45 Day Rule Franking Credits Ato Web Using the franking credit offset is subject to meeting relevant integrity rules such as the 45 day holding rule Example tax treatment of trust franked distributions In 2019 20 Lang

Web The holding period rule generally applies to shares bought on or after 1 July 1997 To be eligible for a tax offset for the franking credit you are required to hold the shares at risk Web Jodie ATO Community Support 9 Apr 2021 Hi Miss Chan The website advises This means that you must continuously own shares 195 162 226 172 203 at risk for at least 45 days 90

45 Day Rule Franking Credits Ato

45 Day Rule Franking Credits Ato

https://i.ytimg.com/vi/BNe57sHuyeo/maxresdefault.jpg

Dividends And Franking Credits Venture Private Advisory

https://venture.frame.hosting/content/uploads/2017/08/bigstock-140370788-1200x1067.jpg

Bendigo Bank ASX BEN Share Price Goes Nuts On Strong FY23 Update

https://www.raskmedia.com.au/wp-content/uploads/2022/12/Bendigo-Bank-BEN-share-price-FY23-update.png

Web 20 Juni 2022 nbsp 0183 32 Your organisation must hold shares or the interest at risk for at least 45 days or 90 days for preference shares during the secondary qualification period to be Web 28 Apr 2022 nbsp 0183 32 Eligibility for a refund Applying for a refund of franking credits Anti avoidance rules Franking credits attached to franked dividends paid to your

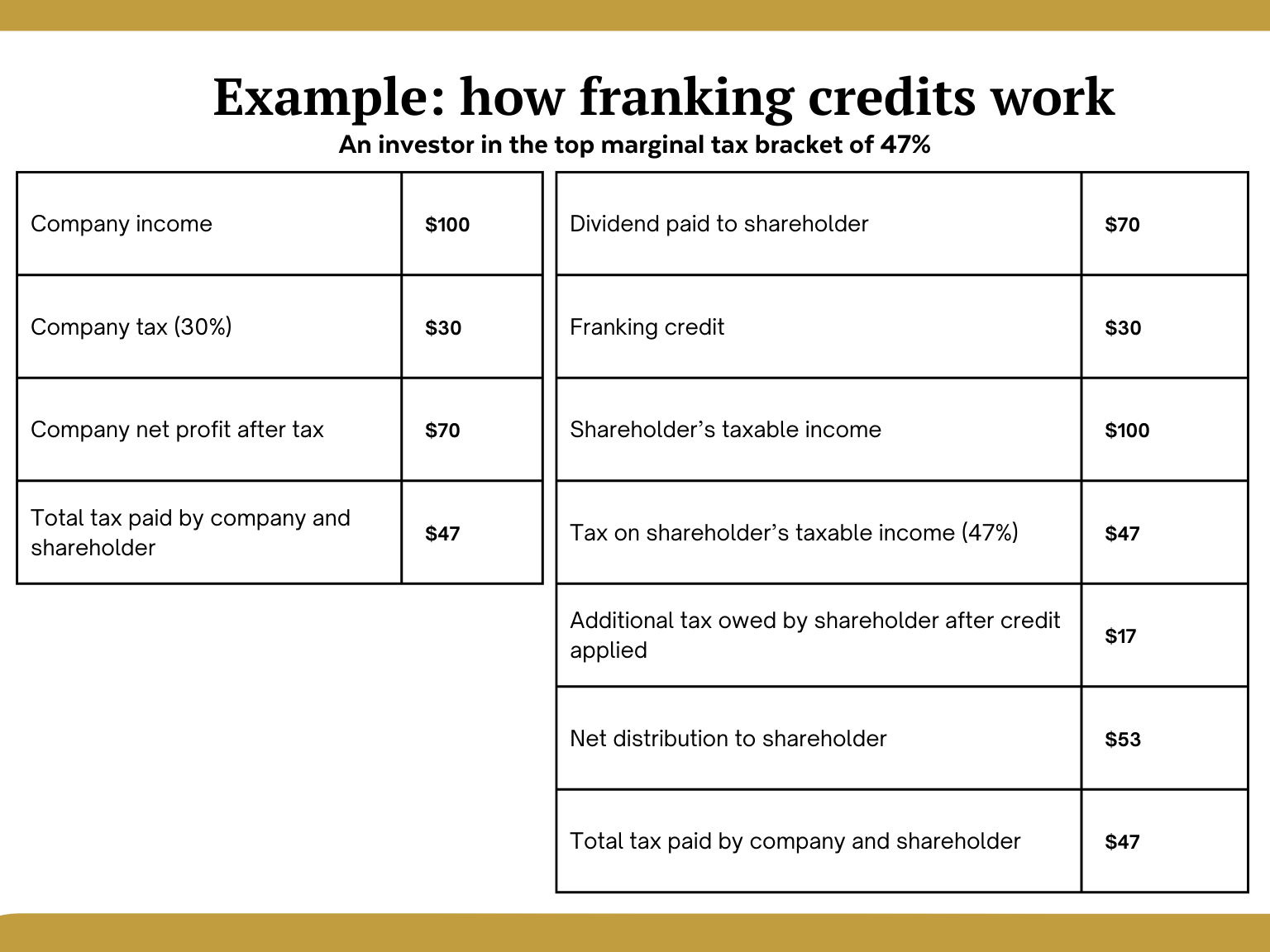

Web Simply this rule means if you purchase shares and receive a franked dividend you may lose the Franking Tax Offset if you do not hold the shares at risk for 45 days But it s Web 9 Aug 2022 nbsp 0183 32 Franking credits represent the tax a company has already paid on any profit it distributes to shareholders as a dividend The credits reduce a shareholder s tax

Download 45 Day Rule Franking Credits Ato

More picture related to 45 Day Rule Franking Credits Ato

The 1031 Exchange 45 Day Rule Extension Canyon View Capital

https://www.canyonviewcapital.com/wp-content/uploads/2023/11/The-1031-Exchange-45-Day-Rule.jpg

Labor s Budget Management Is A Joke Their Hit To Franking Credits

https://i.ytimg.com/vi/cD3JkK01500/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGHIgQyg-MA8=&rs=AOn4CLDHbowwL_45tRTSnnCIolpnvRpkHQ

European Patent Office To Abolish 10 day Rule Avidity IP

https://avidity-ip.com/wp-content/uploads/2023/05/10-epo-rule.jpg

Web If after applying the LIFO method the shares or interest in shares have not been held at risk for a continuous period of at least 45 days in the relevant qualification period the Web The 45 day rule sometimes called dividend stripping requires shareholders to have held the shares at risk for at least 45 days plus the purchase day and sale day in order to

Web 12 Jan 2019 nbsp 0183 32 Key News Summary The 45 day holding rule is important if it is still a requirement for claiming a franking credit offset It is widely understood to be still Web The 45 Day Rule requires resident taxpayers to hold shares at risk for at least 45 days 90 days for preference shares not including the day of acquisition or disposal in

The Critical 45 Day Rule In A 1031 Exchange

https://global-uploads.webflow.com/6434185404baa867fc004d62/64b4ed94dc903d9fad7b5b93_Dh641iPCptLFHR6sMP8BmrQ43GWfLEX4aDNTyjzCqpjFfpQRA-out-0.png

.png)

The Divide nd Of Income How To Invest For Franking Credits Sara

https://assets.livewiremarkets.com/rails/active_storage/blobs/proxy/eyJfcmFpbHMiOnsibWVzc2FnZSI6IkJBaHBBMnI0QVE9PSIsImV4cCI6bnVsbCwicHVyIjoiYmxvYl9pZCJ9fQ==--e8fb80da9cdf3a23040080ca6ccd6820f3e31b69/Vanguard US Total Market Shares ETF (ASX code VTS).png

https://www.ato.gov.au/businesses-and-organisations/trusts/in-detail/...

Web Using the franking credit offset is subject to meeting relevant integrity rules such as the 45 day holding rule Example tax treatment of trust franked distributions In 2019 20 Lang

https://www.ato.gov.au/.../refunding-franking-credits-individuals

Web The holding period rule generally applies to shares bought on or after 1 July 1997 To be eligible for a tax offset for the franking credit you are required to hold the shares at risk

Franking Credits 101

The Critical 45 Day Rule In A 1031 Exchange

Franking Credits Imgflip

ATO Franking Credits Explained Rask Media

Unlocking The Power Of Franking Credits The Qualified Person Rule And

What The New Dividend Rules Mean For Franking Credits

What The New Dividend Rules Mean For Franking Credits

Franking Credits Guidelines Expat US Tax

What Is The Benefit Of Franking Credits For Investors Sleek Australia

New Franking Credits Rule Could Leave Less Money In Your Pocket Here s

45 Day Rule Franking Credits Ato - Web 14 Juli 2023 nbsp 0183 32 This period requires the person to hold their shares for a minimum of 45 days excluding the purchase and sale date The reason behind this rule is the