30 Tax Break Solar The Residential Clean Energy Credit also known as the solar investment tax credit or ITC is a tax credit for homeowners who invest in solar and or battery storage Thanks to the Inflation Reduction Act the 30 credit is

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate No Used property is not eligible for the federal solar tax credit

30 Tax Break Solar

30 Tax Break Solar

https://rikurenergy.b-cdn.net/wp-content/uploads/2020/03/AdobeStock_218390261-1200x675.jpeg

Solar Panels Free Stock Photo Public Domain Pictures

https://www.publicdomainpictures.net/pictures/250000/velka/solar-panels-151541185456U.jpg

Solar Stocks And Solar Flows

https://media.innovationorigins.com/2022/02/VXGJ4SjA-LV5iGzdc-WKvYMhQ4-DSC03549.jpg

Now the 30 tax credit is here until 2032 and the long term savings of solar are in reach for more Americans The Inflation Reduction Act has extended the 30 solar tax credit to 2032

The ITC will cut the cost of installing rooftop solar for a home by 30 or more than 7 500 for an average system By helping Americans get solar on their roofs these tax credits will help millions more families unlock an In 2024 the ITC currently allows both homeowners and businesses to claim 30 of their solar system costs as a tax credit The tax credit will stay at 30 for the next nine

Download 30 Tax Break Solar

More picture related to 30 Tax Break Solar

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

150K Tax Break Pickles AU

https://www.pickles.com.au/getmedia/3fb5df90-9af0-4461-9f2b-2b0937b5ed0f/industrial-tax-break.jpg.aspx?width=1500&height=1000&ext=.jpg

Renaldo Cano

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

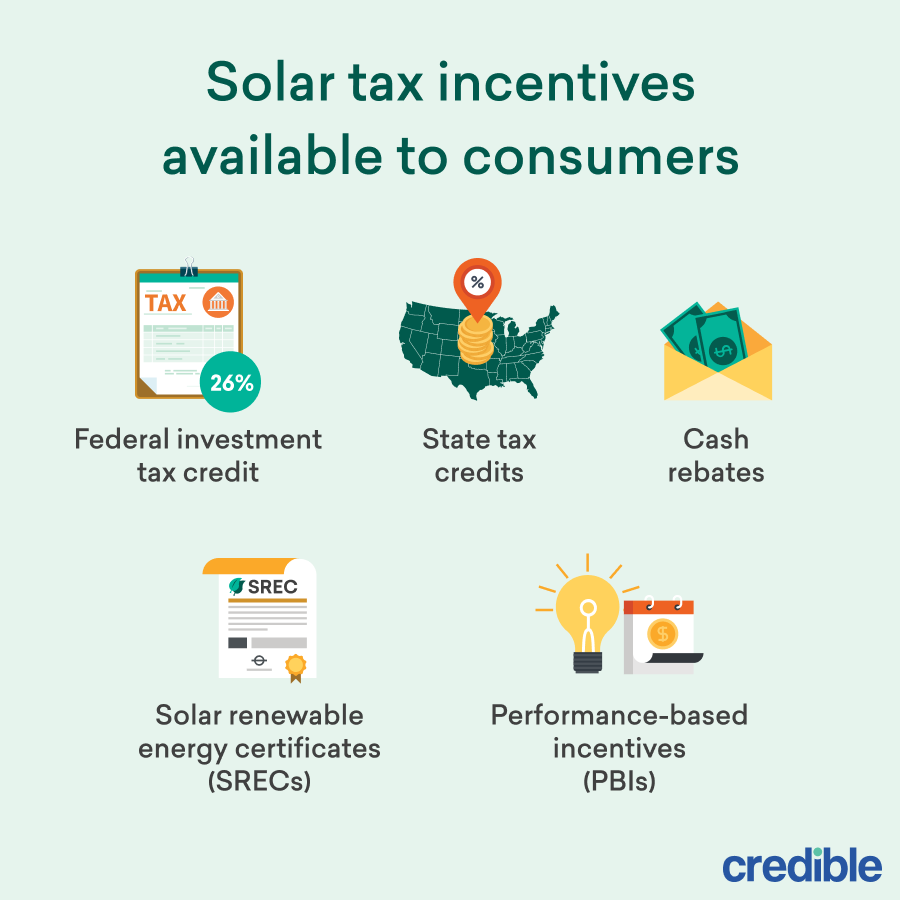

You can read our step by step guide on how to claim the federal solar tax credit for more details but here are the basic steps to know about claiming the tax credit The credit is only limited to 30 of qualified expenditures made for property placed in service in a given year

Here s how it works and who it works best for Since property taxes are locally collected some states allow local taxing authorities to offer this solar related tax incentive

Make Solar Panels With Broken Cells For Off grid Living The Power Of

https://us.solarpanelsnetwork.com/blog/wp-content/uploads/2021/07/Broken-Solar-Panel.jpg

10 Things To Know About 1 Million Tax Break On Center Software

https://www.oncenter.com/wp-content/uploads/2020/12/social_taxbreak_-scaled.jpg

https://www.solar.com › learn › how-to-fi…

The Residential Clean Energy Credit also known as the solar investment tax credit or ITC is a tax credit for homeowners who invest in solar and or battery storage Thanks to the Inflation Reduction Act the 30 credit is

https://www.irs.gov › credits-deductions › residential...

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate

Solar Panels Free Stock Photo Public Domain Pictures

Make Solar Panels With Broken Cells For Off grid Living The Power Of

There s A Tax Break Waiting For Owners Who Renovated This Year

Guide To Solar Energy Efficiency Tax Credits In 2023 Boston Solar

The Local Tax Break Many Retirees Don t Know About but Should

File Solar Panels In Ogiinuur jpg Wikipedia

File Solar Panels In Ogiinuur jpg Wikipedia

WHICH IS BETTER TAX CREDITS OR TAX DEDUCTIONS Tax Professionals

Solar Tax Credit Calculator NikiZsombor

5 Green Home Upgrades That Also Buy You A Tax Break solarpanels

30 Tax Break Solar - The Inflation Reduction Act has extended the 30 solar tax credit to 2032