2024 Tax Rebate South Carolina STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE SOUTH CAROLINA EMPLOYEE S dor sc gov WITHHOLDING ALLOWANCE CERTIFICATE Rev 11 30 23 3527 2024 Give this form to your employer Keep the worksheets for your records The SCDOR may review any allowances and exemptions claimed Your employer may be required to send a copy of this form to the SCDOR

CHARLOTTE N C South Carolina s Department of Revenue announced it will begin accepting 2023 individual income tax returns on Jan 29 and there are three changes you need to know about Here s the earliest folks in SC can get their tax refunds in 2024 2024 01 21 BY PATRICK MCCRELESS pmccreless thestate So when is the soonest a South Carolina taxpayer can get a tax refund IRS The IRS will begin processing tax returns on Jan 29 If you file your tax return online and opt for direct deposit on Jan 29 then you

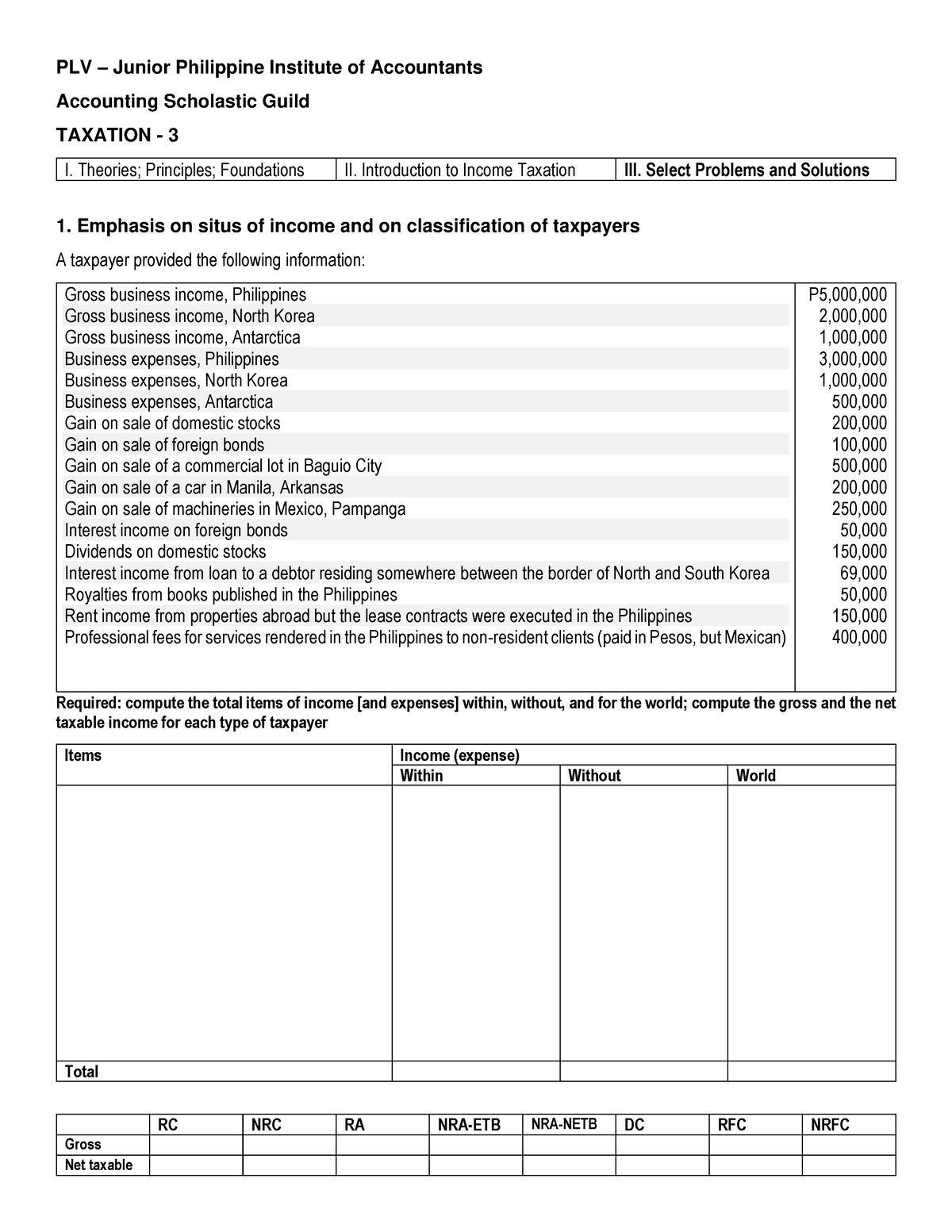

2024 Tax Rebate South Carolina

2024 Tax Rebate South Carolina

https://printablerebateform.net/wp-content/uploads/2022/02/Primary-Rebate-South-Africa-2022.png

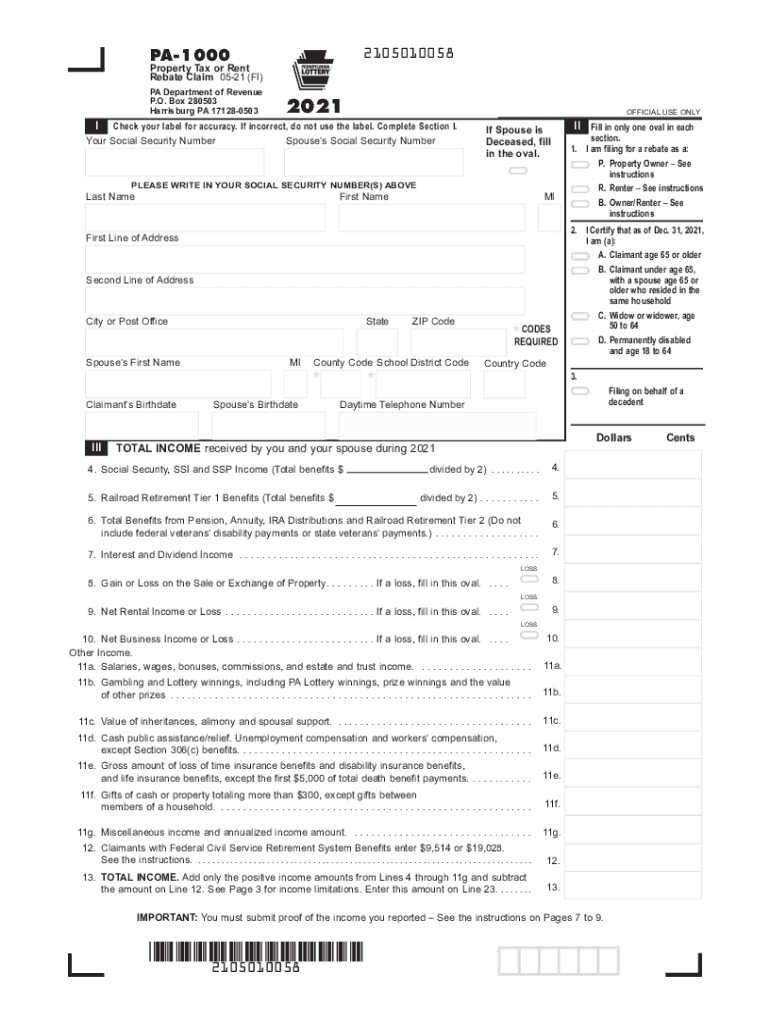

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

SC 2022 Rebate How To Calculate Your Rebate Amount YouTube

https://i.ytimg.com/vi/E9XarfIfXzQ/maxresdefault.jpg

South Carolina lawmakers in June approved the parameters for a tax rebate of 1 billion for South Carolinians Eligible taxpayers have received up to 800 by direct deposit or paper South Carolina taxpayers may see reduced refunds in 2024 The State Part of the McClatchy Media Network Wednesday January 24 2024 Today s eEdition 58 F 58 48 News Politics Sports Go

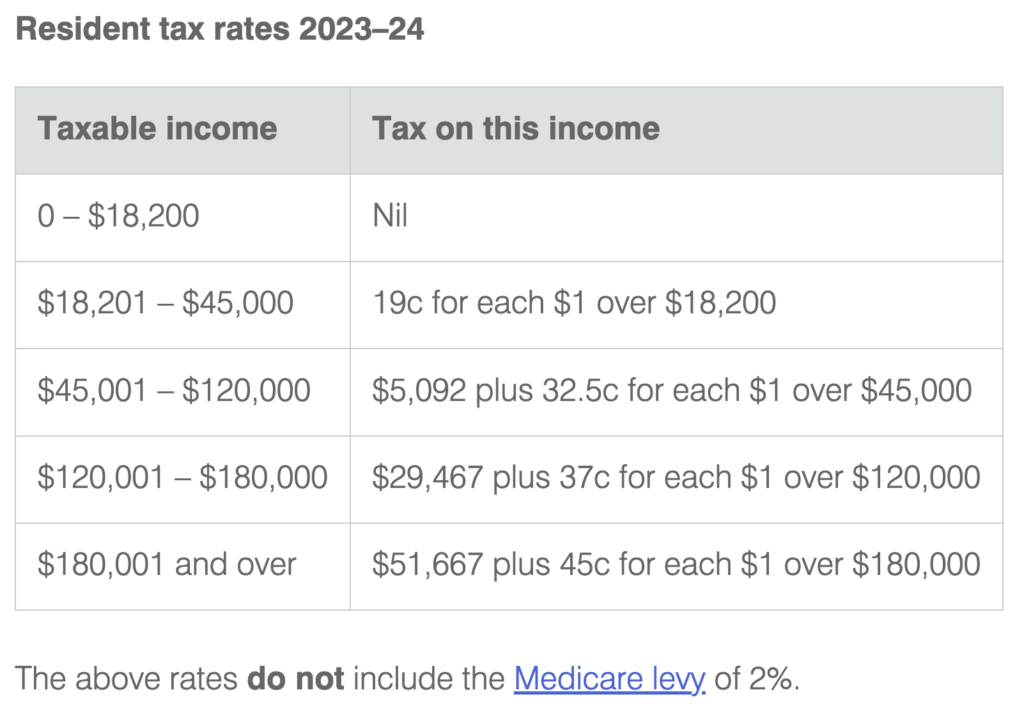

Following an IRS decision to postpone the federal Individual Income Tax extension deadline to February 15 2024 South Carolina taxpayers who requested an extension can also wait until then to file their state 2022 returns The latest State tax rates for 2024 25 tax year and will be update to the 2025 2026 State Tax Tables once fully published as published by the various States Updates to the South Carolina State Tax Calculator The following updates have been applied to the Tax calculator Selectable Tax year Tax calculations allow for Tax Deferred Retirement Plan

Download 2024 Tax Rebate South Carolina

More picture related to 2024 Tax Rebate South Carolina

Self Assessment Tax Returns Threshold To Change For 2023 2024 Tax Year Ashford Partners

https://www.ashfordpartners.co.uk/wp-content/uploads/2023/06/shutterstock_2185447501-1000x630.jpg

SC TAX REBATE 2022 800 TAX REBATE SOUTH CAROLINA SENDING WHEN LINE 10 ON TAX RETURN YouTube

https://i.ytimg.com/vi/ohxOz6TbNn4/maxresdefault.jpg

South Carolina To Issue Individual Income Tax Rebates In 2022

https://www.websterrogers.com/wp-content/uploads/2022/08/Tax-Rebate-e1660164324345.jpg

06 September 2023 The IRS announced that taxpayers anywhere in South Carolina affected by Hurricane Idalia now have until February 15 2024 to file various individual and business tax returns and make tax payments According to the IRS release IRS 2023 163 September 6 2023 the tax relief is provided after a recent disaster declaration Filing electronically is the fastest and easiest way to complete your SC Individual Income Tax return Plus choosing direct deposit allows you to get your refund as soon it s been processed Learn m youtube Aug 08 IIT 101 Deductions and Tax Credits

South Carolina to see income tax reduction in 2024 wltx Right Now Columbia SC 37 Until recently South Carolina had the highest personal income tax rate in the Southeast They have until Feb 15 2023 to file their tax returns State lawmakers approved the distribution of the tax rebates during a session in June including it in a 13 8 billion budget bill The rebates are projected to cost roughly 1 billion Married couples who filed joint 2021 individual income tax returns will receive only one rebate

Tax Rates For The 2024 Year Of Assessment Just One Lap

https://i0.wp.com/justonelap.com/wp-content/uploads/2023/06/Tax-rates-2024-1.jpg?resize=849%2C569&ssl=1

South Carolina Tax Rebate Checks Being Sent Out YouTube

https://i.ytimg.com/vi/Yizo6hJJwiw/maxresdefault.jpg

http://dor.sc.gov/forms-site/Forms/SCW4_2024.pdf

STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE SOUTH CAROLINA EMPLOYEE S dor sc gov WITHHOLDING ALLOWANCE CERTIFICATE Rev 11 30 23 3527 2024 Give this form to your employer Keep the worksheets for your records The SCDOR may review any allowances and exemptions claimed Your employer may be required to send a copy of this form to the SCDOR

https://www.wcnc.com/article/money/personal-finance/income-tax-season-2024-tips-to-file-and-changes-you-need-to-know/275-07791b2d-5e6b-4630-8360-710bf531f6b0

CHARLOTTE N C South Carolina s Department of Revenue announced it will begin accepting 2023 individual income tax returns on Jan 29 and there are three changes you need to know about

How To Save A Home Deposit In 2 Years 200 Per Week Updated 15 11 2022 Julia s Blog

Tax Rates For The 2024 Year Of Assessment Just One Lap

South Carolina State Rebate Printable Rebate Form

SC Senate Unanimously Passes Income Tax Cut And Rebate South Carolina Public Radio

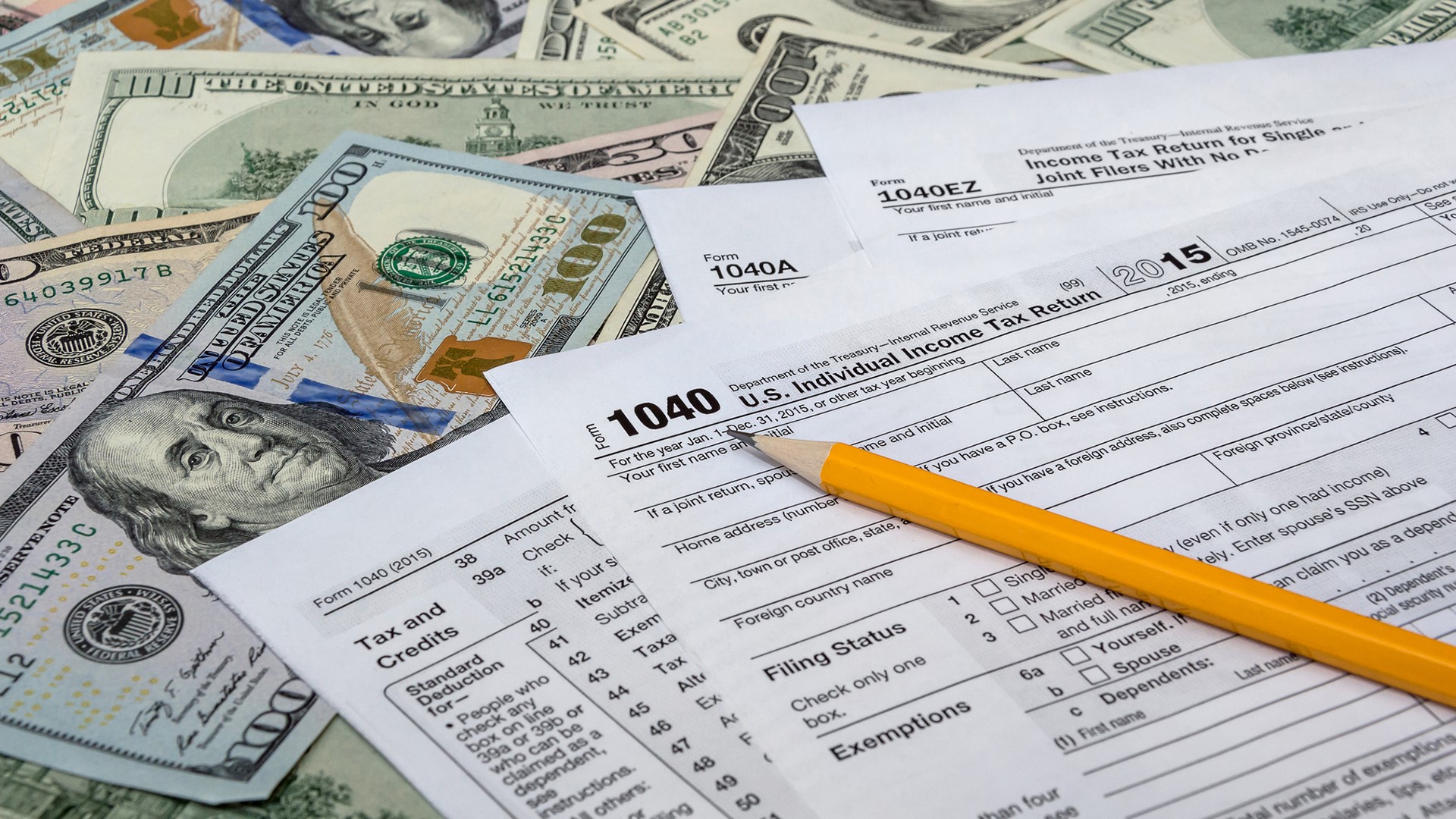

AKS 2023 2024 TAX 1 DAY 3 PLV Junior Philippine Institute Of Accountants Accounting

800 TAX REBATE SOUTH CAROLINA SC TAX REBATE 2022 SENDING WHEN LINE 10 ON TAX RETURN

800 TAX REBATE SOUTH CAROLINA SC TAX REBATE 2022 SENDING WHEN LINE 10 ON TAX RETURN

2022 South Carolina Tax Rebate What You Need To Know Wltx

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

2023 Tax Bracket Changes PBO Advisory Group

2024 Tax Rebate South Carolina - With a fully solvent and resilient UI Trust Fund balance of nearly 1 6 billion South Carolina Set the 2024 tax rates to raise approximately the same level of revenue as 2023 and 2022 Lowered rates for rate classes 2 19 by an average of 6 compared to 2023 levels rates for classes 1 and 20 are set by statute and do not change from year to year