2nd Housing Loan Tax Exemption India Verkko 9 tammik 2021 nbsp 0183 32 1 You cannot claim HRA exemption if you own a house in the same city of employment except if you have valid reasons for not living there 2 You can

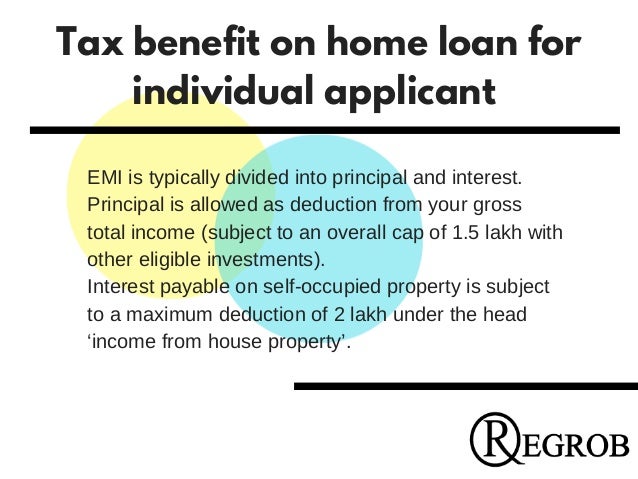

Verkko 5 helmik 2023 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and Verkko 18 jouluk 2023 nbsp 0183 32 how much tax benefit on home loan The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under

2nd Housing Loan Tax Exemption India

2nd Housing Loan Tax Exemption India

https://image.slidesharecdn.com/taxbenefitsonhomeloaninindia-170208093857/95/tax-benefits-on-home-loan-in-india-call-9529331331-5-638.jpg?cb=1486546872

Housing Loan Tax Exemption Revision In Fiscal 2022 PLAZA HOMES

https://www.realestate-tokyo.com/media/15206/housing-loan-tax-exemption.jpg

Home Loan EMI And Tax Deduction On It EMI Calculator

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

Verkko Tax benefits are subject to changes in tax laws Please contact your tax consultant for an exact calculation of your tax liabilities Check out the tax benefits on second home Verkko 21 maalisk 2021 nbsp 0183 32 Premium Whether you have one home loan or more the deduction allowable under Section 80 C for repayment of home loan is restricted to Rs 1 50 lakh

Verkko ORANGE HUB Blog 2 mins Read 1 Year Ago Tax Benefits of a Second Home Loan Save More on Taxes Home Loan Share Copy Apply Now Know More While Home Loan borrowers are generally well aware of Verkko Self occupied first home rented second home From your second residence you earn rental income that needs to be declared You can deduct a typical 30 percent interest

Download 2nd Housing Loan Tax Exemption India

More picture related to 2nd Housing Loan Tax Exemption India

Home Loan Tax Benefits In India Important Facts

https://propertyadviser.in/assets/front/images/real-estate-news/s1/income-tax-rebate-on-home-loan-819-s1.jpg

Can I Claim Both Home Loan And HRA Tax Benefits

https://www.paisabazaar.com/wp-content/uploads/2019/05/HRA-Home-Loan.jpg

Home Loan Interest Tax Exemption India Home Sweet Home Modern

https://cdn.slidesharecdn.com/ss_thumbnails/taxbenefitsonhomeloan-160524122037-thumbnail-4.jpg?cb=1465554774

Verkko What is the maximum tax benefit on home loan The maximum tax deduction for a housing loan as per different sections in Income Tax Acts is listed below Up to Rs 2 Verkko 5 Mins Jan 17 2022 Tweet Today with growing aspirations and families many are looking at buying their second home And now is perhaps the best time given that

Verkko 23 maalisk 2023 nbsp 0183 32 Let s understand second home loan tax benefits Deductions Under Section 80C According to Section 80C of the Income Tax Act 1961 a home loan Verkko People who own two homes are eligible for a wide range of second home loan tax benefits Let s examine these advantages in greater detail and the tax benefit on

Pin On Infographics

https://i.pinimg.com/originals/6e/0d/21/6e0d21b75e7a9c7b8ba9983b3ed8adc6.jpg

Home Loan Tax Exemption Check Tax Benefits On Home Loan

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

https://taxguru.in/income-tax/income-tax-benefits-deductions-seco…

Verkko 9 tammik 2021 nbsp 0183 32 1 You cannot claim HRA exemption if you own a house in the same city of employment except if you have valid reasons for not living there 2 You can

https://cleartax.in/s/home-loan-tax-benefit

Verkko 5 helmik 2023 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Pin On Infographics

How To Get A Second Home Loan For Rental Income

Tax Benefits On Second Home Loan Tax Exemption On 2nd Home Loan PNB

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

How Housing Loan Tax Benefit

How Housing Loan Tax Benefit

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Home Loan Tax Exemption Salaried Self Employed Loan Home Loans

Home Loan Interest Exemption In Income Tax Home Sweet Home

2nd Housing Loan Tax Exemption India - Verkko 8 tammik 2021 nbsp 0183 32 If you have bought more than one property with home loan then you can get tax benefit on the second property as well Here s how you can claim tax