2024 Homeowner Tax Rebate Credit Ny About Inflation Reduction Act Homeowners Back to Inflation Reduction Act Combine IRA Savings with State Incentives to Upgrade Your Home and Ditch Fossil Fuels The Inflation Reduction Act IRA helps New Yorkers get the latest clean energy technologies and equipment that will save energy for years to come

Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are subject to tax under Tax Law Article 22 you were a New York State resident for all of the tax year your qualified gross income is 250 000 or less Homeowner tax rebate credit registration If you received a letter Form RP 5303 requesting that you register for the homeowner tax rebate credit please follow the instructions below This will enable us to determine your eligibility for the credit If you did not receive a letter please do not register for the credit How to register 1

2024 Homeowner Tax Rebate Credit Ny

2024 Homeowner Tax Rebate Credit Ny

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

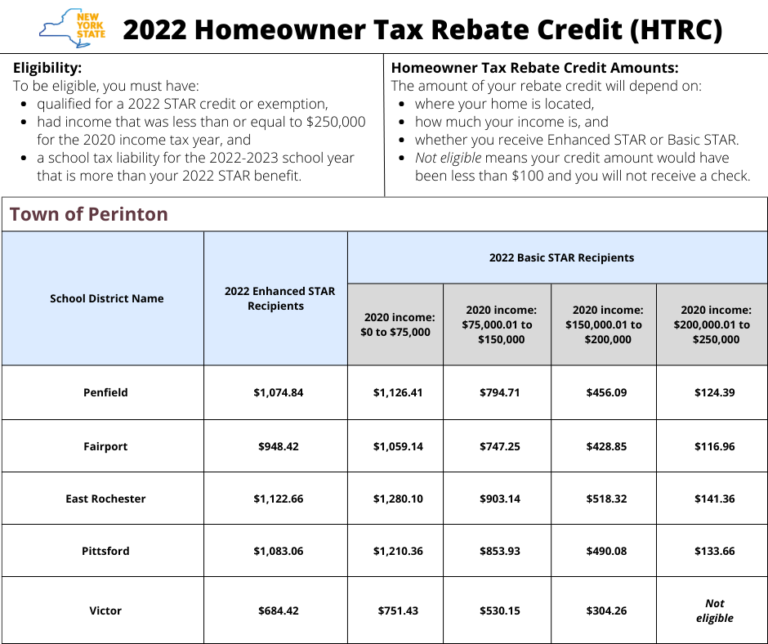

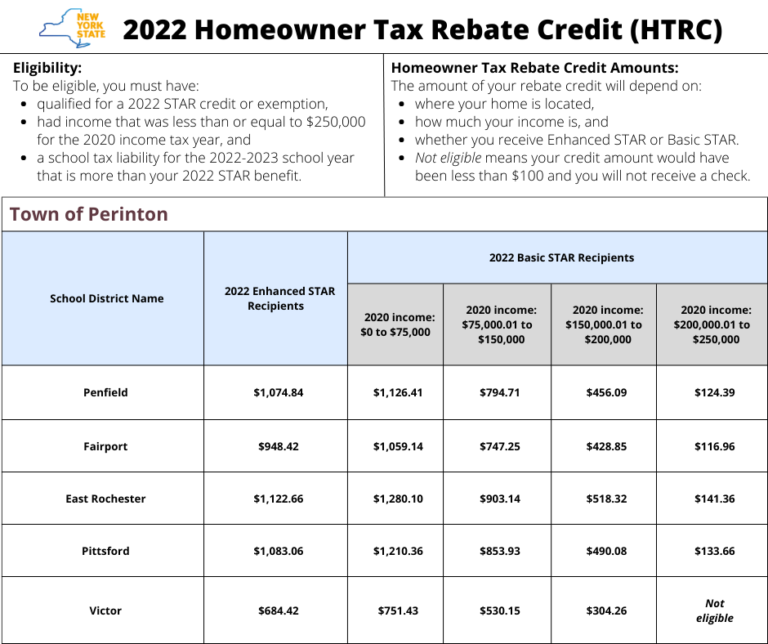

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

https://perinton.org/wp-content/uploads/2022-Homeowner-Tax-Rebate-Credit-HTRC-1-768x644.png

Confusion Over When Eligible New Yorkers Will Get Their Homeowner Tax Rebate Check WRGB

https://cbs6albany.com/resources/media2/16x9/full/1015/center/80/bb776db9-9697-43c3-882f-8577bedc9e89-large16x9_tax_rebate.PNG

2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks When you file your tax return you must decide whether to take the standard deduction 13 850 for single tax filers 27 700 for joint filers or 20 800 for heads of household or married filing

To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit ALBANY N Y In June Governor Kathy Hochul announced the one time Homeowner Tax Rebate Credit would be sent out available to eligible New Yorkers The state s Department of Taxation and

Download 2024 Homeowner Tax Rebate Credit Ny

More picture related to 2024 Homeowner Tax Rebate Credit Ny

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

https://media.wgrz.com/assets/WGRZ/images/a07fcd1f-3754-4e57-bce5-9be83e9634c0/a07fcd1f-3754-4e57-bce5-9be83e9634c0_1140x641.jpg

Your Stories Q A Are You Still Waiting For Your Homeowner Tax Rebate Credit Check YouTube

https://i.ytimg.com/vi/_vD5dD4pZ7Q/maxresdefault.jpg

Over 3M New Yorkers To Receive Homeowner Tax Rebate Checks This Summer Port Washington NY Patch

https://patch.com/img/cdn20/shutterstock/23121104/20220610/034752/styles/patch_image/public/shutterstock-228062581___10154715779.jpg?width=1200

The New York Department of Taxation and Finance will soon begin sending direct financial assistance to 1 75 million New Yorkers who received the Empire State Child Credit and or the Earned Income Credit on their 2021 state tax returns including a gas tax moratorium and a homeowner tax rebate credit Our families have felt the effects of a By Anthony Parrelli and Androula Constantinou As part of an approved 2 2 billion tax relief program in New York s Budget 2 5 million eligible New York homeowners will receive checks in the mail for a one time property tax credit titled the Homeowner Tax Rebate Credit HTRC Eligibility for the program depends on a variety of factors

S T A T E O F N E W Y O R K 3495 2023 2024 Regular Sessions I N S E N A T E January 31 2023 Introduced by Sen WEIK read twice and ordered printed and when printed to be committed to the Committee on Budget and Revenue AN ACT to amend the tax law in relation to the homeowner tax rebate credit THE PEOPLE OF THE STATE OF NEW YORK REPRESENTED IN SENATE AND ASSEM BLY DO ENACT To be eligible to receive a check residents must have qualified for a 2022 STAR credit or exemption have an income at or below 250 000 for the 2020 income tax year and a school tax

NYS Homeowner Tax Rebate Credit Checks Being Mailed Out

https://townsquare.media/site/497/files/2022/06/attachment-RS28849_ThinkstockPhotos-623211702-scr.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

New York State To Mail Out Homeowner Tax Rebate Credit Checks DSJ

https://dsj.us/wp-content/uploads/2022/06/homeowners-tax-rebate-checks.jpg

https://www.nyserda.ny.gov/All-Programs/Inflation-Reduction-Act/Inflation-Reduction-Act-homeowners

About Inflation Reduction Act Homeowners Back to Inflation Reduction Act Combine IRA Savings with State Incentives to Upgrade Your Home and Ditch Fossil Fuels The Inflation Reduction Act IRA helps New Yorkers get the latest clean energy technologies and equipment that will save energy for years to come

https://www.tax.ny.gov/pit/credits/real-property-tax-relief-credit.htm

Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are subject to tax under Tax Law Article 22 you were a New York State resident for all of the tax year your qualified gross income is 250 000 or less

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

NYS Homeowner Tax Rebate Credit Checks Being Mailed Out

Direct Payments Worth Up To 1 050 Being Sent To Millions Of Americans NOW Are You Eligible

When Will NY Homeowners Get New STAR Rebate Checks Syracuse

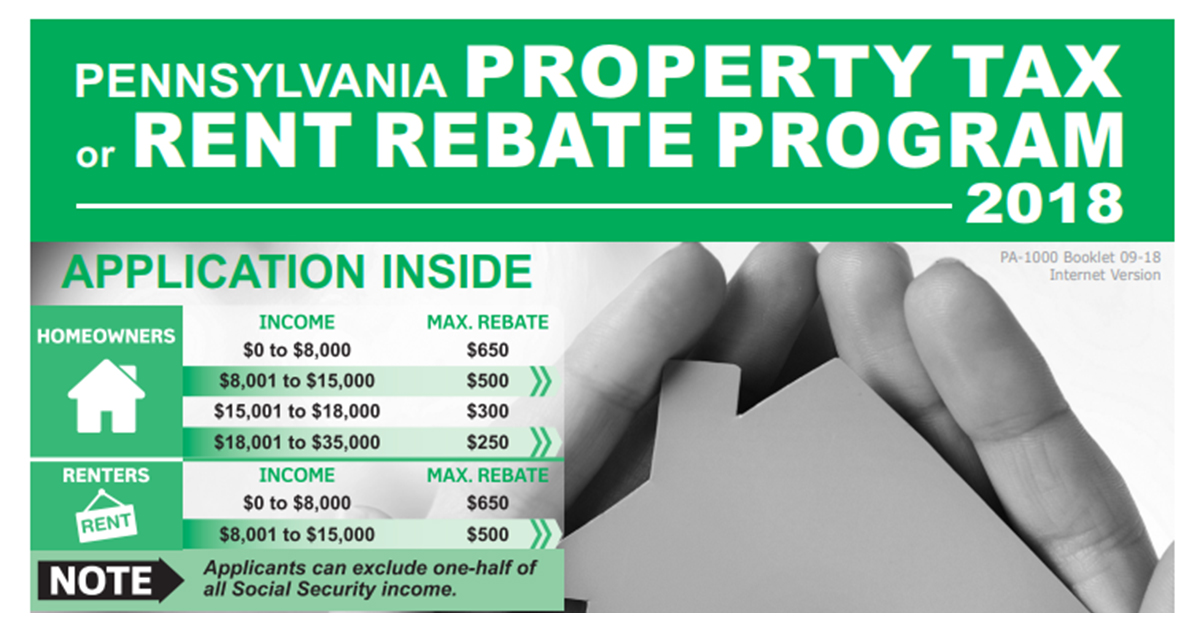

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

The Ultimate List Of Homeowner Tax Credits For 2020 Lifestyle

2024 Homeowner Tax Rebate Credit Ny - ALBANY N Y In June Governor Kathy Hochul announced the one time Homeowner Tax Rebate Credit would be sent out available to eligible New Yorkers The state s Department of Taxation and