30 Deduction On Rental Income Under New Tax Regime Explore the exemptions and deductions allowed under the new tax regime for FY 2023 24 AY 2024 25 Learn about the options available to taxpayers and make informed decisions to optimize tax efficiency

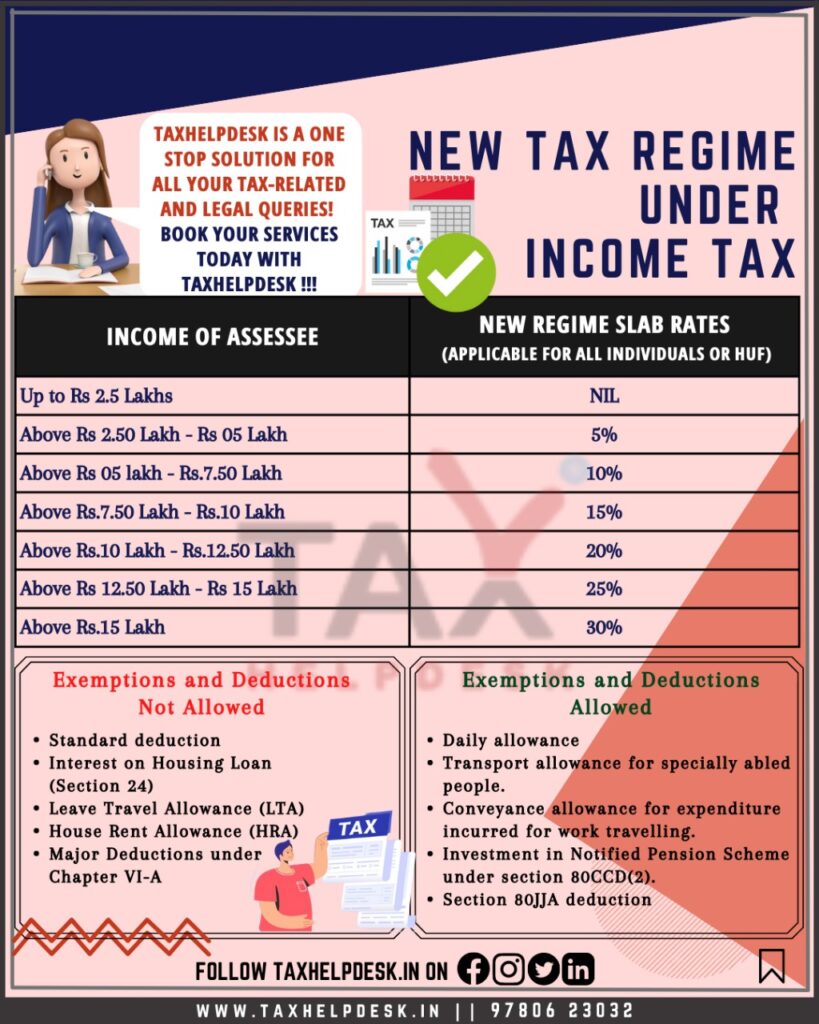

Let out house If you are earning a rental income from house property then you can claim certain deductions in the new tax regime under income tax laws So for these Ans Person earning rent income gets 30 deduction and same will continue under new regime along with interest on housing loan for rented property Under new tax regime

30 Deduction On Rental Income Under New Tax Regime

30 Deduction On Rental Income Under New Tax Regime

https://taxwithholdingestimator.com/wp-content/uploads/2021/08/standard-deduction-for-salary-ay-2021-22-standard.jpg

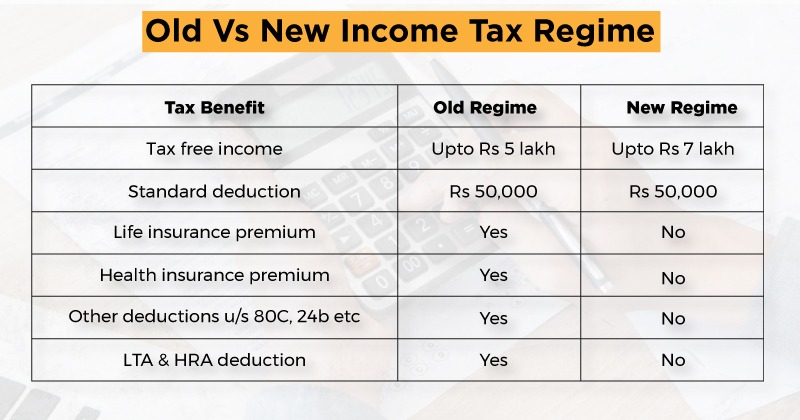

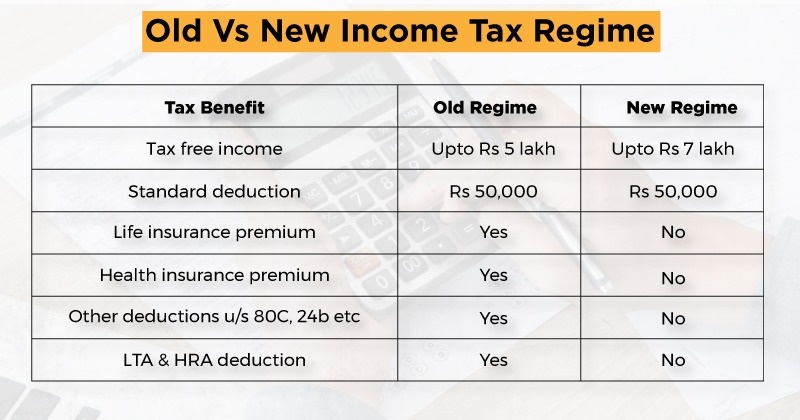

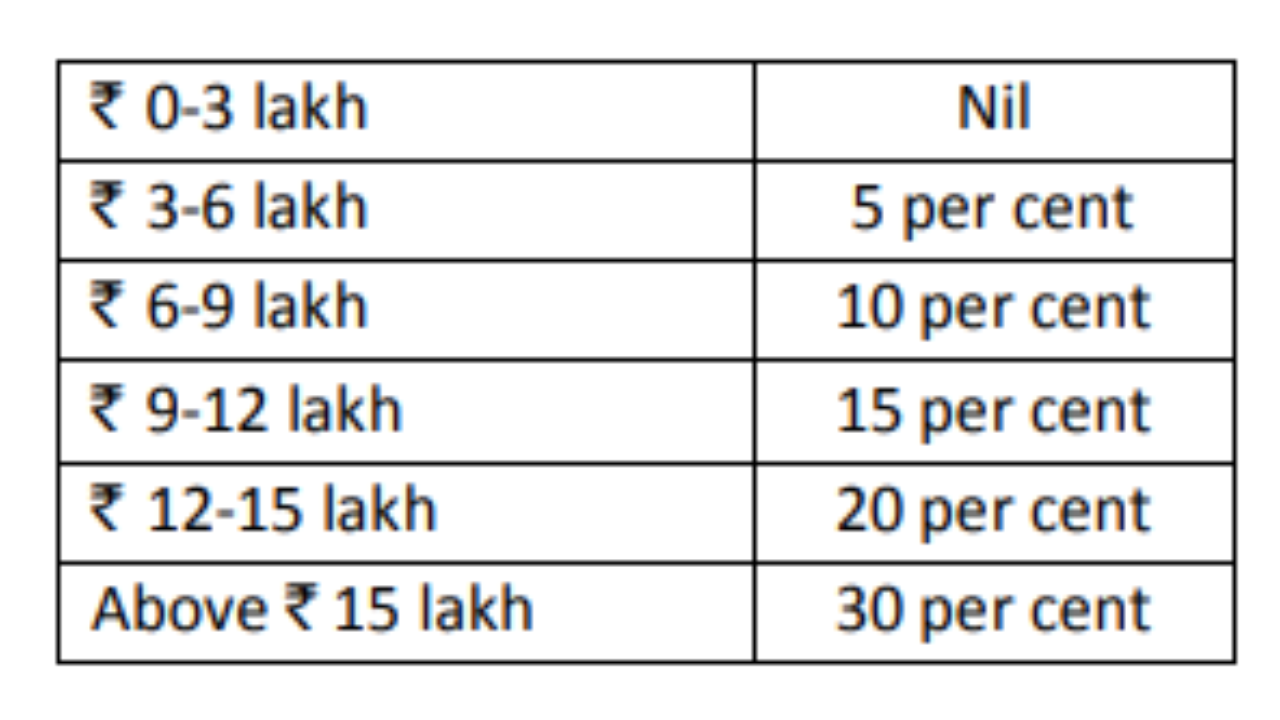

Old Vs New Tax Regime Which One To Pick

https://im.indiatimes.in/content/2023/Feb/Old-Vs-New-Tax-Regime-Which-One-To-Pick-After-Budget-2023_63db747264d86.jpg

Rental Property Tax Deductions A Comprehensive Guide Credible Cash

https://i.pinimg.com/originals/8e/f4/2c/8ef42c9ab3dffc9b087a7a496909a1de.png

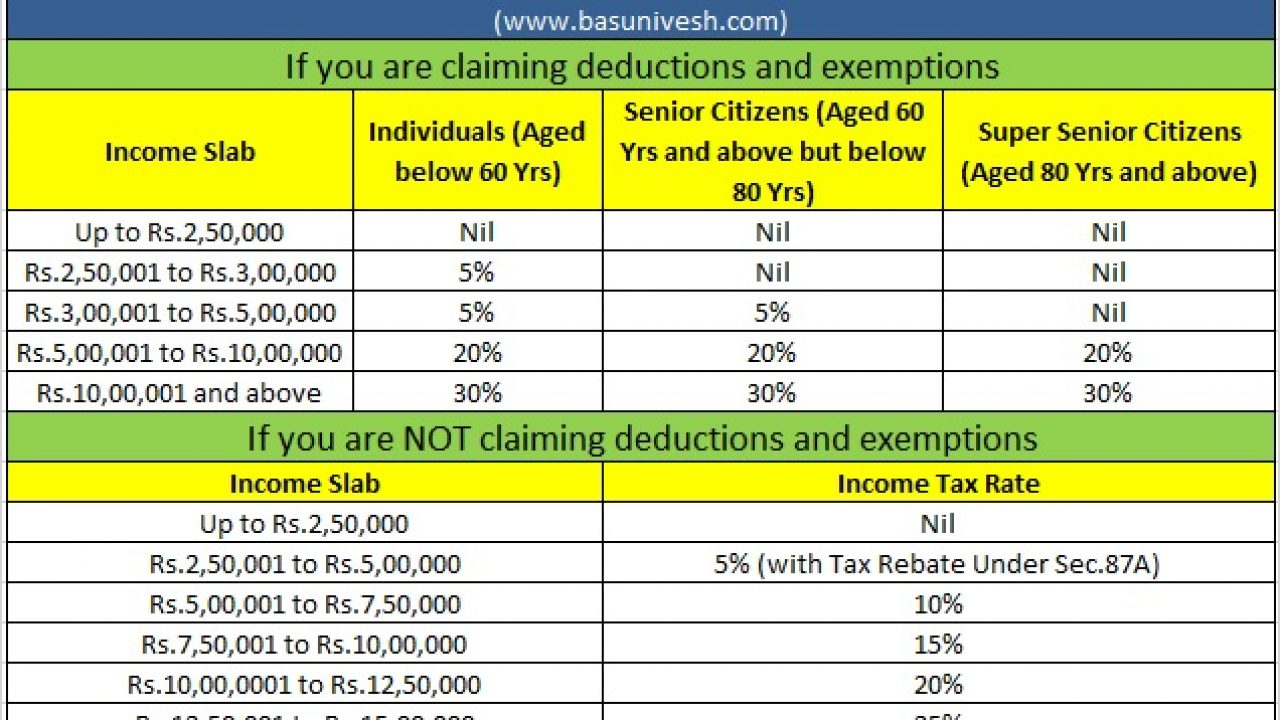

You can claim a standard deduction of 30 of the notional NAV municipal taxes paid and home loan interest limited to the rental income Deductions that can be claimed from Standard Deduction A 30 standard deduction on NAV is allowed to cover repairs maintenance and other associated costs Home Loan Interest If the property is financed

From the Net Annual Value NAV deduct 30 percent which is the standard deduction permissible under Section 24A of the Income Tax Act If the owner has taken out a Rented Out House If the house has been rented out one can claim deductions for municipality tax a standard deduction of 30 per cent and the interest on the home loan under the new tax

Download 30 Deduction On Rental Income Under New Tax Regime

More picture related to 30 Deduction On Rental Income Under New Tax Regime

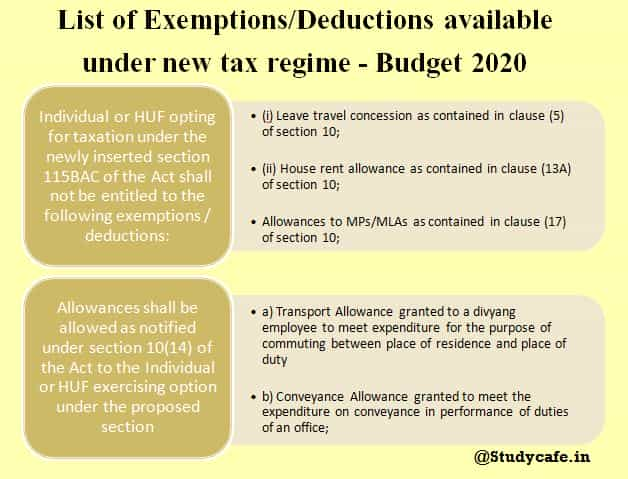

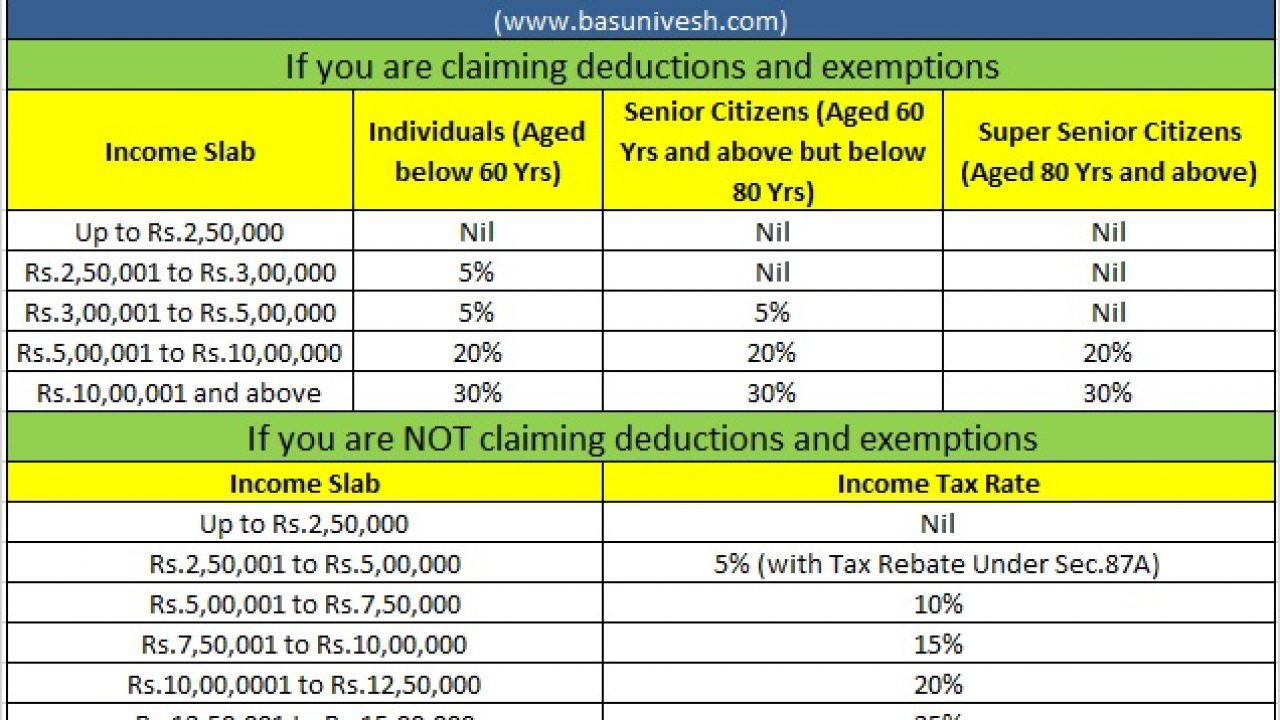

Deductions Allowed Under The New Income Tax Regime Paisabazaar Com

https://studycafe.in/wp-content/uploads/2020/02/List-of-ExemptionsDeductions-available-under-new-tax-regime-Budget-2020-1.jpg

Income Tax Under New Regime Understand Everything

https://www.taxhelpdesk.in/wp-content/uploads/2022/06/New-Regime-under-Income-Tax-819x1024.jpeg

Income Tax Calculator 2023 24 Check Your Taxable Income Under New Tax

https://images.indianexpress.com/2023/01/income-tax-1200.jpg

I receive rent of 3 lakh per annum by letting out a house I own in another city Now can I take the 30 per cent deduction on rent amount and opt for the new tax regime House on Lease If you generate a rental income from house property you may be able to claim certain deductions under the new tax system under income tax legislation So in the new tax regime the interest on a

Interest on let out property Both old and new tax regimes allow deduction of interest paid on a home loan for let out properties This deduction reduces the taxable rental Thus the summary of deductions under Income from house property is as under 1 In case of Rented property Standard deduction of 30 available Interest paid for rented

Old Income Tax Regime Vs New Regime Filing Of Return After Due Date

https://cachandanagarwal.com/wp-content/uploads/2022/03/Income-Tax-3-1024x576.jpeg

Opt New Tax Regime If Deduction Exemption Claims Less Than Rs 3 75

https://akm-img-a-in.tosshub.com/indiatoday/images/story/202302/ezgif.com-gif-maker_78-sixteen_nine.jpg?VersionId=xUwpmYRrPS0rtimFBRBauVHLpBCu3Uq9&size=690:388

https://taxguru.in › income-tax

Explore the exemptions and deductions allowed under the new tax regime for FY 2023 24 AY 2024 25 Learn about the options available to taxpayers and make informed decisions to optimize tax efficiency

https://economictimes.indiatimes.com › wealth › tax › ...

Let out house If you are earning a rental income from house property then you can claim certain deductions in the new tax regime under income tax laws So for these

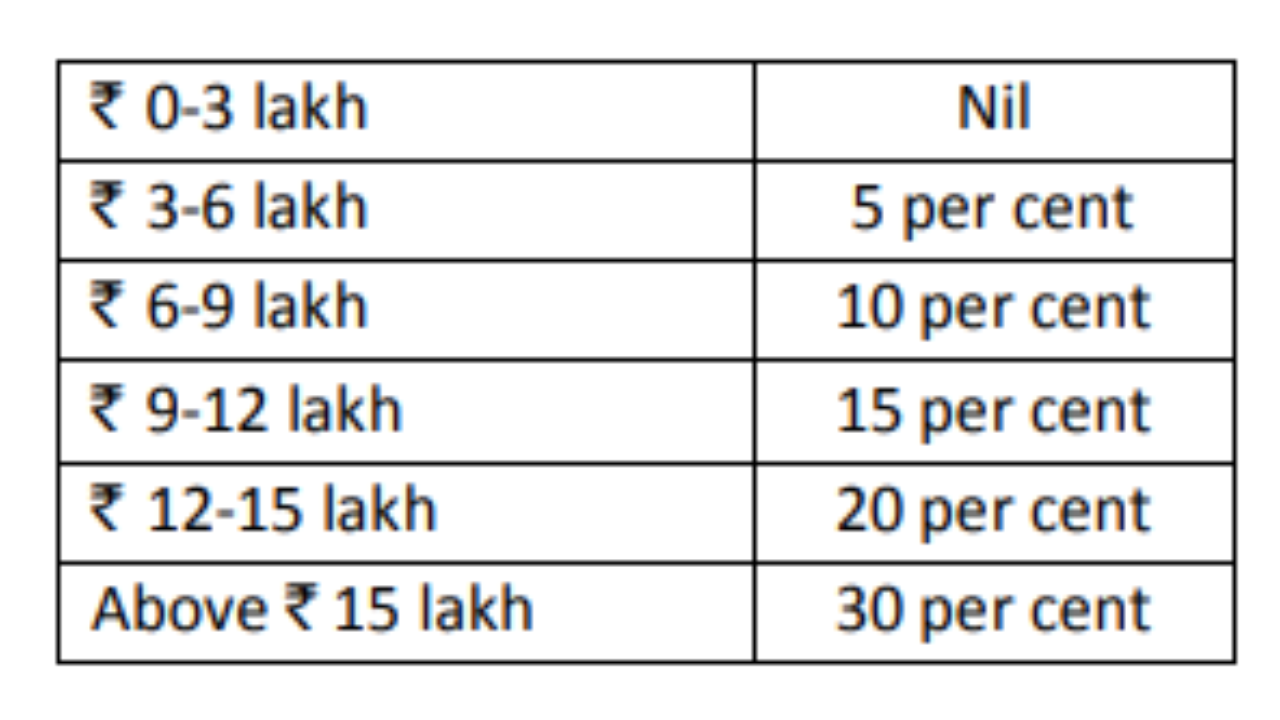

For Family Pensioners New Income Tax Slabs 2023 24 Deductions You

Old Income Tax Regime Vs New Regime Filing Of Return After Due Date

Budget 2023 What Could The FM Do To Make The New Regime Attractive To

Special Tax Deduction On Rental Reduction Latest Updated 15 June 2020

INTRODUCTION OF SECTION 115BAC TO INCOME TAX ACT 1961 Onfiling Blog

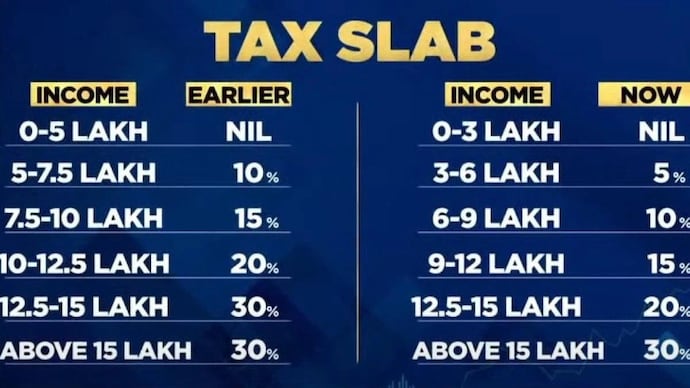

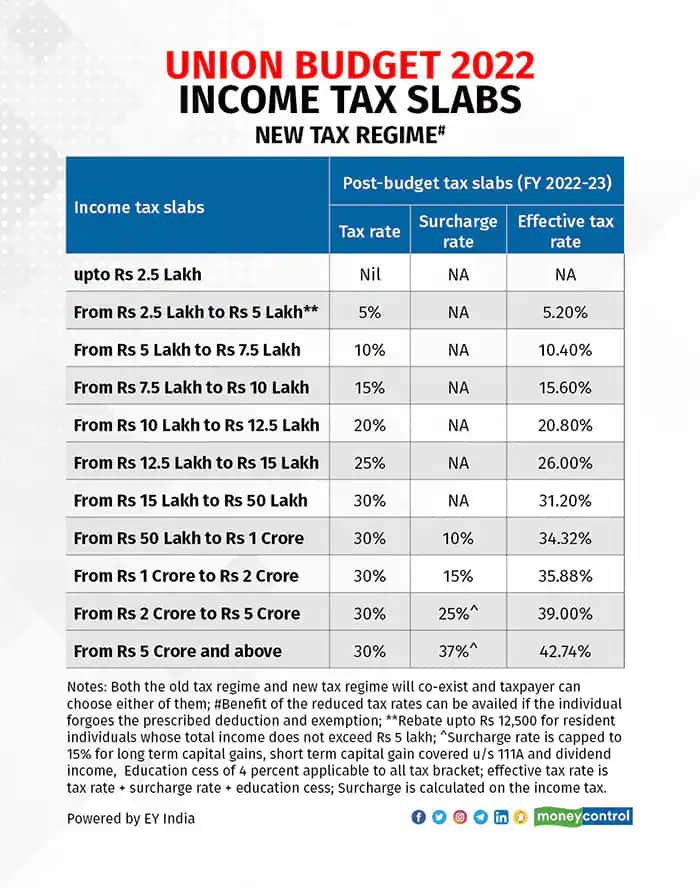

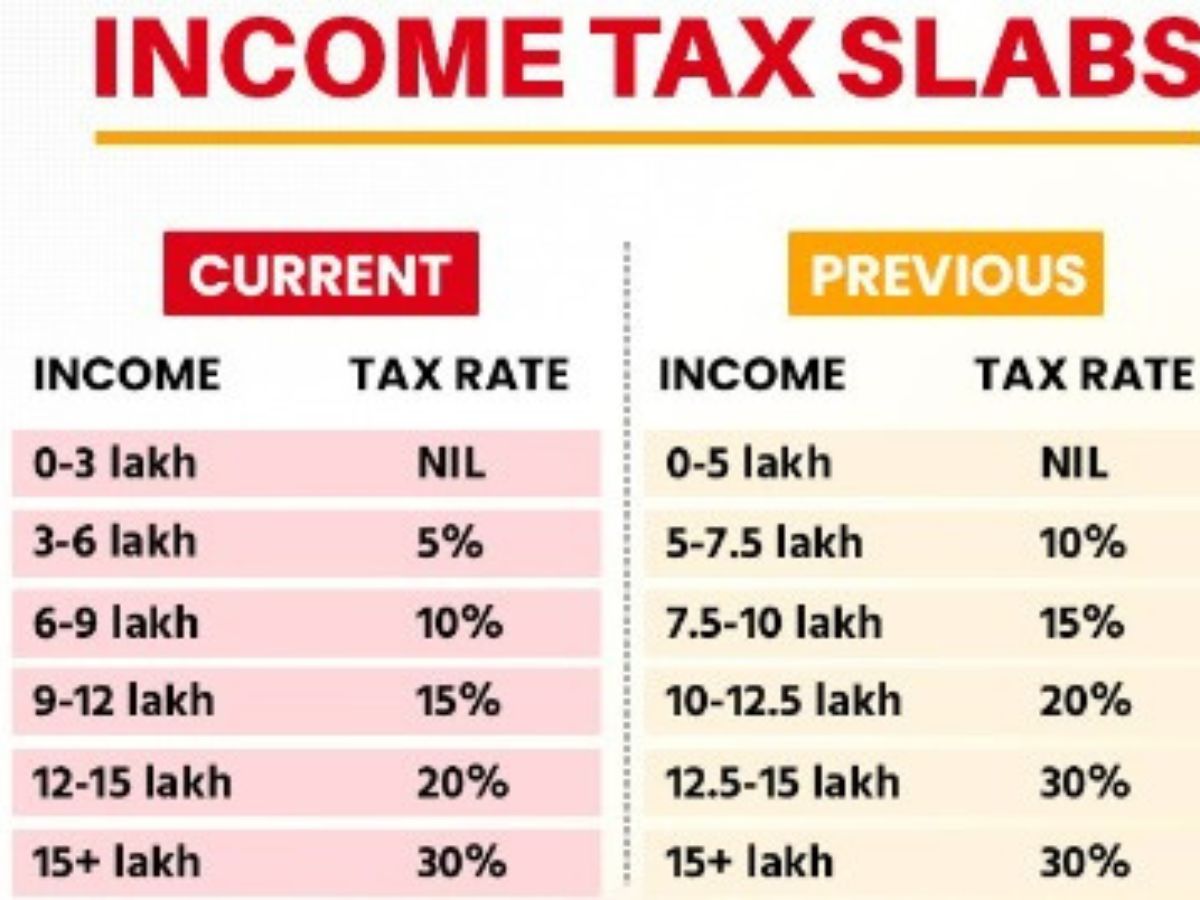

New Income Tax Regime Changes In Tax Slabs And Rebate Limits See

New Income Tax Regime Changes In Tax Slabs And Rebate Limits See

Budget 2023 Tax Saving Under New Tax Regime Vs Old Tax Regime For Rs 7

Rebate Limit New Income Slabs Standard Deduction Understanding What

Deductions Under The New Tax Regime Budget 2020 Blog By Quicko

30 Deduction On Rental Income Under New Tax Regime - Standard Deduction of 30 under section 24 a on Rental Income from Rented Property Interest on Sukanya Samruddhi Yojana Interest on Housing Loan up to Rs 2 00 000 under section