30 Standard Deduction On Rental Income Let out house If you are earning a rental income from house property then you can claim certain deductions in the new tax regime under income tax laws So for

As per Section 24A of the Income Tax Act a taxpayer is entitled to a 30 percent standard deduction from the rental income to cover expenses like Standard Deduction If you have bought a property for investment purpose and put it on rent then you can claim 30 of Net Asset Value as standard deduction

30 Standard Deduction On Rental Income

30 Standard Deduction On Rental Income

https://i.pinimg.com/originals/8e/f4/2c/8ef42c9ab3dffc9b087a7a496909a1de.png

Special Tax Deduction On Rental Reduction Extension Jan 20 2022

https://cdn1.npcdn.net/image/1642686079f1fe8a348162e3762ee96d0d06b3984c.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

Pay Deduction Calculator 2021 Tax Withholding Estimator 2021

https://taxwithholdingestimator.com/wp-content/uploads/2021/08/standard-deduction-for-salary-ay-2021-22-standard.jpg

Topic no 415 Renting residential and vacation property If you receive rental income for the use of a dwelling unit such as a house or an apartment you may If you own a rental property the IRS allows you to deduct expenses you pay for the upkeep and maintenance of the property conserving and managing the property

If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return These expenses may The rate of tax you ll pay on rental income depends on your total income for the year for example from wages or a pension Find out about the current Income

Download 30 Standard Deduction On Rental Income

More picture related to 30 Standard Deduction On Rental Income

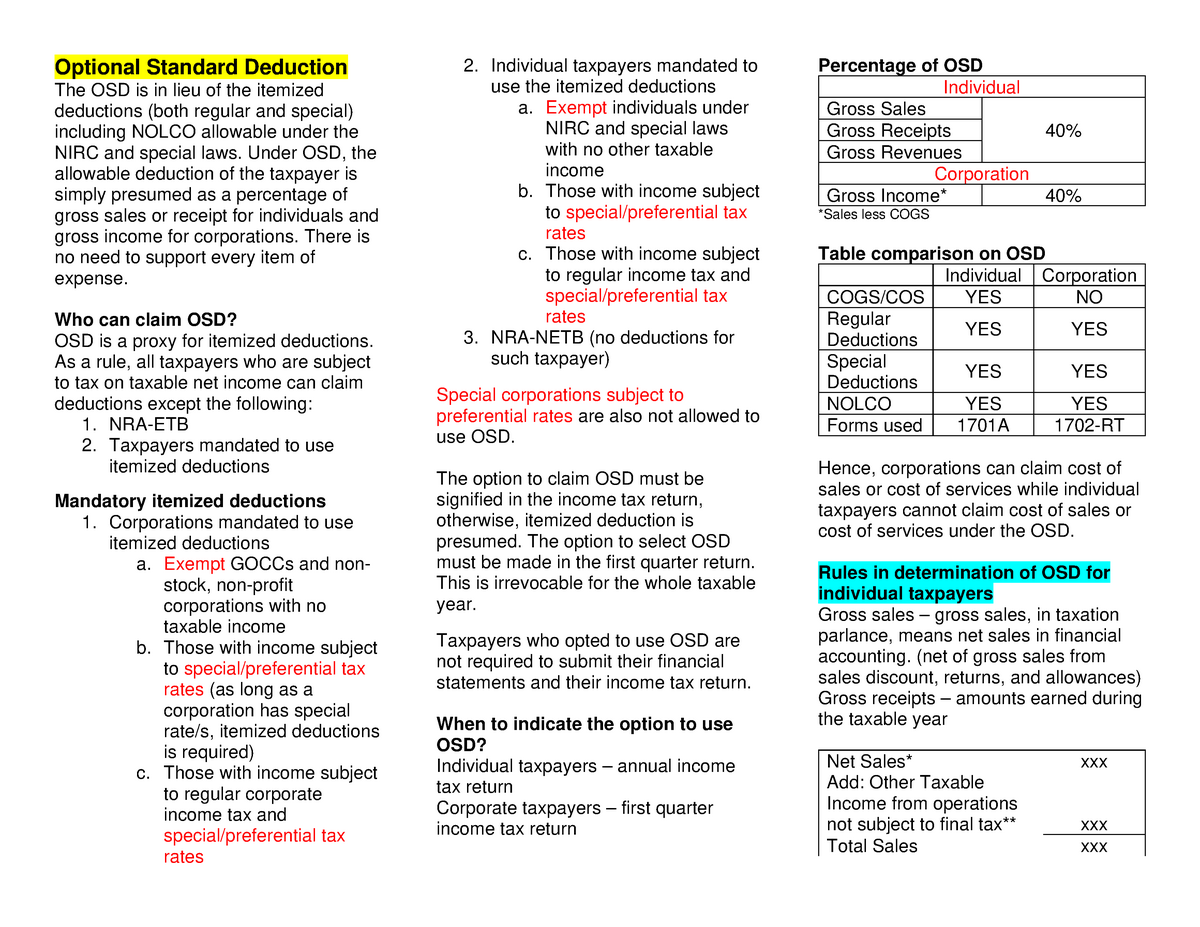

Optional Standard Deduction Revised Optional Standard Deduction The

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/c39899a1deafc80f6f822ef6c796b4c2/thumb_1200_927.png

Printable Itemized Deductions Worksheet

https://i2.wp.com/www.worksheeto.com/postpic/2011/02/federal-income-tax-deduction-worksheet_472256.jpg?crop=12

Mortgage Interest Tax Deduction What You Need To Know

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/BB1hW7J4.img?w=1920&h=1280&m=4&q=79

You can deduct the ordinary and necessary expenses of traveling away from home if the primary purpose of the trip is to collect rental income or to manage conserve or maintain your rental property A standard deduction of 30 on Rental income after deducting municipal taxes is provided for maintenance No additional deduction related to sweeping

You re typically allowed to reduce your rental income by subtracting expenses that you incur to get your property ready to rent and then to maintain it as a The standard deduction u s 24 of 30 of NAV is allowed irrespective of actual expenditure incurred on insurance repairs water supply etc The taxpayer can

Special Tax Deduction On Rental Reduction Latest Updated 15 June 2020

https://chengco.com.my/wp/wp-content/uploads/2020/04/Special-Tax-Deduction-on-Rental-Reduction-15-June-2020_Eng-Cover-scaled.jpg

How To Calculate Standard Deduction In Income Tax Act Scripbox

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/05/standard-deduction-income-tax.jpg

https://economictimes.indiatimes.com/wealth/tax/...

Let out house If you are earning a rental income from house property then you can claim certain deductions in the new tax regime under income tax laws So for

https://www.99acres.com/articles/how-is-rental-income-taxed.html

As per Section 24A of the Income Tax Act a taxpayer is entitled to a 30 percent standard deduction from the rental income to cover expenses like

Potentially Bigger Tax Breaks In 2023

Special Tax Deduction On Rental Reduction Latest Updated 15 June 2020

Optional Standard Deductions Example PDF Revenue Tax Deduction

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

10 Standard Deduction Worksheet For Dependents 2020 Worksheets Decoomo

10 Tax Deduction Worksheet Worksheeto

10 Tax Deduction Worksheet Worksheeto

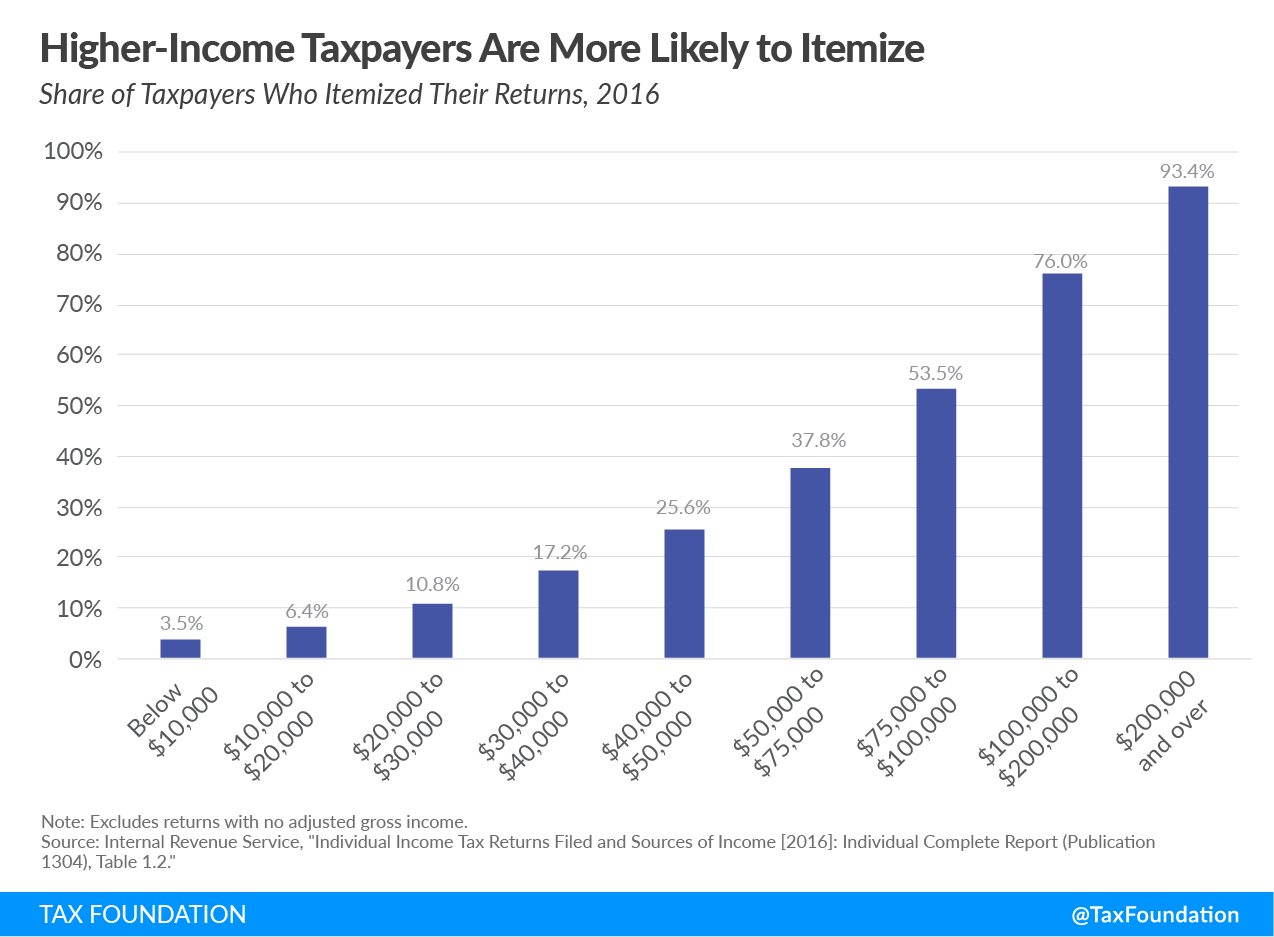

Itemized Deduction Who Benefits From Itemized Deductions

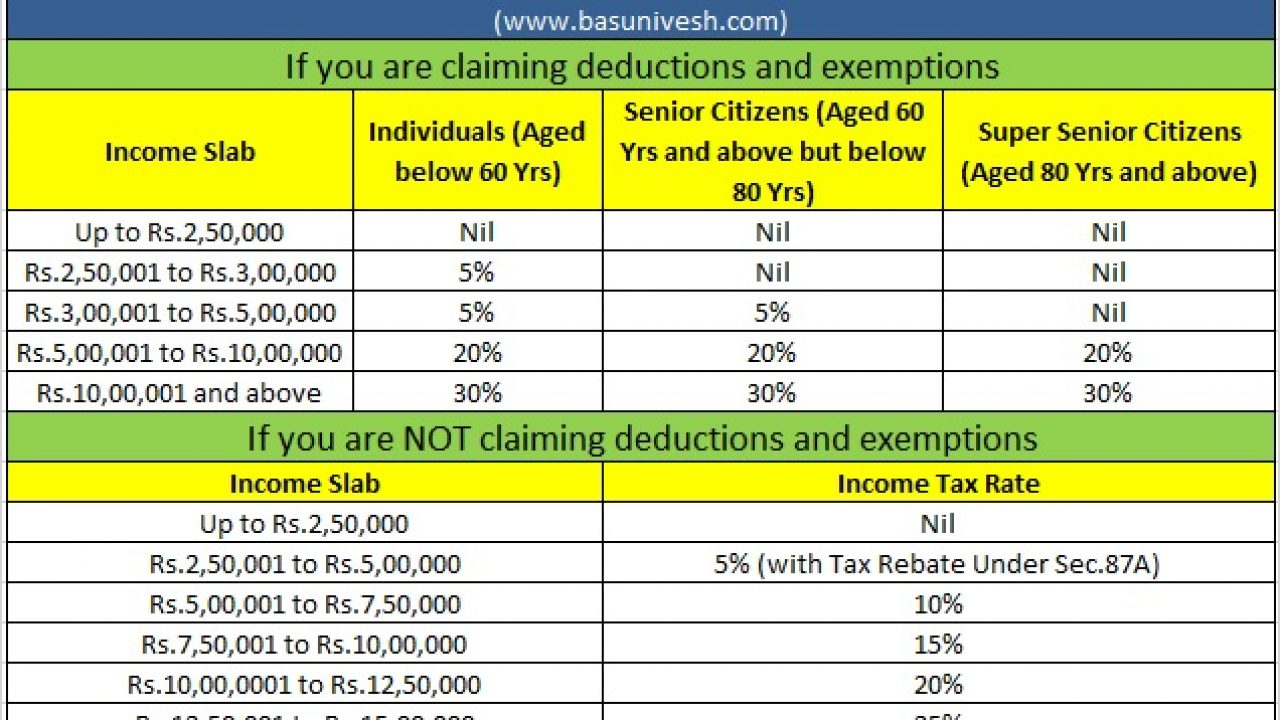

Tax Rates Absolute Accounting Services

Tax Deduction Letter Sign Templates Jotform

30 Standard Deduction On Rental Income - Taxability as HP provides or limits a standard deduction of 30 of the income along with a deduction on interest paid on borrowed capital for the purposes of