2024 Homeowner Tax Rebate Status 2024 tax refund calculator vice president of tax operations at TaxAct Homeowners who tapped expanded home energy tax The IRS said the best way to check the status of your refund is to

Checking Rebate Status HOMEOWNER email email 717 000 0000 Verify Address Select the correct address if multiple results Select Save Property Tax Rent Rebate Program P O Box 280503 Harrisburg PA 17128 0503 Tips to Avoid Processing Delays Common Reminders When you file your tax return you must decide whether to take the standard deduction 13 850 for single tax filers 27 700 for joint filers or 20 800 for heads of household or married filing

2024 Homeowner Tax Rebate Status

2024 Homeowner Tax Rebate Status

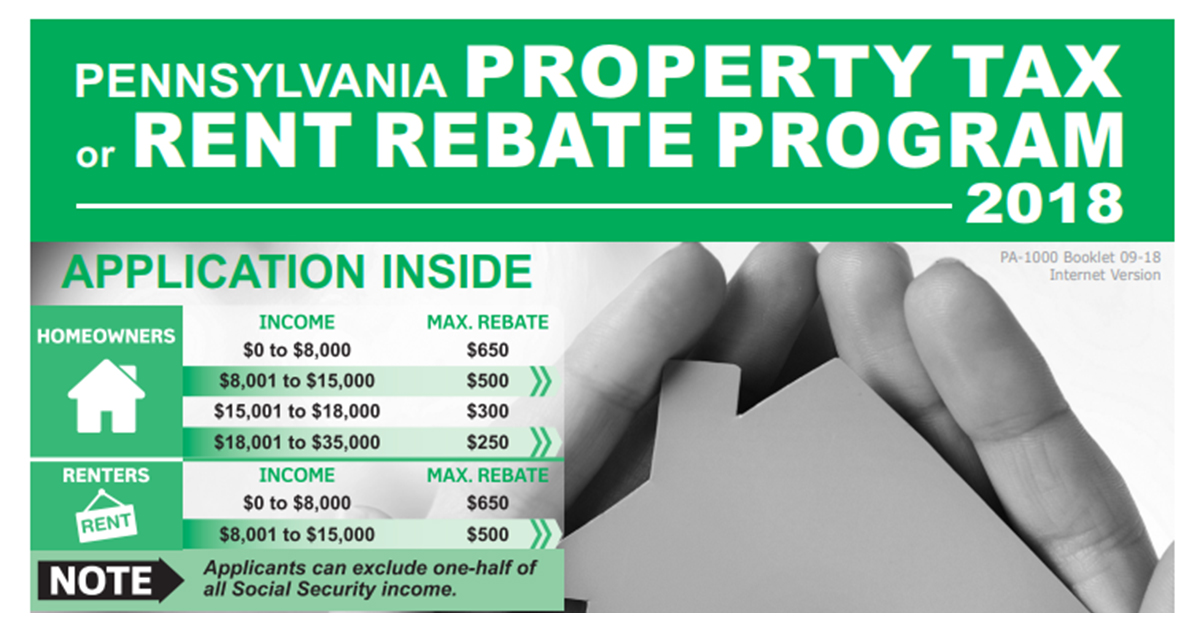

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

Learn about all the possible tax breaks for homeowners to get the biggest refund possible on your taxes For more on taxes learn about the biggest tax credits and how to create an online IRS JUNE 30 2024 Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available Applicants can exclude one half of all Social Security income INCOME MAX REBATE 0 to 8 000 1 000 8 001 to 15 000 770 15 001 to 18 000 460 18 001 to 45 000 380 INCOME MAX REBATE 0

Minnesota rebate checks were sent beginning in mid August of last year to about 2 5 million Minnesota households The one time payments of up to 1 300 sometimes called Walz checks or Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax

Download 2024 Homeowner Tax Rebate Status

More picture related to 2024 Homeowner Tax Rebate Status

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Homeowner Tax Rebate Program For People Who Live In Their Home YouTube

https://i.ytimg.com/vi/Dk6m3vyq3cY/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYOSBUKHIwDw==&rs=AOn4CLAiLu8JQ1ipHT9vjuy4jqjIumoU2g

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

https://www.informnny.com/wp-content/uploads/sites/58/2022/06/GettyImages-985842598-2.jpg?w=960&h=540&crop=1

For joint filers deductions apply to mortgage interest payments on loans up to 1 million or 750 000 for loans made after Dec 15 2017 Single filers can claim half these amounts 500 000 or 375 000 respectively To claim this deduction use IRS Form 1098 provided by your lender in early 2024 entering the amount from Line 1 onto Line The rebates are available to households earning less than 150 of the area s median income If your household income falls Below 80 of the area median income you can claim rebates for 100 of

Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief Tax Day is Apr 15 2024 for most taxpayers Taxpayers in Maine or Massachusetts have until Apr 17 2024 due to the Patriot s Day and Emancipation Day holidays Taxpayers living in a federally

Confusion Over When Eligible New Yorkers Will Get Their Homeowner Tax Rebate Check CNYcentral

https://chittenango.com/wp-content/uploads/2022/08/bb776db9-9697-43c3-882f-8577bedc9e89-large16x9_tax_rebate.PNG

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

https://media.wgrz.com/assets/WGRZ/images/a07fcd1f-3754-4e57-bce5-9be83e9634c0/a07fcd1f-3754-4e57-bce5-9be83e9634c0_1140x641.jpg

https://www.cbsnews.com/news/tax-refund-2024-what-to-expect-when-will-i-get/

2024 tax refund calculator vice president of tax operations at TaxAct Homeowners who tapped expanded home energy tax The IRS said the best way to check the status of your refund is to

https://www.revenue.pa.gov/GetAssistance/LegislativeAffairs/Documents/2024_PTRR_Training.pdf

Checking Rebate Status HOMEOWNER email email 717 000 0000 Verify Address Select the correct address if multiple results Select Save Property Tax Rent Rebate Program P O Box 280503 Harrisburg PA 17128 0503 Tips to Avoid Processing Delays Common Reminders

Martwick Encourages Residents To Check Their Tax Rebate Status Senator Robert Martwick

Confusion Over When Eligible New Yorkers Will Get Their Homeowner Tax Rebate Check CNYcentral

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

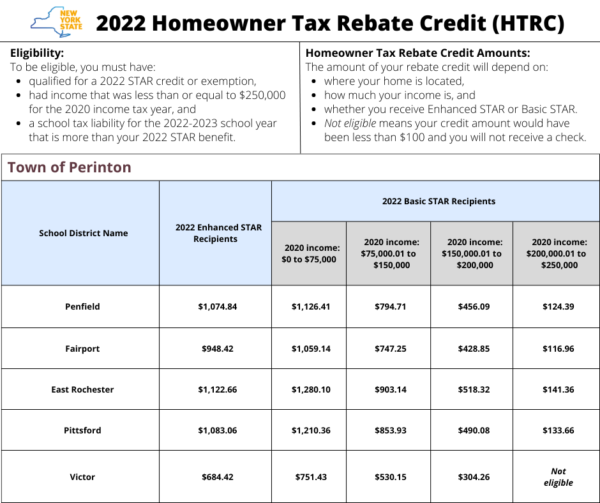

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

Your Stories Q A Are You Still Waiting For Your Homeowner Tax Rebate Credit Check YouTube

New York State To Mail Out Homeowner Tax Rebate Credit Checks DSJ

New York State To Mail Out Homeowner Tax Rebate Credit Checks DSJ

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

Direct Payments Worth Up To 1 050 Being Sent To Millions Of Americans NOW Are You Eligible

2024 Homeowner Tax Rebate Status - JUNE 30 2024 Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available Applicants can exclude one half of all Social Security income INCOME MAX REBATE 0 to 8 000 1 000 8 001 to 15 000 770 15 001 to 18 000 460 18 001 to 45 000 380 INCOME MAX REBATE 0