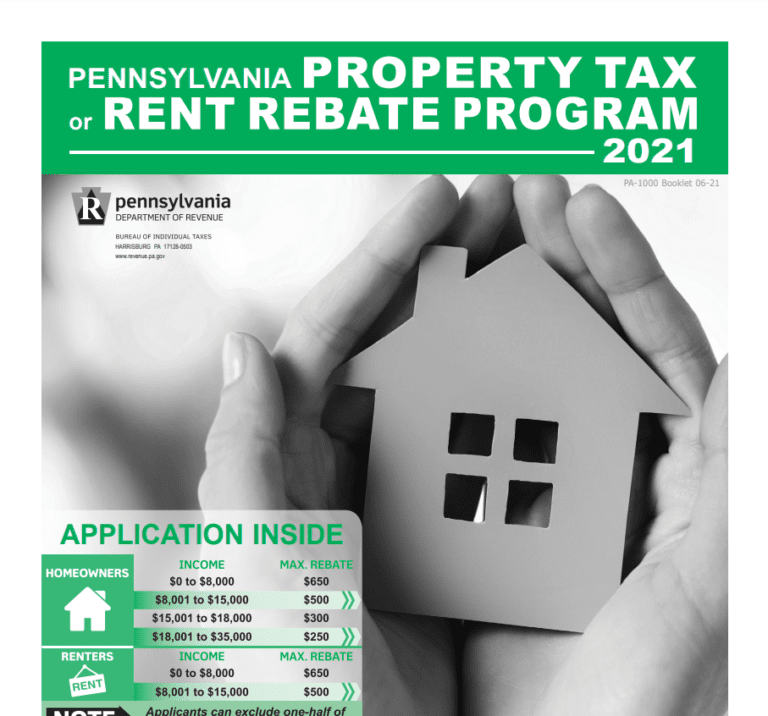

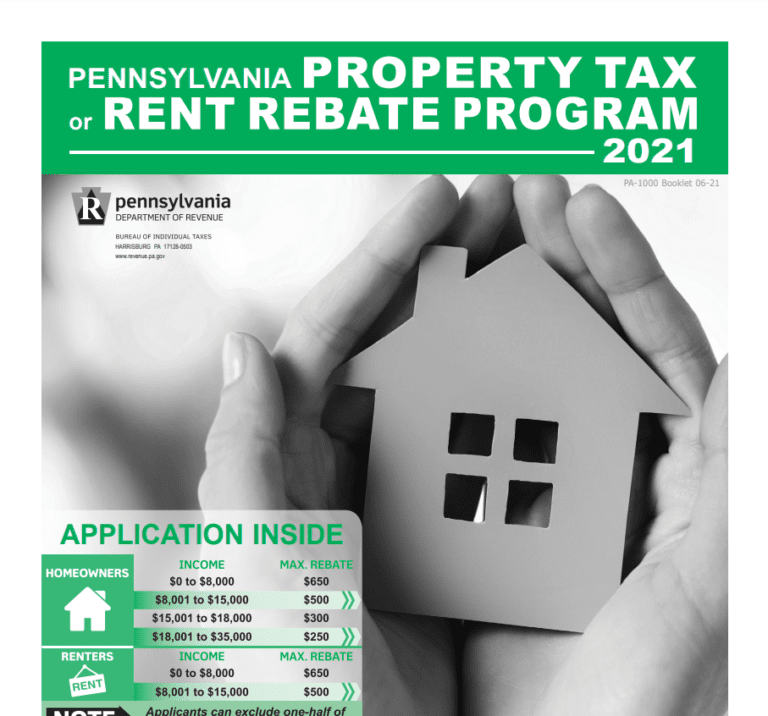

2024 Pa Property Tax Rebate Form TAX or PA 1000 Booklet 04 23 Rebates for eligible seniors widows widowers and people with disabilities HARRISBURG PA 17128 0503 www revenue pa gov IMPORTANT DATES Application deadline JUNE 30 2024 Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available

The expansion Increases the maximum standard rebate from 650 to 1 000 Increases the income cap from 35 000 to 45 000 for homeowners Increases the income cap from 15 000 to 45 000 Property owners with 30 000 or less of total income that either Live in Philadelphia Pittsburgh or Scranton OR Have a high tax burden taxes are 15 or more of their total income No Action needed on the application The supplemental rebate is automatically calculated Supplemental Rebate Table Spanish Instructions

2024 Pa Property Tax Rebate Form

2024 Pa Property Tax Rebate Form

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189550-Z9C3QJVKXYFO4N04VXT7/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_2.jpg

Minnesota Fillable Tax Forms Printable Forms Free Online

https://handypdf.com/resources/formfile/images/10000/renters-rebate-sample-form-page1.png

Pennsylvania s Property Tax Rent Rebate Program May Help Low income Households Apply By 12 31

http://static1.squarespace.com/static/5d8d4c603aab2563d4a30208/t/62ebf2c02ff2b767de17f485/1659630272071/2022-8-4+one-time+bonus+rebate+-+property+tax+rebate-insta.jpg?format=1500w

First the maximum standard rebate is increasing from 650 to 1 000 Second the income cap for both renters and INCOME MAX REBATE HOMEOWNERS 0 to 8 000 1 000 RENTERS 8 001 to 15 000 770 15 001 to 18 000 460 homeowners will be made equal and increase to 18 001 to 45 000 380 45 000 a year Property Tax Rent Rebate Program Online filing for the Property Tax Rent Rebate Program is now available for eligible Pennsylvanians to begin claiming rebates on property taxes or rent paid in 2022 Learn More PA Tax Talk

First time filers who have filed by June 1 2024 should expect to receive their rebates between July 1 and September 1 2024 Some rebates may take additional time if DOR needs to correct or verify any information on a rebate application 2023 Property Tax or Rent Rebate Claim PA 1000 PA 1000 Property Tax or Rent Rebate Claim 03 23 FI 2305010056 PA Department of Revenue P O Box 280503 Harrisburg PA 17128 0503 2023 I Check your label for accuracy If incorrect do not use the label Complete Section I Your Social Security Number Spouse s Social Security Number

Download 2024 Pa Property Tax Rebate Form

More picture related to 2024 Pa Property Tax Rebate Form

PA Property Tax Rebate Forms Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/11/PA-Property-Tax-Rebate-Form-768x719.png

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg

My ofice is available to assist you with Property Tax and Rent Rebate Forms for 2024 The Pennsylvania Property Tax Rent Rebate program is open to state residents 65 or older widows and widowers 50 or older or anyone age 18 and over who is 100 disabled New income limits for 2024 are 45 000 a year for both homeowners and renters Starting in 2024 the maximum standard rebate will increase from 650 to 1 000 Also in 2024 the household income limit for property tax rebates will increase to 45 000 up from the current 35 000 limit The household income limit for rent rebates will also increase to 45 000 up from 15 000 Half of Social Security income is excluded

Under the expansion crucial updates will be in place when the Department of Revenue in January 2024 opens the filing period to submit applications for property taxes and rent paid in 2023 First the maximum standard rebate will increase from 650 to 1 000 Applicants can access forms and other information about the program at revenue pa gov ptrr and can call 1 888 222 9190 for assistance In person and mail options are available in addition to the

Where To Mail Pa Property Tax Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/Where-To-Mail-Pa-Property-Tax-Rebate-Form-768x716.png

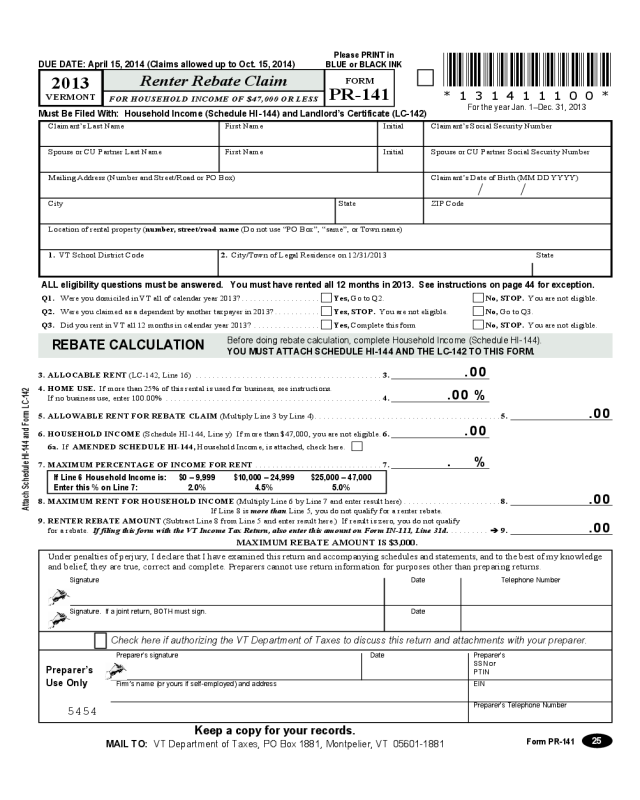

2023 Rent Rebate Form Printable Forms Free Online

https://www.pdffiller.com/preview/47/686/47686220/large.png

https://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/PTRR/Documents/2023_pa-1000_inst.pdf

TAX or PA 1000 Booklet 04 23 Rebates for eligible seniors widows widowers and people with disabilities HARRISBURG PA 17128 0503 www revenue pa gov IMPORTANT DATES Application deadline JUNE 30 2024 Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available

https://www.readingeagle.com/2024/01/26/pa-makes-push-for-expanded-property-tax-and-rent-rebate-applications/

The expansion Increases the maximum standard rebate from 650 to 1 000 Increases the income cap from 35 000 to 45 000 for homeowners Increases the income cap from 15 000 to 45 000

Pennsylvanians Can Now File Property Tax Rent Rebate Program Applications Online Beaver County

Where To Mail Pa Property Tax Rebate Form Printable Rebate Form

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Tax Rebate For Individual It Is The Refund Which An Individual Can Claim From The Income Tax

Pennsylvania s Property Tax Rent Rebate Program May Help Low income Households Apply By 12 31

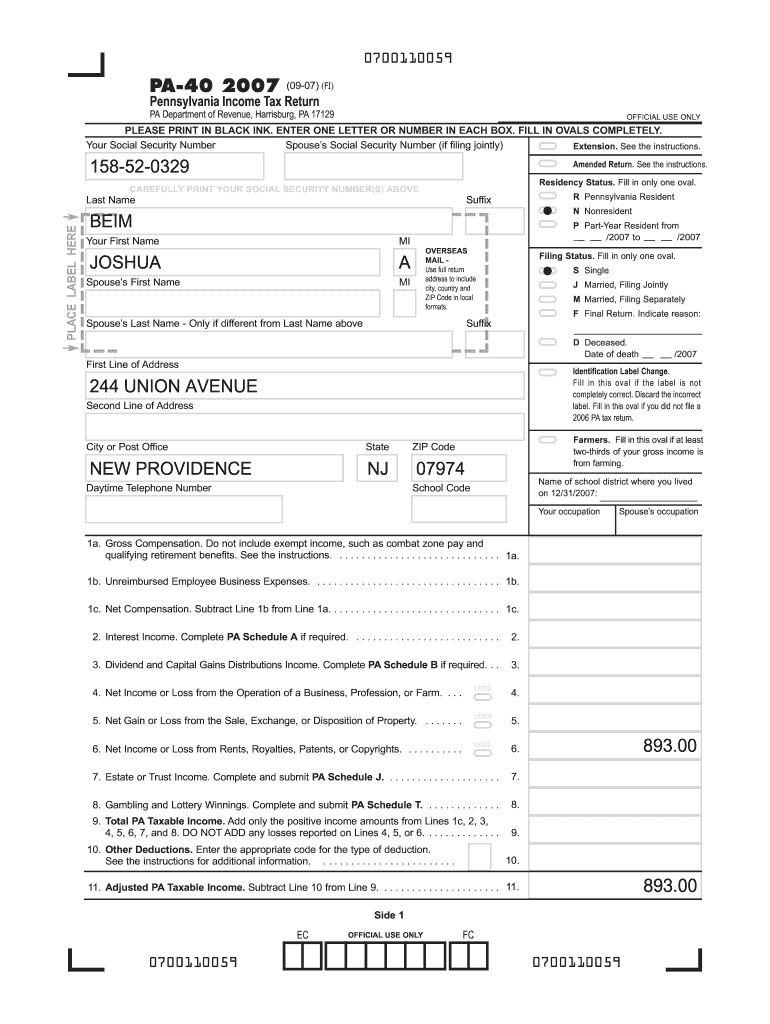

Pa Estimated Tax Form Fill Online Printable Fillable Blank PdfFiller

Pa Estimated Tax Form Fill Online Printable Fillable Blank PdfFiller

Fillable Pa 40 2019 2024 Form Fill Out And Sign Printable PDF Template SignNow

Pa Rent Rebate 2021 Printable Rebate Form

2022 Pa Property Tax Rebate Forms PropertyRebate

2024 Pa Property Tax Rebate Form - Property Tax Rent Rebate Program Online filing for the Property Tax Rent Rebate Program is now available for eligible Pennsylvanians to begin claiming rebates on property taxes or rent paid in 2022 Learn More PA Tax Talk