2024 Rent Rebate Ways to Apply There are three ways to apply for the Property Tax Rent Rebate Program online by mail or in person Applicants are encouraged to apply online for the fastest review process Learn more about your options to ensure your application is submitted correctly by the June 30 2024 filing deadline Apply Online

Governor Shapiro s expansion of the Property Tax Rent Rebate program delivered the largest targeted tax cut for seniors in nearly two decades expanding access to nearly 175 000 more Pennsylvanians and increasing maximum rebate from 650 to 1000 2024 For more information and to access forms instructions visit revenue pa gov ptrr or Step 1 Select Find a Submission on the Additional Services Panel in myPATH Step 2 Enter the email used to file the claim and enter the confirmation code received upon completion Obtaining a Copy of Electronic Application Step 3 Select the Print hyperlink on the summary screen for a copy of the claim

2024 Rent Rebate

2024 Rent Rebate

https://handypdf.com/resources/formfile/images/10000/renters-rebate-sample-form-page1.png

Fillable Pa 40 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/42/749/42749850/large.png

Connecticut Rent Rebate Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/01/Connecticut-Renters-Rebate-2023.png

First time filers who have filed by June 1 2024 should expect to receive their rebates between July 1 and September 1 2024 Some rebates may take additional time if DOR needs to correct or verify any information on a rebate application Governor Josh Shapiro signed into law a historic expansion of the Property Tax Rent Rebate PTRR Markets today HARRISBURG KDKA Hundreds of thousands of older adults and those with disabilities are now able to apply for rebates of up to 1 000 Pennsylvania s Property Tax Rent Rebate

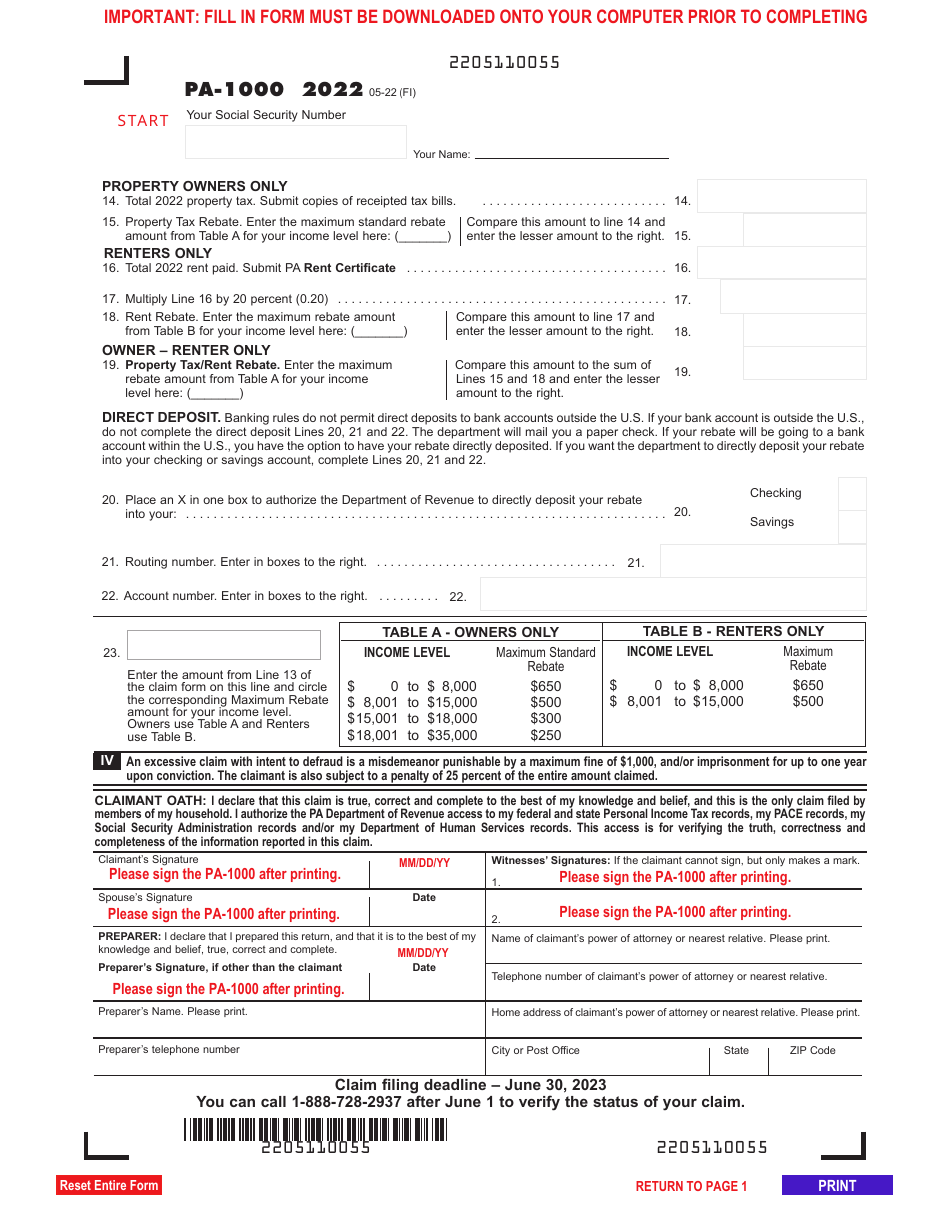

The property tax rebate program provides rent or property tax rebates to eligible older adults and adults with disabilities The rebates range from 380 to 1 000 with lower income residents receiving higher rebates and some applicants qualifying for additional money The program which is funded by the Pennsylvania Lottery and gaming was Under the expansion crucial updates will be in place when the Department of Revenue in January 2024 opens the filing period to submit applications for property taxes and rent paid in 2023 First the maximum standard rebate will increase from 650 to 1 000

Download 2024 Rent Rebate

More picture related to 2024 Rent Rebate

Standard Deduction For 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-3.jpg

Drive up Property Tax Or Rent Rebate Event Senator Lindsey Williams

https://senatorlindseywilliams.com/wp-content/uploads/2021/05/Tax-Rent-Event-2021.jpg

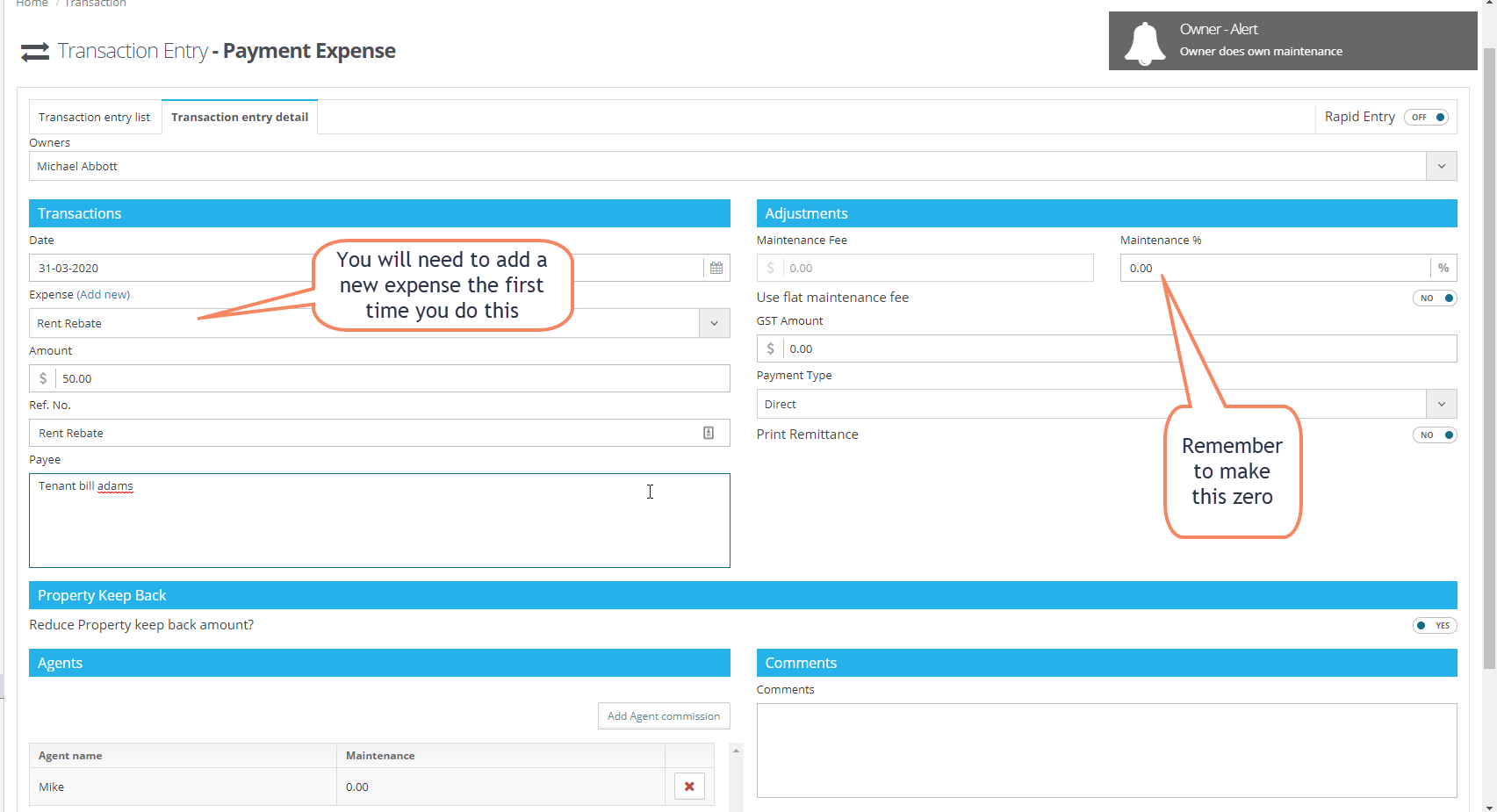

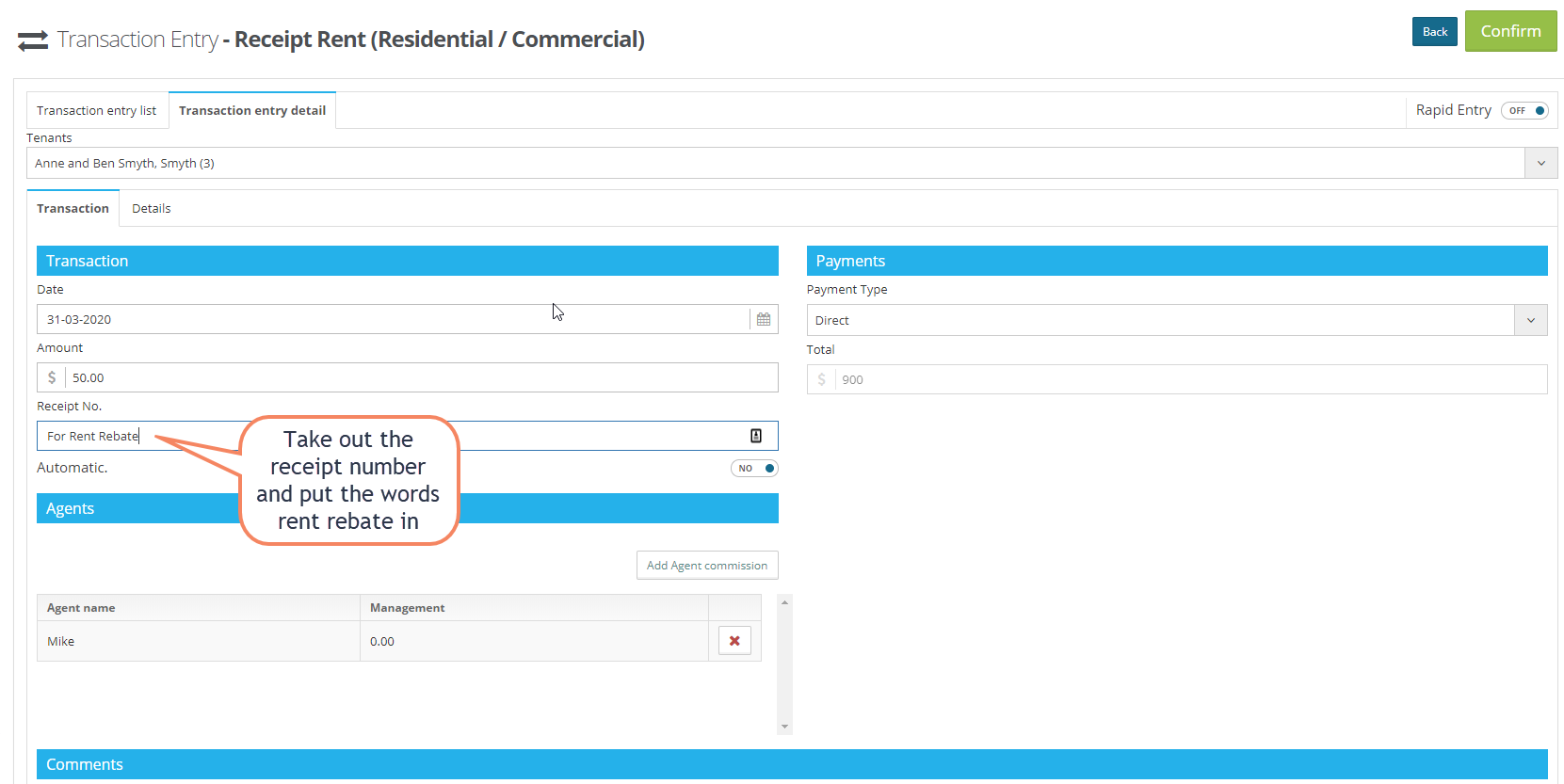

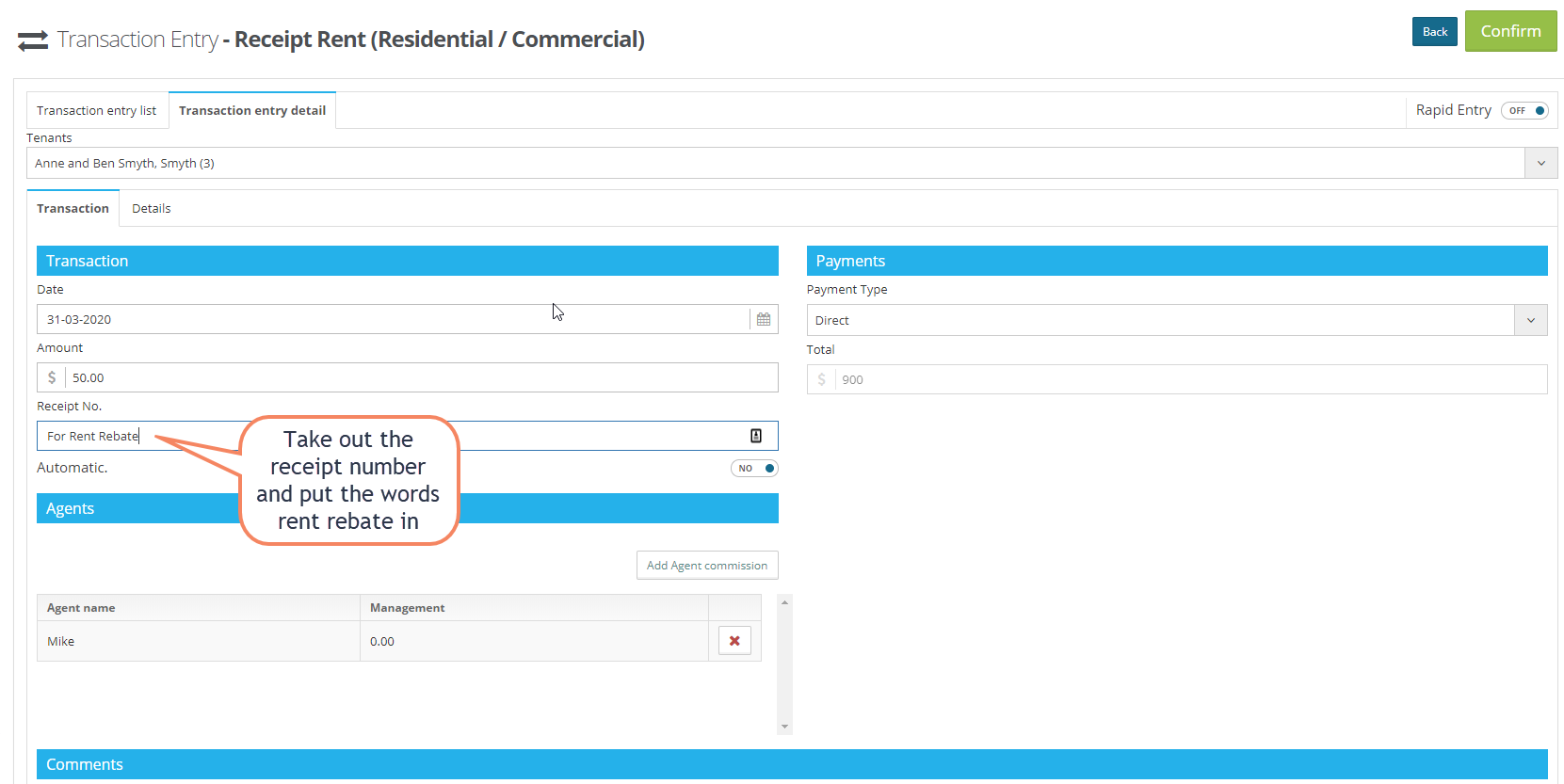

Partial Rent Rebate For Tenants Welcome MRI Palace Support Centre

https://support.getpalace.com/hc/article_attachments/360064338033/Rebate_Rent_1.png

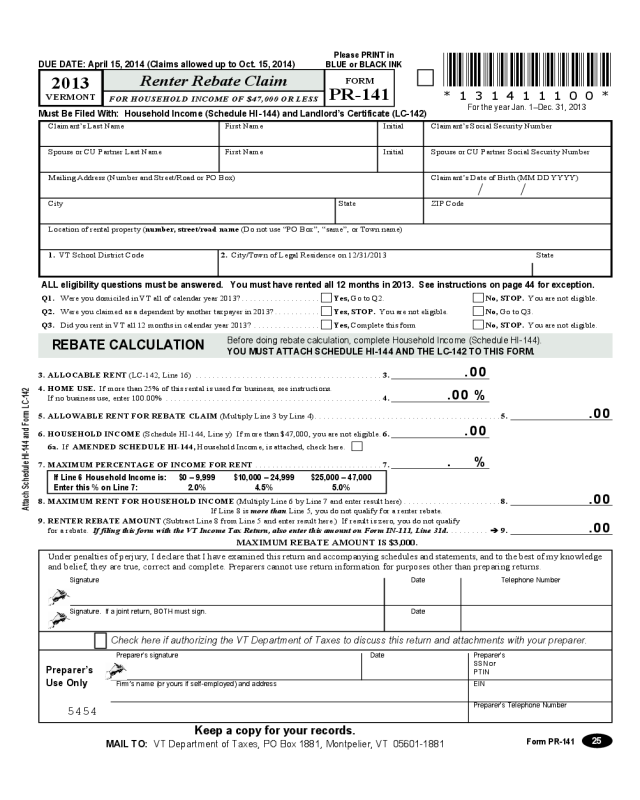

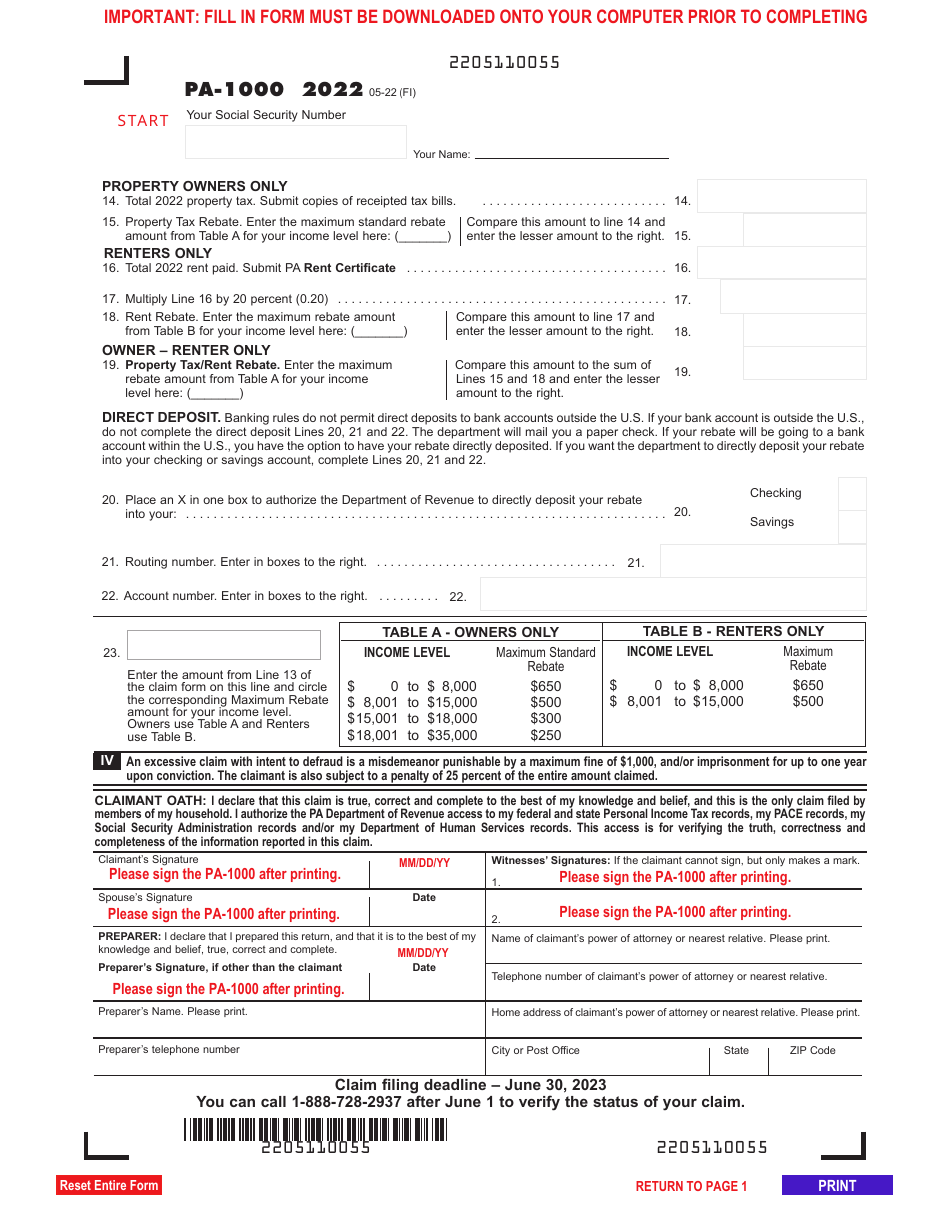

Starting in 2024 the maximum standard rebate will increase from 650 to 1 000 Also in 2024 the household income limit for property tax rebates will increase to 45 000 up from the current 35 000 limit The household income limit for rent rebates will also increase to 45 000 up from 15 000 Half of Social Security income is excluded Enter the total property tax rent paid during the claim year and select Next Provide the personal information for the claimant and spouse in the required fields Select the Verify Address button after entering the claimaint s address Select the County from the drop down menu Indicate whether the rebate should be direct deposited If yes

HARRISBURG Pa AP The Pennsylvania House of Representatives on Monday overwhelmingly approved a bill to increase the state s property tax and rent subsidy for seniors and people with disabilities plus raise the income eligibility cap to expand the program The bill passed 194 9 and goes on to the state Senate The expansion Increases the maximum standard rebate from 650 to 1 000 Increases the income cap from 35 000 to 45 000 for homeowners Increases the income cap from 15 000 to

Partial Rent Rebate For Tenants Welcome Palace Support Centre

https://support.getpalace.com/hc/article_attachments/360063357754/rent_rebate_1.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

https://www.revenue.pa.gov/IncentivesCreditsPrograms/PropertyTaxRentRebateProgram/Ways-to-Apply

Ways to Apply There are three ways to apply for the Property Tax Rent Rebate Program online by mail or in person Applicants are encouraged to apply online for the fastest review process Learn more about your options to ensure your application is submitted correctly by the June 30 2024 filing deadline Apply Online

https://www.governor.pa.gov/newsroom/governor-shapiro-property-tax-rent-rebates-now-available-for-eligible-older-pennsylvanians-people-with-disabilities/

Governor Shapiro s expansion of the Property Tax Rent Rebate program delivered the largest targeted tax cut for seniors in nearly two decades expanding access to nearly 175 000 more Pennsylvanians and increasing maximum rebate from 650 to 1000 2024 For more information and to access forms instructions visit revenue pa gov ptrr or

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

Partial Rent Rebate For Tenants Welcome Palace Support Centre

2023 Rent Rebate Form Printable Forms Free Online

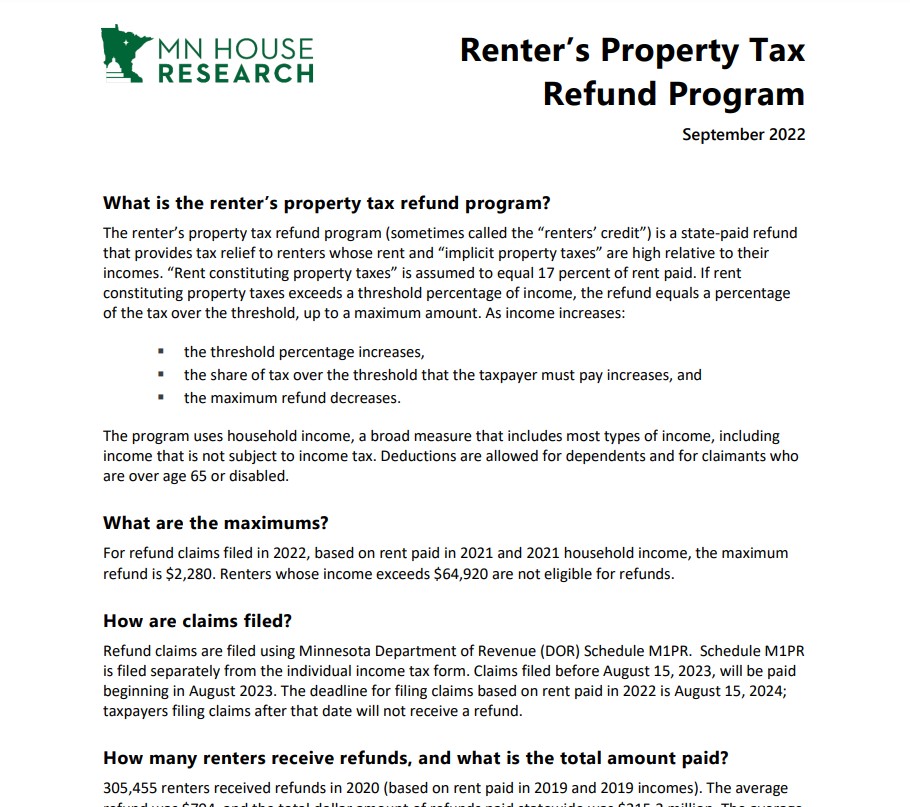

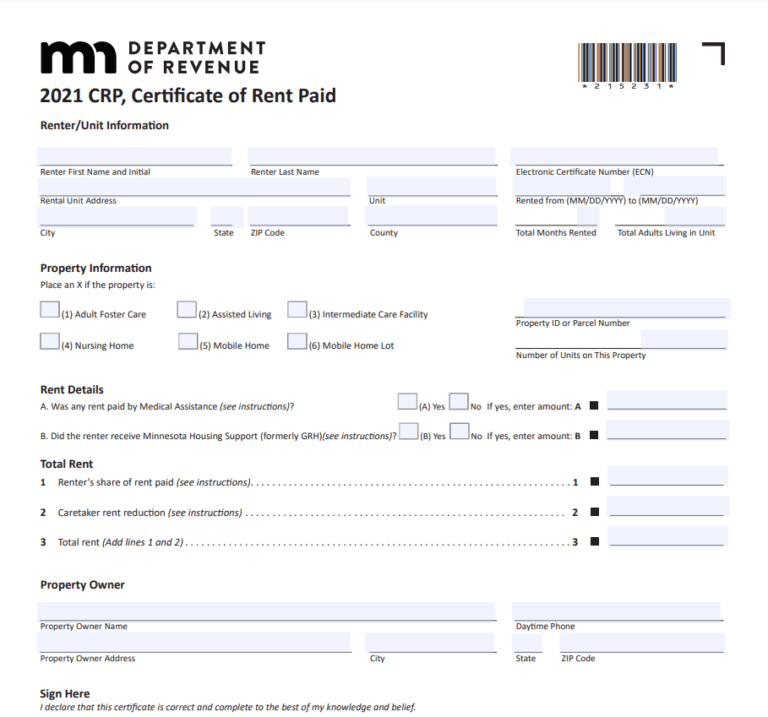

Minnesota Renters Rebate 2023 Printable Rebate Form

M1pr Fillable Form Printable Forms Free Online

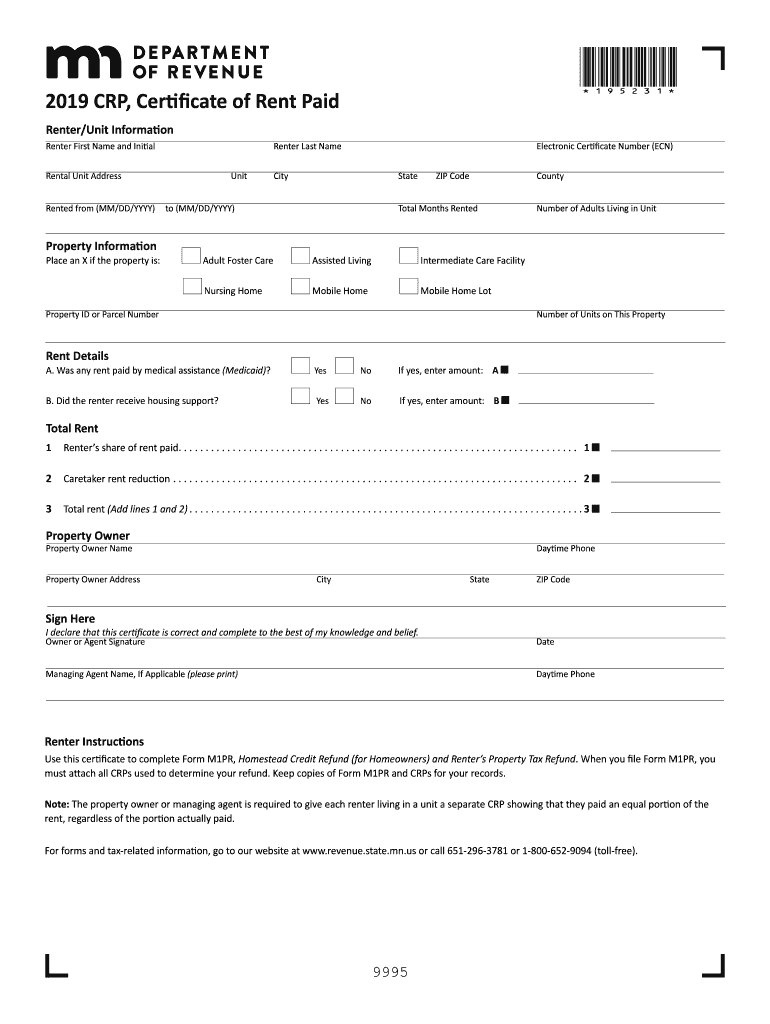

Form PA 1000 Download Fillable PDF Or Fill Online Property Tax Or Rent Rebate Claim 2022

Form PA 1000 Download Fillable PDF Or Fill Online Property Tax Or Rent Rebate Claim 2022

How To Fill Out Rent Rebate Form Direct Deposit Printable Rebate Form

Property Tax Rebate Pennsylvania LatestRebate

Pennsylvania s Property Tax Rent Rebate Program May Help Low income Households Apply By 12 31

2024 Rent Rebate - The property tax rebate program provides rent or property tax rebates to eligible older adults and adults with disabilities The rebates range from 380 to 1 000 with lower income residents receiving higher rebates and some applicants qualifying for additional money The program which is funded by the Pennsylvania Lottery and gaming was