30 Tax Rebate On Geothermal Web 30 d 233 c 2022 nbsp 0183 32 The following Residential Clean Energy Tax Credit amounts apply for the prescribed periods 30 for property placed in service after December 31 2016 and

Web 3 d 233 c 2019 nbsp 0183 32 The federal tax credit initially allowed homeowners to claim 30 percent of the amount they spent on purchasing and installing a geothermal heat pump system from their federal income taxes The tax credit Web The renewable energy tax credit covers 30 of the total system cost including installation of GeoThermal heat pumps meeting the requirements of the ENERGY STAR program

30 Tax Rebate On Geothermal

30 Tax Rebate On Geothermal

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/geothermal-heating-cooling-systems-hauser-air-2.png

30 Federal Tax Credit On GeoThermal Heat Pumps Symbiont Service

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/30-federal-tax-credit-on-geothermal-heat-pumps-symbiont-service.png?w=1200&ssl=1

Geothermal Heat Pump Tax Rebate PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/what-incentives-rebates-are-available-for-geothermal-in-connecticut-2.png

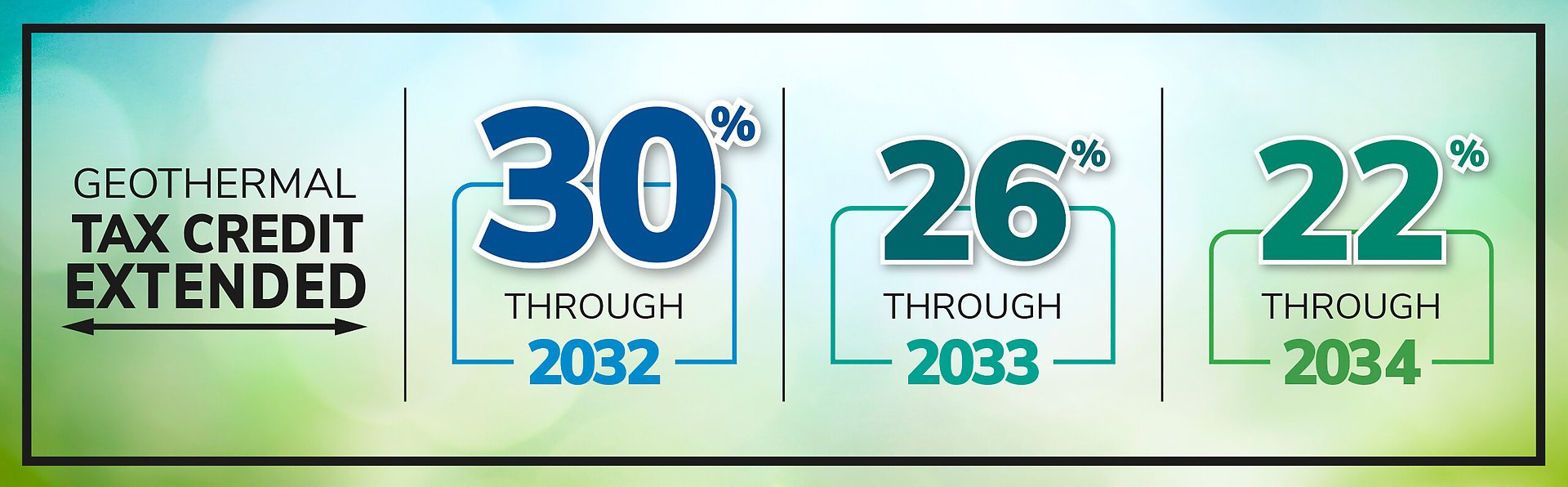

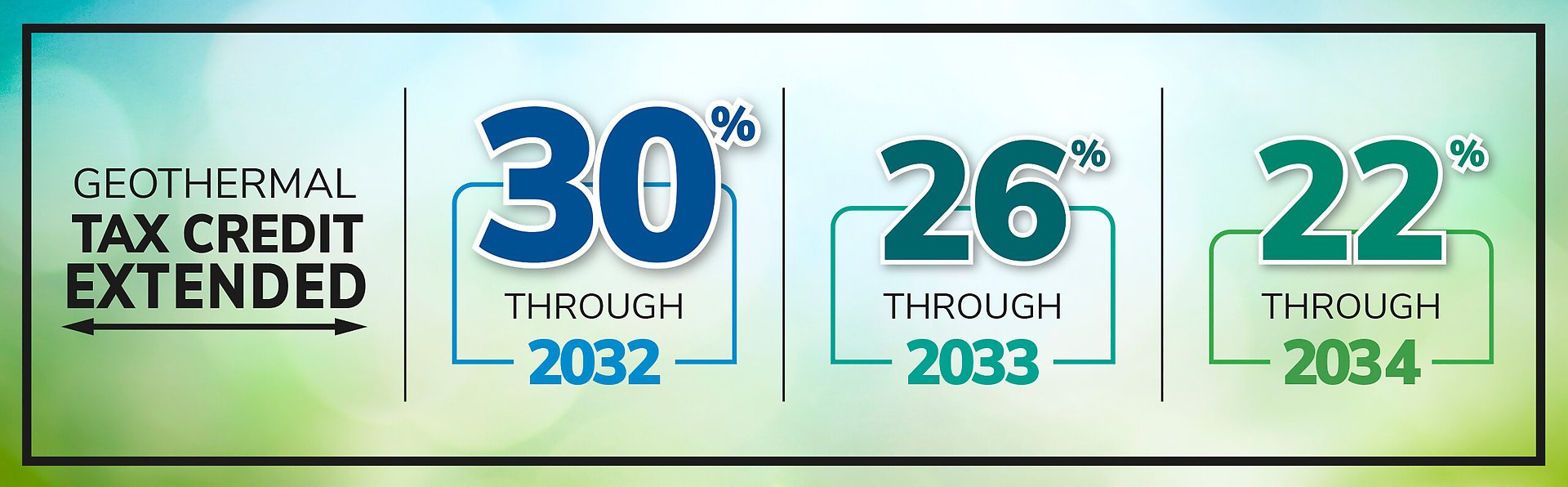

Web In August 2022 the 30 tax credit for geothermal heat pump installations was extended through 2032 and can be retroactively applied to installations placed in service on Web On a refundable tax credit you would receive a refund of 1 000 from the above example Since the Geothermal Tax Credit is non refundable you would not receive a refund if

Web A 30 federal tax credit for residential ground source heat pump installations has been extended through December 31 2032 The incentive will be lowered to 26 for systems that are installed in 2033 and 22 in Web In July a bill was introduced to the House and Senate to push for a five year extension of the 30 tax credit for Geothermal systems This would mean a 30 tax credit through 2024 a 26 tax credit in 2025 and a 22 tax

Download 30 Tax Rebate On Geothermal

More picture related to 30 Tax Rebate On Geothermal

Energystar gov Offers A Treasure Chest Of Goodies And Information For

https://i.pinimg.com/originals/bf/52/6c/bf526cf68d35913e33e2858d12cd8676.png

Nys Star Tax Rebate Checks 2022 StarRebate

https://i0.wp.com/www.starrebate.net/wp-content/uploads/2022/10/what-is-the-2021-geothermal-tax-credit-climatemaster-geothermal-hvac.jpg?fit=768%2C325&ssl=1

Form Rpd 41346 New Mexico Geothermal Ground Coupled Heat Pump Tax

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/form-rpd-41346-new-mexico-geothermal-ground-coupled-heat-pump-tax.png?w=530&ssl=1

Web A 30 tax credit for the installation of a ground source heat pump geothermal system with no cap was enacted in 2009 This Tax credit was available through the end of 2016 Web Homeowners can now receive 30 on the installation of new geothermal systems with federal tax credits offered because of the Inflation Reduction Act legislation passed in

Web 21 d 233 c 2022 nbsp 0183 32 30 of cost Heating Cooling and Water Heating Heat pumps 300 30 of cost up to 2 000 per year Heat pump water heaters Biomass stoves Geothermal Web 9 f 233 vr 2023 nbsp 0183 32 You ll get a 30 tax break for expenses related to qualified improvements that use alternative power like solar wind geothermal or biomass energy The tax credit

Vermont Energy Tax Credit Rebates Grants For Solar Wind And

https://i.pinimg.com/originals/34/0c/9c/340c9c4124f57767c3b9b5489ec3494e.jpg

Federal Tax Incentives Increased Extended For Geothermal Heat Pumps

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/federal-tax-incentives-increased-extended-for-geothermal-heat-pumps.jpg?w=800&ssl=1

https://www.energystar.gov/about/federal_tax_credits/geothermal_heat_p…

Web 30 d 233 c 2022 nbsp 0183 32 The following Residential Clean Energy Tax Credit amounts apply for the prescribed periods 30 for property placed in service after December 31 2016 and

https://dandelionenergy.com/federal-geother…

Web 3 d 233 c 2019 nbsp 0183 32 The federal tax credit initially allowed homeowners to claim 30 percent of the amount they spent on purchasing and installing a geothermal heat pump system from their federal income taxes The tax credit

Pin On REMODELING PROJECTS

Vermont Energy Tax Credit Rebates Grants For Solar Wind And

New Rebates On Heat Pumps In Massachusetts Maritime Geothermal

Energy Efficiency Tax Rebates Solar Energy Companies Energy

Geothermal Heat Geothermal Heat Pump Tax Credit PumpRebate

Geothermal Wins With New IRA Tax Credits HVAC Distributors

Geothermal Wins With New IRA Tax Credits HVAC Distributors

Geothermal Rebates Take Up To 45 Off Your Total Cost Of Job When You

Geothermal Tax Credit PumpRebate

Tax Rebates For Heat Pumps 2022 PumpRebate

30 Tax Rebate On Geothermal - Web 13 janv 2023 nbsp 0183 32 Under the Inflation Reduction Act IRA of 2022 the federal tax credit for residential geothermal system installations was increased from 26 to 30 percent