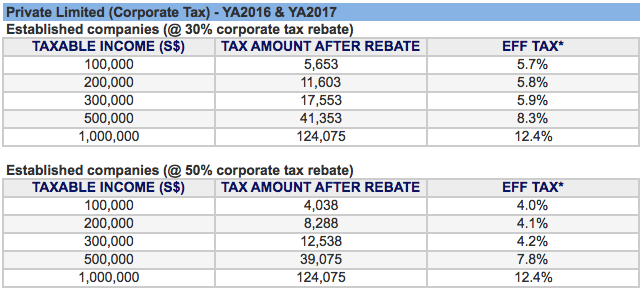

30 Corporate Income Tax Rebate Web Corporate Income Tax Rebates Corporate Income Tax Rate Your company is taxed at a flat rate of 17 of its chargeable income This applies to both local and foreign

Web YA 2020 onwards 75 exemption on the first 100 000 of normal chargeable income and a further 50 tax exemption on the next 100 000 of normal chargeable income YA Web 16 f 233 vr 2021 nbsp 0183 32 Corporate income tax The corporate income tax rate remains at 17 with a partial tax exemption on the first SGD 200 000 of a company s normal chargeable

30 Corporate Income Tax Rebate

30 Corporate Income Tax Rebate

https://static1.squarespace.com/static/55b79c7fe4b0f338367f9329/t/56f7c11bac962c8475209b2d/1459077422156/50%25-corporate-tax-rebate-for-Singapore-companies

Fillable Form N 30 Corporation Income Tax Return 2013 Printable Pdf

https://data.formsbank.com/pdf_docs_html/281/2816/281644/page_1_thumb_big.png

Corporate Tax Rebate Budget 2022 Rebate2022

https://www.rebate2022.com/wp-content/uploads/2023/05/latest-income-tax-slab-rates-for-fy-2022-23-ay-2023-24-budget-2022.jpg

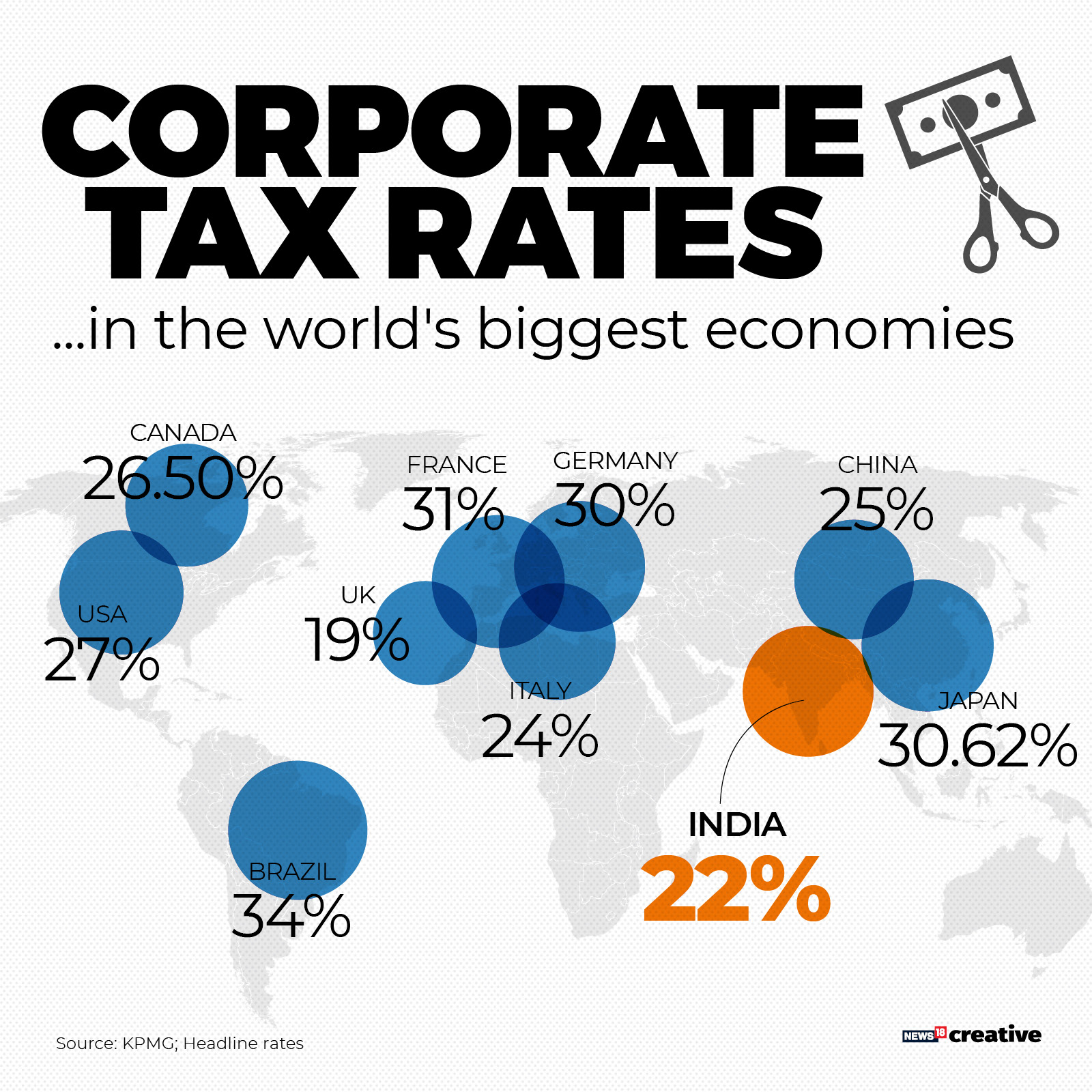

Web 23 juin 2021 nbsp 0183 32 The corporate tax rate in Singapore is a single tier territorial based flat rate system The effective tax rate is one of the lowest in the world and contributes to the Web 23 f 233 vr 2022 nbsp 0183 32 The corporate income tax rate would remain at 17 for year of assessment 2022 with no corporate income tax rebate proposed A minimum effective tax rate

Web The corporate income tax rate remains at 17 with a partial tax exemption on the first SGD 200 000 of a company s normal chargeable income No corporate income tax Web 14 mars 2023 nbsp 0183 32 If the chargeable income falls between the range of S 10 000 and S 200 000 or the next S 190 000 you ll be granted a 50 exemption for the next

Download 30 Corporate Income Tax Rebate

More picture related to 30 Corporate Income Tax Rebate

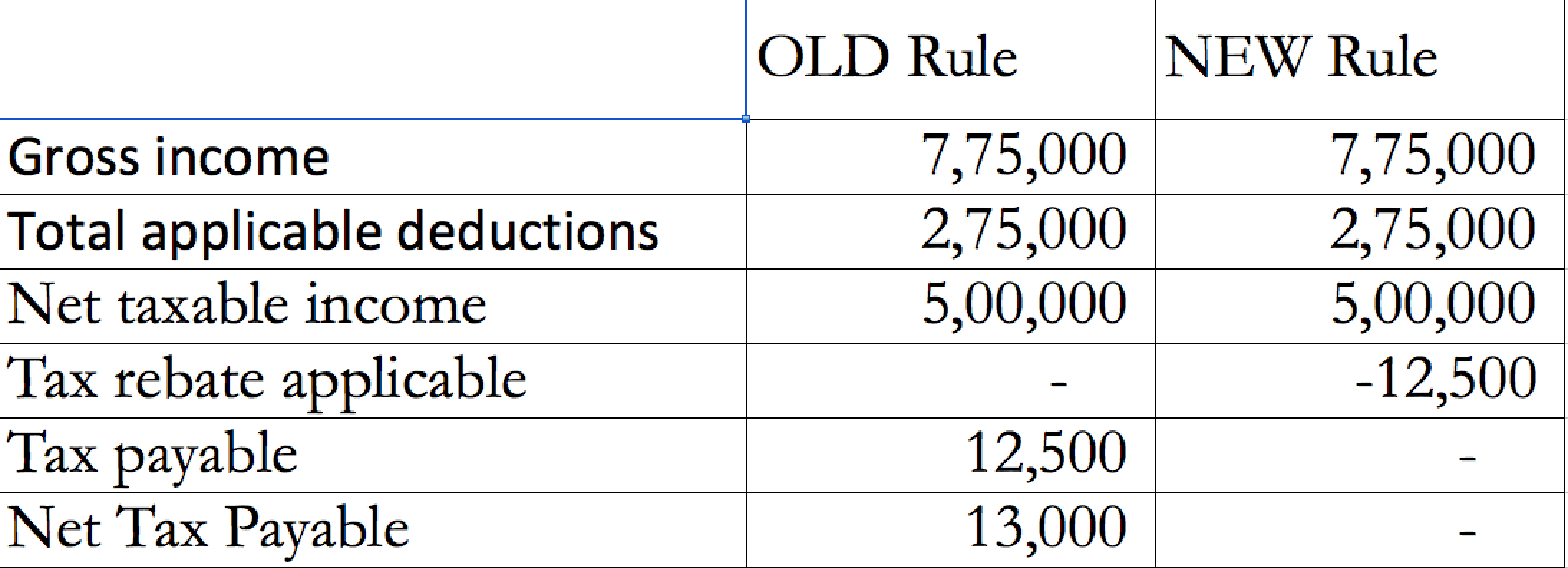

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

https://images.news18.com/ibnlive/uploads/2023/02/83255640-2381-4550-9fb8-1f5c2c312a75.jpg?impolicy=website&width=0&height=0

Tax Services Singapore File Tax Returns On Time Company Taxation

https://www.accountingsolutionssingapore.com/wp-content/uploads/CIT-2018.jpg

Form N 30 Download Fillable PDF Or Fill Online Corporation Income Tax

https://data.templateroller.com/pdf_docs_html/1898/18981/1898160/form-n-30-2018-corporation-income-tax-return-hawaii_big.png

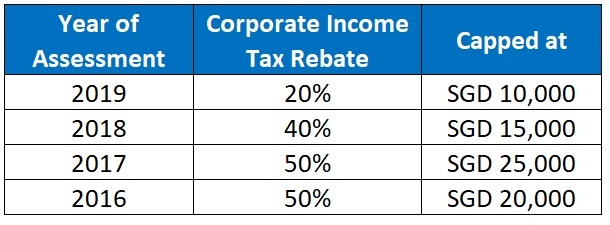

Web February 2 2022 What s in the article Corporate Income Tax Exemption Schemes Corporate Income Tax CIT Rebate for YAs 2013 to 2020 There s no denying that Web Corporate income tax rate and rebate The corporate income tax rate would remain at 17 for year of assessment YA 2023 with no corporate income tax rebate proposed

Web 25 mars 2020 nbsp 0183 32 Through a new wage subsidy scheme employers will be able to receive a 1 500 payment per retained worker every two weeks Businesses qualify for the subsidy Web 15 mars 2020 nbsp 0183 32 Corporate Income Tax Rebate Singapore Budget 2020 15 03 2020 To help businesses cushion the economic impact of the COVID 19 outbreak the

Deferred Tax And Temporary Differences The Footnotes Analyst

https://www.footnotesanalyst.com/wp-content/uploads/2022/04/FAG-DT1.png

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

https://www.iras.gov.sg/taxes/corporate-income-tax/basics-of-corporate...

Web Corporate Income Tax Rebates Corporate Income Tax Rate Your company is taxed at a flat rate of 17 of its chargeable income This applies to both local and foreign

https://www.singaporecompanyincorporation.sg/faqs/tax-exemptions-for...

Web YA 2020 onwards 75 exemption on the first 100 000 of normal chargeable income and a further 50 tax exemption on the next 100 000 of normal chargeable income YA

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

Deferred Tax And Temporary Differences The Footnotes Analyst

How Do I Find Out About Tax Rebate Tax Walls

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

Happy Bright Day Quotes

Happy Bright Day Quotes

Why Invest In India Through A Singapore Company Rikvin Pte Ltd

What The Corporate Tax Cuts Mean For India In Four Charts Forbes India

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

30 Corporate Income Tax Rebate - Web 23 juin 2021 nbsp 0183 32 The corporate tax rate in Singapore is a single tier territorial based flat rate system The effective tax rate is one of the lowest in the world and contributes to the