2024 Ev Rebate Vs Credit EV tax credit 2024 eligible vehicles As of New Year s Day the first change is that fewer vehicles are eligible for the full 7 500 EV tax credit That s due to stricter rules for

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit The tax benefit which was recently modified by the Inflation Reduction Act for years 2023 through 2032 allows for a maximum credit of 7 500 for new EVs and up to 4 000 limited to 30 of the

2024 Ev Rebate Vs Credit

2024 Ev Rebate Vs Credit

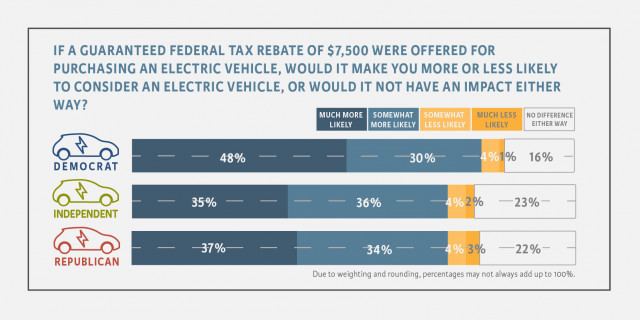

https://images.hgmsites.net/med/ev-tax-credit-support--climate-nexus-may-2019_100702679_m.jpg

EV Rebate Vs Tax Credit What s The Difference Between EV Incentives

https://cdn.topcarnews.info/media/wp-content/uploads/2022/05/09161151/image-ev-rebate-vs-tax-credit-whats-the-difference-between-ev-incentives-165206231169253.jpg

2024 Cadillac Lyriq Incentive And Rebates YouTube

https://i.ytimg.com/vi/jku8oXe4Stk/maxresdefault.jpg

Jan 1 2024 at 3 09pm ET By Patrick George A year ago nearly every new electric vehicle and plug in hybrid on the market qualified for a tax credit of up to 7 500 provided it was EV tax credit changes for 2024 The IRS updated its electric vehicle tax credit rules as of Jan 1 which makes it easier to see immediate savings on an EV purchase Practically

To claim the credit for vehicles placed in service before January 1 2024 file Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles with your tax return Starting January 1 2024 credit eligibility and amount will be determined at the time of sale using the IRS Energy Credits Online website For EV customers everything changes on January 1 2024 The Treasury Department has now issued new rules that will turn the federal EV tax credit into what is basically a point of sale

Download 2024 Ev Rebate Vs Credit

More picture related to 2024 Ev Rebate Vs Credit

Why Queensland s EV Rebate Scheme Slays In 2023 The Latch

https://thelatch.com.au/wp-content/uploads/2023/05/QLD-EV-Rebate.jpg

Trump Bill Signing Meme Imgflip

https://i.imgflip.com/7esiyl.jpg

Top EV Charger Rebates In BC For 2023 TCA Electric

https://www.tcaelectric.ca/wp-content/uploads/2023/06/2023-06-14-ev-charger-rebates-bc-TCA.jpg

The Internal Revenue Service updated the rules for electric vehicle tax credits again starting with the first day of 2024 The bad news is that fewer vehicles are now eligible for tax credits and Consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle tax credit on their annual tax filing Starting in 2024 the Inflation Reduction Act establishes a mechanism that will allow car buyers to transfer the credit to dealers at the point of sale so that it can directly reduce the purchase price

The 2024 electric vehicle tax credit is here to make that dream a reality In this post we will guide you through the ins and outs of the federal EV tax credit the upcoming changes under the Inflation Reduction Act and how to maximize your benefits and savings Understanding the 2024 electric vehicle tax credit A new federal tax credit of 4 000 for used EVs priced below 25k Subject to other requirements like lower annual income see below Revised credit applies to battery electric vehicles with an

VCE EV Rebates Valley Clean Energy

https://valleycleanenergy.org/wp-content/uploads/new-ev-banner-1536x320.jpg

Colorado Rebates For Electric Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/black-hills-energy-spotlights-ev-charging-rebates-during-national-drive.jpg

https://www.kiplinger.com/taxes/ev-tax-credit-changes-new-years-day

EV tax credit 2024 eligible vehicles As of New Year s Day the first change is that fewer vehicles are eligible for the full 7 500 EV tax credit That s due to stricter rules for

https://www.irs.gov/newsroom/qualifying-clean-energy-vehicle-buyers-are-eligible-for-a-tax-credit-of-up-to-7500

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

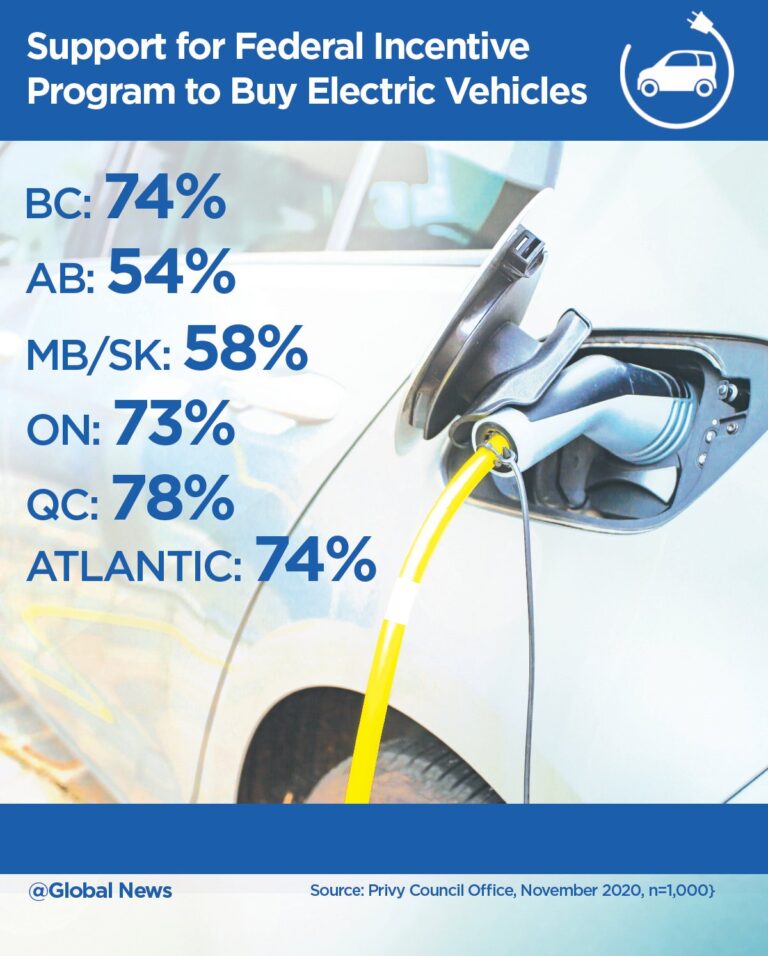

Canadians Support Federal EV Rebates Shows Internal Govt Poll

VCE EV Rebates Valley Clean Energy

Electric Vehicle EV Incentives Rebates

British Columbians Can Now Get 9 000 In EV Rebates Environment

3 EV Incentives GoEV CITY

Types Of Rebate Programs By Charger Type Graphs

Types Of Rebate Programs By Charger Type Graphs

EV Incentives In Canada How You Can Get Back Up To 10 000 In 2022

.png)

Customer Rebates Vs Supplier Rebates What You Need To Know Enable

More Vehicles Now Qualify For The Federal EV Rebate In Canada

2024 Ev Rebate Vs Credit - Jan 1 2024 at 3 09pm ET By Patrick George A year ago nearly every new electric vehicle and plug in hybrid on the market qualified for a tax credit of up to 7 500 provided it was