2024 Tax Credit Ev Beginning in 2024 buyers can transfer clean vehicle credits to qualified sellers at the time of sale and use the credit amount as a down payment or a reduction of the manufacturer s suggested retail price

What s new for 2024 instant rebate EV buyers no longer have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead there s a new option We ve gathered every new EV that s currently eligible to earn either the partial 3750 or the full 7500 federal tax credit By Jack Fitzgerald Updated Jun 17 2024 Save Article

2024 Tax Credit Ev

2024 Tax Credit Ev

https://e-vehicleinfo.com/global/wp-content/uploads/2023/06/EV-Tax-Credit-2023-All-you-need-to-know-2.png

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

https://electrek.co/wp-content/uploads/sites/3/2022/11/EV-tax-credit-flowchart.jpg?quality=82&strip=all&w=1024

Eligible vehicles For The EV Tax Credit In 2024 Here s the full list of eligible EVs from FuelEconomy gov where you can also check if a certain car qualifies from its VIN Federal tax credit for EVs will remain at 7 500 The timeline to qualify is extended a decade from January 2023 to December 2032 Tax credit cap for automakers after they hit 200 000 EVs sold

EV tax credit changes for 2024 The IRS updated its electric vehicle tax credit rules as of Jan 1 which makes it easier to see immediate savings on an EV purchase Practically speaking buyers The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the 30D tax credit The IRA also added a new credit for previously owned clean vehicles under 25E of the Code

Download 2024 Tax Credit Ev

More picture related to 2024 Tax Credit Ev

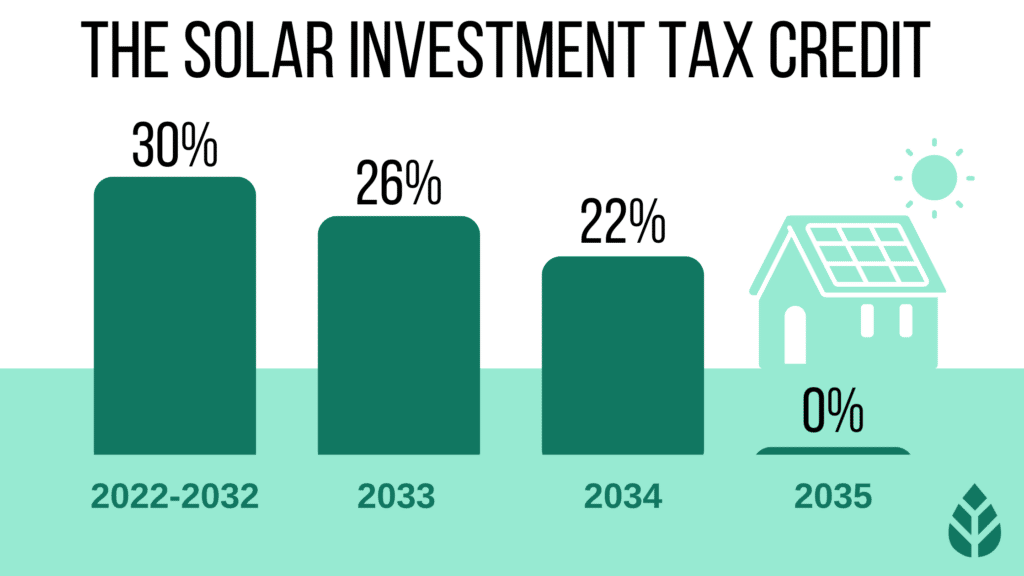

California Solar Incentives Rebates Tax Credits 2023 Guide

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2-1024x576.png

China s 2023 Auto Sales Grow 12 On Overseas Demand For EVs

https://cdn.i-scmp.com/sites/default/files/styles/1200x800/public/d8/images/2019/03/25/screenshot_2019-03-25_at_4.04.24_pm.png?itok=ExVTTySx

2024 Psd 2024 2024 Psd PNG PSD

https://png.pngtree.com/png-clipart/20231001/original/pngtree-2024-calendar-psd-png-image_13222859.png

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 Consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle tax credit on their annual tax filing Starting in 2024 the Inflation Reduction Act establishes a mechanism that will allow car buyers to transfer the credit to dealers at the point of sale so that it can directly reduce the purchase price

The government is offering free money for top notch EVs from a growing number of brands including Ford Rivian Tesla VW and Honda though fewer vehicles qualify in 2024 than in 2023 Just 19 different electric vehicle and plug in hybrid variations qualify for tax credits in 2024 down from 43 last year See below for the full list including all the model variations

Form 8911 For 2023 Printable Forms Free Online

https://i.imgur.com/NqXOLIL.jpg

Features Of Budget 2023 2024 Tax Parley

https://i0.wp.com/taxparley.com/wp-content/uploads/2023/02/Features-of-Budget-2023-2024.png?w=2240&ssl=1

https://www.irs.gov/newsroom/qualifying-clean...

Beginning in 2024 buyers can transfer clean vehicle credits to qualified sellers at the time of sale and use the credit amount as a down payment or a reduction of the manufacturer s suggested retail price

https://www.npr.org/2023/12/28/1219158071

What s new for 2024 instant rebate EV buyers no longer have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead there s a new option

Tax Rates For The 2024 Year Of Assessment Just One Lap

Form 8911 For 2023 Printable Forms Free Online

Prepare And File Form 2290 E File Tax 2290

Tax Rates For The 2024 Year Of Assessment Just One Lap

Poza 2 Rom nia Are Echipamente Noi Pentru Preliminariile EURO 2024

Poza 2 Rom nia Are Echipamente Noi Pentru Preliminariile EURO 2024

EV Tax Credit 2023

Tax Solutions Klm Property Tax Solutions

Buy 2023 Vertical 11x17 2023 Wall Runs Until June 2024 Easy

2024 Tax Credit Ev - EV tax credit changes for 2024 The IRS updated its electric vehicle tax credit rules as of Jan 1 which makes it easier to see immediate savings on an EV purchase Practically speaking buyers