2024 Hvac Rebates For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project

The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air conditioners In 2024 you can claim 30 of the costs for all qualifying HVAC systems installed during the year as tax credits The maximum tax credit amount you can get back is 3 200 year Up to 1 200 for central air conditioners boilers furnaces and natural gas oil and propane water heaters up to 600 per item

2024 Hvac Rebates

2024 Hvac Rebates

https://nwcalliancesoccer.demosphere-secure.com/_files/tryouts-2023-2024/NWC 2023-2024.JPG

Buy 2024 Wall 2024 Jan 2024 Dec 2024 12 X 24 Open 12 Month Wall 2024 With Unruled

https://m.media-amazon.com/images/I/81J20wwDaLL.jpg

Tolminator 2024

https://tolminator.mojekarte.si/design/tolminator/img-tolminator/logo-2024-1.png

The Inflation Reduction Act signed by President Biden on August 16 2022 stands as the most significant investment in clean energy and climate action in U S history As part of this transformative law tax credit opportunities have been expanded and are available to any homeowner making energy efficient home upgrades 2024 HEATING AND COOLING REBATE APPLICATION FOR SINGLE FAMILY MULTIFAMILY AND CONDOS 1 of 2 Step 3 Complete Your Application Submit the application within 60 days Incomplete or missing information will delay processing Required documentation Completed and signed rebate application both pages Invoice sales receipt

2024 Rebates for Heating and Cooling Equipment These rates apply to equipment installed January 1 2024 through May 31 2024 Applications must be submitted within 60 days of installation and no later than June 30 2024 Rebates are subject to change Check focusonenergy for current rebate amounts The law provides 391 billion nationwide to support clean energy and address climate change including 8 8 billion designated for the Home Efficiency Rebates HOMES Program and Home Electrification and Appliance Rebate HEEHRA Program

Download 2024 Hvac Rebates

More picture related to 2024 Hvac Rebates

2024 Campaign Kick Off The Birmingham Jewish Federation

https://bjf.org/wp-content/uploads/2022/06/Kickoff-2024.jpg

LMSII SWCR 2024

https://www.lmsii.org/img/conf/swcr.png

Guide To 2023 HVAC Rebates In California Simpson Sheet Metal Heating Air Conditioning

https://eadn-wc05-10606524.nxedge.io/wp-content/uploads/2023/01/Guide-to-2023-HVAC-Rebates-in-California.webp

1 What is the Inflation Reduction Act 2 Which provisions in the Inflation Reduction Act IRA establish home energy rebates 3 HOW MUCH MONEY IS THERE FOR HOME ENERGY REBATES 4 What is U S Department of Energy s timeline for distributing these funds to states and Indian Tribes 5 Published January 25 2024 Written by CLEAResult We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and

Home Energy Rebates are not yet available but DOE expects many states and territories to launch their programs in 2024 Our tracker shows which states and territories have applied for and received funding Income dependent rebates of up to 8 000 earmarked in the Inflation Reduction Act are slated to become available in California beginning in summer 2024 Many utility companies in California offer rebates for heat pumps ranging from 100 to 3 000 Use the incentive finder tool at The Switch Is On to figure out what s available in your zip code

Drivers Of Global HVAC Industry Growth

https://andersonaircorps.com/wp-content/uploads/2019/05/file-2.jpg

HVAC Rebates Available In 2021 Indoor Air Quality Inc

https://iaqcolorado.com/wp-content/uploads/2021/06/2021-hvac-rebates-768x512.jpg

https://www.forbes.com/home-improvement/hvac/heat-pump-tax-credit/

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project

https://todayshomeowner.com/hvac/guides/hvac-tax-credit/

The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air conditioners

How To Install ZWCAD MFG 2024 SP0 Archives CLICK TO DOWNLOAD ITEMS WHICH YOU WANT

Drivers Of Global HVAC Industry Growth

Austin HVAC Rebates McCullough Heating Air Conditioning

Are You Eligible For HVAC Rebates Ernst Heating Cooling Metro East IL

2023 HVAC Rebates And Tax Incentives HEEHRA Rebates 2023

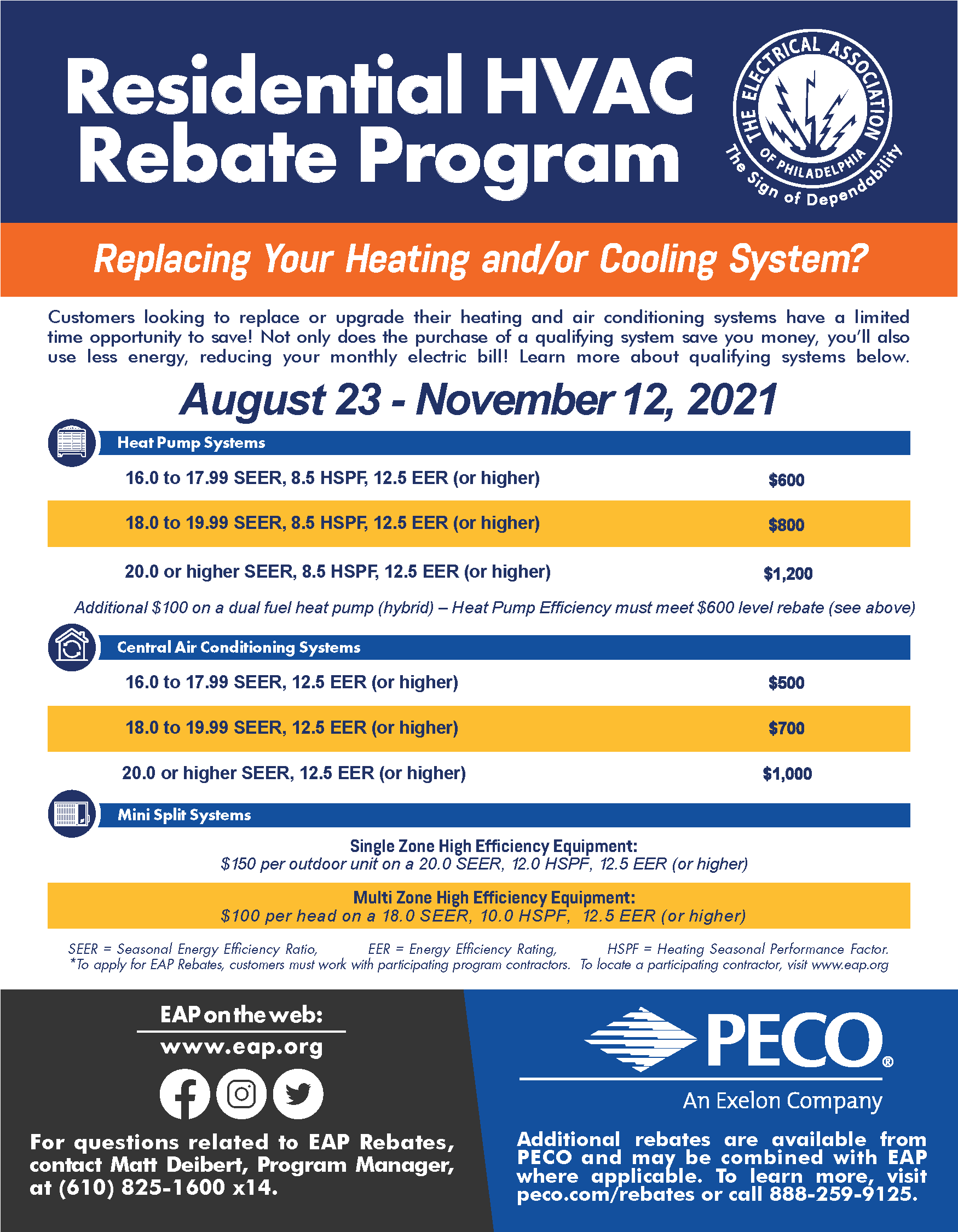

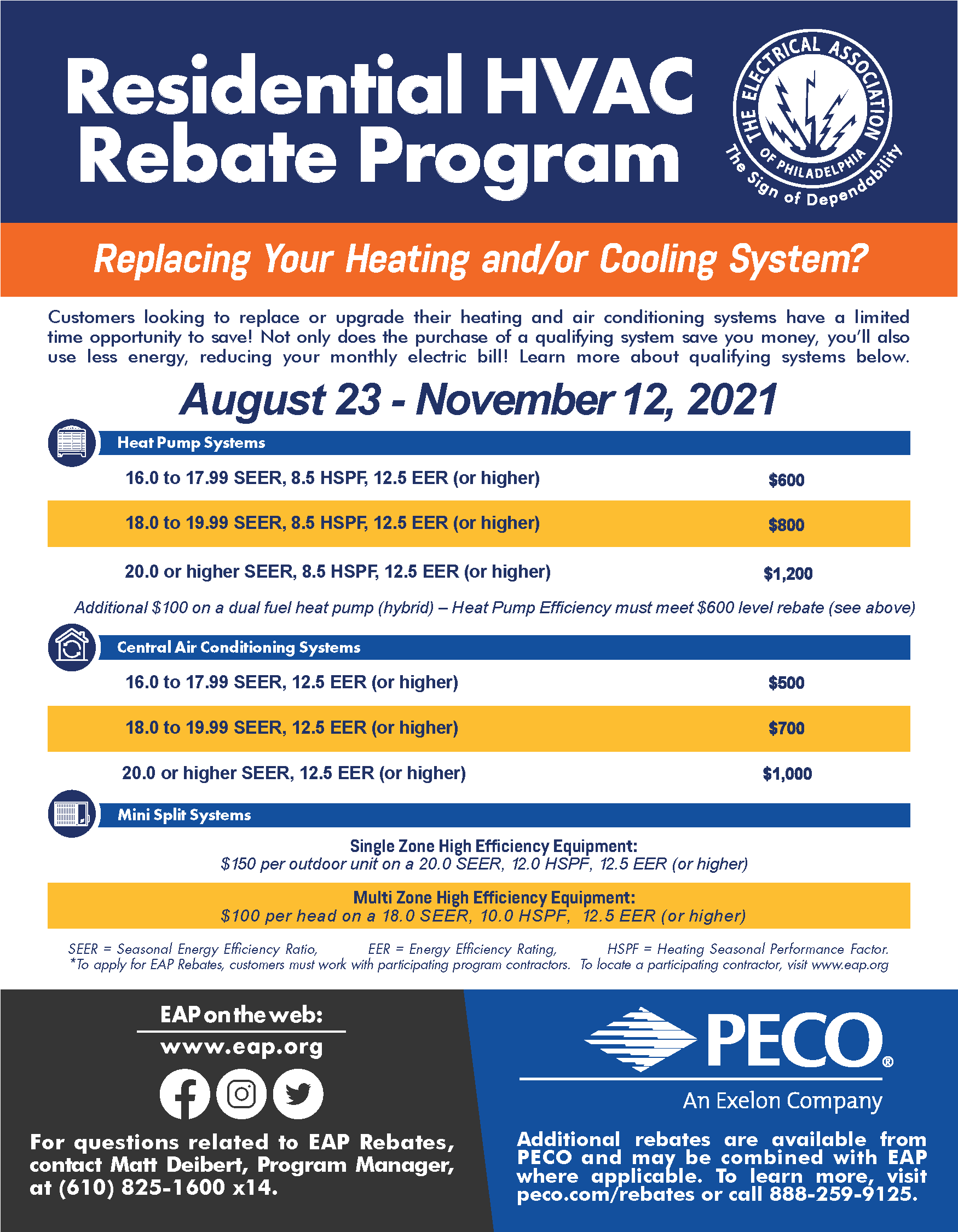

Residential HVAC Rebates

Residential HVAC Rebates

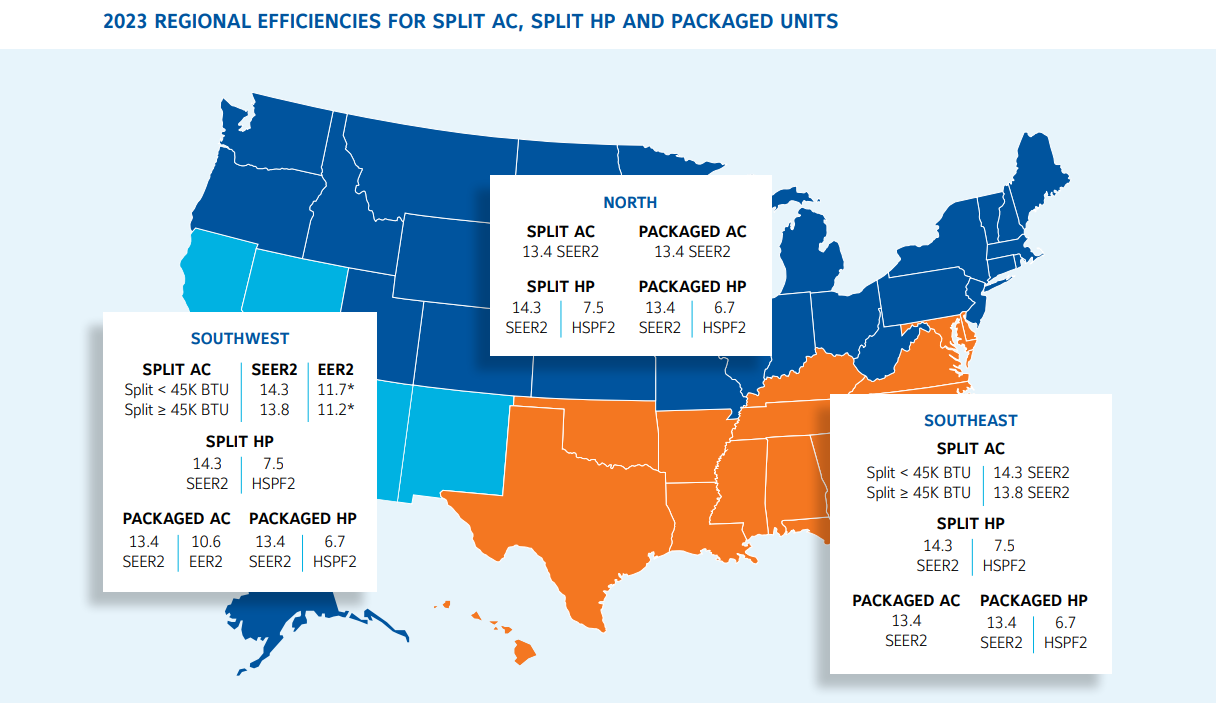

Prepare Now For 2023 Energy Efficiency Standards ACHR News

Why Carrier Cool Cash Is The Best 2023 HVAC Rebate Apollo

HVAC Rebates Carrier Cool Cash Rebate Allison Air Conditioning

2024 Hvac Rebates - The law provides 391 billion nationwide to support clean energy and address climate change including 8 8 billion designated for the Home Efficiency Rebates HOMES Program and Home Electrification and Appliance Rebate HEEHRA Program