2024 Property Tax Rebate Form The credit will appear on your 2024 property tax bill Filing deadline mm dd yyyy County Treasurer address Note If the property is located in Milwaukee County submit this completed form to your Municipal Treasurer Do not send it to the Milwaukee County Treasurer LC 100 R 12 23

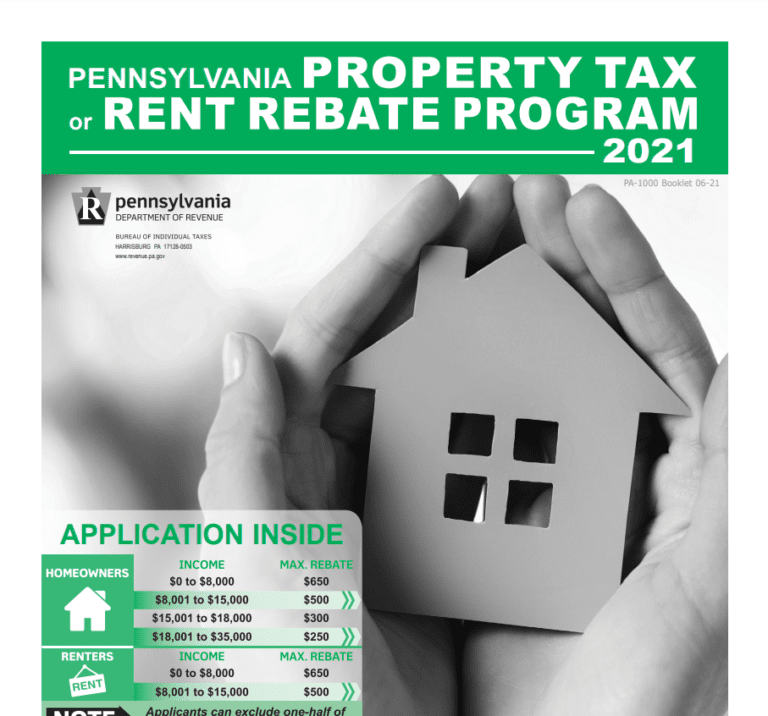

For more information about the Property Tax Rent Rebate Program please visit revenue pa gov PTRR or call 1 888 222 9190 Forms Publications Keywords Property Tax Rent Rebate Program Expanded Income Eligibility and Larger Rebates Now Available REV 573 1 8 2024 1 35 14 PM Homeowners with an approved application may receive up to a 500 credit against their 2024 property tax obligation To be eligible for the credit you must own a home house mobile home town home duplex or condo in North Dakota and reside in it as your primary residence There are No Age Restrictions or Income Limitations for this credit

2024 Property Tax Rebate Form

2024 Property Tax Rebate Form

https://data.formsbank.com/pdf_docs_html/140/1407/140793/page_1_bg.png

Alconchoice Com Printable Rebate Form Printable Word Searches

https://handypdf.com/resources/formfile/images/10000/renters-rebate-sample-form-page1.png

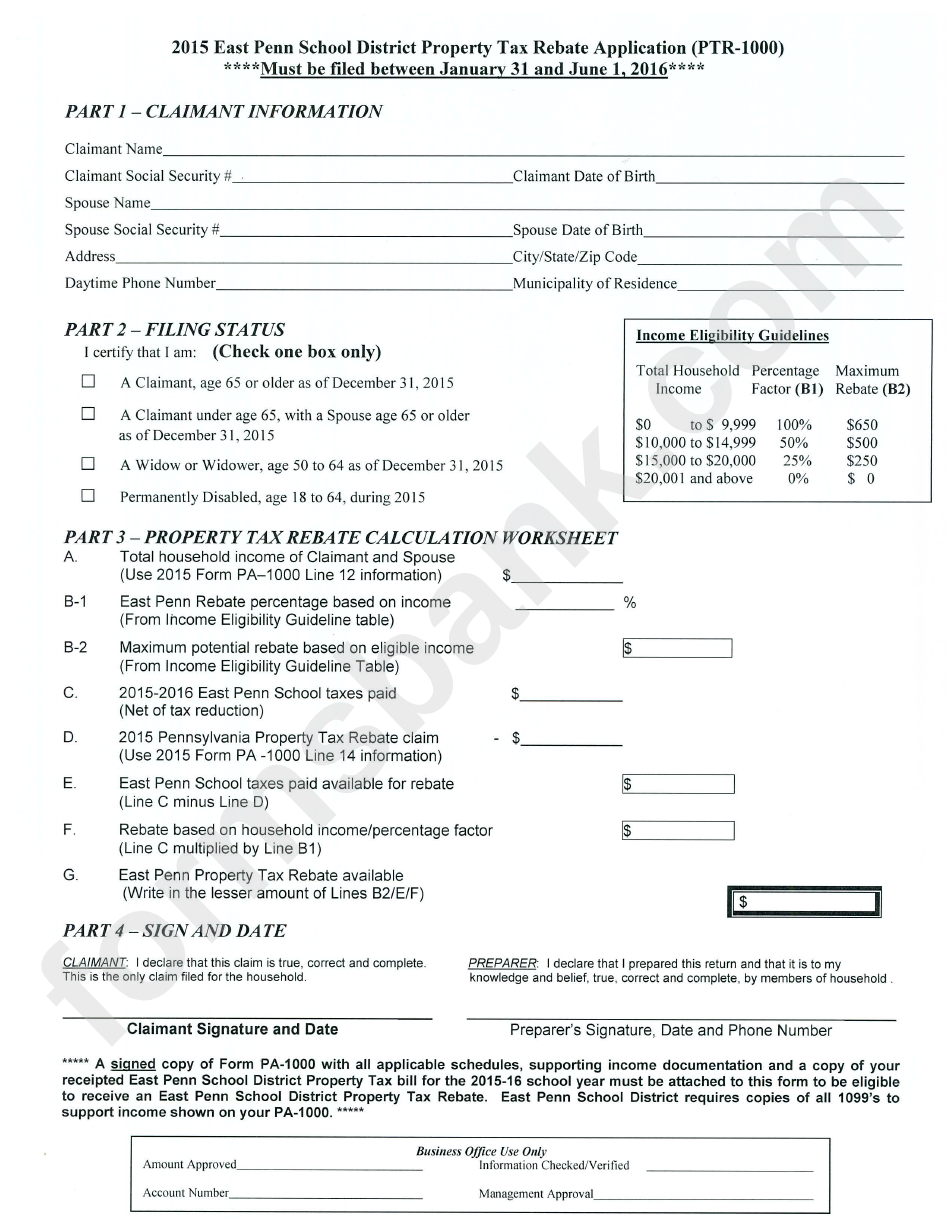

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/11/PA-Property-Tax-Rebate-Form-768x719.png

How to maximize your 2024 tax refund according to a CPA 02 34 Many Americans got a shock last year when the expiration of pandemic era federal benefits resulted in their receiving a smaller tax In order to claim the homestead credit you or your spouse must meet certain qualifications including one of the following You or your spouse if married have earned income during the year You or your spouse if married are disabled Get more information on Homestead Credit qualifications Watch our About the Wisconsin Homestead Credit video

Exemption requests for 2024 are now being accepted and are due March 1 2024 Property Tax Exemptions Requests MUST be filed by March 1 to be eligible for exemption for the current assessment year A request for exemption is required if The property was taxed in the previous year There was a change of property use The Pennsylvania Property Tax Rent Rebate program is open to state residents 65 or older widows and widowers 50 or older or anyone age 18 and over who is 100 disabled New income limits for 2024 are 45 000 a year for both homeowners and renters NOTE Only half of your Social Security income is included in calculations H ATTENTION H

Download 2024 Property Tax Rebate Form

More picture related to 2024 Property Tax Rebate Form

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

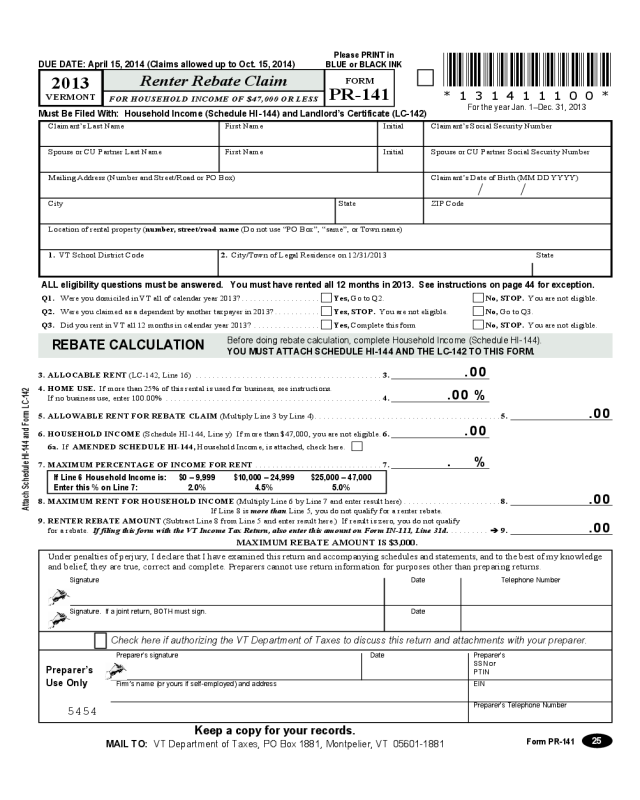

2023 Rent Rebate Form Printable Forms Free Online

https://www.pdffiller.com/preview/47/686/47686220/large.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Individual Income Tax Form D 400V The Refund Process Pay a Bill or Notice Notice Required AV 9 2024 Application for Property Tax Relief Documents 2024 AV 9 Secured pdf Side Nav File Pay PO Box 25000 Raleigh NC 27640 0640 General information 1 877 252 3052 Individual income tax refund inquiries 1 877 252 4052 Activity When you file your tax return you must decide whether to take the standard deduction 13 850 for single tax filers 27 700 for joint filers or 20 800 for heads of household or married filing

IRS Free File participants These tax providers are participating in IRS Free File in 2024 Tax Tip 2024 03 Jan 22 2024 IRS Free File is now available for the 2024 filing season With this program eligible taxpayers can prepare and file their federal tax returns using free tax software from trusted IRS Free File partners The rebate amount can be up to 1 044 a year and if you apply by April 15 2024 you could receive up to a 1 600 TABOR refund 800 for single filers In 2023 this program could provide more than 7 million in relief to Coloradans ensuring seniors and Coloradans with disabilities can heat and remain in their homes

Conquista Midollo Coro Rebate Program Template Omettere Additivo Bobina

https://data.templateroller.com/pdf_docs_html/2100/21003/2100371/rebate-form_print_big.png

M1pr Form 2022 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/459/835/459835865/large.png

https://www.revenue.wi.gov/DORForms/24lc-100f.pdf

The credit will appear on your 2024 property tax bill Filing deadline mm dd yyyy County Treasurer address Note If the property is located in Milwaukee County submit this completed form to your Municipal Treasurer Do not send it to the Milwaukee County Treasurer LC 100 R 12 23

https://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/PTRR/Documents/rev-573.pdf

For more information about the Property Tax Rent Rebate Program please visit revenue pa gov PTRR or call 1 888 222 9190 Forms Publications Keywords Property Tax Rent Rebate Program Expanded Income Eligibility and Larger Rebates Now Available REV 573 1 8 2024 1 35 14 PM

Pennsylvania s Property Tax Rent Rebate Program May Help Low income Households Apply By 12 31

Conquista Midollo Coro Rebate Program Template Omettere Additivo Bobina

Illinois Property Tax Rebate Form 2023 PrintableRebateForm

Minnesota Property Tax Refund 2019 2023 Form Fill Out And Sign Printable PDF Template SignNow

Where To Mail Pa Property Tax Rebate Form Printable Rebate Form

Illinois 1040 2017 2024 Form Fill Out And Sign Printable PDF Template SignNow

Illinois 1040 2017 2024 Form Fill Out And Sign Printable PDF Template SignNow

2023 Pa Tax Form Printable Forms Free Online

Fillable Online Property Tax Rebate Form Fax Email Print PdfFiller

Fillable Pa 40 Fill Out Sign Online DocHub

2024 Property Tax Rebate Form - Property Tax Rebate for All Owner Occupied Residential Properties in 2024 30 Nov 2023 Property taxes PT for most residential properties will increase in 2024 due to higher market rents and Annual Values AVs for most residential properties and an increase in PT rates for higher value private residential properties