2024 State Of Illinois Tax Rebates Status The Illinois Department of Revenue IDOR announced that it will begin accepting and processing 2023 tax returns on January 29 the same date the Internal Revenue Service begins accepting federal income tax returns For more information see the Illinois Department of Revenue Announces Start to 2024 Income Tax Season press release

The tax filing deadline is Monday April 15 Tax credits Depending on circumstances taxpayers may be able to reduce the amount of taxes owed through tax credits Harris said Some popular tax credits include the Illinois K 12 Education Expense Credit and the Property Tax Credit and the Illinois Earned Income Tax Credit EITC MyTax Illinois facilitates free filing and taxpayers can also use tax prep software or consult professionals The platform allows payments inquiry responses and refund status checks Taxpayers who file error free returns should receive a direct deposit refund in about four weeks The tax filing deadline is April 15 2024 Tax Credits

2024 State Of Illinois Tax Rebates Status

2024 State Of Illinois Tax Rebates Status

https://www.siepert.com/wp-content/uploads/Unorganized/IL-1040-RF-Rebates-1.jpg

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

https://repsnessil66.com/wp-content/uploads/2022/09/2022-IL-Tax-Rebates_post.jpg

State Withholding Tax Form 2023 Printable Forms Free Online

https://www.patriotsoftware.com/wp-content/uploads/2022/12/2023-Form-W-4.png

See the following page for a list of other Illinois tax and fee Acts to which this change also applies The Cigarette Machine Operators Occupation Tax Act Section 1 45 the Cigarette Tax Act Section 9a the Cigarette Use Tax Act Section 13 and The Liquor Control Act Section 8 5 are amended to include Here s what you need to know How Do I Check the Status of my Rebates For additional information or to check on the status of a rebate visit tax illinois gov rebates Those needing

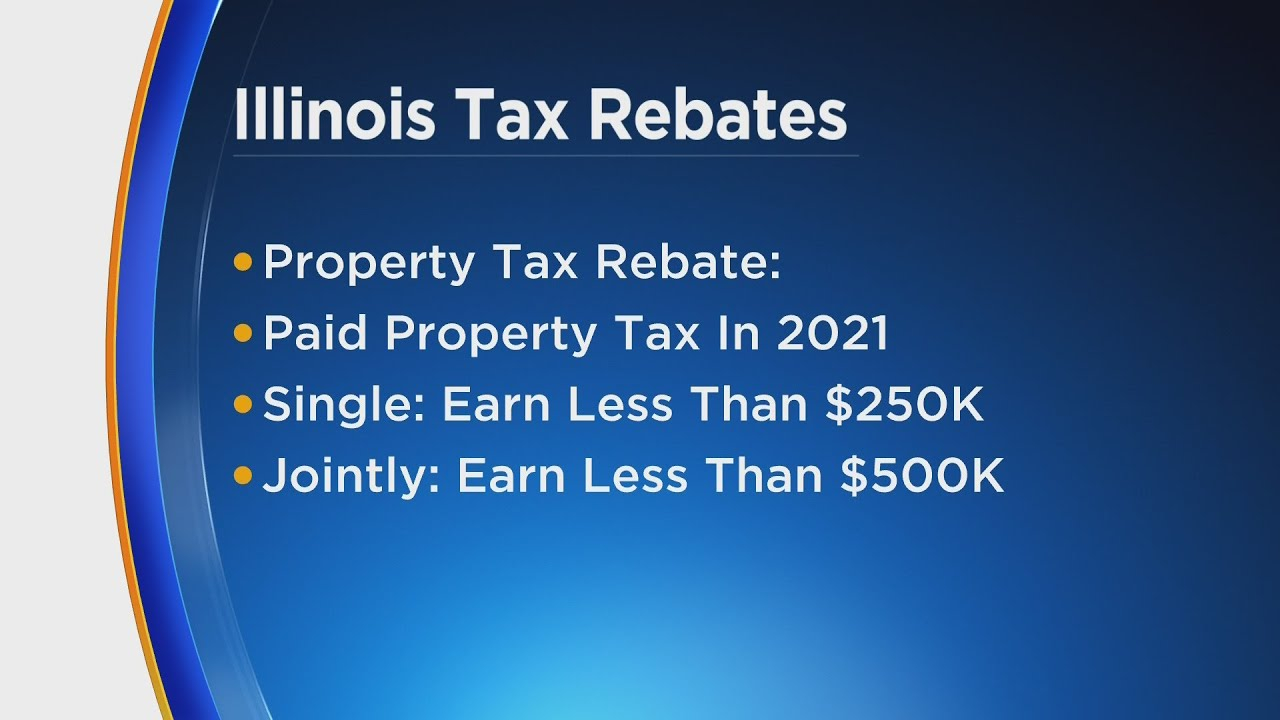

The property tax rebate is a maximum of 300 per household that is equal to the credit claimed for residential real estate property taxes on the 2021 Illinois income tax return The individual income tax rebate is 50 per individual 100 for couples who file married filing jointly provided their federal adjusted gross income is less than Here s everything else you need to know about the rebates Income tax rebates Who qualifies You must have been an Illinois resident in 2021 with an adjusted gross income on your 2021 Form IL

Download 2024 State Of Illinois Tax Rebates Status

More picture related to 2024 State Of Illinois Tax Rebates Status

2022 State Of Illinois Tax Rebates Scheffel Boyle

https://scheffelboyle.com/wp-content/uploads/2022/07/2022-State-of-IL-Tax-Rebates-927x1030.png

K A Report Kakenmaster Tax Accounting

https://images.squarespace-cdn.com/content/v1/5c1eaa01266c07c75d02f75d/1663866031393-BZ5N0TOHL8NXCZPZEIB8/unsplash-image-H_KabGs8FMw.jpg

Il 941 X Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/624/517/624517823/large.png

January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to In just a matter of weeks residents across Illinois will start receiving tax relief rebate checks On Sept 12 the state will start distributing one time income and property tax relief payments

The property tax rebate amount your clients can receive is equal to the property tax credit they were qualified to claim on the 2021 IL 1040 with a maximum credit of 300 State of Illinois The income tax rebate works in a similar manner allowing individuals to claim a credit of 50 each with an additional 100 per dependent up to 300 How to check my status for the Illinois state tax relief Tracking the status of the rebates online also is also possible through filing a Where s My Rebate application The

Stimulus Check Update 2022 Everything You Need To Know About Illinois State Tax Rebates

https://img.particlenews.com/img/id/42ogs1_0htToTWZ00?type=thumbnail_1600x1200

Il W 4 Form 2023 Printable Forms Free Online

https://www.pdffiller.com/preview/516/699/516699239/large.png

https://tax.illinois.gov/research/news/illinois-department-of-revenue-announces-start-to-2024-income-ta.html

The Illinois Department of Revenue IDOR announced that it will begin accepting and processing 2023 tax returns on January 29 the same date the Internal Revenue Service begins accepting federal income tax returns For more information see the Illinois Department of Revenue Announces Start to 2024 Income Tax Season press release

https://www.hfchronicle.com/2024/01/26/state-announces-start-to-2024-income-tax-filing-season/

The tax filing deadline is Monday April 15 Tax credits Depending on circumstances taxpayers may be able to reduce the amount of taxes owed through tax credits Harris said Some popular tax credits include the Illinois K 12 Education Expense Credit and the Property Tax Credit and the Illinois Earned Income Tax Credit EITC

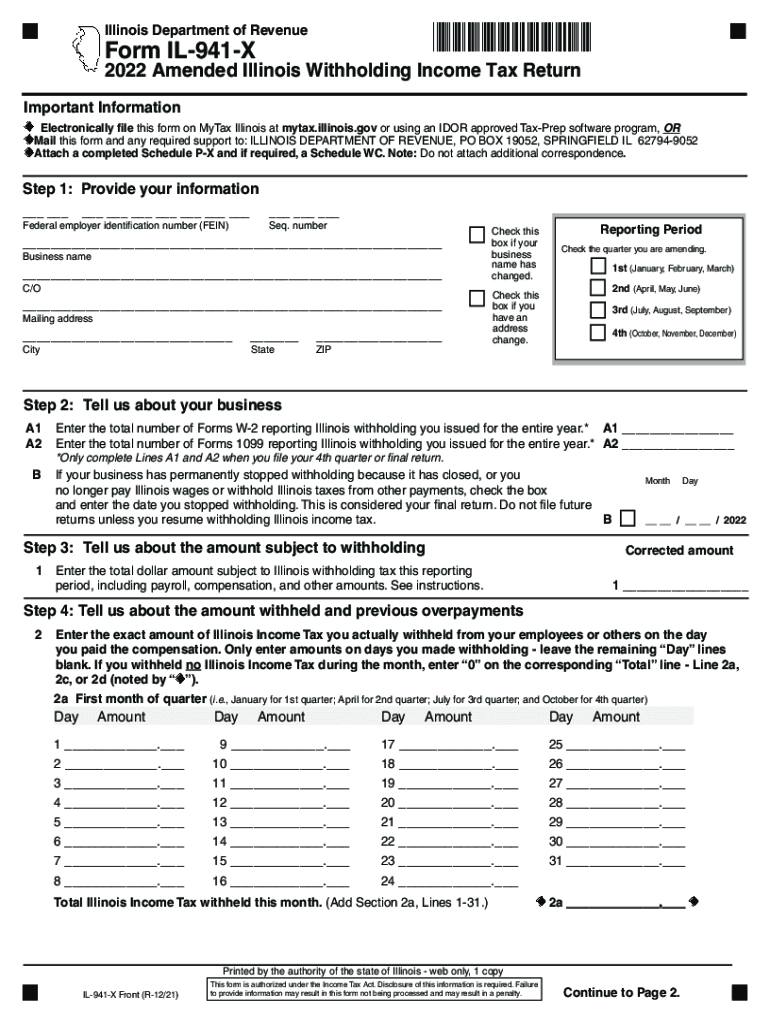

Sales Tax Rebates Remain Prevalent In Northeastern Illinois CMAP

Stimulus Check Update 2022 Everything You Need To Know About Illinois State Tax Rebates

4 Things To Know About Illinois Income Property Tax Rebates

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

Illinois Tax Rebates 2022 Property Income Rebate Checks Being Sent To 6M Taxpayers Governor

Illinois State Senator Steve Stadelman

Illinois State Senator Steve Stadelman

Nj Property Tax Rebates 2023 PropertyRebate

/cloudfront-us-east-1.images.arcpublishing.com/gray/JWN5HIT5AZABVOENKVEEIJW4GM.jpg)

Illinois Rolls Out Income Property Tax Rebates

Illinois Tax Rebate Tracker Rebate2022

2024 State Of Illinois Tax Rebates Status - See the following page for a list of other Illinois tax and fee Acts to which this change also applies The Cigarette Machine Operators Occupation Tax Act Section 1 45 the Cigarette Tax Act Section 9a the Cigarette Use Tax Act Section 13 and The Liquor Control Act Section 8 5 are amended to include