2024 Income Tax Rebates One way to check your refund is to plug in your income and other data into a 2024 tax refund calculator given an expansion of the Earned Income Tax Credit The maximum credit for the 2023 tax

WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline Expand Section 179 expensing by increasing the maximum deduction from 1 16 million to 1 29 million and increasing the phaseout threshold from 2 89 million to 3 22 million for tax years beginning after 2023 with these levels indexed for inflation thereafter Provide relief from double taxation

2024 Income Tax Rebates

2024 Income Tax Rebates

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj3RPHIvoGiyFMqYgzPepp7W-yacCgvnB_-QZrpBQqpUEem43puz5Do6OGV4HF7M87pTxpyGfFWOh8KT9mXdn0cASjSTLfRPT4iAxd3HUNAcYFHNLtvdPS0SAwskzdHBY1WJ9hPdoKwsD45ZZ64qc17JyAuzsPHMZCf_iA1JVrepCAanVrfrNtUCvUQ/w1200-h630-p-k-no-nu/Income Tax 2023-24 FY [2024-25 AY] Old & New Tax Slab Rates Online IT 2023-24 Calculator.png

Primary Rebate South Africa Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/02/Primary-Rebate-South-Africa-2022.png

Cukai Pendapatan How To File Income Tax In Malaysia

https://www.jobstreet.com.my/career-resources/wp-content/uploads/sites/4/2021/10/3-What-You-Need-To-Know-About-Income-Tax-Calculation-in-Malaysia.jpg

The tax year 2024 maximum Earned Income Tax Credit amount is 7 830 for qualifying taxpayers who have three or more qualifying children an increase of from 7 430 for tax year 2023 The revenue procedure contains a table providing maximum EITC amount for other categories income thresholds and phase outs WASHINGTON The Internal Revenue Service today urged taxpayers to take important actions now to help them file their 2023 federal income tax return next year This is the second in a series of reminders to help taxpayers get ready for the upcoming filing season

Tax credits directly reduce what you owe while tax deductions decrease your taxable income As a result tax credits are generally more valuable but less common than deductions Top tax credits and deductions for 2024 There are numerous tax credits and deductions though many are only available to qualifying filers Qualifying children This policy would be effective for tax years 2023 2024 and 2025 Modification in Overall Limit on Refundable Child Tax Credit Under current law the maximum refundable child tax credit is limited to 1 600 per child for 2023 even if the earned income limitation described above is in excess of this amount

Download 2024 Income Tax Rebates

More picture related to 2024 Income Tax Rebates

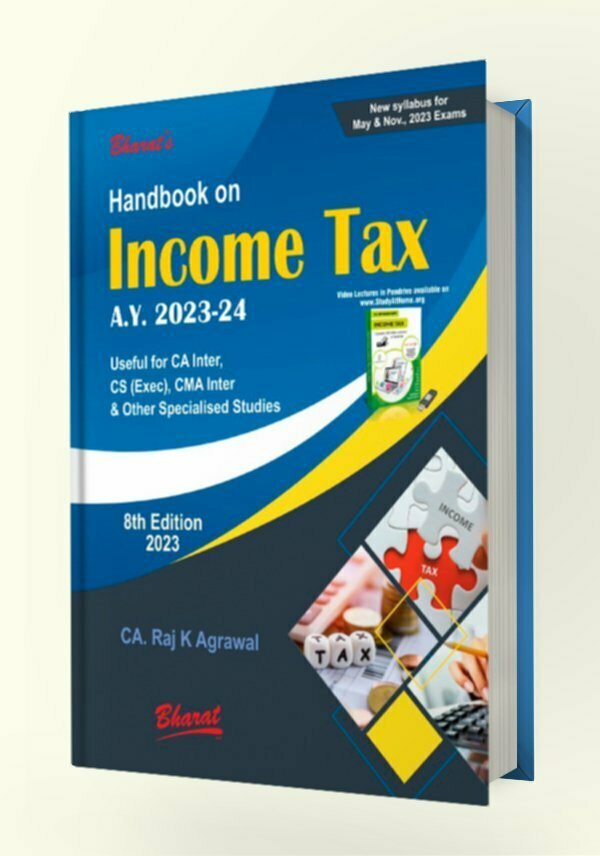

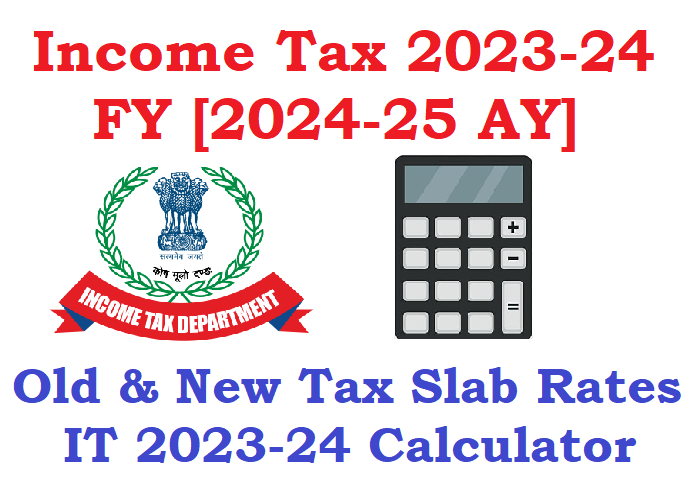

New Income Tax Slabs FY 2023 2024 Update New Income Tax Slabs No Tax Till 7 Lakh TeacherNews

https://teachernews.in/wp-content/uploads/2023/02/New-Income-Tax-Slabs-FY-2023-2024-Update.jpg

Handbook On Income Tax A Y 2023 2024

https://shopscan.in/wp-content/uploads/2023/02/Handbook-on-INCOME-TAX-A.Y.-2023-2024-mockup.jpg

Combien Vous Serez Impos En Afrique Du Sud En 2022 En Fonction De Ce Que Vous Gagnez

https://businesstech.co.za/news/wp-content/uploads/2022/02/Tax.png

Earned Income Tax Credit EITC is a tax break for low to moderate income workers and families This credit can reduce the taxes you owe and maybe even result in a bigger refund For tax year 2023 this tax credit is worth up to 7 430 for a family with three kids The IRS is currently planning for a threshold of 5 000 for tax year 2024 Getty The IRS has announced the annual inflation adjustments for the year 2024 including tax rate schedules tax tables and cost of living adjustments These are the official numbers for the

WASHINGTON To increase the awareness of eligible working families about the benefits of the Earned Income Tax Credit EITC the Office of the Comptroller of the Currency joins stakeholders across the country in promoting January 26 as EITC Awareness Day The EITC is a refundable federal income tax credit for low to moderate income households The five major 2024 tax changes cover income tax brackets the standard deduction retirement contribution limits the gift tax exclusion and phase out levels for Individual Retirement Account IRA deductions Roth IRAs and the Saver s Credit This annual inflation adjustment ensures that taxpayers aren t bumped into higher brackets due to cost of living increases rather than pay raises

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rates-Applicable-for-FY-2023-24-as-per-the-new-regime-for-HUF-and-all-Individuals-1.jpg

Understanding Income Tax Reliefs Rebates Deductions And Exemptions In Malaysia

https://ringgitplus.com/en/blog/wp-content/uploads/2020/02/Tax-Rebates-800x534.jpg

https://www.cbsnews.com/news/tax-refund-2024-what-to-expect-when-will-i-get/

One way to check your refund is to plug in your income and other data into a 2024 tax refund calculator given an expansion of the Earned Income Tax Credit The maximum credit for the 2023 tax

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

Income Tax Calculator FY 2023 24 2022 23 FinCalC Blog

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

How To Calculate Income Tax 2023 24 Ay 2024 25 Tax Calculation Explained In Hindi Otosection

Income Tax Filing With Printable Forms Printable Forms Free Online

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude Porn Photos

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident And Non Resident Indian

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident And Non Resident Indian

LHDN IRB Personal Income Tax Rebate 2022

Individual Income Tax Rebate

New Federal Tax Brackets For 2023

2024 Income Tax Rebates - In 2024 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 The federal income tax has seven tax rates in 2024 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent