30 Deduction On Rental Income As per Sethuraman the 30 standard deduction provision results in only Rs 7 lakh as taxable income out of the total Rs 10 lakh collected as rent As Rs 7 lakh is tax free under New Regime

Let out house If you are earning a rental income from house property then you can claim certain deductions in the new tax regime under income tax laws So for these Standard Deduction of 30 You can claim a 30 deduction on the net annual value after deducting property taxes of your property regardless of the actual expenses for

30 Deduction On Rental Income

30 Deduction On Rental Income

https://taxwithholdingestimator.com/wp-content/uploads/2021/08/standard-deduction-for-salary-ay-2021-22-standard.jpg

Special Tax Deduction On Rental Reduction Extension Jan 20 2022

https://cdn1.npcdn.net/image/1642686079f1fe8a348162e3762ee96d0d06b3984c.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

Rental Property Tax Deductions A Comprehensive Guide Credible Cash

https://i.pinimg.com/originals/8e/f4/2c/8ef42c9ab3dffc9b087a7a496909a1de.png

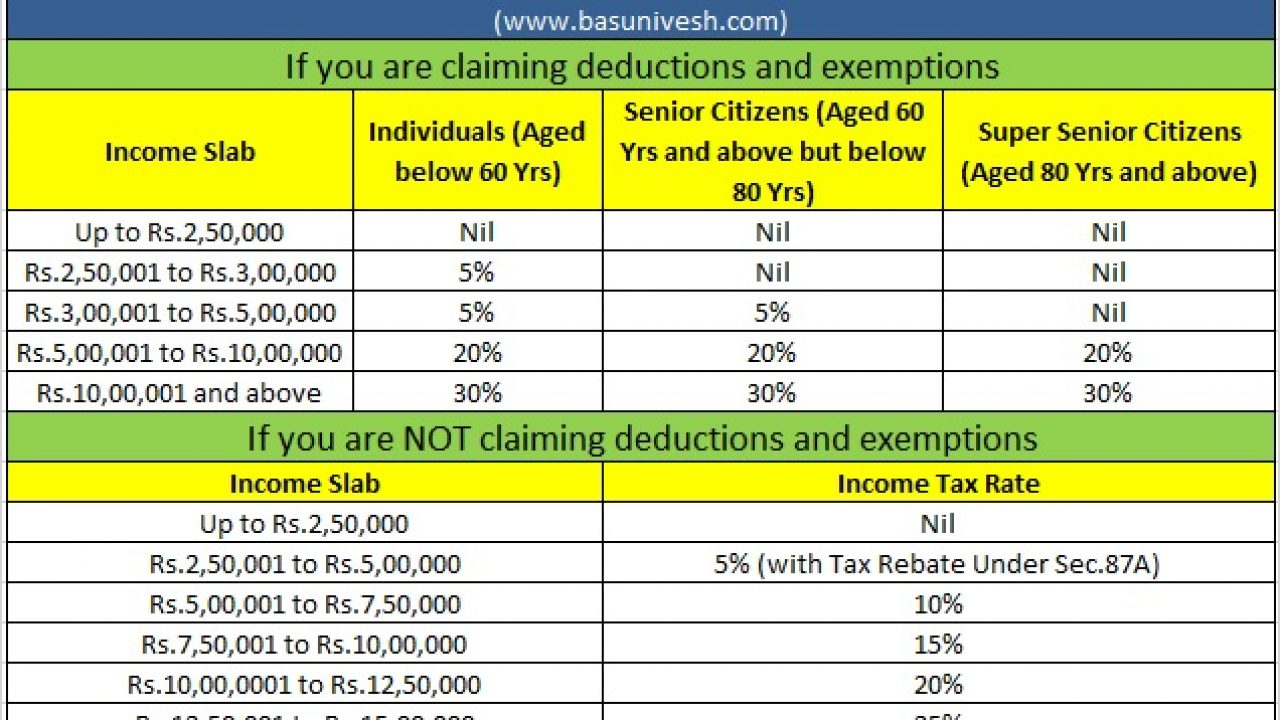

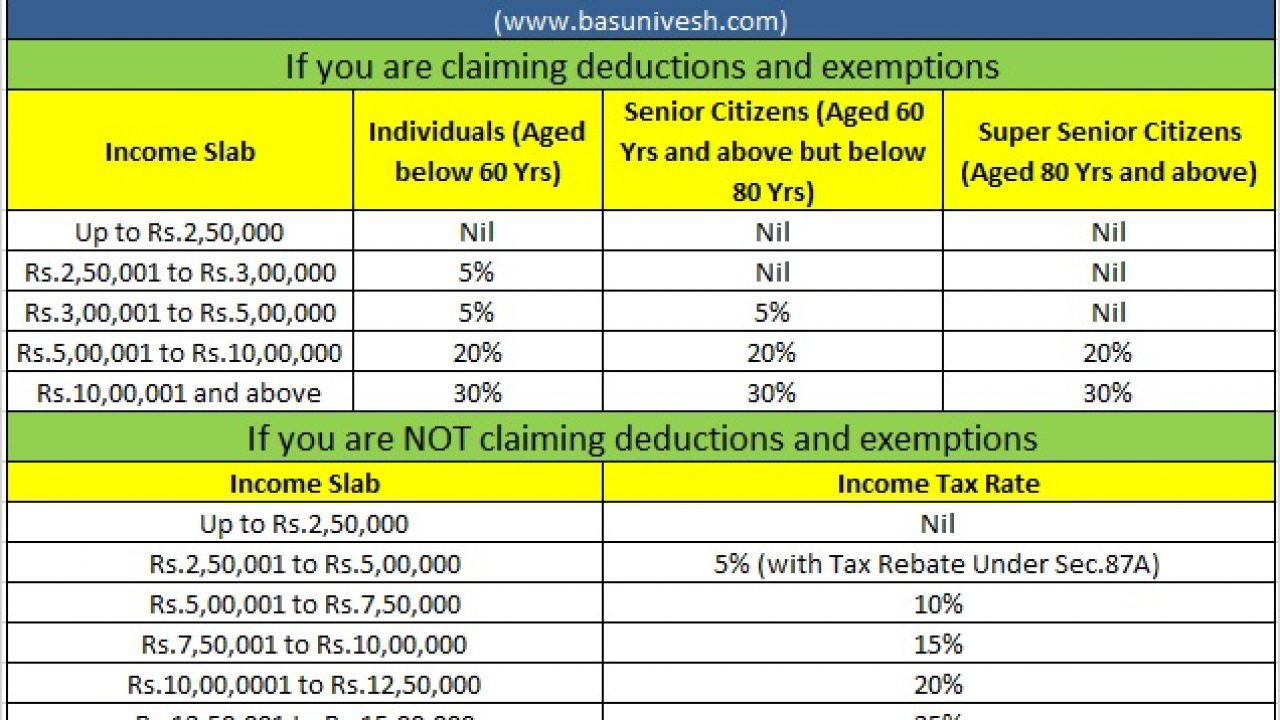

You can apply a 30 standard deduction on net asset value gross rent received less property taxes paid by the landlord to arrive at net income from house and property Standard Deduction A 30 standard deduction on NAV is allowed to cover repairs maintenance and other associated costs Home Loan Interest If the property is financed

Rented Out House If the house has been rented out one can claim deductions for municipality tax a standard deduction of 30 per cent and the interest on the home loan under the new tax If you are a landlord who derives rental income through letting out of his her house property then you must know how to calculate net annual value NAV Read here to find out

Download 30 Deduction On Rental Income

More picture related to 30 Deduction On Rental Income

Deduction For Expenditure On Provision Of Employees Accommodation

https://cdn1.npcdn.net/image/16456087501d867d0beebb071a13d3f54d9928ab04.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

Special Tax Deduction On Rental Reduction Latest Updated 15 June 2020

https://chengco.com.my/wp/wp-content/uploads/2020/04/Special-Tax-Deduction-on-Rental-Reduction-15-June-2020_Eng-Cover-scaled.jpg

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

From the rental income a property owner is allowed to deduct municipal taxes on the property rent that is not realised a 30 standard deduction on the annual value of the property as well as interest on the If your property is rented then a flat 30 deduction is allowed from the rental income each year for such repairs irrespective of expenditure incurred

Deductions under Section 24 include a 30 standard deduction on NAV and interest on loans taken for property acquisition or construction with certain limitations on Section 30 of the Income tax Act 1961 allows businesses to claim deductions for rent repairs property taxes and insurance premiums on buildings used for business purposes These

Potentially Bigger Tax Breaks In 2023

https://static.fmgsuite.com/media/InlineContent/originalSize/984f6148-60aa-49b7-971c-fb3554606b40.jpg

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

https://www.financialexpress.com › money …

As per Sethuraman the 30 standard deduction provision results in only Rs 7 lakh as taxable income out of the total Rs 10 lakh collected as rent As Rs 7 lakh is tax free under New Regime

https://economictimes.indiatimes.com › wealth › tax › ...

Let out house If you are earning a rental income from house property then you can claim certain deductions in the new tax regime under income tax laws So for these

Deduction

Potentially Bigger Tax Breaks In 2023

Claiming Rental Income Deductions Which News

Rental Reduction For SME Tenants Special Tax Deduction

Do Nonprofits Pay Taxes On Rental Income Hassie Wolf

Allowable Deductions From Income While Filing Return Of Income

Allowable Deductions From Income While Filing Return Of Income

How Is Tax Deducted From Salary In Ghana TAX

Do I Qualify For The Qualified Business Income QBI Deduction Alloy

Standard Deduction For Fy 2023 24 In New Tax Regime Printable Forms

30 Deduction On Rental Income - 30 Standard Deduction on Rental Income The government offers a flat 30 deduction on your rental income This means that for any income you make from renting out