2024 Tax Rebate Eligibility Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief

The IRS expects most EITC and ACTC related refunds to be available in taxpayer bank accounts or on debit cards by Feb 27 2024 if the taxpayer chose direct deposit and there are no other issues with the tax return Last quarterly payment for 2023 is due on Jan 16 2024 For more information about ABLE accounts see Publication 907 Tax Highlights for Persons With Disabilities The maximum Saver s Credit is 1 000 2 000 for married couples The credit can increase a taxpayer s refund or reduce the tax owed but is affected by other deductions and credits

2024 Tax Rebate Eligibility

2024 Tax Rebate Eligibility

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

What s new for 2024 instant rebate Starting in January EV buyers won t have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead The IRS has significantly limited the list of EVs that qualify for the federal tax credit in 2024 Here are the models that remain eligible rebate instantly The IRS offers a 7 500 tax

Strategic Operating Plan In 2024 we re launching a new pilot tax filing service called Direct File If you re eligible and choose to participate file your 2023 federal tax return online for free directly with IRS It will be rolled out in phases and is expected to be more widely available in mid March The rules surrounding EV tax rebate eligibility will change in the US in 2024 There are still a lot of unanswered questions about which cars will be eligible for the full 7 500 federal incentive

Download 2024 Tax Rebate Eligibility

More picture related to 2024 Tax Rebate Eligibility

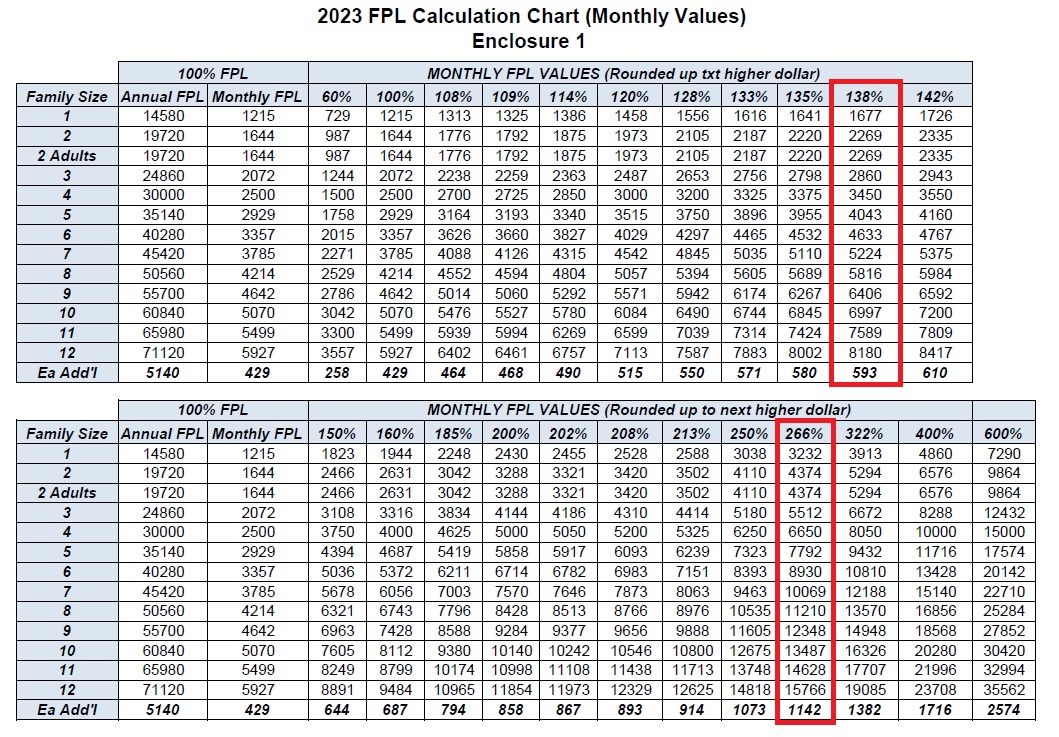

2023 2024 Income Eligibility Guidelines CDPHE WIC

https://www.coloradowic.gov/sites/default/files/media/image/IEG 22-23 English_02.png

Simple ERTC Eligibility Check Fast Application 2020 2021 Payroll Tax Rebate

https://ampifire.com/video/images/stock-pexels-photo-3483098.jpeg

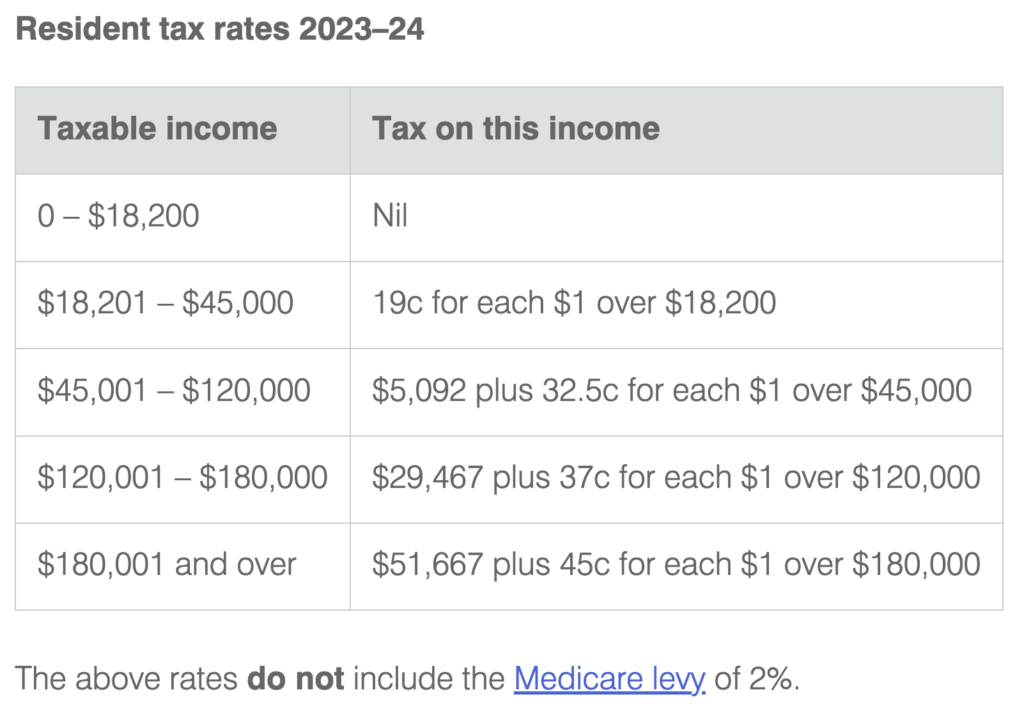

Self Assessment Tax Returns Threshold To Change For 2023 2024 Tax Year Ashford Partners

https://www.ashfordpartners.co.uk/wp-content/uploads/2023/06/shutterstock_2185447501-1000x630.jpg

CNN The Internal Revenue Service updated the rules for electric vehicle tax credits again starting with the first day of 2024 bringing some good and bad news The bad news is that fewer Under rules established in the Inflation Reduction Act of 2022 the EV tax credit allows eligible taxpayers to claim a maximum credit of 7 500 for new EVs and up to 4 000 limited to 30 of the sale price for used EVs Starting on Jan 1 2024 eligible buyers can choose between getting an instant EV tax rebate to use as a down payment on

Starting in 2024 eligibility will be determined based on the individual vehicle not by model Automakers will submit the vehicle identification numbers VINs of eligible vehicles to the When tax filing season opens on January 29 some taxpayers will have the option of filing their 2023 federal tax returns with a brand new government run system Known as Direct File the free

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of What You Should Claim

https://i0.wp.com/blog.fundingsocieties.com.my/wp-content/uploads/2023/03/Personal-Income-Tax-Relief-Malaysia-2023-YA-2022.png?fit=1200%2C628&ssl=1

Tax Rates For The 2024 Year Of Assessment Just One Lap

https://i0.wp.com/justonelap.com/wp-content/uploads/2023/06/Tax-rates-2024-1.jpg?resize=849%2C569&ssl=1

https://tax.thomsonreuters.com/blog/understanding-the-tax-relief-for-american-families-and-workers-act-of-2024/

Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief

https://www.irs.gov/newsroom/get-ready-to-file-in-2024-whats-new-and-what-to-consider

The IRS expects most EITC and ACTC related refunds to be available in taxpayer bank accounts or on debit cards by Feb 27 2024 if the taxpayer chose direct deposit and there are no other issues with the tax return Last quarterly payment for 2023 is due on Jan 16 2024

Tax Rates For The 2024 Year Of Assessment Just One Lap

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of What You Should Claim

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Who Is Eligible For The Council Tax Rebate Eligibility For The 150 Support And Payment

Property Tax Rebate Pennsylvania LatestRebate

How To Save A Home Deposit In 2 Years 200 Per Week Updated 15 11 2022 Julia s Blog

How To Save A Home Deposit In 2 Years 200 Per Week Updated 15 11 2022 Julia s Blog

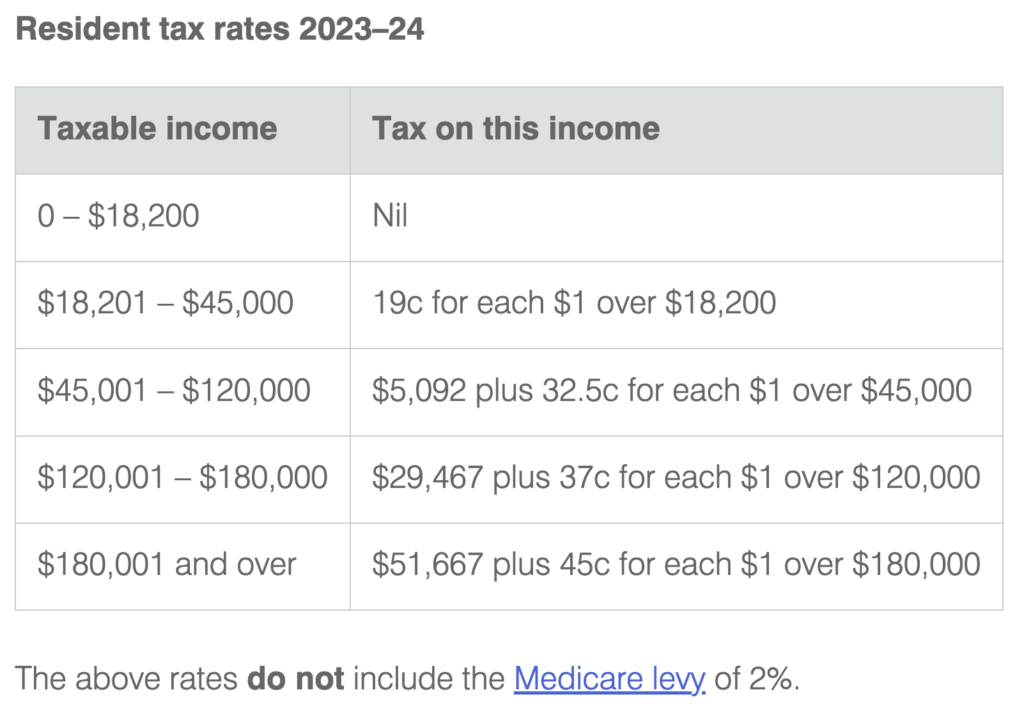

MAGI Medi Cal Income Eligibility For 2023 Increases Over 6

Recovery Rebate Credit 2024 Eligibility Calculator How To Claim

Income Tax Rebate Under Section 87A

2024 Tax Rebate Eligibility - Strategic Operating Plan In 2024 we re launching a new pilot tax filing service called Direct File If you re eligible and choose to participate file your 2023 federal tax return online for free directly with IRS It will be rolled out in phases and is expected to be more widely available in mid March