2024 Nys Homeowner Tax Rebate You are the one that paid real property taxes on the property fully or partially How much is the credit The amount of the credit is the product of the amount of real property tax which exceeds 6 of the taxpayer s qualified gross income QGI and a specified rate based on the taxpayer s QGI

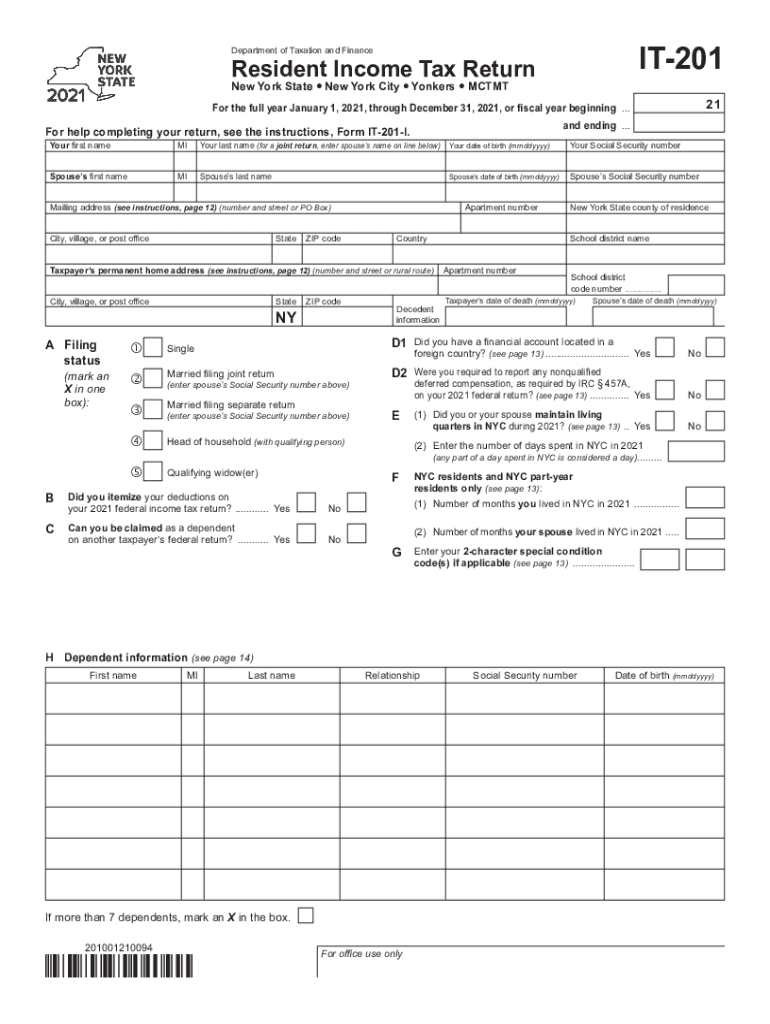

The income limit for this program for 2024 is 98 700 The Bulletin Seagulls swirl around the Statue of Liberty at the end of the day in New York City on December 7 2023 New York state To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit

2024 Nys Homeowner Tax Rebate

2024 Nys Homeowner Tax Rebate

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

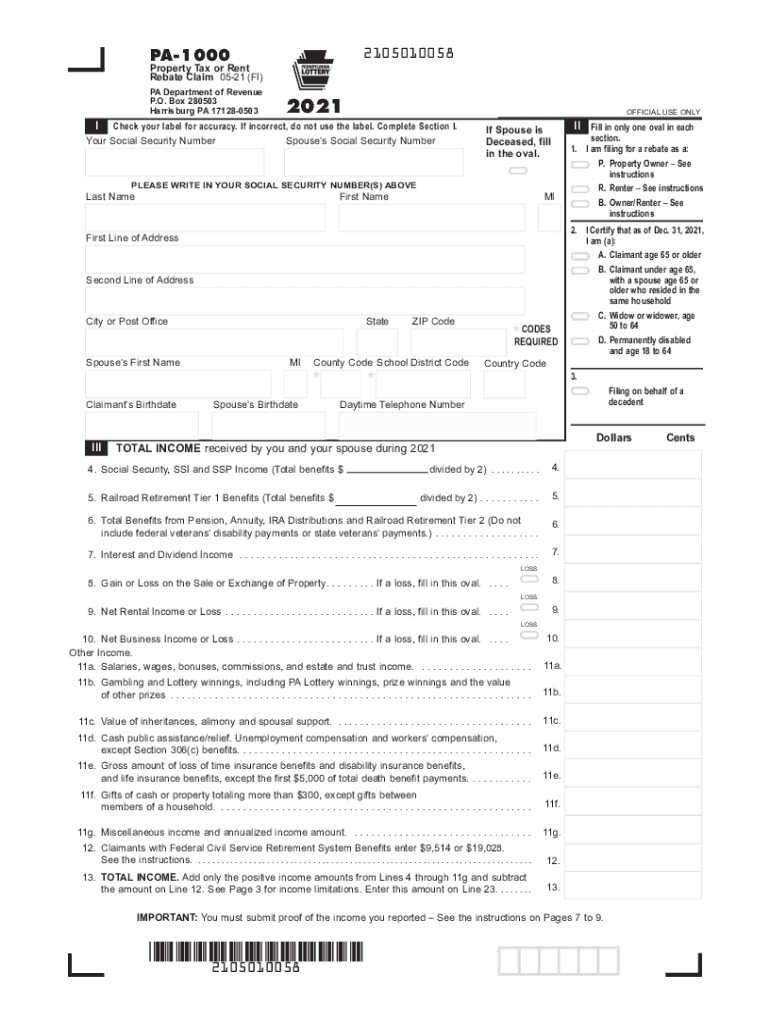

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

All New York residents are eligible to receive a no cost home energy assessment that can reveal how efficiently your home is operating and where energy is being wasted An assessment will provide you with recommendations to save energy and improve the efficiency comfort and safety of your home Get a Free Assessment 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks

May 3 2023 Albany NY Governor Hochul Announces Support for Homeowners Tenants and Public Housing Residents as Part of FY 2024 Budget Adds 391 Million for New York s Emergency Rental Assistance Program to Support Thousands More Tenants and Families Including New York City Housing Authority Residents and Section 8 Voucher Recipients ALBANY N Y In June Governor Kathy Hochul announced the one time Homeowner Tax Rebate Credit would be sent out available to eligible New Yorkers The state s Department of Taxation and

Download 2024 Nys Homeowner Tax Rebate

More picture related to 2024 Nys Homeowner Tax Rebate

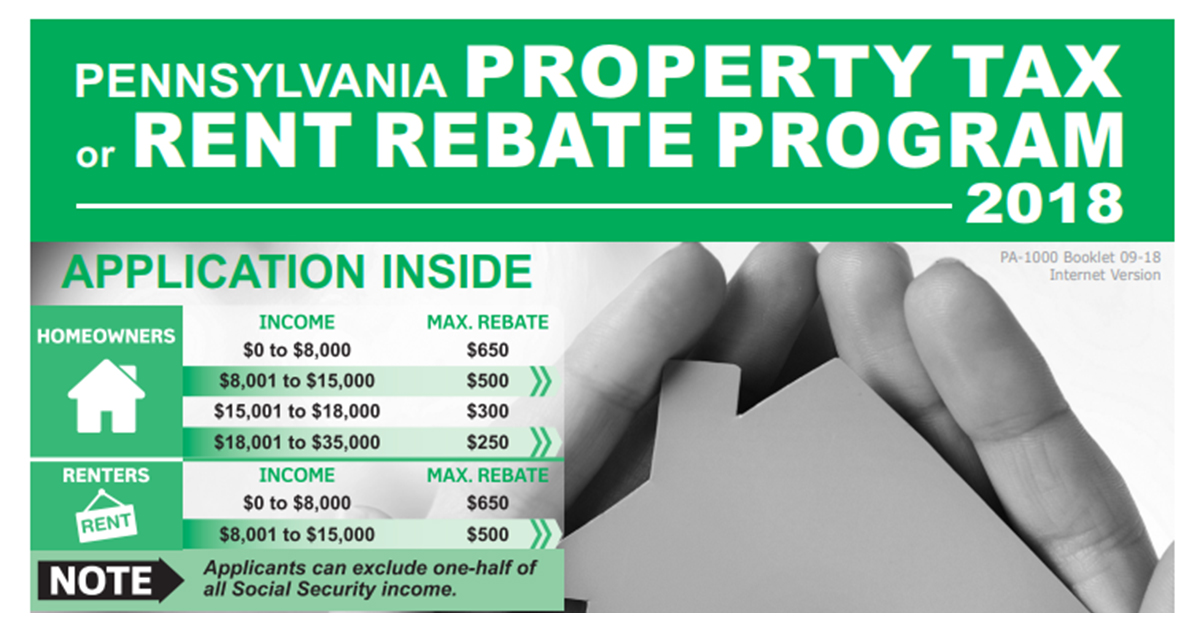

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Confusion Over When Eligible New Yorkers Will Get Their Homeowner Tax Rebate Check CNYcentral

https://chittenango.com/wp-content/uploads/2022/08/bb776db9-9697-43c3-882f-8577bedc9e89-large16x9_tax_rebate.PNG

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

https://media.wgrz.com/assets/WGRZ/images/a07fcd1f-3754-4e57-bce5-9be83e9634c0/a07fcd1f-3754-4e57-bce5-9be83e9634c0_1140x641.jpg

For the property tax relief credit income is defined as federal adjusted gross income FAGI from two years prior modified so that the net amount of loss reported on Federal Schedule C D E or F doesn t exceed 3 000 the net amount of any other separate category of loss doesn t exceed 3 000 and To be eligible to receive a check residents must have qualified for a 2022 STAR credit or exemption have an income at or below 250 000 for the 2020 income tax year and a school tax

Publication 532 2024 A publication is an informational document that addresses a particular topic of interest to taxpayers Subsequent changes in the law or regulations judicial decisions Tax Appeals Tribunal decisions or changes in Department policies could affect the validity of the information contained in a publication The amount of the credit is between 250 and 350 and will be available through 2023 To be eligible homeowners must be Eligible for the 2022 School Tax Relief STAR credit or exemption Make less than 250 000 a year based on federal adjusted gross income from tax year 2020 and Have a school tax liability for the 2022 2023 school year

NYS Homeowner Tax Rebate Credit Checks Being Mailed Out

https://townsquare.media/site/497/files/2022/06/attachment-RS28849_ThinkstockPhotos-623211702-scr.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

https://media.wgrz.com/assets/WGRZ/images/1045202f-604f-4386-8a31-35efff450899/1045202f-604f-4386-8a31-35efff450899_1920x1080.jpg

https://www.tax.ny.gov/pit/credits/real-property-tax-relief-credit.htm

You are the one that paid real property taxes on the property fully or partially How much is the credit The amount of the credit is the product of the amount of real property tax which exceeds 6 of the taxpayer s qualified gross income QGI and a specified rate based on the taxpayer s QGI

https://www.newsweek.com/stimulus-check-update-homeowners-this-state-can-apply-rebate-1852264

The income limit for this program for 2024 is 98 700 The Bulletin Seagulls swirl around the Statue of Liberty at the end of the day in New York City on December 7 2023 New York state

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

NYS Homeowner Tax Rebate Credit Checks Being Mailed Out

NYS 2023 Homeowner Tax Rebate Tax Rebate

NYS Homeowner Tax Credit Talks Lyons Main Street

2023 Nys Tax Form Printable Forms Free Online

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

New York State To Mail Out Homeowner Tax Rebate Credit Checks DSJ

Homeowner Tax Rebate Program For People Who Live In Their Home YouTube

2024 Nys Homeowner Tax Rebate - 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks