2024 Nys Homeowners Tax Rebate The income limit for this program for 2024 is 98 700 The Bulletin Seagulls swirl around the Statue of Liberty at the end of the day in New York City on December 7 2023 New York state

Real property tax relief credit Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are subject to tax under Tax Law Article 22 you were a New York State resident for all of the tax year your qualified gross income is 250 000 or less About Inflation Reduction Act Homeowners Back to Inflation Reduction Act Combine IRA Savings with State Incentives to Upgrade Your Home and Ditch Fossil Fuels The Inflation Reduction Act IRA helps New Yorkers get the latest clean energy technologies and equipment that will save energy for years to come

2024 Nys Homeowners Tax Rebate

2024 Nys Homeowners Tax Rebate

https://ld16nj.com/wp-content/uploads/2022/10/Homeowners-2.jpg

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

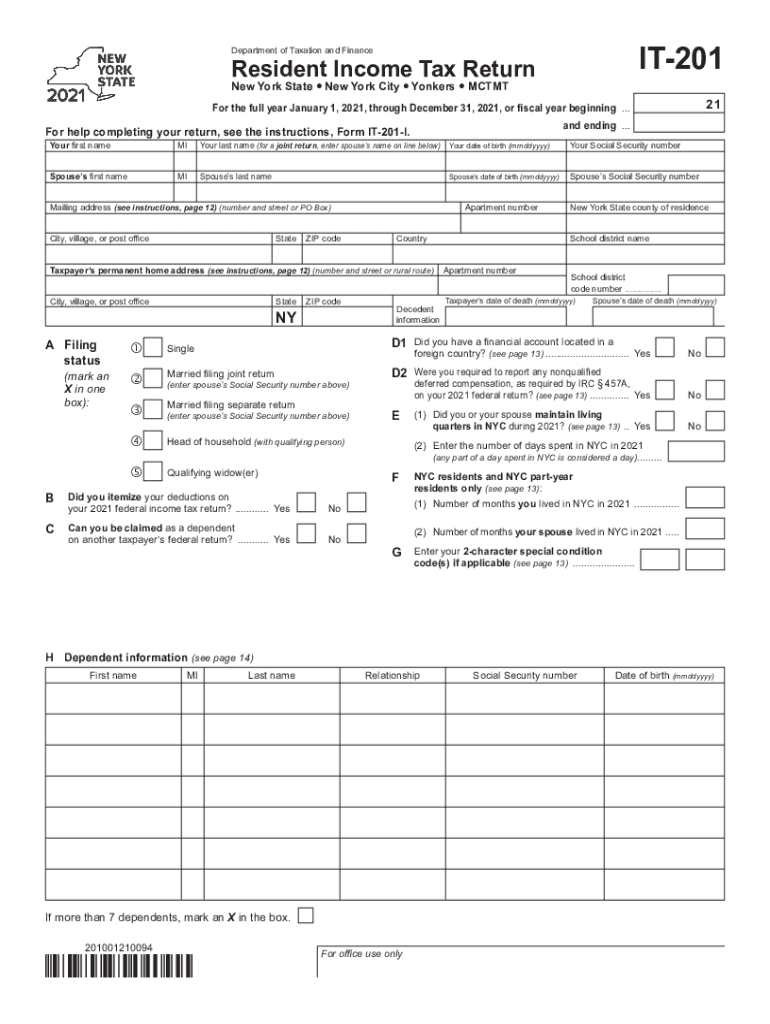

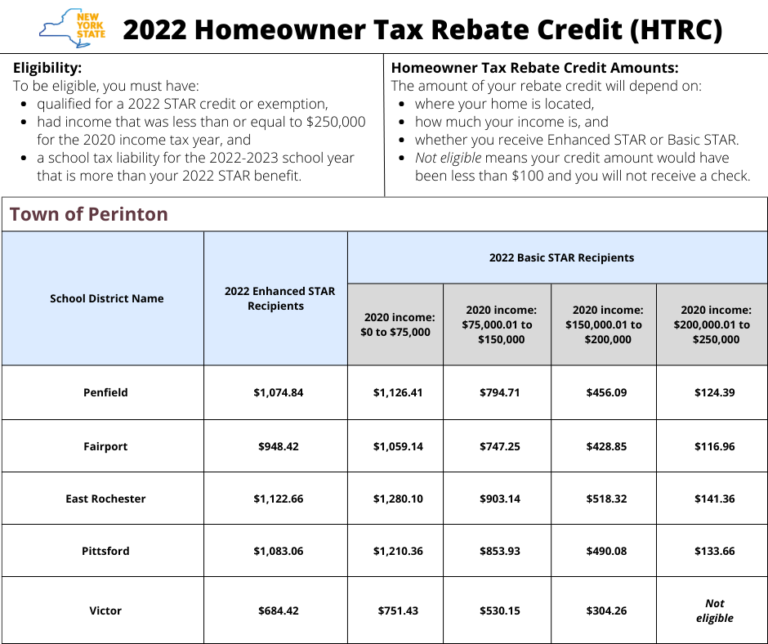

To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit Budget May 3 2023 Albany NY Governor Hochul Announces Support for Homeowners Tenants and Public Housing Residents as Part of FY 2024 Budget Adds 391 Million for New York s Emergency Rental Assistance Program to Support Thousands More Tenants and Families Including New York City Housing Authority Residents and Section 8 Voucher Recipients

2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks New York City residents New York City is not subject to the tax cap and therefore city residents weren t eligible for this credit Property tax relief credit amounts Basic STAR recipients

Download 2024 Nys Homeowners Tax Rebate

More picture related to 2024 Nys Homeowners Tax Rebate

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

2023 Nys Tax Form Printable Forms Free Online

https://www.pdffiller.com/preview/584/982/584982095/large.png

1 01 STAR benefit checks and exemptions reflected on school property tax bills have already started filling New Yorkers inboxes and mailboxes and will continue to do so through the end of the New York News Homeowner tax rebate credit checks coming to New Yorkers by Delaney Keppner Posted Jul 5 2022 02 19 PM EDT Updated Jul 5 2022 02 41 PM EDT SHARE ALBANY N Y WWTI

The amount of the credit is between 250 and 350 and will be available through 2023 To be eligible homeowners must be Eligible for the 2022 School Tax Relief STAR credit or exemption Make less than 250 000 a year based on federal adjusted gross income from tax year 2020 and Have a school tax liability for the 2022 2023 school year Tax Tips for Property Owners We ve begun issuing homeowner tax rebate checks We recently began mailing nearly three million checks for the 2022 homeowner tax rebate credit HTRC to eligible New Yorkers The credit provides direct property tax relief in the form of checks to eligible homeowners The amount of the credit will depend on

Income Tax Rates 2022 Vs 2021 Caroyln Boswell

http://thumbor-prod-us-east-1.photo.aws.arc.pub/r-5-lDAfA7hx2qRoVpXX6UhZ43k=/arc-anglerfish-arc2-prod-advancelocal/public/U5MVCZVZI5COTCDGVU3MWDQABQ.png

NYS 2023 Homeowner Tax Rebate Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/NYS-2023-Homeowner-Tax-Rebate.jpg?fit=996%2C728&ssl=1

https://www.newsweek.com/stimulus-check-update-homeowners-this-state-can-apply-rebate-1852264

The income limit for this program for 2024 is 98 700 The Bulletin Seagulls swirl around the Statue of Liberty at the end of the day in New York City on December 7 2023 New York state

https://www.tax.ny.gov/pit/credits/real-property-tax-relief-credit.htm

Real property tax relief credit Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are subject to tax under Tax Law Article 22 you were a New York State resident for all of the tax year your qualified gross income is 250 000 or less

When Will NY Homeowners Get New STAR Rebate Checks Syracuse

Income Tax Rates 2022 Vs 2021 Caroyln Boswell

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

4923 H 2014 2024 Form Fill Out And Sign Printable PDF Template SignNow

Nys Taxation Rebate Checks 2023 101 A Comprehensive Guide To Maximizing Your Savings

Money In Your Pocket Who Qualifies For Tax Cut Property Tax Rebate In NYS 2023 Budget WRGB

Money In Your Pocket Who Qualifies For Tax Cut Property Tax Rebate In NYS 2023 Budget WRGB

NYS Property Tax Rebate 2023 Eligibility Criteria And Application Process Tax Rebate

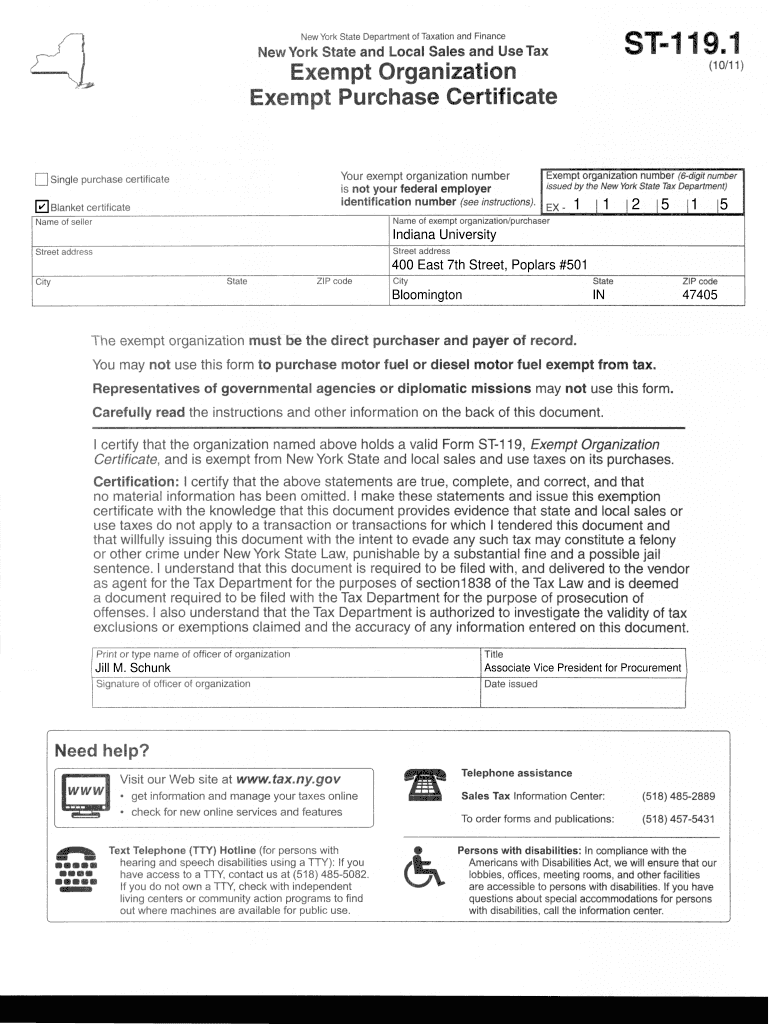

New York State Tax Exempt Form St 119 ExemptForm

Nys School Tax Relief Checks Printable Rebate Form

2024 Nys Homeowners Tax Rebate - To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit