2024 Government Furnace Ac Rebates 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air conditioners On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

2024 Government Furnace Ac Rebates

2024 Government Furnace Ac Rebates

https://i.ytimg.com/vi/YMvf-a4-yYo/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGEggZShlMA8=&rs=AOn4CLCje6q7hxStF3Xcds6wMfj9if6KVw

2022 Government Heating Cooling System Rebates FurnacePrices Ca PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/2022-government-heating-cooling-system-rebates-furnaceprices-ca.png?resize=768%2C540&ssl=1

Government Organization Driver Jobs 2023 2024 Job Advertisement Pakistan

https://www.jobz.pk/images/jobs/2023-01/529013_1.jpg

Homeowners can now get a tax credit equal to 30 of installation costs for highly efficient heating and cooling products up to 600 for qualifying natural gas and oil furnaces The qualification is dependent on what type of fuel it uses Gas furnaces must be Energy Star certified and have an AFUE of 97 or greater In 2024 you can claim 30 of the costs for all qualifying HVAC systems installed during the year as tax credits The maximum tax credit amount you can get back is 3 200 year Up to 1 200 for central air conditioners boilers furnaces and natural gas oil and propane water heaters up to 600 per item

The Internal Revenue Service IRS issued guidance specifying that the audit must identify the most significant and cost effective energy efficiency improvements including an estimate of the energy and cost savings to each improvement Taxpayers can get a 150 tax credit for a 500 audit The law gives states until August 2024 to start handing out the rebates or lose the funding DOE has just taken the first step in a long process of getting these programs designed and those

Download 2024 Government Furnace Ac Rebates

More picture related to 2024 Government Furnace Ac Rebates

Explore Government Rebates For New Furnaces In Ontario 2023

https://thehvacservice.ca/wp-content/uploads/2023/05/how-to-save-money-with-government-furnace-rebates-in-ontario-1536x533.jpg

New Furnace Rebates 2022 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/04/Government-Rebate-for-Furnaces-2022-1024x769.png

Bosch Heat Pumps Rebates 24 7 Furnace AC Tankless Attic Insulation GTA Rebates Repairs

https://constanthomecomfort.com/wp-content/uploads/2022/10/bosch-hvac.jpg

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent IR 2023 97 May 4 2023 The Internal Revenue Service reminds taxpayers that making certain energy efficient updates to their homes could qualify them for home energy tax credits

2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit Product Rebate Finder Enter your zip code to find rebates and other special offers on ENERGY STAR certified products available in your area Visit website to learn more The federal government offers a tax credit on the purchase and installation of Ductless Air Conditioning mini multi split Systems Offer valid 01 01 2023 through 12 31

How To Claim FortisBC s Furnace Rebates Murray s Solutions

https://murrayssolutions.com/wp-content/uploads/2021/11/furnaceRebate2.jpg

Conquista Midollo Coro Rebate Program Template Omettere Additivo Bobina

https://data.templateroller.com/pdf_docs_html/2100/21003/2100371/rebate-form_print_big.png

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

https://todayshomeowner.com/hvac/guides/hvac-tax-credit/

The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air conditioners

Gas Furnace AC Replacement YouTube

How To Claim FortisBC s Furnace Rebates Murray s Solutions

Who s Visiting Iowa In The 2022 Campaign Season Iowa Capital Dispatch

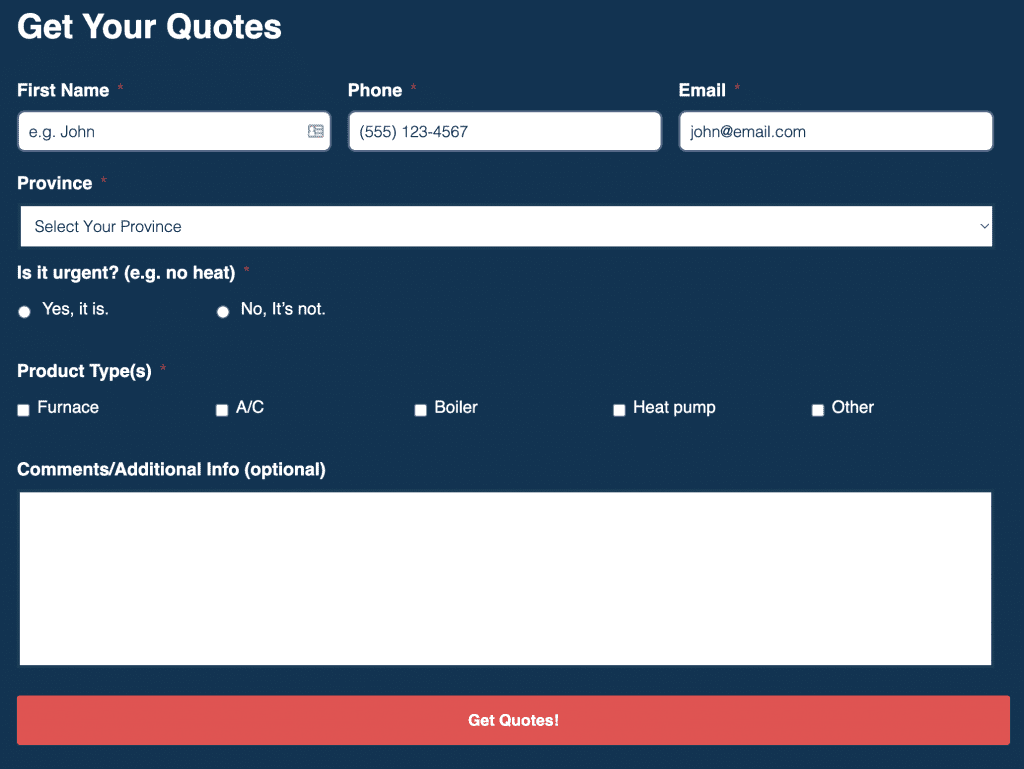

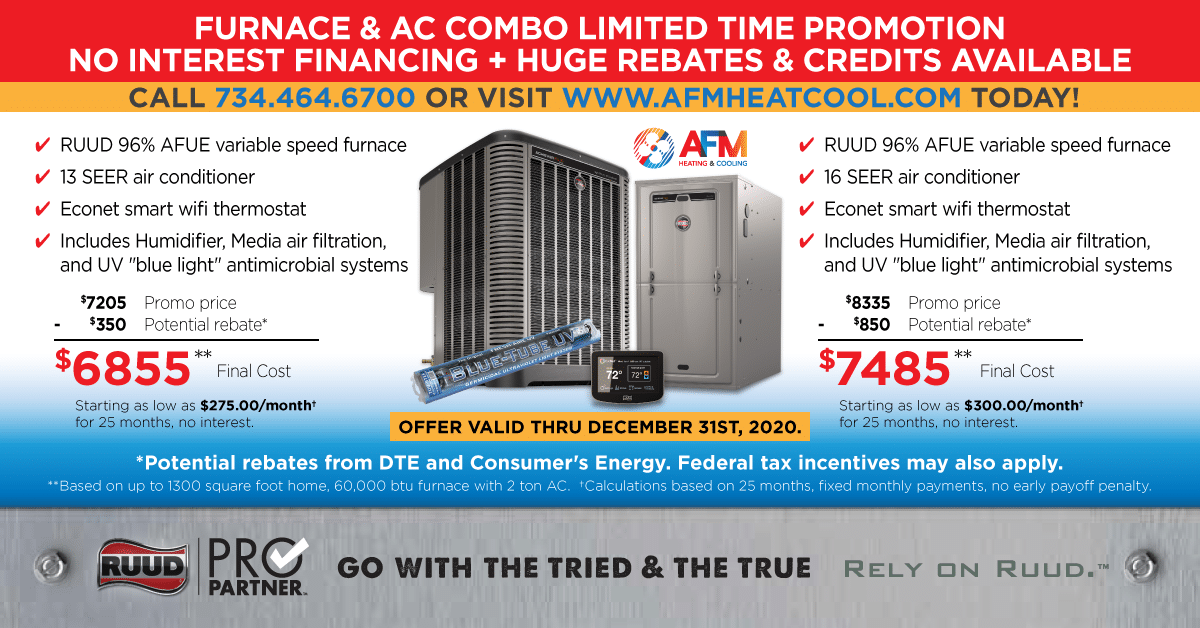

New Furnace AC Combo Limited Time Promotion No Interest Financing Huge Rebates And Credits

Promotional Offers Rebates HVAC And Plumbing Contractor MN

2023 Heat Pump Rebates 24 7 Furnace AC Tankless Attic Insulation GTA Rebates Repairs

2023 Heat Pump Rebates 24 7 Furnace AC Tankless Attic Insulation GTA Rebates Repairs

Clicking Amana Furnace AC DIY Home Improvement Forum

RUUD 2 Ton 14 Seer A C 60K 95 AFUE Gas Furnace System My HVAC Price

How To Size Your Furnace Or AC Empower Home Comfort

2024 Government Furnace Ac Rebates - In 2024 you can claim 30 of the costs for all qualifying HVAC systems installed during the year as tax credits The maximum tax credit amount you can get back is 3 200 year Up to 1 200 for central air conditioners boilers furnaces and natural gas oil and propane water heaters up to 600 per item