30 Tax Credit Geothermal 30 for property placed in service after December 31 2021 and before January 1 2033 26 for property placed in service after December 31 2032 and before January 1

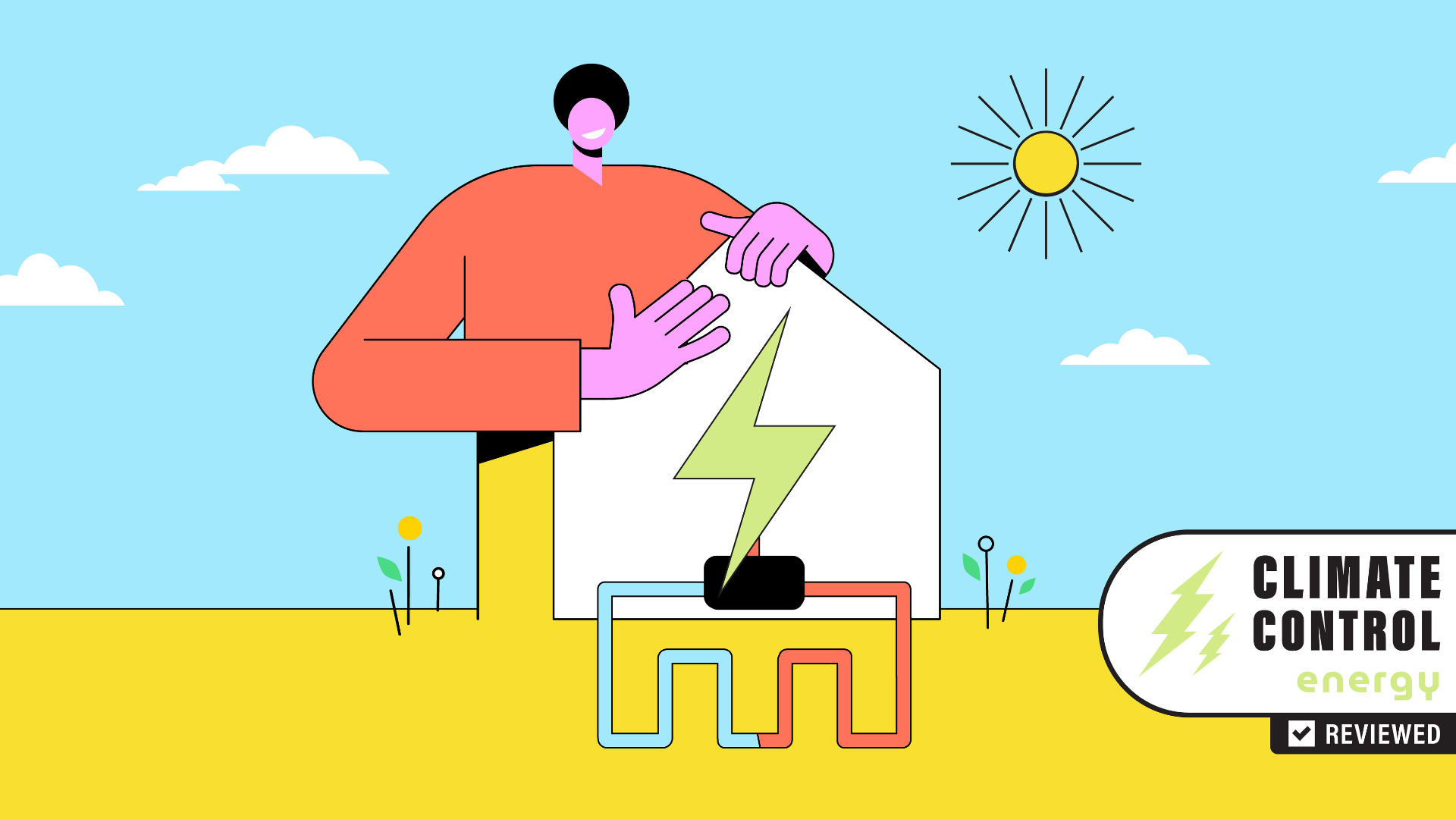

You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump Under the Inflation Reduction Act of 2022 IRA the federal tax credit for residential geothermal system installations was increased from 26 to 30 effective

30 Tax Credit Geothermal

30 Tax Credit Geothermal

https://news.mit.edu/sites/default/files/images/202206/MIT-Quaise-01-press.jpg

Geothermal Tax Credit Geothermal Experts In Hampton Roads 757 855

https://i.ytimg.com/vi/JgRY1AhszXI/maxresdefault.jpg

Understanding The Geothermal Tax Credit Extension

https://s3.us-east-1.amazonaws.com/uniqueheatingandcooling/UIC_geothermalTax_Image.jpg?mtime=20191021110124&focal=none

As we mentioned before the geothermal tax credit goes through cycles of reinstatement expiration and renewal within the U S legislative process In 2019 the tax credit was The Energy Credit In August 2022 the 30 tax credit for geothermal heat pump installations was extended through 2032 and can be retroactively applied to installations

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for a home in the United States installed anytime from A 30 federal tax credit for residential ground source heat pump installations has been extended through December 31 2032 The incentive will be lowered to 26 for systems that are installed in 2033 and 22 in

Download 30 Tax Credit Geothermal

More picture related to 30 Tax Credit Geothermal

Geothermal Energy Geothermal Energy

https://i.pinimg.com/originals/1b/5b/2b/1b5b2bb22e346c8cae48da09f846c165.jpg

Geothermal Energy Pros And Cons

http://1.bp.blogspot.com/-lYGPZ-z2qSs/UuqbU_g4w4I/AAAAAAAAAA8/qFZh4xKPkWg/s1600/file00076747836.jpg

Congress Extends Tax Benefits For Geothermal Heat Pumps Colorado

https://www.cogeothermal.com/wp-content/uploads/2020/09/image1-3-1510x1200.jpeg

The renewable energy tax credit covers 30 of the total system cost including installation of GeoThermal heat pumps meeting the requirements of the ENERGY STAR program For example the 30 federal tax credit paired with electrification rebates can decrease household geothermal project costs by up to 50 saving as much as

The Residential Clean Energy Property Credit is a 30 percent tax credit for certain qualified expenditures made by a taxpayer for residential energy eficient property eligible The geothermal tax credit was increased to 30 until 2032 Click here for the most recent information on the geothermal tax credit There is a 26 Federal Tax Credit available

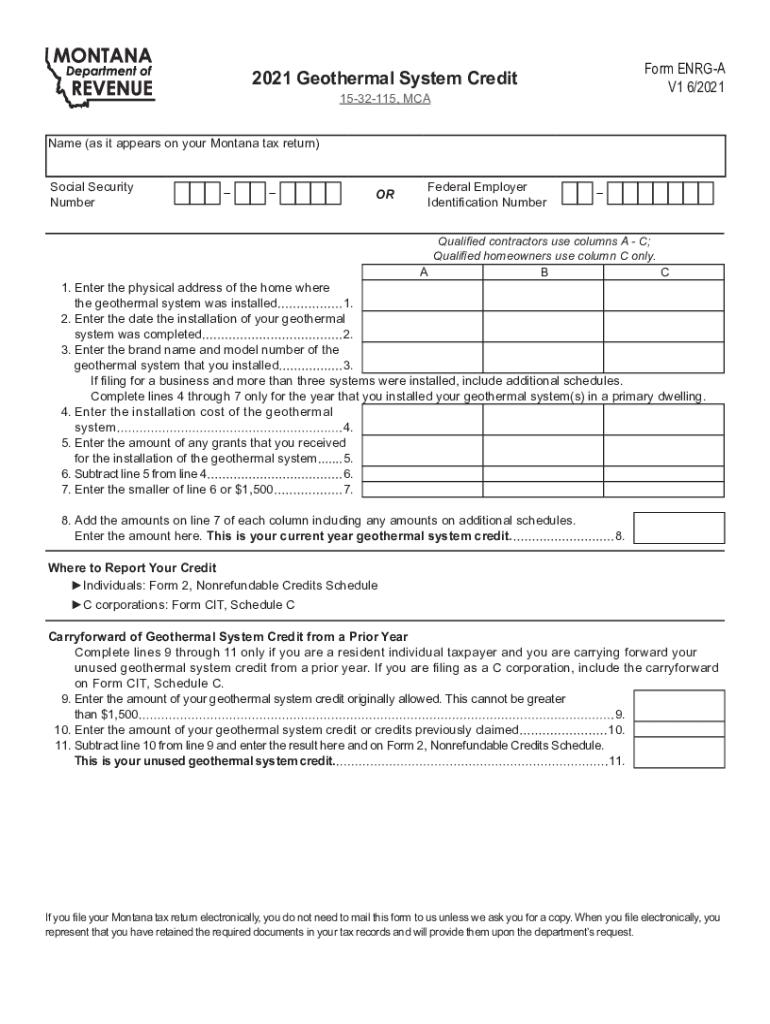

Fillable Online Understand The Geothermal Tax Credit Form Fill Out

https://www.signnow.com/preview/594/860/594860947/large.png

What Is The 2021 Geothermal Tax Credit ClimateMaster Geothermal HVAC

https://geothermal.climatemaster.com/wp-content/uploads/2021/01/2021-geothermal-tax-credits.jpg

https://www.energystar.gov/about/federal-tax...

30 for property placed in service after December 31 2021 and before January 1 2033 26 for property placed in service after December 31 2032 and before January 1

https://www.irs.gov/instructions/i5695

You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump

Learning To Cope Without The Geothermal Tax Credit 2017 03 01

Fillable Online Understand The Geothermal Tax Credit Form Fill Out

Agnus Good

What Is Geothermal Energy And Is It Right For You Flipboard

Pin On Green Home

Expiring Geothermal Tax Credits What Will The Industry Do ACCA HVAC

Expiring Geothermal Tax Credits What Will The Industry Do ACCA HVAC

30 Federal Tax Credit On GeoThermal Heat Pumps Symbiont Service

Geothermal Heating And Cooling Iowa City

4 Benefits Of Geothermal Well Drilling Hewitt Messenger Well Drilling

30 Tax Credit Geothermal - Installing a geothermal heat pump provides a renewable energy source that will lower your company s carbon footprint and utility bills The 10 percent federal tax