2024 Tax Rebate Working From Home WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

Work from home expenses are still deductible for self employed people So if a worker is classified as an independent contractor rather than a regular employee the above restrictions don t apply Self employed independent contractors also get several deductions that are not available to employees including those among the exceptions The IRS expects most EITC and ACTC related refunds to be available in taxpayer bank accounts or on debit cards by Feb 27 2024 if the taxpayer chose direct deposit and there are no other issues with the tax return Last quarterly payment for 2023 is due on Jan 16 2024

2024 Tax Rebate Working From Home

2024 Tax Rebate Working From Home

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

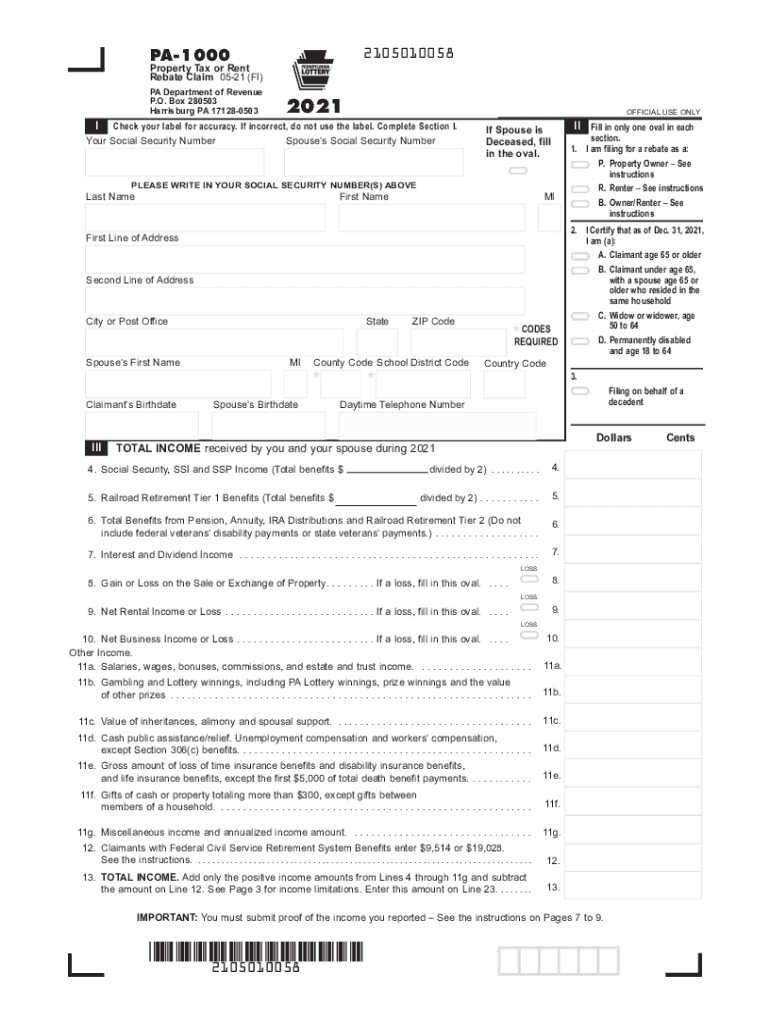

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

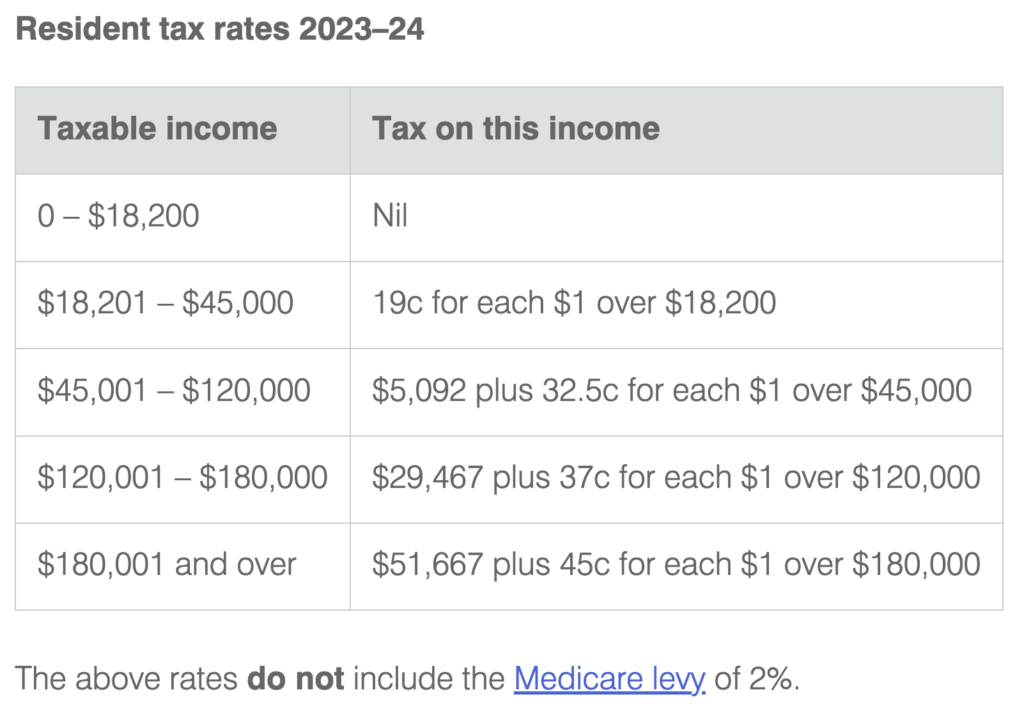

Tax Rates For The 2024 Year Of Assessment Just One Lap

https://i0.wp.com/justonelap.com/wp-content/uploads/2023/06/Tax-rates-2024-1.jpg?resize=849%2C569&ssl=1

Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000 Tax reform in 2018 changed the home office deduction including what traditional employees can deduct related to their work expenses Before the Tax Cuts and Jobs Act TCJA went into effect in 2018 you could deduct unreimbursed job expenses that exceeded 2 of your adjusted gross income AGI on your federal income tax return using Schedule A

Tax Tip 1 Deduct home office expenses if you only worked for yourself or worked for yourself in addition to a W 2 job Click to expand Key Takeaways Employees who work from home can no longer claim tax deductions for their unreimbursed employee expenses or home office costs on their federal tax return a In general Paragraph 6 of section 24 h of the Internal Revenue Code of 1986 is amended 1 by striking credit Subsection and inserting credit A I N GENERAL Subsection and 2 by adding at the end the following new subparagraphs B R ULE FOR DETERMINATION OF EARNED INCOME i I N GENERAL In the case of a taxable year beginning after 2023

Download 2024 Tax Rebate Working From Home

More picture related to 2024 Tax Rebate Working From Home

How To Save A Home Deposit In 2 Years 200 Per Week Updated 15 11 2022 Julia s Blog

https://www.bantacs.com.au/Jblog/wp-content/uploads/2022/11/resident-tax-rates-2023-2024-2-1024x715.png

Homeowner Renters District 16 Democrats

https://ld16nj.com/wp-content/uploads/2022/10/Homeowners-2.jpg

Tax Rebate Service No Rebate No Fee MBL Accounting

https://mblaccounting.co.uk/wp-content/uploads/2021/04/Tax-Rebate.jpg

Self employment tax Uncle Sam takes a bigger bite out of your income employment tax wise when you re on your own To cover your Social Security and Medicare taxes in 2023 you ll owe Uncle Sam 15 3 percent on the first 160 200 of your net earnings from self employment This Social Security wage limit increases to 168 600 for the 2024 tax Summary H R 7024 would amend portions of the Internal Revenue Code of 1986 The revisions discussed in this estimate include those concerning the child tax credit the employee retention tax credit ERTC and various business tax deductions The bill also would provide tax relief to some people affected by federally declared disasters make

For tax year 2023 the Child Tax Credit benefits are as follows Credit changed from up to 3 600 under COVID relief in tax year 2021 to up to 2 000 Each dependent child must be under age 17 No longer fully refundable but is refundable up to 1 600 There were no advance payments issued for tax year 2023 IRS Tax Tip 2024 01 Jan 4 2024 Tax credits and deductions change the amount of a person s tax bill or refund People should understand which credits and deductions they can claim and the records they need to show their eligibility Tax credits A tax credit reduces the income tax bill dollar for dollar that a taxpayer owes based on their

Self Assessment Tax Returns Threshold To Change For 2023 2024 Tax Year Ashford Partners

https://www.ashfordpartners.co.uk/wp-content/uploads/2023/06/shutterstock_2185447501-1000x630.jpg

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

https://smartasset.com/taxes/work-from-home-tax-deductions

Work from home expenses are still deductible for self employed people So if a worker is classified as an independent contractor rather than a regular employee the above restrictions don t apply Self employed independent contractors also get several deductions that are not available to employees including those among the exceptions

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of What You Should Claim

Self Assessment Tax Returns Threshold To Change For 2023 2024 Tax Year Ashford Partners

Income Tax Rebate Under Section 87A

Property Tax Rebate Pennsylvania LatestRebate

Printable Blank Form 4923h Mo Printable Forms Free Online

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

P55 Tax Rebate Form By State PrintableRebateForm

Working From Home Tax Rebate

2024 Tax Rebate Working From Home - Self employed business owners can deduct up to 1 080 000 for tax year 2022 for qualified business equipment like computers printers and office furniture The amount you can deduct is still limited to the amount of income from business activity