2024 Mn Renters Rebate Form Renter s Property Tax Refund Forms and Instructions Form M1PR Homestead Credit Refund for To check your refund status go to www revenue state mn us after July 1 and enter Where s My Refund into the Search box With this system you can 2024 or you believe the rent amount or any other amounts entered on your CRP are

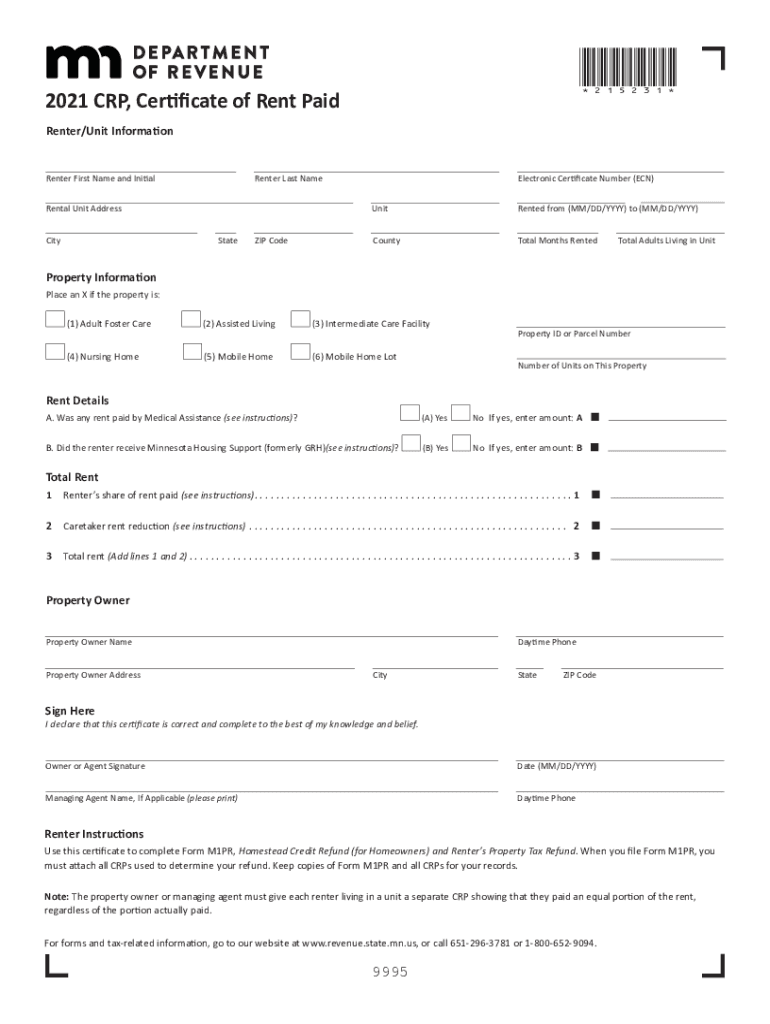

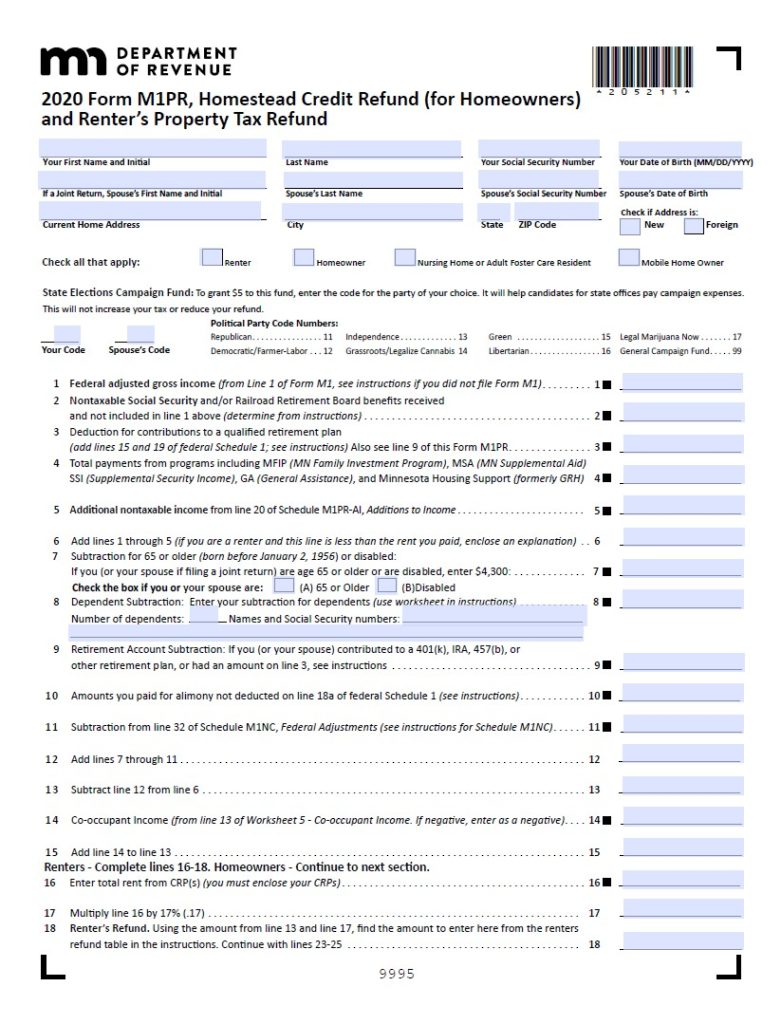

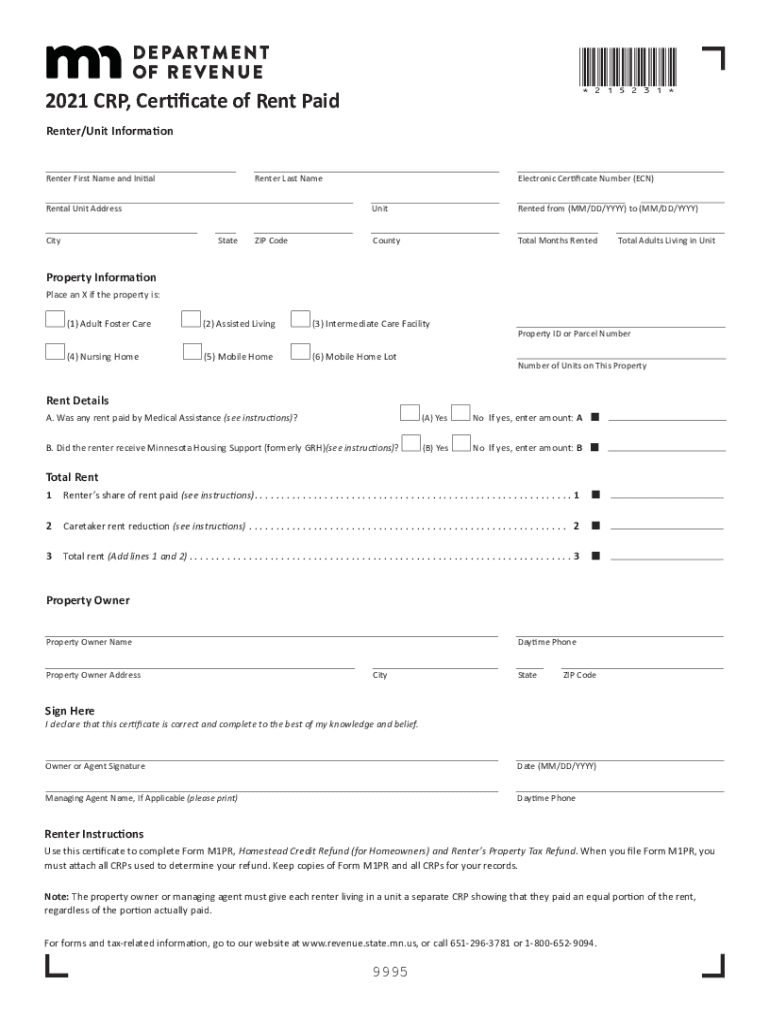

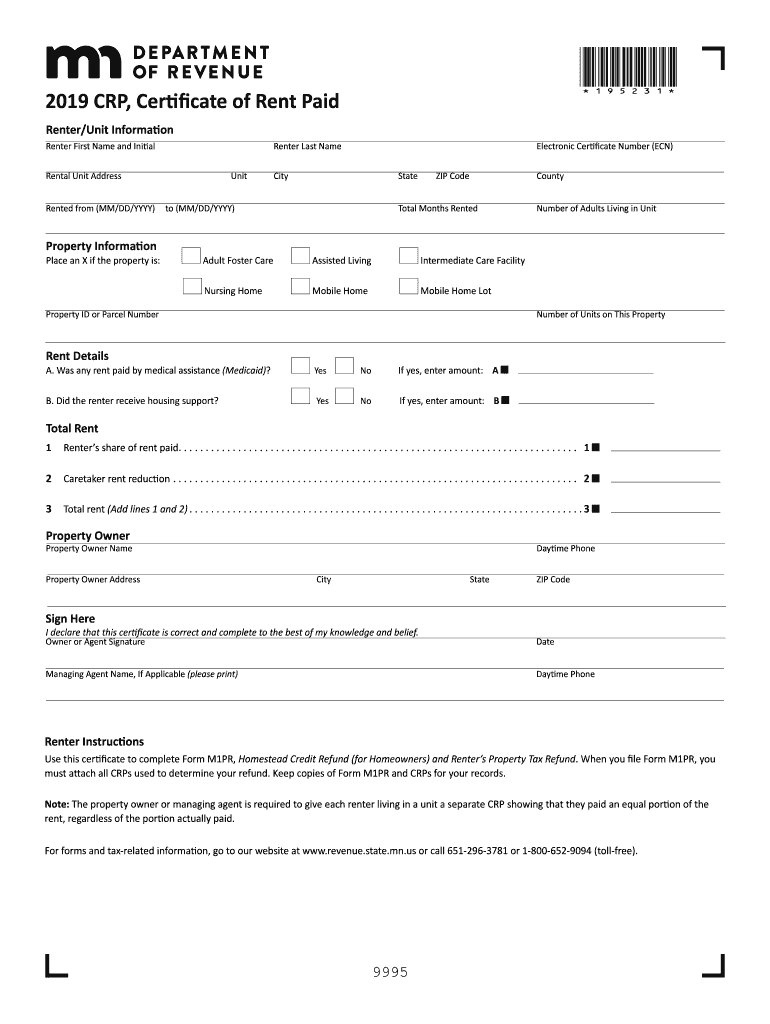

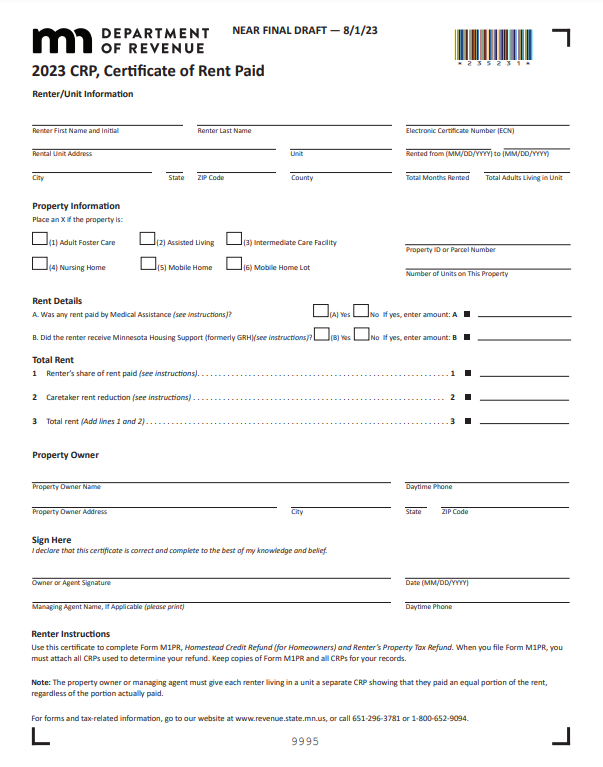

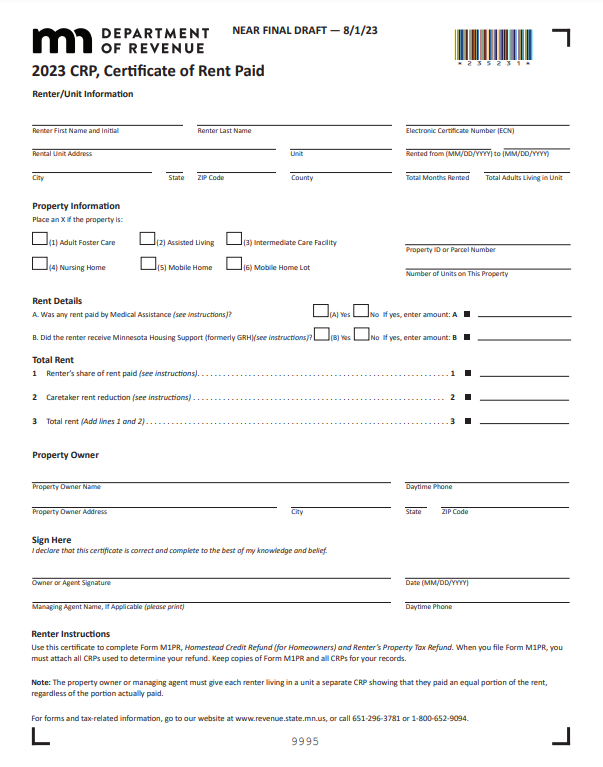

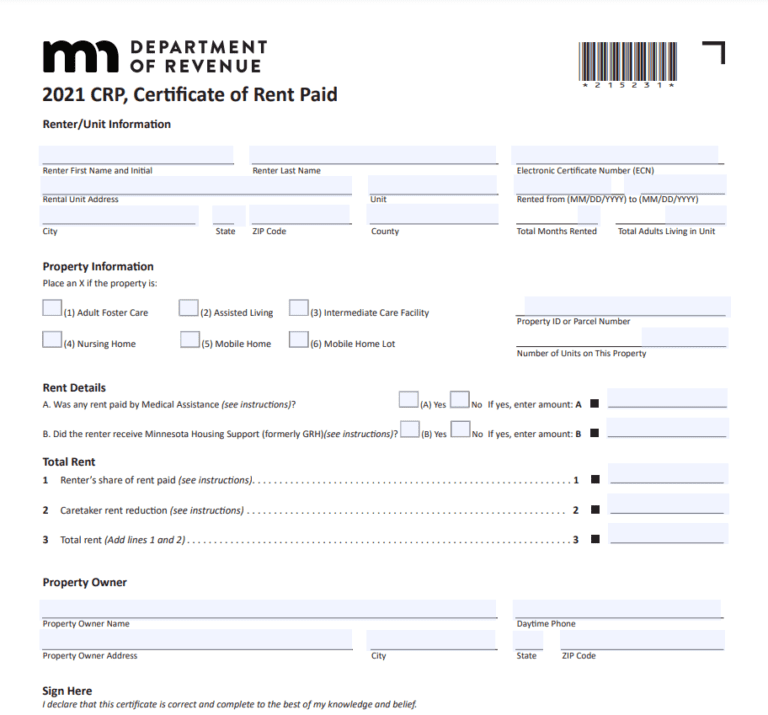

Renters will need the CRP to apply for the Renter s Property Tax Refund The Minnesota Department of Revenue has expanded access to their CRP system in e Services and you will be able to create CRPs using e Services by January 1 2024 all residential property owners and managing agents will be able to use e Services Minnesota Department of How do I get my refund If you rent your landlord must give you a Certificate of Rent Paid CRP by January 31 2024 If you own use your Property Tax Statement Get the tax form called the 2023 Form M 1PR Homestead Credit Refund for Homeowners and Renter s Property Tax Refund

2024 Mn Renters Rebate Form

2024 Mn Renters Rebate Form

https://www.signnow.com/preview/578/948/578948407/large.png

Missouri Renters Rebate 2024 PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/02/Missouri-Renters-Rebate-2023.jpg

New Jersey Renters Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/New-Jersey-Renters-Rebate-2023.jpg

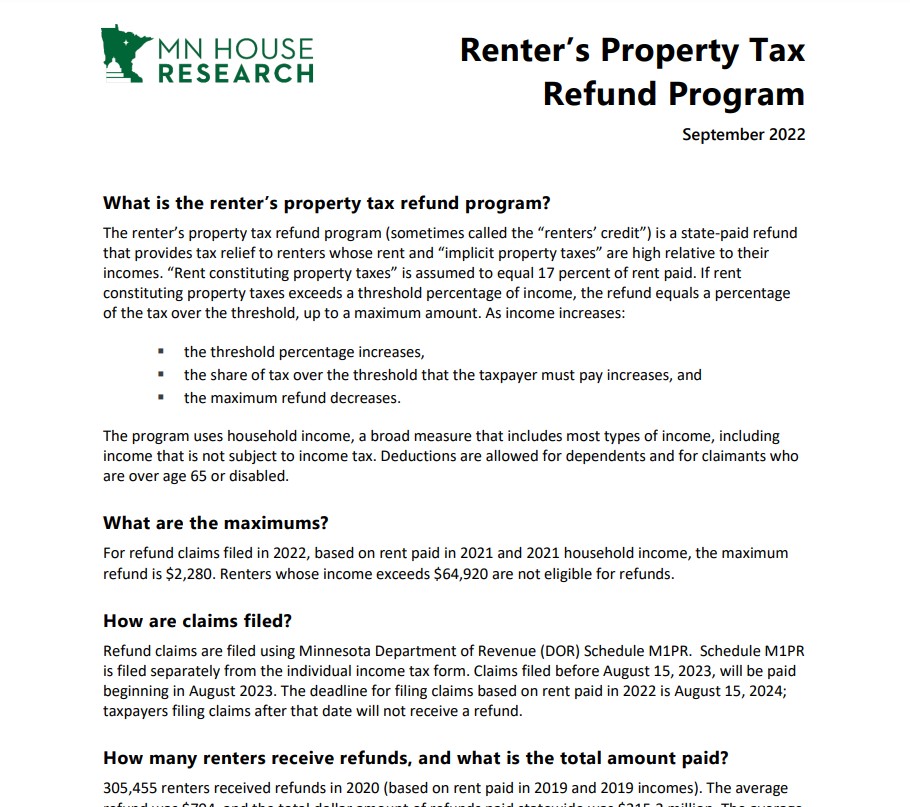

The deadline for filing claims based on rent paid in 2022 is August 15 2024 taxpayers filing claims after that date will not receive a refund How many renters receive refunds and what is the total amount paid 305 455 renters received refunds in 2020 based on rent paid in 2019 and 2019 incomes If you rent your landlord must give you a Certificate of Rent Paid CRP by January 31 2024 If you own use your Property Tax Statement Get the tax form called the 2023 Form M 1PR Homestead Credit Refund for Homeowners and Renter s Property Tax Refund You can call 651 296 3781 to get a form or write to Minnesota Tax Forms Mail Station 1421 600 N Robert St St Paul MN 55146 1421

Your net property tax increased by more than 12 from 2023 to 2024 AND The increase was at least 100 Renters with household income of less than 73 270 can claim a refund up to 2 570 You must have lived in a building where the owner of the building Was accessed the property tax Paid a portion of the rent receipts instead of the property tax The renter s property tax refund program sometimes called the renters credit is a state paid refund that provides tax relief to renters whose rent and implicit property taxes are high relative to their incomes Rent constituting property taxes is assumed to equal 17 percent of rent paid If rent constituting property

Download 2024 Mn Renters Rebate Form

More picture related to 2024 Mn Renters Rebate Form

Renters Rebate 2021 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021-781x1024.jpg

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

PA Rent Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/PA-Rent-Rebate-Form-2021-768x993.jpg

For 2024 CLE December 7 2023 9 00am 3 00pm free legal educational and advocacy services to Minnesota renters We have advised over 300 000 renters since 1992 Our primary program is a free and confidential legal hotline time and place of the hearing specified in the summons by at least one form of written communication Minnesota Homeowner and Renter Refund Overview Form M1PR is used by both homeowners and renters to claim a refund on property taxes that have either been paid directly to one s county for homeowners or indirectly via rent paid to one s landlord for renters Homeowners can qualify for one or two different types of refunds Renters can qualify for a single refund

Minnesota Housing Support and 5 000 was paid by the renter enter 2 000 on Line A 3 000 on Line B and 10 000 on Line 1 Nursing homes or intermediate care facilities Multiply the number of months the resident lived in the care facility by 600 Published December 10 2023 According to Minnesota Gov Tim Walz the IRS will tax state rebates sent to many Minnesota residents last year These rebates commonly known as Walz checks were

Minnesota Renters Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Minnesota-Renters-Rebate-2023.jpg

2022 Renters Rebate Mn Instructions RentersRebate

https://www.rentersrebate.net/wp-content/uploads/2023/05/pa-renters-rebate-form-2022-rentersrebate-72.jpg

https://www.revenue.state.mn.us/sites/default/files/2023-12/m1pr-inst-23.pdf

Renter s Property Tax Refund Forms and Instructions Form M1PR Homestead Credit Refund for To check your refund status go to www revenue state mn us after July 1 and enter Where s My Refund into the Search box With this system you can 2024 or you believe the rent amount or any other amounts entered on your CRP are

https://www.careproviders.org/CPM/ACTION/Vol39/Ed03/ZP05.aspx

Renters will need the CRP to apply for the Renter s Property Tax Refund The Minnesota Department of Revenue has expanded access to their CRP system in e Services and you will be able to create CRPs using e Services by January 1 2024 all residential property owners and managing agents will be able to use e Services Minnesota Department of

Central Oregon Rental Association Printable Rebate Form RentersRebate

Minnesota Renters Rebate 2023 Printable Rebate Form

M1pr Fillable Form Printable Forms Free Online

Oklahoma Renters Rebate 2023 Printable Rebate Form RentersRebate

Minnesota Renters Rebate Efile RentersRebate

Renters Rebate Form PrintableRebateForm

Renters Rebate Form PrintableRebateForm

New Hampshire Renters Rebate 2023 Printable Rebate Form

Maine Renters Rebate 2023 Printable Rebate Form RentersRebate

MN Renters Printable Rebate Form

2024 Mn Renters Rebate Form - The renter s property tax refund program sometimes called the renters credit is a state paid refund that provides tax relief to renters whose rent and implicit property taxes are high relative to their incomes Rent constituting property taxes is assumed to equal 17 percent of rent paid If rent constituting property