5 Lac Tax Rebate Web Budget 2023 has further tweaked the tax slabs under the new income tax regime There will not be any tax for income of up to Rs 3 lakh Income above Rs 3 lakh and up to Rs 5

Web Income Tax Above 5 Lakh Income tax is the tax levied on the income earned by an individual through any source and hence Read more Best Tax Saving Plans High Web 1 f 233 vr 2023 nbsp 0183 32 Finance Minister Nirmala Sitharaman announces that there will not be any new tax for income up to 3 lakh reduces the number of I T slabs to 5 Budget 2023 Income Tax rebate limit raised to 7 lakh from

5 Lac Tax Rebate

5 Lac Tax Rebate

https://cdn.slidesharecdn.com/ss_thumbnails/budgetrebatenormslessthan5l-190312163028-thumbnail-4.jpg?cb=1552408556

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

http://cachandanagarwal.com/wp-content/uploads/2021/04/Income-Tax-Rebate.jpeg

Important Information You Need To Know About Tax Rebate For Taxpayers

https://thelogicalindian.com/wp-content/uploads/2019/02/Screenshot_44.png

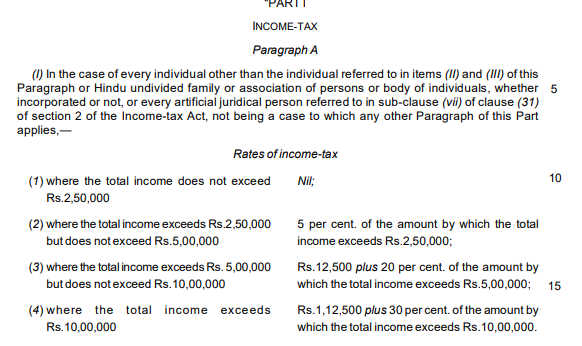

Web This will provide additional tax benefit of Rs 4 700 crore to more than 3 crore salary earners and pensioners the Finance Minister informed TDS THRESHHOLD INCREASED Tax Web 2 mai 2023 nbsp 0183 32 Claim a tax rebate under section 87A if your total income does not exceed Rs 5 lakh The maximum rebate under section 87A for the AY 2022 23 is Rs 12 500 See the example below for rebate calculation

Web 3 f 233 vr 2023 nbsp 0183 32 This is because both the old and new tax regime offer rebate to individuals with incomes of up to Rs 5 lakh Budget 2023 announcements will not affect this class of salaried taxpayers Web As per present Section 87A an individual is entitled to tax rebate upto Rs 2 500 if his total income does not exceed Rs 3 50 lakhs This rebate is available only for the individual

Download 5 Lac Tax Rebate

More picture related to 5 Lac Tax Rebate

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Tax Slabs And Tax Rebate For 2019 20 Budget 2019 20 Tax Rebate Tax

https://i.ytimg.com/vi/4ZjX7DbJ83g/maxresdefault.jpg

Tax Rebate U s 87A No Tax Upto 5 Lacs 5 Lacs Tax YouTube

https://i.ytimg.com/vi/Kd-WziOOfAo/maxresdefault.jpg

Web 13 juil 2022 nbsp 0183 32 As per the updated Sec 87A a taxpayer is eligible to get a tax rebate up to INR 12 500 if his total income falls below INR 5 lakh Here is the Explanation for the Same Let s assume a taxpayer s Total Income Web 26 f 233 vr 2020 nbsp 0183 32 Consequently after paying the Rs 15 080 as tax the person would be left with post tax income of Rs 5 10 000 minus Rs 15 080 that is Rs 494 920 On the other

Web 9 d 233 c 2021 nbsp 0183 32 December 9 2021 18 15 IST Many taxpayers exhaust the limit of Rs 1 5 lakh under Section 80C and yet want to bring save more tax The last date to save tax for the Web 7 f 233 vr 2019 nbsp 0183 32 If some one has income of just 5 lakhs gross income retired no property income no stocks bonds etc only income is FD interest the 5 lakh IT threshhold is

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-1-rev.jpg

https://economictimes.indiatimes.com/wealth/tax/new-income-tax-slabs...

Web Budget 2023 has further tweaked the tax slabs under the new income tax regime There will not be any tax for income of up to Rs 3 lakh Income above Rs 3 lakh and up to Rs 5

https://www.policybazaar.com/income-tax/income-tax-above-5-lakh

Web Income Tax Above 5 Lakh Income tax is the tax levied on the income earned by an individual through any source and hence Read more Best Tax Saving Plans High

INCOME TAX SLAB FOR AY 20 21 NO INCOME TAX FOR INCOME UPTO 5 LACS IS

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Shares 5 Lacs Tax No Tax On Capital Gains Up To 5

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

1 5 Lac Extra Rebate In Income Tax Tax Rebate Under 80C Hindi YouTube

ALL INDIA RMS AND MMS EMPLOYEES UNION MAILGUARDS MULTI TASKING STAFF

ALL INDIA RMS AND MMS EMPLOYEES UNION MAILGUARDS MULTI TASKING STAFF

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Income 7 Lacs No Tax Under New Scheme Rebate Increase 87A 5 Lac To 7

Budget 2019 India Highlights LIVE Full Tax Rebate For Individuals With

5 Lac Tax Rebate - Web Taxable income limit for availing rebate u s 87A increased from 5 lac to 7 Lac under New Regime Slab Rates revised under new tax regime Surcharge for income exceeding 5