Tesla Rivian and Lucid

https://cleantechnica.com/2023/10/08/heres-what-happens-to-the-federal-ev-tax-credit-on-january-1-2024/

For EV customers everything changes on January 1 2024 The Treasury Department has now issued new rules that will turn the federal EV tax credit into what is basically a point of sale rebate

How Do The Used And Commercial Clean Vehicle Tax Credits Work Blink Charging

2024 Range Rover EV Is Going Fully Electric Coming Soon Land Rover Event Confirms Tech Times

Best Car 2023 Suv 2023 Ford Expedition Hybrid Redesign And Rumors Luud Kiiw

2024 GMC Sierra EV Preview Pricing Photos Release Date

Kia To Build 2024 EV9 SUV In US To Qualify For Federal Tax Credit

First Production 2024 GMC Hummer EV SUV Could Sell For Millions Carscoops

First Production 2024 GMC Hummer EV SUV Could Sell For Millions Carscoops

Best Car 2023 Eu Best Cars Review

Potential Missed Deadline For 2023 Sales As Numerous Dealers Fail To Provide Point of Sale

Honda Electric Suv 2023 New Cars Review

2024 Ev Point Of Sale Rebate - BREAKING Tesla is now officially offering the new 7 500 Fed EV point of sale POS rebate in the US enabling an estimated 250 million Americans up from 75M in 2023 To get a 7 500 discount